.jpg)

Crypto Miners Are Being Destroyed

I normally like to write about positive things in crypto but that's become a little bit of a challenge. I'll have one for you later today however! If you thought you took a beating in the recent sell offs have you stopped to think about how miners are doing?

Mining

Primarily mining is done with Asic for Bitcoin and GPUs for Ethereum. Many of these miners have been selling at a premium and are often sold out before they even hit production! While ASIC systems have one purpose only and that's to mine bitcoin (along with some other rather lackluster cryptos that run on the same algo) GPUs on the other hand have many use cases outside of mining.

The Hash Rates

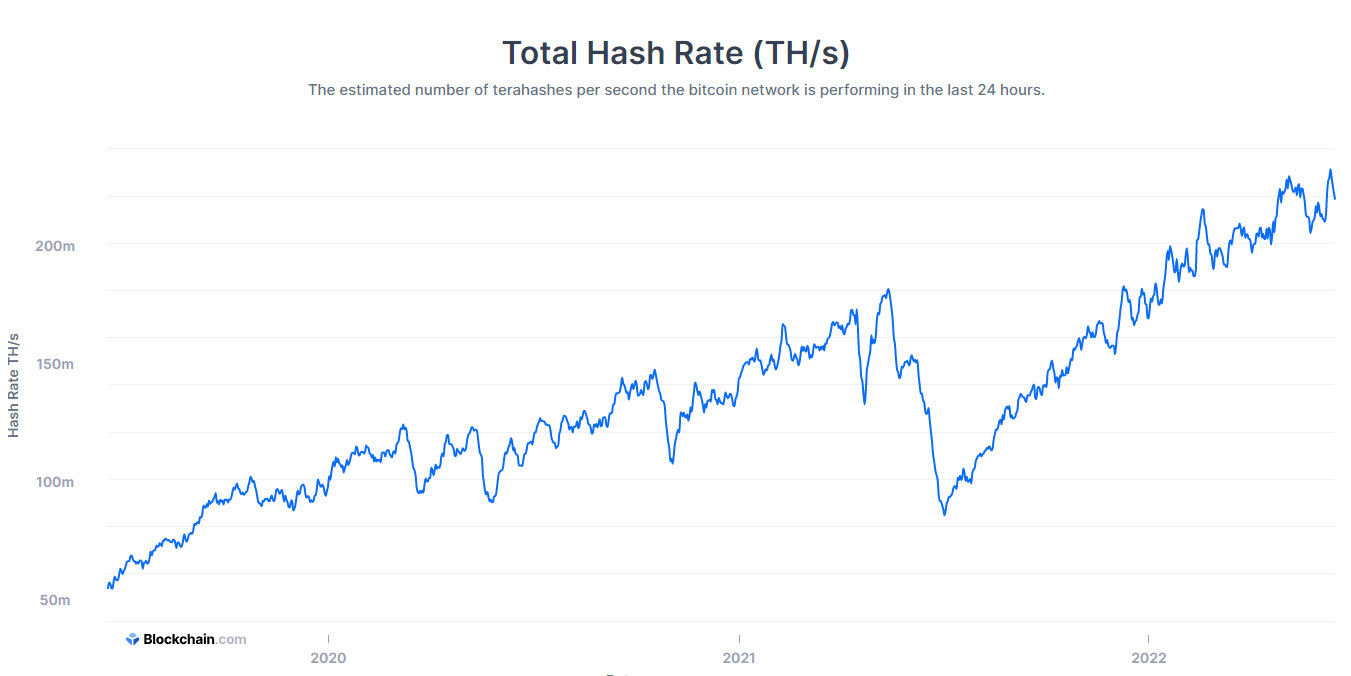

Bitcoins hash rate over the last three years

There hasn't been much change yet in terms of the hash rate of bitcoin. That crash you see from 2021 to 2022 in the middle there was when China announced it was kicking all bitcoin miners out. We can see it didn't take long for that to recover and beat it! When you really look at this chart you see nothing but a rather steady trajectory upwards.

This is most likely due to major companies now mining bitcoin so their operations continue to run no matter the price swings. Many of these have also invested in infrastructure of solar, wind etc which has minimal upkeep costs and continue to provide power to these mining systems.

Ethereum hash rate over the last three years

Looks much the same however has been hit with some shutting down on miners. This most likely will tank as Ethereum inches closer and closer to being a proof of stake token in which GPU miners will become pointless and instead it will be all about owning ETH tokens and staking them. This is most likely going to cause a huge surpluses in GPUs. In fact prices on new GPUs are already dropping in many cases I can now get a 3080 for about $800 - $900 and just last month would run me well over $1,000+

Get ready to see a bunch of used GPU cards hitting the market as well. If you ever wanted to build a solid gaming system and that GPU cost was holding you back wait a few more months and you should be able to grab up one heck of a deal. Also rumor has it the 4080 or if they skip to the 5080 will be coming out mid July thus further decreasing the value of these 3080 gpus and below.

The Miners

Not only do you still have a increase in mining hash rate making your asic systems less and less profitable but you also have a drastically huge reduction in price. Many miners or companies might soon find themselves needing to liquidate their assets unless the built a long term renewable plan.

Companies like RIOT Blockchain although off their all time highs still hold a rather decent price level. Hut 8 also commanding a decent price at the moment along with others. However these might be short lived and it will be interesting to see their profits come the next quarter and if they will remain in operations.

Here's the cool thing about what's happening right now. This sell off and correction removes many of the bad eggs in the system. The ones that didn't build solid foundations and create a real value and wealth behind their systems. This is much like the 2017 rally in which shit coins became a huge thing. Nearly 95% of those shit coins are now gone and what came of it where solid legitimate projects many of which we still see today like Polygon(MATIC).

These corrections are nessasrly in order to fish out and remove the over hyped worthless projects and products in the system. I estimate however this crypto winter wont last anywhere near as long as the last.

Are you mining yourself?

Posted Using LeoFinance Beta

I think the mining landscape is about to completely get knocked off it's rocker when the ETH 2.0 POS (and I mean the other POS, not proof of stake) merge happens, lol. I mean they never really respected their mining community anyway, but for those of use who mine with GPUs, we are pretty much out of options on decent chains. All of the other worthy chains are all ASIC chains at this point except Monero, but you have to have a monster CPU to come close to making a profit on that these days.

It's really sad because that is what really drew me into the space. I was a hardware junkie and loved the fact that I could just put my equipment to work. Proof of stake systems are so easily gamed by the bigger players that it really defeats the purpose entirely. DPoS is alright, but has it's drawbacks as well. I think the whole politics of it all kills the beauty of the system. That was was great about mining. I didn't have to give my opinions online or have to try and prove my worth, like with DPoS chains like Hive and all of the Cosmos chains. Being a validator in that space with all the governance BS that happens there has almost turned me off from the space entirely other than Hive and BTC. But I digress...

I am in the camp that the climate change narrative is complete and utter BS and people screaming that as a reason to go PoS, is really just wrong on so many levels. You really give up decentralization as a whole. We see this in the Cosmos ecosystems when people just delegate to the top 10 validators because they don't know why they are delegating to them, they just stake with them because they are at the top. This causes HUGE issues in an ecosystem.

Instead, let the nerds just hook up computers and support blockchains, that's why I love PoW. That and it actually backs crypto with real world assets like hardware and power... I could keep going, but then it would be a whole other post, lol

It's natural.

I mean if you mine the same amount of a crypto with the prices down, you probably may fall short of meeting your expenses.

Posted using LeoFinance Mobile

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

There's a lot going on and1 it has actually affected this area drastically.

Posted using LeoFinance Mobile

I'm not mining but been thinking about it. I'll keep eyeing the GPU prices, if they would drop sometime soon it would be a good time to buy few and build a rig.

Posted Using LeoFinance Beta

Looks not so good for miners! Thanks for the report.

Posted Using LeoFinance Beta

I uses to dabble in some mining with my GPU, but now I'm only doing proof-of-brain mining.

Posted Using LeoFinance Beta

I use to mine Ethereum and Z-cash, but shut down my five 8-GPU rigs when the prices fell below electricity costs.

I definately gave some thought to resuming mining in thelast year, but the thought of dealing with the noise, heat and electric bill calmed those urges.

Paradoxically, the best time to get into mining maybe during a bear market, because of the lower costs you mention.

And if you can afford to mine and hold you will be much better off in the next bull market. But that is much easier said then done.

Posted Using LeoFinance Beta