This update is regarding the previous update posted last week about Bitcoin.

Since then it has been ranging sideways, market was very calm for the whole week.

Here's the previous post.

https://leofinance.io/hive-167922/@beehivetrader/bitcoin-technical-support-resistance-zones-we-are-watching

Considering the same charts, here's one more perspective. Currently I've noticed one more interesting pattern which I'm sharing below.

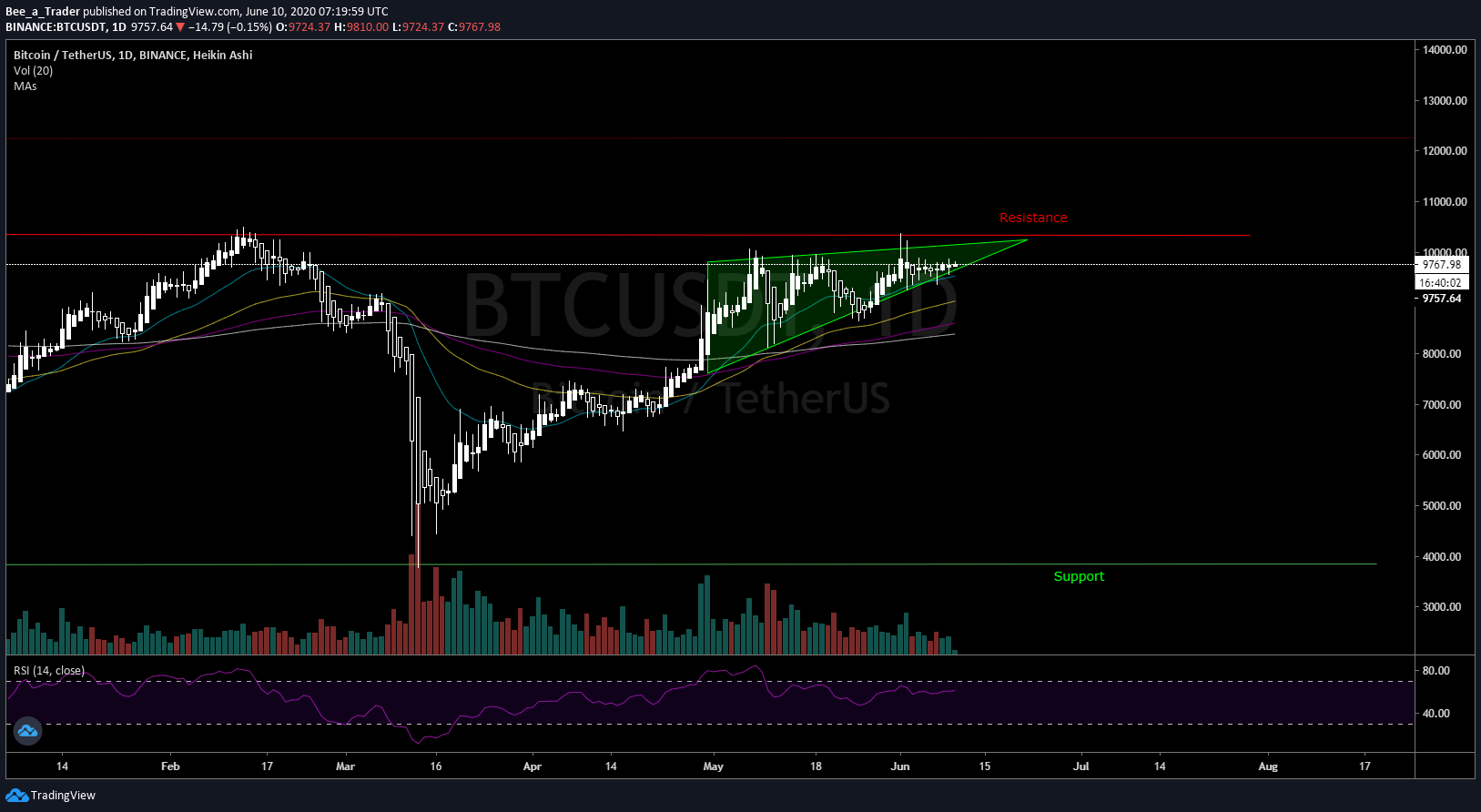

BTC/USDT 1D

Chart:

Overall Bias: Neutral (In Critical Zone*)

Points to note:

- Small uptrend noticed.

- Resistance on the ascending triangle pattern, as well as the daily chart.

- Moving averages -> Bullish (not yet crossed bearish)

- A small divergence on RSI noticed. (Price making higher highs, and RSI making lower lows)

- This pattern usually breaks above.

