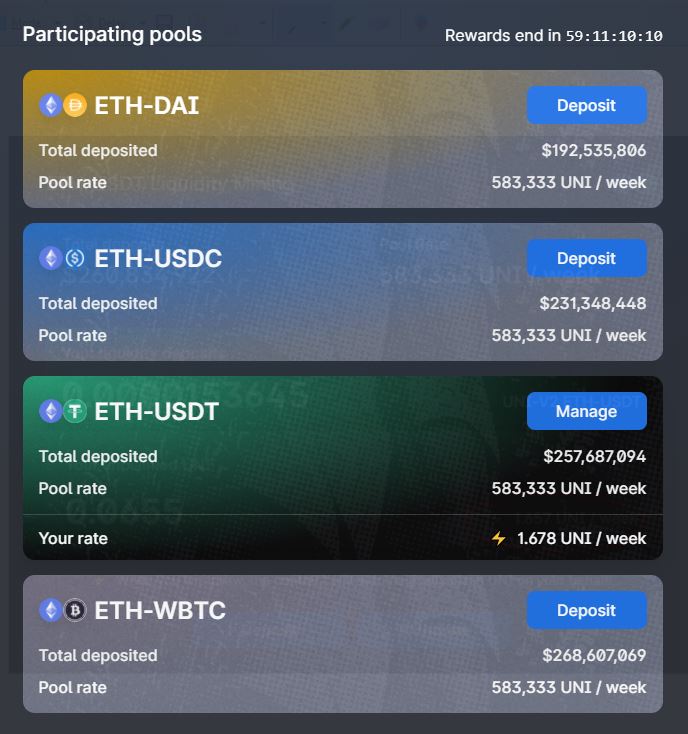

So I received the UNIswap airdop yesterday like a lot of you. And started researching on the much anticipated UNI mining just by providing Liquidity to 4 main pairs. These pairs are

By providing Liquidity to these pairs you are able to receive UNI tokens as rewards on top of the fees generated. How much of rewards you receive is based on how much your contribution to the pool is.

Is it really worthit ?

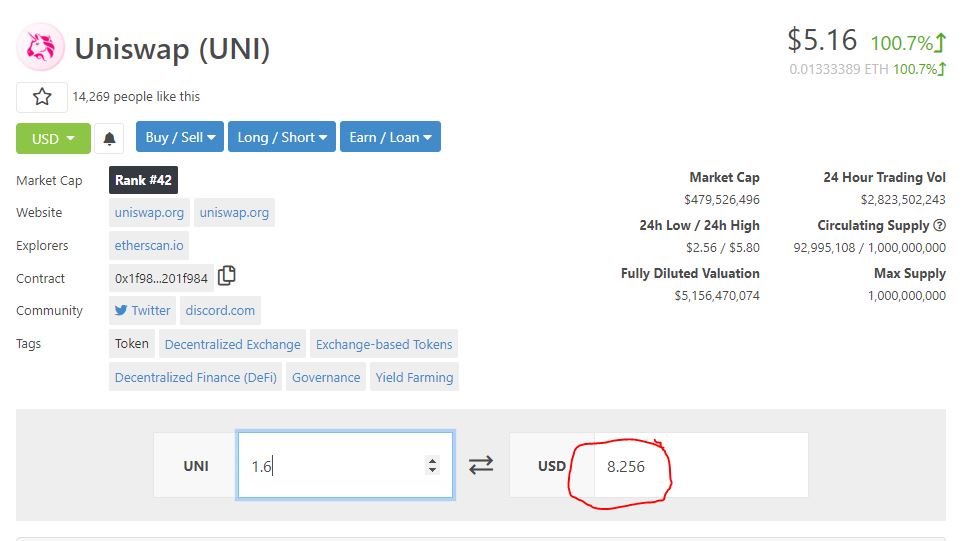

So in my 12 hours of experience in staking LP for ETH/USDT pool, it looks like I would only be receiving less then 2 UNI per week. And this number will go down as more people adds Liquidity to the pair. This would however run for about 60 days and who knows whats going to happen next.

Based on current price that would bring it to roughly $8 per week. So for $8, I'm locking about 1ETH and $372 USDT which comes up to close to $800 in total. On top of that I paid close to $30 for the entire transaction from approving to adding LP. I'm not so sure how much Fees I would be receiving as there is no indicator to show at this point of time.

Unless you have a better way to earn , I guess it would be worthwhile. However as a frequent trader ... I believe that throwing the ETH and USDT onto the exchange and make some trades there, I guess I would be able to get a way much higher yield.

Is it worthit for me ??? My answer is not at this point unless UNI tokens rises to a crazy stupid value.

But these are just my opinions alone. What do you think ? Have you tried it ?

Posted Using LeoFinance

Thank you for your support. We will be working for a new payout scheme for you soon. Keep your chins up and stay tune!

did you also take the regular return from liquidity providing into account or is this just the UNI income?

some food for thought https://leofinance.io/hive-167922/@felander/when-to-sell-your-uni-if-at-all

Posted Using LeoFinance