Bitcoin set the stage for a Cambrian explosion of decentralized networks. While most were just copycats that only changed a few parameters in the source code, some actually innovated atop of Bitcoin to create more efficient and resilient systems.

In this article, we are going to cover some recent developments in three emerging layer 1 blockchains, with market caps below $50 million, that have been building throughout the extended bear market. These projects may be worth keeping an eye on as we advance into 2025.

Syscoin (SYS)

Unlike Ethereum's account model, Syscoin uses Unspent Transaction Outputs (UTXOs) for fast and cheap transactions, as well as asset creation like Syscoin Platform Tokens (SPTs). It is simultaneously a data availability layer for rollups, which is secured by merge mining with Bitcoin.

In January, the Syscoin zkSYS testnet went live. This testnet leverages zero-knowledge rollups, AI-enhanced validation, and seamless liquidity sharing to create a high-performance execution layer secured by Bitcoin’s Proof-of-Work (PoW).

In mid-March, the Syscoin community voted (95% approval) for Syscoin 5: Nexus. This upgrade aims to improve decentralized infrastructure, governance, and cross-chain interoperability.

Taraxa (TARA)

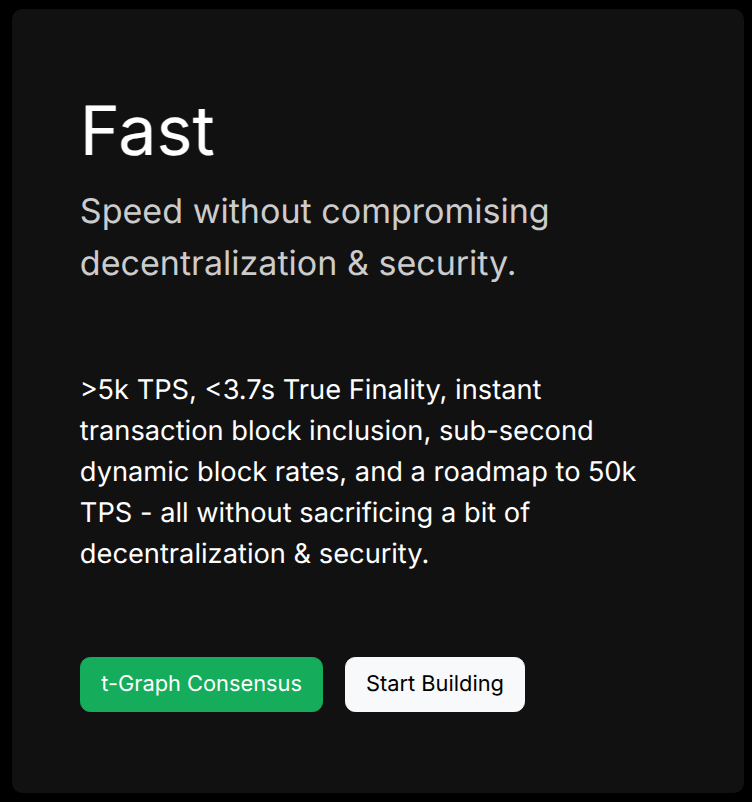

Unlike Bitcoin’s linear block production, Taraxa employs a BlockDAG, allowing multiple blocks to be created and validated in parallel. Taraxa claims that this increases throughput to over 5,000 transactions per second (TPS) compared to Bitcoin’s 7 TPS, without sacrificing security.

A notable milestone from early March demonstrated the mainnet processing 4.6 million transactions across 966 blocks. This test shows ongoing stability and scalability as the team pushes towards their roadmap goal of 50,000 TPS.

Low hardware requirements for validators also remains a focus for the developers, with X posts highlighting that Taraxa has “the highest output per hardware requirement.”

Alephium (ALPH)

Alephium is another Layer 1 blockchain that combines Bitcoin’s PoW and UTXO model with Ethereum’s smart contract capabilities, enhanced by a unique sharding implementation called BlockFlow.

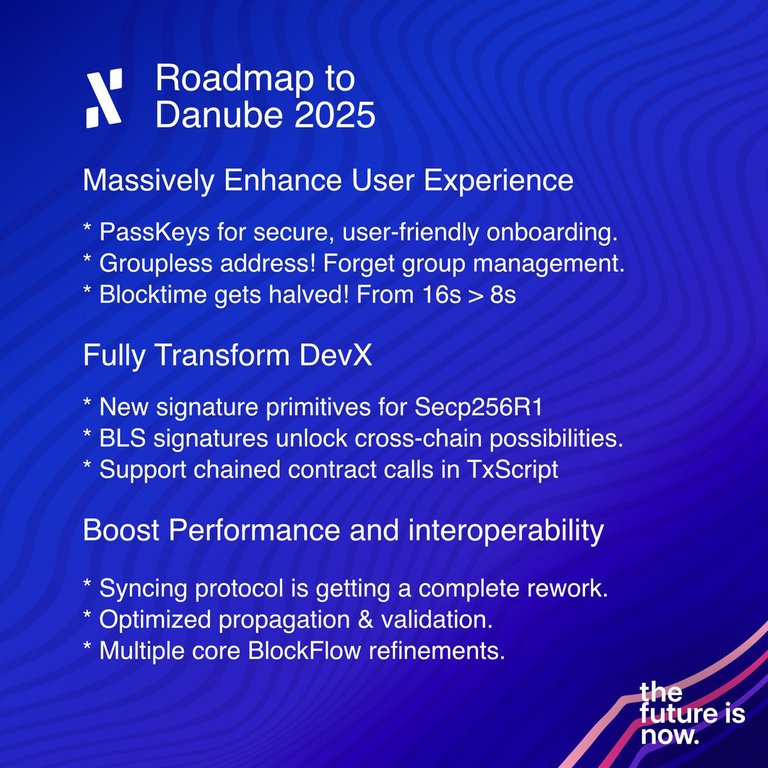

A significant focus has been on the upcoming Danube upgrade, described as an even bigger upgrade than the previous Rhône update in 2024. Danube promises the “fastest block times for smart contract PoW coins” and the most technologically advanced sharding.

In late January, Alephium released an updated mobile wallet for both iOS and Android. This update introduced in-app purchases, an improved user experience (UX), as well as several bug fixes.

Until next time...

While many teams have succumbed to the extended bear market, the above projects have been staying above water and building.

By implementing new scaling techniques such as BlockDAG, BlockFlow, and ZK proofs, these layer 1s are staying ahead of the game, and are definitely worth keeping a close eye on in 2025.

If you learned something new from this article, be sure to check out my other posts on crypto and finance here on the Hive blockchain. You can also follow me on InLeo for more frequent updates.

Further Reading

- Are Layer 2s or Sharding the Ultimate Solution to Blockchain Scalability?

Posted Using INLEO

Taraxa’s BlockDAG approach is something, 5,000 TPS compared to Bitcoin’s 7 is like upgrading from a bicycle to a jet. I'll be looking forward to seeing if they actually hit 50,000 TPS