*I'm planning to buy move contracts on FTX (though not immediately)

Note: This breakout will be significant, and we may even need to wait for another week to come to a decision!

Bonus take:

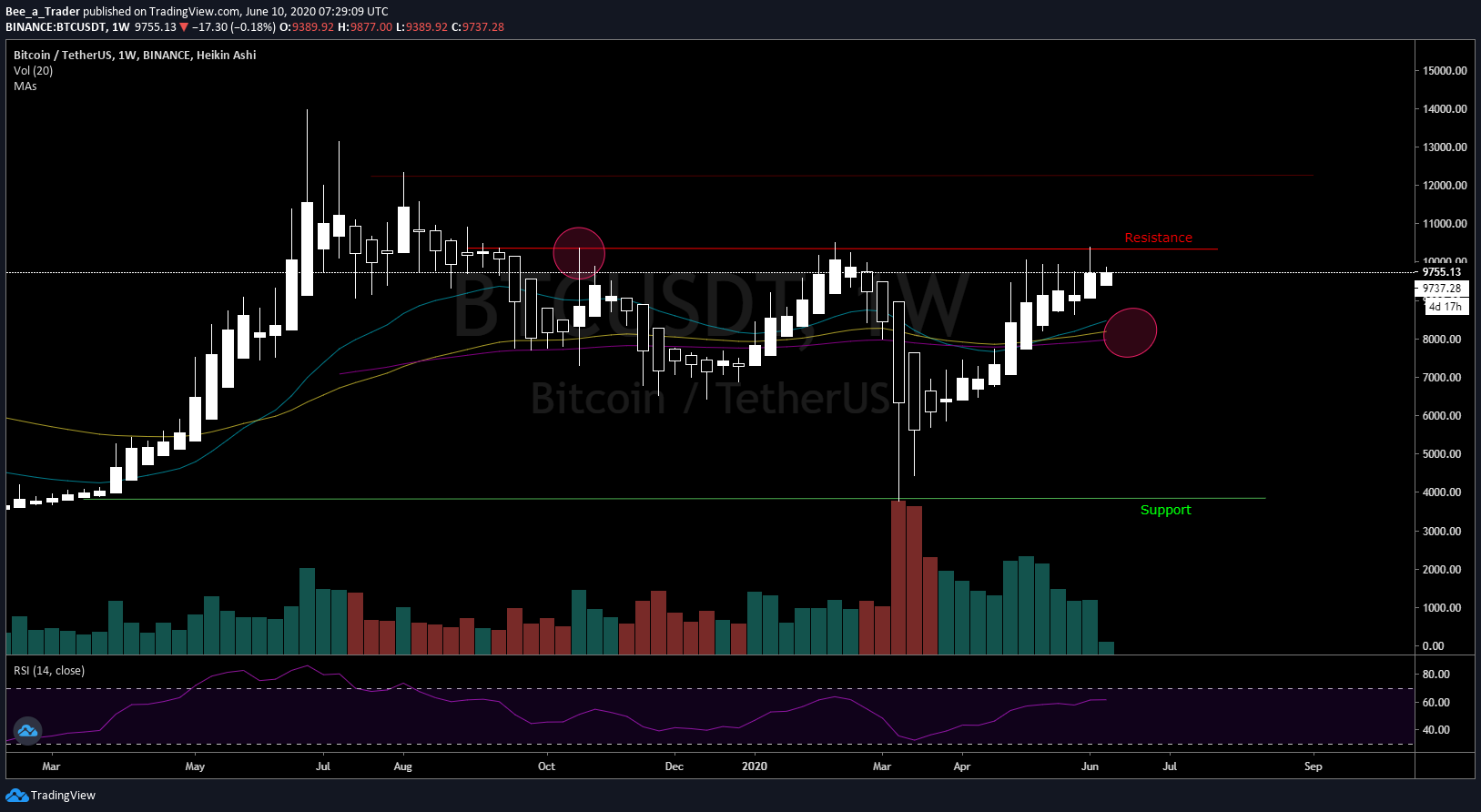

Considering the weekly chart,

If price breaks down, I'll be looking forward to see the reaction around the weekly moving averages, marked on the chart.

Extra points you may consider, from global markets!

