Price action in Bitcoin looks a bit shitty as expected, and the recent options expiry did not fuel any "Massive volatility" everyone was expecting. (Remember: If everyone expects something, it never happens)

So, as I was going through my tweeter feed, I came across an interesting tweet by Glassnode about a chart they shared.

Link: https://studio.glassnode.com/metrics?a=BTC&m=supply.ActiveMore1YPercent

So apparently,

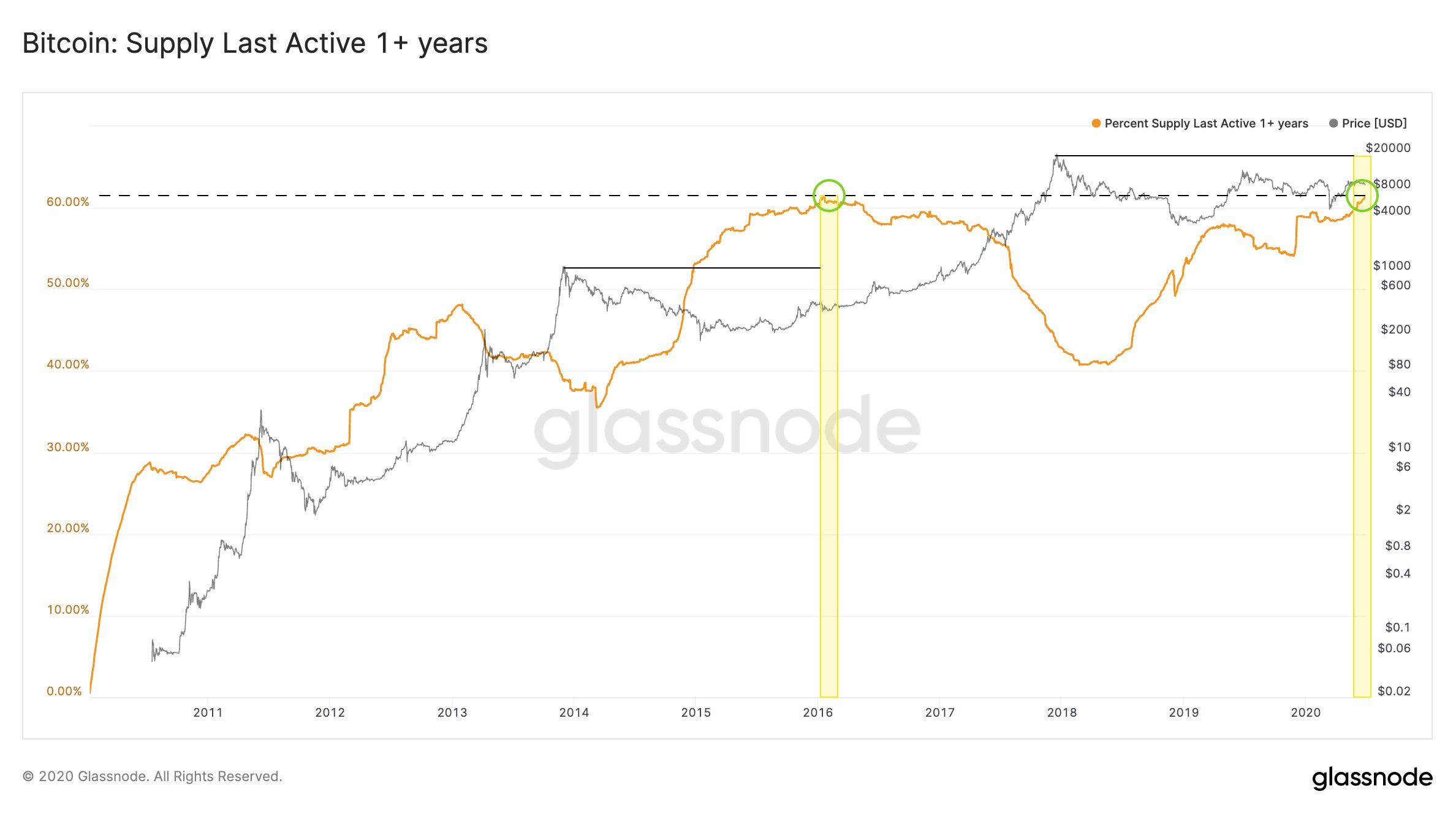

"The last time we saw this amount of #Bitcoin that had not moved in over a year, was in early 2016 – preceding $BTC's bull run to $20k."

