For better or worse, the open-source code behind Bitcoin has allowed anyone on the planet to compete in the world of decentralized finance. In other words, anyone who can form a community of miners or validators can launch their own blockchain, and minting a token is even easier.

Thanks to the explosive success of early cryptocurrencies like Bitcoin and Ethereum, we've seen a cambrian explosion of experimental blockchains and tokens, all of which are trying to improve on the technology and gain market share.

Most Cryptocurrencies Fail

While some of these projects have achieved success, the truth is that the majority of them have failed miserably. The biggest problem is that a lot of impostors show up during the bull runs who just want to make a quick buck, and are not willing to stick it out during the bear markets.

The staff at websites like Coingecko and Coinmarketcap are responsible for sifting through these thousands of crypto projects and removing those that have failed. Coingecko recently posted to Twitter that over 50% of cryptocurrencies listed on their site have failed since 2014:

Since creating a cryptocurrency is something anybody can do, we need to exercise caution before investing in them. Most projects don't stand a chance in this incredibly competitive industry, as they are competing with the brightest minds of America, Asia, Europe, and more.

There's Still Room For Innovation

Even though Bitcoin was launched over fifteen years ago, we are still relatively early in the history of cryptocurrency. We have seen a lot of innovation in decentralized finance (DeFi) over the past decade and a half.

Since Bitcoin launched in 2009, we have witnessed the creation of decentralized autonomous organizations, smart contracts, NFTs, proof of stake, sharding, DAG structures, zero knowledge proofs, and more.

We cannot foresee what other developments may happen in crypto over the next 15 years, and that's why we need to remain objective and open-minded as time goes on.

At this stage of the game, it's impossible to accurately predict which blockchains and tokens will attract the most adoption in the future. However, if we pay close attention to the industry, and use our critical thinking skills, we can make some educated guesses.

Limiting Your Portfolio

One could argue that having an expansive crypto portfolio would be detrimental to your success as it overextends your attention span, and prevents you from maintaining a deep understanding of each project.

On the other hand, you could miss out on some important innovations if you limit your attention to just a few projects. Having general knowledge of a large number of projects will help you hone in on those which appear to be innovating and making progress.

At the end of the day, I think the number of projects you should have in your portfolio depends on your risk tolerance and level of knowledge.

Those with a low-risk tolerance who just want to observe the crypto world from a distance should stick to maybe 2 or 4 projects. This will allow you to monitor the projects and learn the blockchain basics without getting overwhelmed.

If you are willing to dedicate more time to investigating the crypto space, you could increase that number to 5 or 10, in order to understand more crypto concepts and start building a mental map of the space.

Expanding Your Knowledge

Only if you're willing to commit time to research and analysis each week should you be branching out further and adding more experimental coins and tokens to your portfolio.

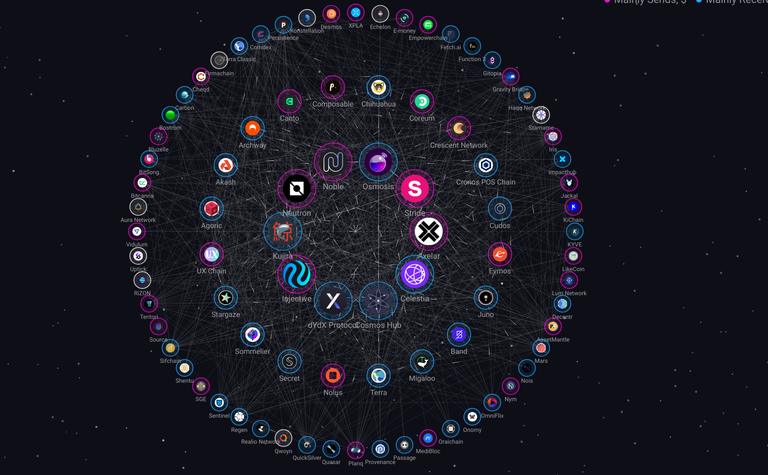

After your exploration, you may come to the conclusion that we're heading into a world of hundreds, if not thousands of cryptocurrencies.

It's important to understand that you're probably going to lose "money" (at least, what we collectively consider to be money today) along your journey, and you'll probably make some too. The key is to learn from those experiences so that you can make better decisions in the future.

Conclusion

Blockchains like Bitcoin and Ethereum are open-source, meaning anyone in the world is able to modify their code to create a new cryptocurrency.

Most cryptocurrencies fail. That said, some offer true innovation, form solid communities, stick it out through the bear markets, and achieve long-term success.

When first introduced to the world of crypto, you should keep your portfolio relatively limited in size, in order to learn at a steady pace and not overwhelm yourself.

Once you have a solid understanding of crypto basics you can branch out to more experimental blockchains and tokens, to increase your knowledge and risk tolerance.

More Info

If you enjoyed this article be sure to check out my other posts about finance and crypto here on HIVE, and follow me on InLeo for more frequent updates.

Until next time...

Resources

Big Bang image [1]

Crypto evolution image [2]

Cosmos Map of Zones [3]

I share the same light suggestion when im bridging people over. Specifically i say 2-5 but its the same reasoning. IMO even if your experienced, once you have over 5 assets you're heavy into, it becomes a lot to manage.