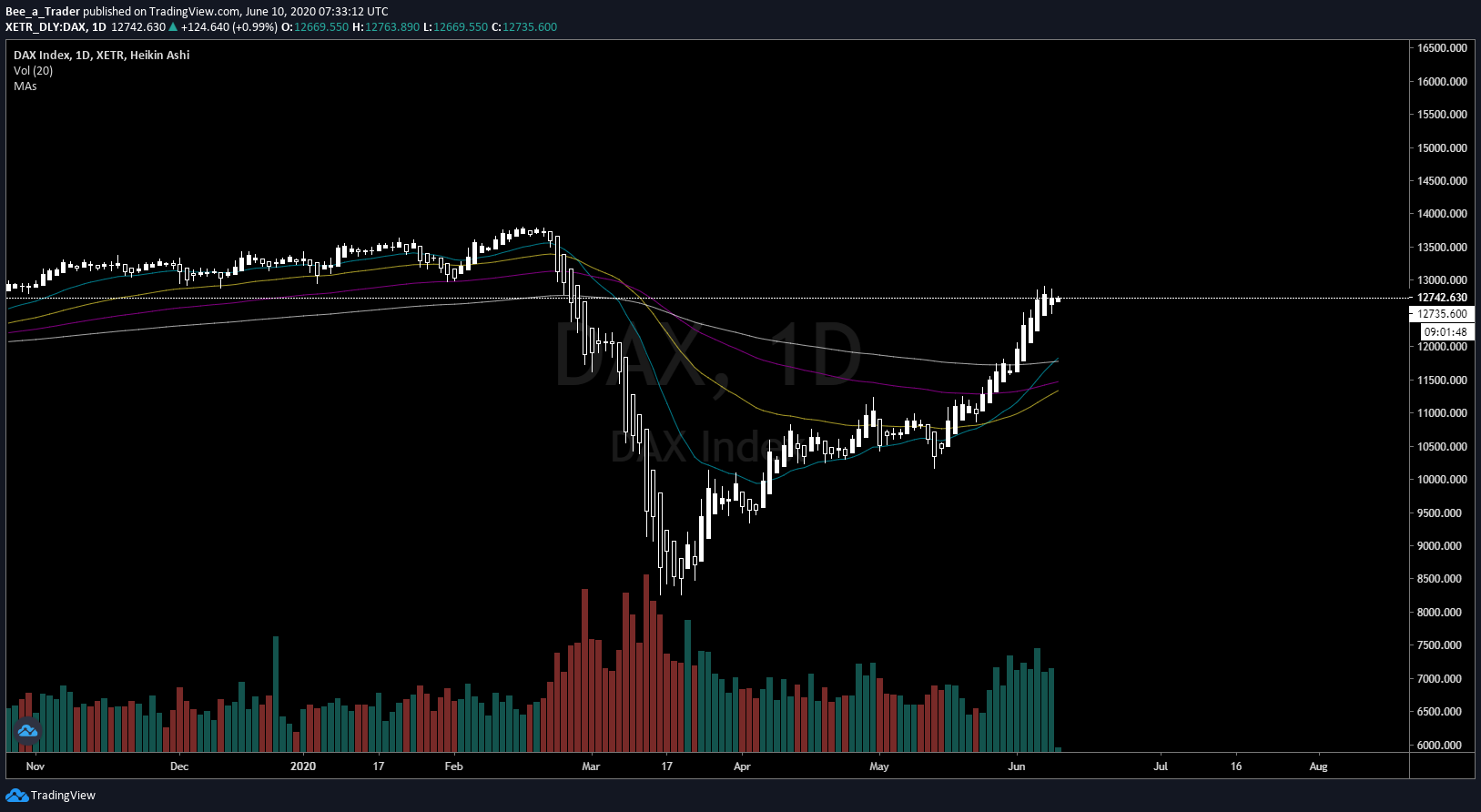

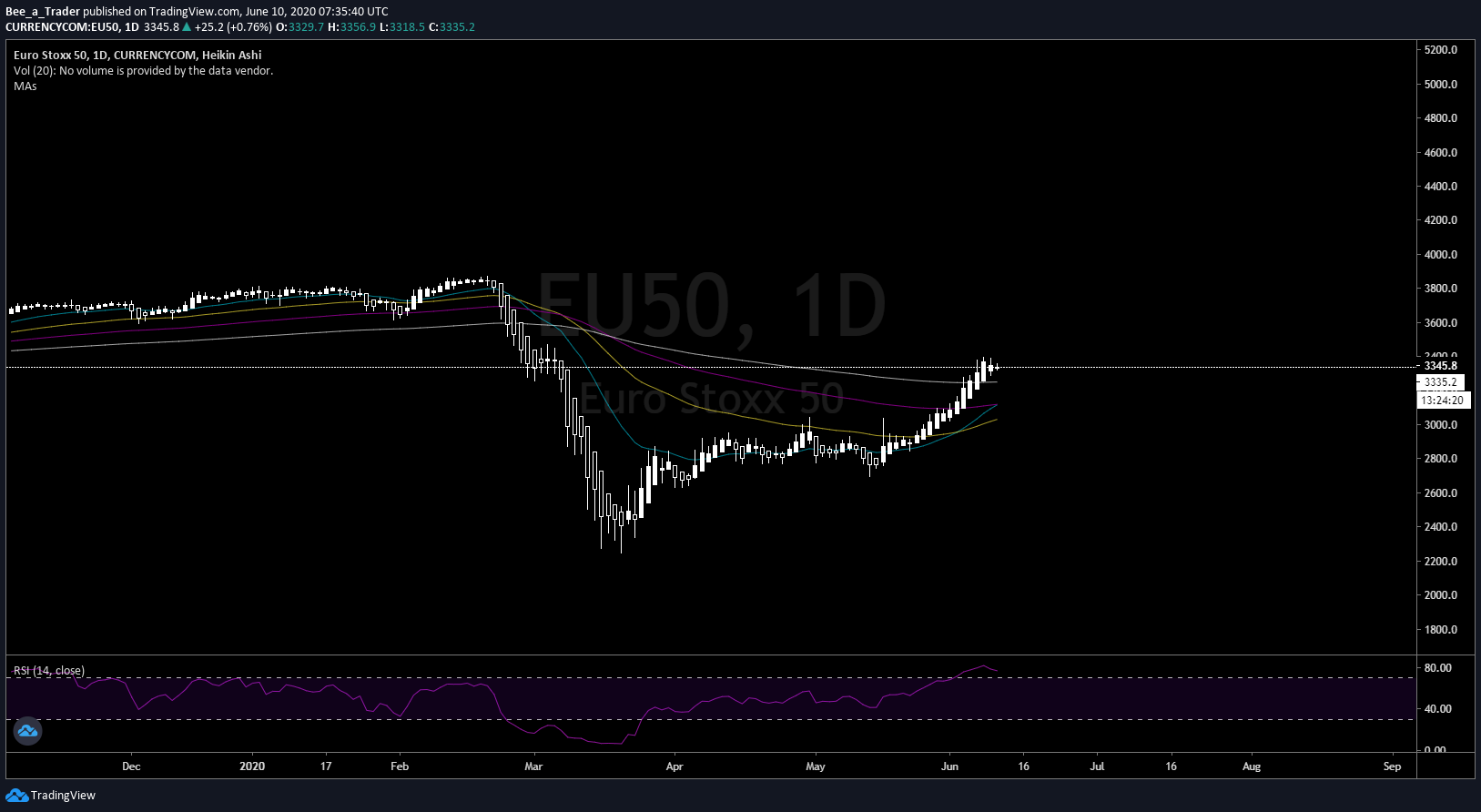

Almost all the major world indices are having similar structure. So is BTC really a safe haven asset? Or is it just behaving how the rest of the markets are behaving? :D

The S&P 500, or simply the S&P, is a stock market index that measures the stock performance of 500 large companies listed on stock exchanges in the United States

The DAX is a blue chip stock market index consisting of the 30 major German companies trading on the Frankfurt Stock Exchange

The Euro Stoxx 50 index covers 50 stocks from 8 Eurozone countries: Belgium, Finland, France, Germany, Ireland, Italy, Luxembourg, the Netherlands and Spain

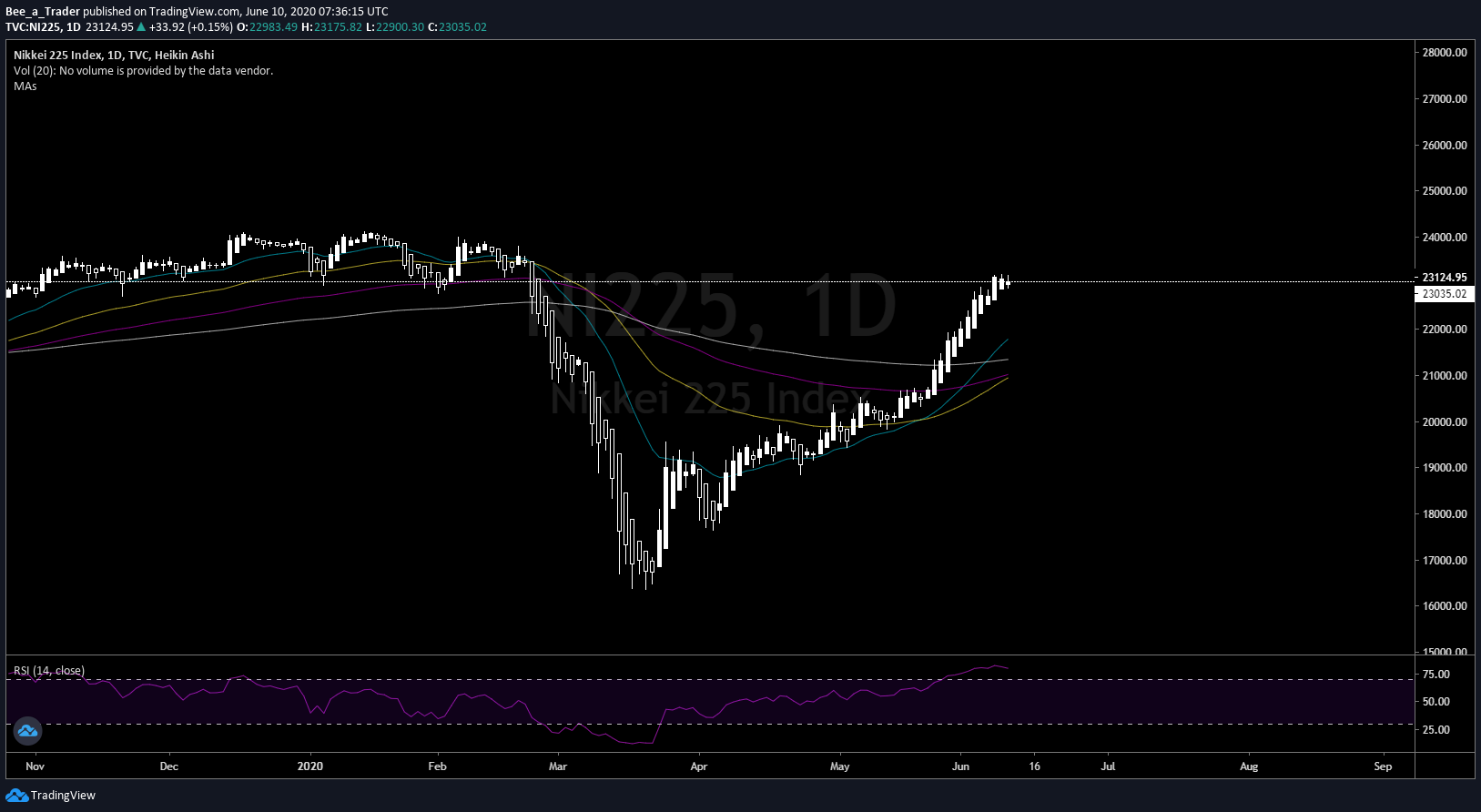

The Japan Nl225, commonly referred to as Nikkei Stock Average, or Nikkei 225, is a stock market index for the Tokyo Stock Exchange (TSE).

The Korea Composite Stock Price Index or KOSPI is the index of all common stocks traded on the Stock Market Division—previously, Korea Stock Exchange—of the Korea Exchange. It is the representative stock market index of South Korea

The NIFTY 50 index is National Stock Exchange of India's benchmark broad based stock market index for the Indian equity market. NIFTY 50 stands for National Index Fifty, and represents the weighted average of 50 Indian company stocks in 17 sectors

In almost all the charts, you'll notice similar patterns.

I have covered some of the major stock market indicess around the world, for reference, to show where we are,

and most of them are showing similar patterns, and also note the breakouts on most of the charts, if you look at the RSI, Moving averages, for example.

I'll cover a detailed analysis later on about what the other markets are saying, and why I have attached the stock market charts. As of now I have attached the charts just for reference!

Let me know what you think! and I'll cover a detailed analysis in another post regarding the market correlations between gold/silver/stocks/cryptos, and whether Bitcoin is really a "safe haven asset" or a "store of value". We can have a debate on that as well if you want!

Bonus point about Bitcoin: If it breaks above, it will be really good for the overall crypto community!

Follow me on twitter! https://www.twitter.com/beehivetrader

Upvote if you like the content.

Comment and let me know if you want some analysis on any altcoin/asset or anything else, send me 1 BTC and I'll cover that in the next article! :)

(No I dont charge anything lol, just comment and upvote if you like my content, thats it! :P)

Posted Using LeoFinance

Looking at monthly candle chart of $BTC, May candle has already broke the bearish trendline. I'm positive that June going to be another bull candle.

Yes, also weekly candles are looking Bullish, A small push above $10600-10700 will cause a major breakout imo. :)

though I may be wrong, but, who knows :D

Your charts are really helpful great advice keep it up

Thank you very much for appreciating :)