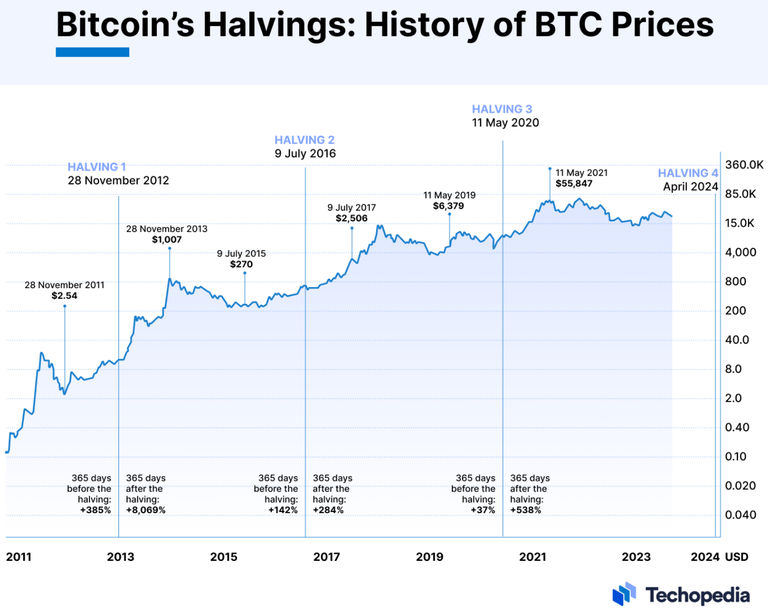

The excitement on crypto twitter has been ramping up as we near the Bitcoin halving, which is slated to occur today on April 20th. People are getting pumped up because whenever the halving event has happened in the past, it caused the price of Bitcoin to skyrocket shortly thereafter.

In this post we are going to explain what the halving is, why it impacts Bitcoin's price, and how relevant it will be in the future when factoring in other cryptocurrencies.

The Halving

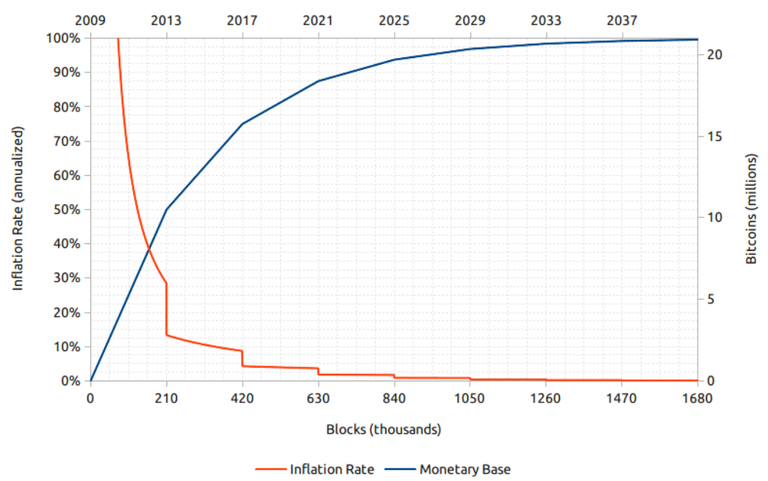

On average, every four years the amount of Bitcoin that's produced by the miners gets cut in half. These halvings are programmed into Bitcoin's code, so they happen automatically without any human intervention. This is how we can predict that the maximum supply of Bitcoin will be 21 million, and calculate the approximate date that limit will be reached.

When Bitcoin first launched back in 2009, a miner would earn 50 Bitcoin for every block they successfully mined. Now that we have been through a few halvings, the amount of Bitcoin earned for successfully mining a block is 6.25, and in short order that will reduced to 3.125. To get a better idea of how this works, check out the emission curve of Bitcoin, illustrated in the chart below:

Historically speaking, the value of Bitcoin has always increased after a halving event, even though there is usually a delay between the supply cut and the price action.

Price Impact

The halving impacts Bitcoin's price due to the basic law of supply and demand. Since there are fewer Bitcoins being produced by the miners, there is less supply to meet the existing demand. The price goes up because people are willing to pay more for scarcer Bitcoins.

Consider how physical resources discover their price the same way in a free market. If there is a shortage of oil, copper, or cacao for example, their prices will increase. On the other hand, if there's a surplus of a commodity (like water, for example), it becomes cheaper.

Bitcoin is the first time in history we've had a digital form of scarcity. This idea has been hotly debated, however. For example, just because there will only be 21 million Bitcoin, doesn't negate the fact that there will only be 84 million Litecoin.

In fact, there is no limit to the number of "scarce" cryptocurrencies that can exist in the online world, and more pop up every year.

Diluting Value

So while Bitcoin's price does increase thanks to its diminishing supply, its overall value is diluted by a wider market of other innovative cryptocurrencies, many of which have very similar emission curves.

Think about how Bitcoin encompassed 95% of the cryptocurrency market back in 2013. Now, after having lost market share to a variety of alternative cyptos, it only makes up about 50%.

The competition is fierce in the world of digital currencies, so only those cryptos which innovate and build strong communities will gain any significant level of adoption.

Halvings Become Less Relevant

Another Bitcoin halving event is upon us, meaning the emission rate of new Bitcoins will be cut in half, and this will almost certainly push the price higher. Remember that the halving is only one of many factors that are causing the price of Bitcoin to surge.

Due to reckless monetary and fiscal policy in traditional finance, the value of Bitcoin will continue to rise relative to fiat currencies like the US dollar, albeit at a slower pace than more innovative cryptocurrencies, which have been joining the race in recent years.

If you learned something from this article, be sure to check out my other posts on crypto and finance here on the HIVE blockchain. You can also follow me in InLeo for more frequent updates.

Until next time...

Resources

Inflation vs. Time Chart [1]

Halvings vs. Price Chart [2]

Bitcoin halving image [3]