Last month, the US national debt surpassed the $38 trillion mark. For some perspective, the debt was only $10 trillion in 2008, and had grown to $23 trillion by 2020. In other words, the debt has been growing exponentially, and arguably unsustainably.

After the massive Convid stimulus and "money printer go brrrr" of 2020, the central bank had to raise interest rates to fight the resulting inflation. However, even with the higher rates we have today, the cost of living crisis continues to worsen across the globe.

To keep inflation under control, the central banks would need to raise interest rates to even higher levels. The problem is that, as they raise rates, the cost of servicing their massive sovereign debts becomes unmanageable.

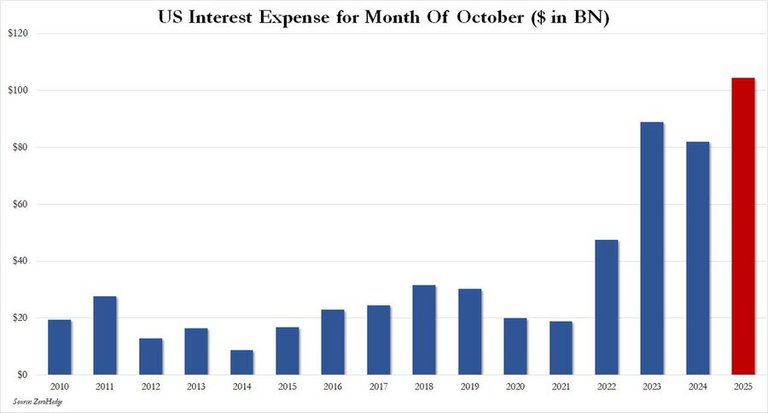

In fact, the most recent interest payment made by the US government in October broke a record, even exceeding that of October 2020, at the height of Covid stimulus spending.

At this point, ~25% of tax revenue is being used to service the national debt, and that number is projected to increase as more debt is rolled over at these higher interest rates.

The bottom line here is that the debt-based fiat system is not sustainable in the long-term (perhaps not even in the short-term), and we need an alternative - preferably one that that preserves our freedoms.

The New Money

Bitcoin appeared in 2009 as a new form of money. Permissionless, borderless, and open-source, Bitcoin allows us to not only have full control over our money, but also monitor the supply, ie: it cannot be printed to infinity by a central bank.

Could Bitcoin be the future of money?

While still permissionless and supply-capped, Bitcoin is no longer the peer-to-peer cash it was intended to be. Rather, it's been converted into a form of "digital gold" to protect investors from the inflation generated by the debt spiral we currently find ourselves in.

Even though Bitcoin can save us from worsening inflation, there's still a problem...

If the debt-based dollar system is indeed unsustainable and doomed to failure, we need not only assets to protect our wealth, but also new forms of money that can actually power economic activity. Unlike the US dollar, Bitcoin doesn't enable much economic activity.

That said, the good news is that there are other digital assets, based on Bitcoin's underlying technology, that do.

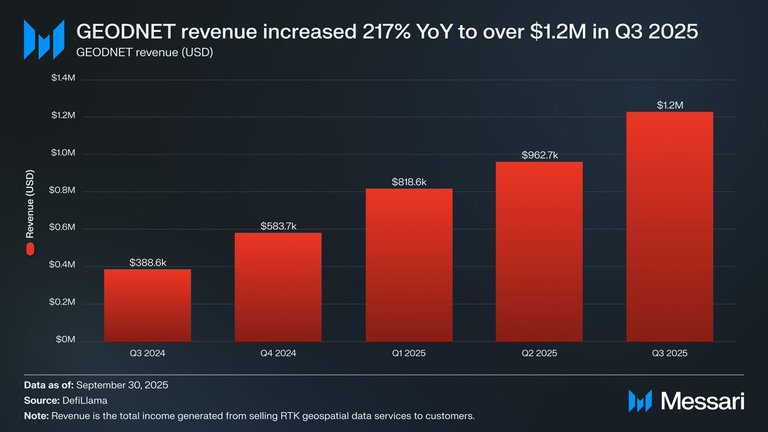

Cryptocurrencies like Zcash and Zano, which respect the privacy of their users, are skyrocketing in usage. Meanwhile, decentralized exchanges (DEXs) like Jupiter and Raydium are increasing in volume. At the same time, DePIN projects like Helium and GEODNET are rapidly expanding using token incentives.

Similar to the US dollar, some of these digital tokens are actually powering real-world economic activity, like the rolling out of decentralized wireless networks, compute networks, and energy grids.

For example, you can earn tokens by lending your spare CPU/GPU power, storage, and bandwidth to these decentralized networks. Additionally, you can invest in wireless hotspots, dashcams, location miners, and other devices to earn tokens passively.

These networks are also experimenting with different tokenomics models. Instead of blindly generating tokens, Burn-and-Mint Equilibrium models automatically adjust the number of tokens in an ecosystem, based on the demand for the service it provides.

A Crypto-Powered Economy

Imagine a future in which you can pay for any service you need (whether that be cellular, compute, energy, etc.) directly with tokens that not only cannot be printed to infinity, but are also fully under your own control, and can be spent from anywhere in the world.

But what if a merchant requests payment in a token that you don't have in your wallet?

That's where DEXs like Uniswap/Raydium and cross-chain DEXs like THORChain would come in, allowing you to easily swap between assets, and seamlessly move between different blockchain ecosystems.

Of course, much of this technology is still experimental, and there are some risks involved. Solana, for example, has only been in operation since 2020, and the first DePIN didn't launch until 2019, so problems will need to be ironed out over time.

That said, we cannot deny that these networks have been growing rapidly.

Preparing For The Wave

At the moment, our collective consciousness is focused on the AI boom, the Nasdaq, Bitcoin, and other assets, but that doesn't mean our attention won't shift in the future. You want to get ahead of that shift, like a surfer preparing for an incoming wave.

My thesis is that investors will eventually notice how these small crypto-powered networks are growing, and start transferring their wealth out of more speculative assets and into blockchains and tokens that are actually generating real-world economic activity.

Until Next Time...

Investing is about predicting, as best we can, the assets that are undervalued today that will be worth more in the future. It involves risk, because no one can predict the future with 100% certainty.

That said, we know that the debt-based fiat system is running into unsustainable territory, and that an alternative financial system and parallel economies will be needed soon.

While the tokens behind DeFi protocols, privacy coins, and DePIN networks are not necessarily guaranteed to be more valuable in the future, we can make an educated guess, based on their growth trajectory, that their values will increase over time.

If you learned something new from this article, be sure to check out my other posts on crypto and finance here on the Hive blockchain. You can also follow me on InLeo for more frequent updates.

Sources

Geodnet Growth Post [1]

Further Reading

Who Does The World Owe $315 Trillion Dollars To?

Posted Using INLEO