But how do we analyse it?

Well, there are a few factors before you can jump into a solid conclusion.

We need to understand a little bit of supply and demand.

Currently, the fact that almost 60% of the Bitcoin hasnt moved in the last one year does not necessarily mean demand is rising as such, but the OGs, and the HODLers are slowly accumulating, they are believing in it for the longer term, and are reducing supply that's available for trading.

Will it mean Bitcoin prices will go up?

Well, no, and yes!

No Because:

We aren't seeing the demand yet which was there back in 2017,

Yes because:

We may start seeing it soon because of the ongoing economic unrest going on around the world, which 'may' trigger traditional investors to look for alternative sources of investment, and they may come across Cryptocurrency and see it as an alternative investment scheme. So its speculation now, if we believe in it right away (though its not always wrong to do so)

So what I personally speculate right now:

Look at the chart again!

Imagine this time to be around 2015, just when the "Crossover" between the (price) and the (percentage of Bitcoin that didnt move in a year) happened. I wont consider that as a very accurate measure because we arent measuring Bitcoin price in percentage here. But anyway, it gives us one small idea, the actual bull run may be a couple of years away.

We may even see a sideways and boring price action in Bitcoin for almost a year.

Again, this particular theory goes well with my previous post on the "Bearish Retest Moon theory" (lol, but I dont know whether that will happen, I'll be happy if that happens though)

So if you really believe bull run will happen immediately, I'd suggest, have some patience! I'll be in this game personally till 2028, and if no bull by 2028 (extreme case: 2035), I'm going to exit permanently (to be very honest).

I learnt having patience the hard way, after getting REKT in my early days of trading, and I know what it is like to lose patience. You end up being on the wrong side of the game and that too, Consistently ; all because of emotions, and believing in news and what everyone else says, just because you want something to happen and it isnt happening.

Anyway, we are also seeing a lot of media coverage about Institutional investors investing in Bitcoin.

Let me bust a myth:

Institutions are smart money. They wont buy on media hype, they will smartly accumulate when there's enough blood on the streets, and also at the same time, Institutions look for trade volume in some Billions. For them, even Ethereum is illiquid, and they can crash prices to zero if they want, but they wont do so, because crashing prices to zero will mean all investors losing confidence in the particular coin, and the common people will not get the confidence to invest again.

A well established and big institution can literally buy up twice the equivalent amount of the whole Bitcoin marketcap in a few days. But they wont do that aw well, they will smartly play/use hedging to accumulate Bitcoin through Futures/Options market while gaining/suppressing the prices of Bitcoin.

As per this, a "Part" of those HODLers as we see on that glassnode chart may even be institutions, who knows?

So coming back to the long term price analysis on Bitcoin: Please refer to that "moon theory" article ; though I may be wrong.

Image source: Internet search

#DYOR and dont forget to buy the dips!

Share and upvote if you liked this article :)

Posted Using LeoFinance

What is your opinion on the enthusiasm of Hive? Is it well-founded or based on emotions? On a technical side, I see that Hive has what it takes to be around for the long-term. However, I don't see any giant rise in its user base. I think the growth in users will be slow and steady.

As you stated, a good institutional investment company could easily buy up all Hive if they wanted. Silicon Valley routinely buys up companies for billions. Hive is only $75 Million.

Posted Using LeoFinance

Nice point, I'll surely cover that in my next article.

Will keep you posted on this :)

Congratulations @beehivetrader! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board And compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz: