I was going through this article from Nasdaq and I thought of doing an analysis on what 'may' happen on this event.

The data has been derived from Skew

Unless you have a corporate trading firm account, you wont be able to login to their website, but you will still be able to see the publicly available analytics page.

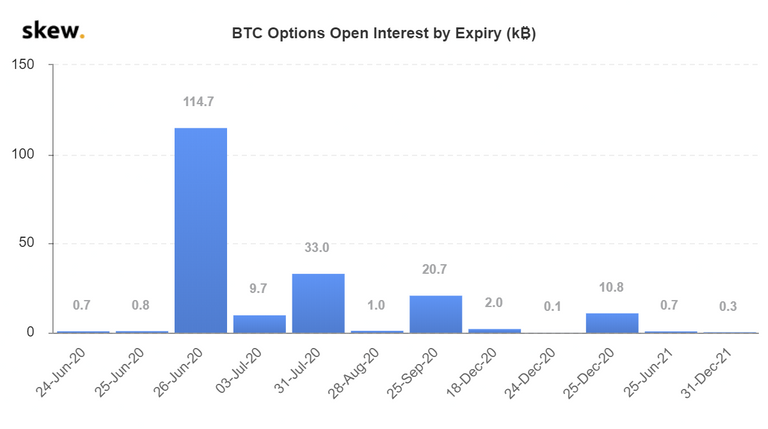

A whopping 114700 contracts are going to expire on June 26th, which has a notional value of over $1.07 billion (at the time of writing) (Huge)

This will be the largest options expiry that BTC has ever seen.

Here's the data from Skew. (you can refer the Nasdaq article, or also any other article, because more or less, everyone covered the same news.)

Some analysts do believe that the event will spark some massive volatility, while some analysts are believing that BTC will remain rather flat. Because options expiry tend to have very less effect in the market. What actually impacts more is the spot buying and selling, to influence the prices of the market, so that one half of the option buyers/sellers are in profits. (Anyway, I believe anything can actually happen)

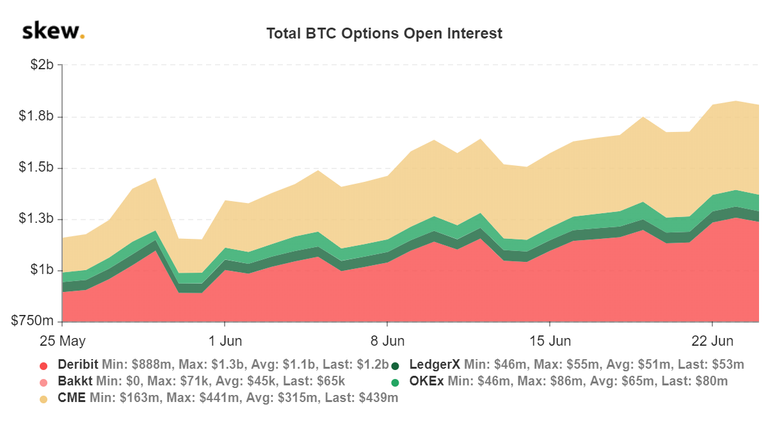

Here's the total Open Interest on Bitcoin options currently:

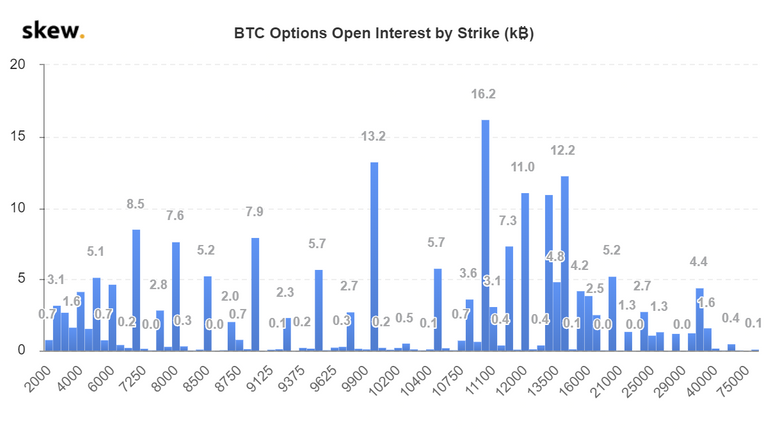

Here is the BTC open interest by strike price:

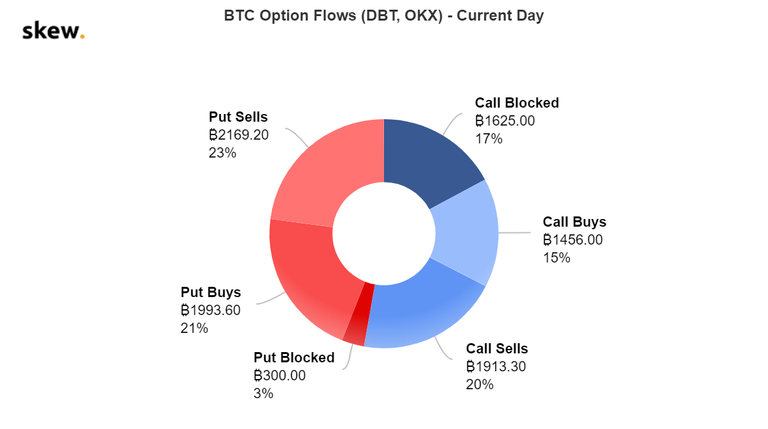

And another important chart about the put/call ratio in options:

Lets see what effect it can have on the market!

NOTE: Trading Options does NOT directly affect prices of the underlying asset. But it indirectly does.

So first things first:

Even if you have never traded options, it is important to understand how options expiration may affect Bitcoin (or any other asset) prices.

Options are financial contracts that give the holder the right but not the obligation to buy or sell certain types of assets. Buy is termed as Call, and Sell is termed as Put in options terminology.

Upon expiration, the holder of the option contract gets either positive or negative asset values when the expiration of assets occurs.

So, in simple words, traders can buy call options if they believe the price will go up.

And they can buy put options if they believe the price will go down.

Remember: Options on the losing side may(and often does) end up expiring worthless.

Have a look at this Investopedia article to know more about the basics

Yesterday we did see a round of volatility on Bitcoin;

As per the data from Skew, most of the open interest lies around the 10k-11k mark, with most traders placing their bets on the 10kish Zone. But there is significant resistance above it, so if Btc stays on this level, most of the options will effectively expire worthless.

From Technical point of view, we can see that the volatility is decreasing slowly over the last few weeks, even though overall price action is choppy and is lacking direction, so it can also be the so called "Calm before the storm" thing, with the options expiry sparking a breakout on either side.

Also note that there are a lot of differences between a High Open Interest on a Futures market, and a High Open Interest on an Options market. Dont confuse between them, especially if you are new in the market; it happens though :)

Here's a great article where you can learn the basics of options trading: https://investingwithoptions.com/options-expiration/

Lets look at the charts now, along with a volatility indicator (feel free to try other indicators, or your favorite ones!)

I'll be using the ATR (Average true range)

It is best used to set a decent stoploss, especially to stop you from being on the wrong side of the market.

So,ATR measures volatility, and using this system; you can build your simple trend-following system; which will also act as a true reversal system that means the position is reversed at every stop.

During a breakout or a breakdown, the ATR range will be higher, marking the beginning of a fresh directional move/trend.

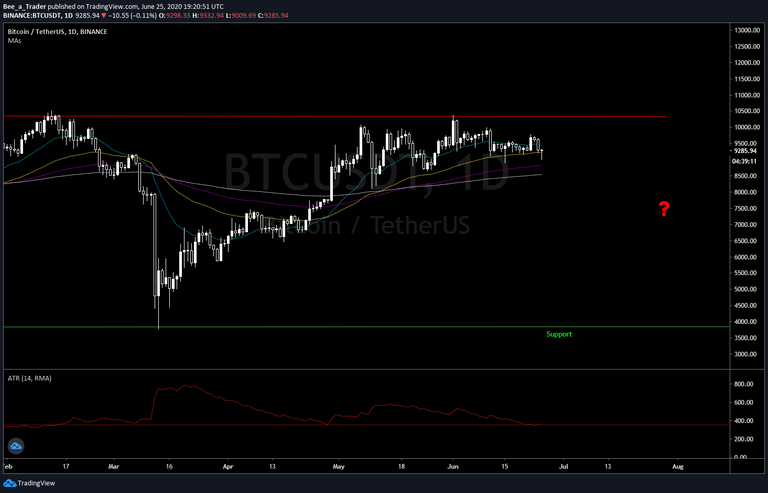

BTC/USDT, 1D chart:

Link: https://www.tradingview.com/x/mvQEeprA/

Wondering why the "?" mark is there? Have a look at my previous article :)

So we see here that the ATR value on 1D timeframe is around 350 (which means, over the last 14 days, on 1D timeframe, the average range of the 1D candles comes to around $350.)

So, whenever price closes more than an ATR above the most recent close, it means, a change in volatility has occurred, and it can trigger a change in trend.

Current scenario: The volatility is going down,and is near a monthly low; and the price is in an uptrend (this is a typical scenario before an explosive breakout on traditional markets).

Though it will be difficult on how to trade effectively with ATR, (I believe it needs another article; so I'll cover them later)

In short, how you can trade this:

- Identify the range during this time period

- Trade the break of the range with a trailing stop, and ride the wave until you get stopped out (and in profits).

There are two good books which used ATRs very efficiently, (if you are really interested in trading) or knowing more:

- The Turtle traders

- StairStops (Using Magee’s Basing Points to Ratchet Stops in Trends)

My Take:

I'm personally leaning a bit bearish for short term (though I may be wrong); based on the following factors:

- The ATR volatility breakout incoming, there can be a violent move.

- Weekly resistance above

- Miners have started sending their Bitcoins to exchanges

- And I dont know whether this will have an impact, but check out how much ETH (and also other tokens) Plustoken scammers are moving. Maybe they will sell?

- Last, but not the least, Most of the traders are leaning bullish, if we pull up the options Open Interest data. So lets see if The theory of contrary opinion plays out here :)

Based on the above points, I'll be looking forward to hedge my positions with the Move contracts, by risking a small amount ;)

(I'll share more on this later; stay tuned :D

Let us know in the comments what you think! :)

I'll provide another update soon.

Show some love and give an upvote if you liked the content.

Check out my profile on Twitter

Posted Using LeoFinance

We continue to enjoy reading your work! Thank you for putting time into every analysis. Also, can we mention that this most recent article is the highest quality so far :)

Posted Using LeoFinance

Thanks for appreciating :)

Awesome analysis. To be honest, I haven't spent much time looking at the options volume on BTC but I personally tend to agree with you that there is likely to be some sort of impact crossing over

Posted Using LeoFinance

Thanks a lot for appreciating :)

Congratulations @beehivetrader! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board And compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @hivebuzz: