There has been a lot of chatter on Twitter/X recently about the possibility of the United States banning its citizens from self-custodying their cryptocurrency assets. If these rumors are true, it would seem we are well into the "then they fight you" stage of crypto adoption.

In this article, we are going to cover the differences between custodial and self-custodied crypto, why the government would want to ban self-custody, and the challenges they would face trying to get it done.

Custodial vs. Self-Custody Crypto

In order to understand the issue here, we first need to explain the difference between self-custody and custodial crypto.

Back when Bitcoin was first launched back in 2009, there were no cryptocurrency exchanges. In those days, the only option users had was to self-custody their Bitcoin, meaning it was their own responsibility to keep safe their private key or seed phrase.

As time went on and demand increased, cryptocurrency exchanges were launched, allowing people to not only trade cryptocurrencies, but have their crypto custodied, in which case the exchange would manage their users' private keys.

In recent months, custodial crypto has been taken to another level with ETF offerings, allowing traditional financial institutions to sell Bitcoin in the form of shares, so their customers don't even need to open a cryptocurrency exchange account.

The Threat vs. The Defense

Before Bitcoin, the powers that be had a pretty firm grip on the financial system. Aside from physical cash, they pretty much knew who owned what, and where it was in the banking system. And although Bitcoin and Ethereum are easily traceable cryptocurrencies, a lot of wallets are not linked to real-world IDs, and that is unsettling for the authorities.

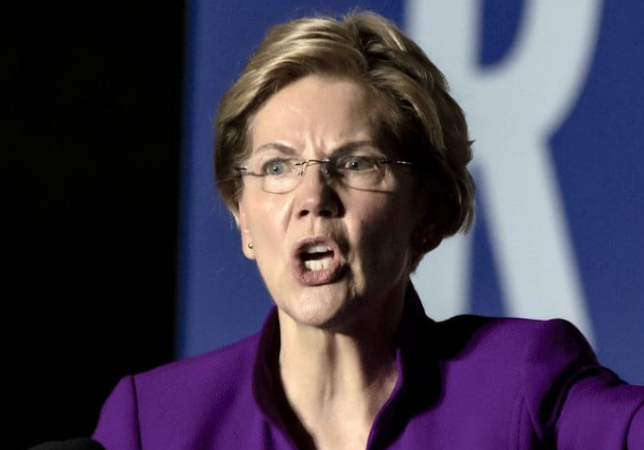

US politicians like Senator Warren have claimed that cyptocurrencies need to be clamped down on because they enable terrorist financing and other heinous crimes. She fails to mention that the true source of terrorist financing is kept secret within an opaque and intricate banking system, which only the elite have visibility into.

She cannot seem to empathize with the increasing number of US citizens who are simply trying to protect themselves from the unprecedented inflation that has resulted from decades of reckless fiscal and monetary policies. She can't put herself in the shoes of a person who has had their bank account suspended for protesting against mandated mRNA shots that have injured millions of people.

Senator Warren is more focused on how the government would be able to confiscate crypto assets from supposed "bad actors", as well as redistribute wealth in the event of an inflationary currency collapse. Needless to say, a lot of people are doing what they can to protect themselves from this outcome, and holding crypto is a peaceful way to prepare for problems in traditional finance.

America's Waning Influence

For over a century, the United States had been a respected world power, especially since the end of World War 2 and the signing of the Bretton Woods agreement, which set the US dollar as the world reserve currency. Although once universally admired, over the past two decades the US has been losing the prestige it once had.

Whether intentional or not, pivotal moments like 9/11, the financial crisis of 2008, the covid-19 plandemic, and the installment of Biden have been gradually eroding the fine reputation the US once had in the eyes of the international community.

Nations that used to adhere to America's standards are starting to sense weakness, and have begun shifting their allegiance over to China and other BRICS countries. If the US were to declare self-custody illegal, it doesn't mean that other nations would follow suit, especially considering America's waning influence worldwide.

Crypto-Friendly Jurisdictions Vs. America

In fact, we already have countries like El Salvador and Central Africa Republic explicitly declaring that self-custody of Bitcoin is legal. Furthermore, Argentina has also made it legal to settle contracts in Bitcoin, or any other cryptocurrency for that matter.

Not only do we have autonomous nation states legalizing crypto, there are an increasing number of states within America itself that are passing laws to protect their citizens' right to self-custody cryptocurrencies. Most recently, Oklahoma passed a bill that permits self-custody.

Considering this trend of smaller countries legalizing cryptocurrencies, and states within America itself proactively legalizing self-custody, we can conclude that the banning of self-custody at a federal level would be pretty much irrelevant, as much of the world simply ignore the new restriction.

Technical Limitations

In addition to the waning influence of the US federal government on the world stage, we should also recognize the technical limitations of banning self-custody.

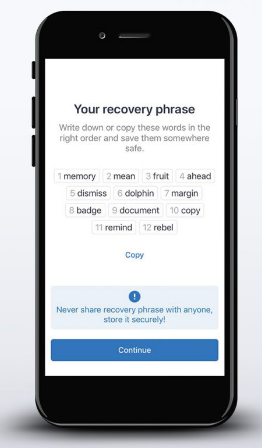

As we explained in a previous article, the act of self-custodying your crypto is as simple as remembering a 12 word seed phrase, and sending your crypto to the public keys that are derived from it.

Making self-custody illegal would mean preventing people from memorizing a set of 12 words that were generated by open-source software. Barring some very sophisticated mind-control 5G technology (haha), it remains unclear how such a law would be enforced.

Consider to that the primary reason Bitcoin accrued value in the first place is because it offers the user complete control of their money. If we all had to store our Bitcoin in a bank, it would lose its permissionless aspect, and become essentially worthless.

A Blip On The Radar

Every now and then a new technology is unleashed on humanity that, aside from being slightly impeded by a few hurdles, spreads like wildfire throughout the world. In retrospect, it has always been better to accept and adapt to new technology than try to fight against it.

For the first time in history, cryptocurrencies allow people to keep money outside of the traditional financial system, in a non-physical form. Any attempt to ban crypto will just be a hurdle, or a small blip on the radar for the adoption of this new technology.

The US continues to lose influence on the international stage. If they chose to ban self-custody domestically, other parts of the world would jump on the opportunity to enact crypto-friendly regulation, and steal business away from them.

Zooming out even further, the reality is that crypto is a threat to the traditional state apparatus, as it empowers the individual and small business. It's going to take time for humanity to adapt to this new technology as it reforms our societies, but its adoption is inevitable.

If you learned something from this article, be sure to check out my other posts on crypto and finance here on the HIVE blockchain. You can also follow me in InLeo for more frequent updates.

Until next time...

Resources

Senator Warren Image [1]

President Biden Image [2]

12 Word Seed Phrase Image [3]