The fallout of the bank problems made for a week of staying out of markets. Was doing the contrarian thing buying into the Swiss banking bailout hoping to find some way to claw back some big losses in Credit Suisse. Crypto players continue to be attacked in the US by the SEC but the quality coins are holding firm

Portfolio News

In a week where S&P 500 rose 1.48% and Europe rose 2.14%, my pension portfolio rose only 0.11%. Drags were 60% hit on Credit Suisse (CSGN.SW) after the bailout, a few resource stocks (not only Australia), and US and European banks.

Big movers of the week were Mogul Games Group (MGG.AX) (+100%), Anagenics (AN1.AX) (+30%), Estia Health (EHE.AX) (+23.6%), Kairos Minerals (KAI.AX) (+17.6%), Northern Minerals (NTU.AX) (+14.3%), Bod Science (BOD.AX) (+14%), MegaChips Corporation (6875.T) (+12.8%), J D Wetherspoon (JDW.L) (+12%), JinkoSolar Holding (JKS) (+12%), KION Group (KGX.DE) (+11.4%), VHM Limited (VHM.AX) (+10.9%)

Hard to pick out themes though there are three Australian healtcare stocks, each in different segments. Ignoring Mogul Games as one tenth of a cent shre price move is 100%. Wetherspoon jumped on earnings howing revenues in the UK pubsector are back at pre-Covid levels. Encouraged to see the pop in MegaChips, recently added to Japan portfolio.

The US markets started a little upbeat after UBS bought Credit Suisse. Then they bounced around a little fearful that the Fed would do more than a 25 basis points rate hike On Wednesday. Well their fears were unfounded and the jobs report was a little better than they expected

The challenge of the week turned to European banks with a smackdown on Friday. This feels like an over-reaction as European Central Bank has run stricter stress tests than the Federal Reserve.

Crypto booms

The Gensler/Yellen attack on crypt rolls on with Wells notice issued against Coinbase and talk that the actions to limit access of crypto firms to banking system is extended to Canada and UK.

Report here

SEC also takes action against high profile influencers for illegally touting crypto assets - report here

Good Hive post about the way SEC is tackling access rails https://leofinance.io/@khaleelkazi/bitcoin-liquidity-is-decreasing-as-fed-tries-to-kill-crypto-rails

Bitcoin tracked sideways most of the week with a test lower and a test higher ranging 10% from trough to peak and finishing 1.9% higher.

Ethereum did much the same with three tests lower and a riange of only 8.5% and ending 1.4% higher

The pump last week in HIVE, my largest crypto holding, was exactly that - two in the week with a drop from the start of the week of 24%. Ignoring the pumps to drop was a more modest 6%

I wrote about the decoupling in crypto a few posts back. This is continuing - a sample from the top of the alphabet - leading lending platform AAVE down 40% vs Bitcoin from mid January

However a few of the top 15 coins have found some buyers at the start of the week and shown signs of reversals forming. Examples Cardano (ADA)

Litecoin (LTCBTC)

Ripple (XRPBTC) - there are rumblings that the SEC case may fall apart. If it does, this will rocket.

This decoupling had me thinking that the April purchase of crypto will be split 50:50 between Bitcoin and Ethereum. I will study these reversals and may persist with the 50/25/25 split and add in one of those reversals.

One altcoin moving against the flow was Celer (CELRBTC) - not quite enough to hit the 50% take profit target from the entry point showing on the chart (blue ray)

Bought

Fresenius SE & Co (FRE.DE): German Healthcare. Software change had me selling a covered call twice. Instead of buying back the call, bought the stock so I am covered - makes for averaging down in holding by 19% in a month. Wrote covered call for 0.64% premium with 10.7% price coverage.

UBS Group (UBSG.SW): Swiss Bank. Share price dropped 12% week to week (Mar 10 to 17) even before the Credit Suisse bailout was announced. Figured this was an over-reaction and wanted to be on the right side of the deal. Bought a small parcel just as market opened (Mar 21) and grabbed the 12% bounce back. Wrote covered call for 1.43% premium with 8.13% price coverage.

Well the bounce lasted for one day and price is now below my entry point and TTB on the credit spread.

ERAMET S.A. (ERA.PA): Base Metals. Market bounce dragged share price back between the sold and bought legs of the credit spread that went TTB last week - added back a small parcel to average down entry price. Wrote covered call for 2.79% premium with 2.48% price coverage.

SPDR S&P Regional Banking ETF (KRE): US Regional Banks. Do not expect US regulators to make the same mistakes they made in 2008. Bought a small parcel to average down entry price and to look for the bounce after Monday sell off (Mar 20). Wrote May covered call for 0.43% premium with 31% price coverage. Kept the coverage very wide as I do not want to be assigned onthe first tracnhe which is unprofitable. Thinking is the market is over-reacting to the banking crisis.

VHM Limited (VHM.AX): Australian Base Metals. Averaged down entry price.

Panther Metals Ltd (PNT.AX): Australian Base Metals. Averaged down entry price. These two stocks are long term investments for materials used in energy transition for batteries

Little did I know that Panther Metals was launching a renounceable rights issue with record date of March 30 priced at 23% discount - normally price drops to that level. The rights are renounceable and also include a listed options issue with expiries 18 months and 30 months out

ASX Portfolio

Top Ups

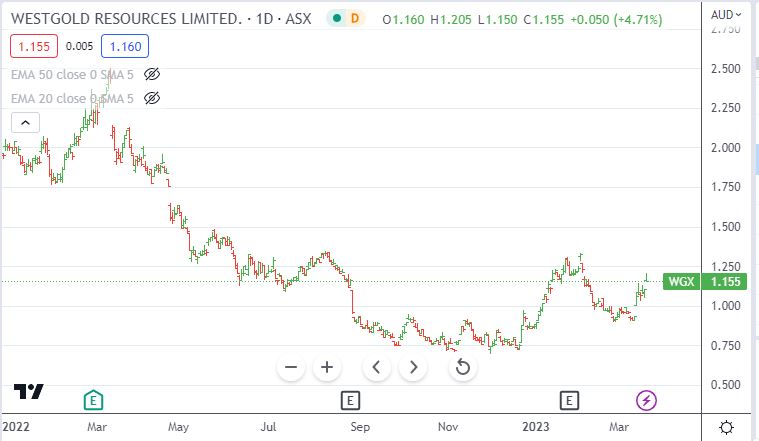

Westgold Resources (WGX.AX): Gold Mining. Price popped up on one month high screen - topped up to average down entry price. The dog has life

Australian Clinical Labs (ACL.AX): Healthcare. Dividend yield 13.30% and trad was added before record date.

Shorts

Hedging Trades

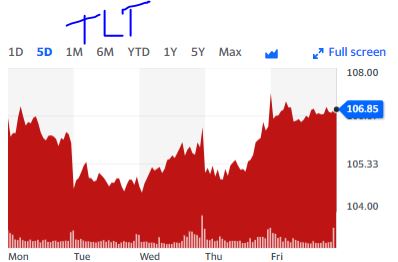

iShares 20+ Year Treasury Bond ETF (TLT): US Treasuries. Sold one more 98 strike put option to get some funding into the bear put spread. Price did drop ahead of the Federal Reserve rate announcement but bounced stronger when the 25 basis points was announced. Looks like the long-dated Treasury market is seeing the end of rate hikes.

Cryptocurrency

Deployed Element Smart Node

Income Trades

A low key start to the income month with only 65 covered calls written across three portfolios (UK 3 Europe 22 US 40) and no naked puts. There is enough exposure from the sold puts kicked down the road last week

Naked Puts

Exercise exposure is close to margin limits in the pension portfolio - there will be more kicking down the road or stocks sales to raise cash.

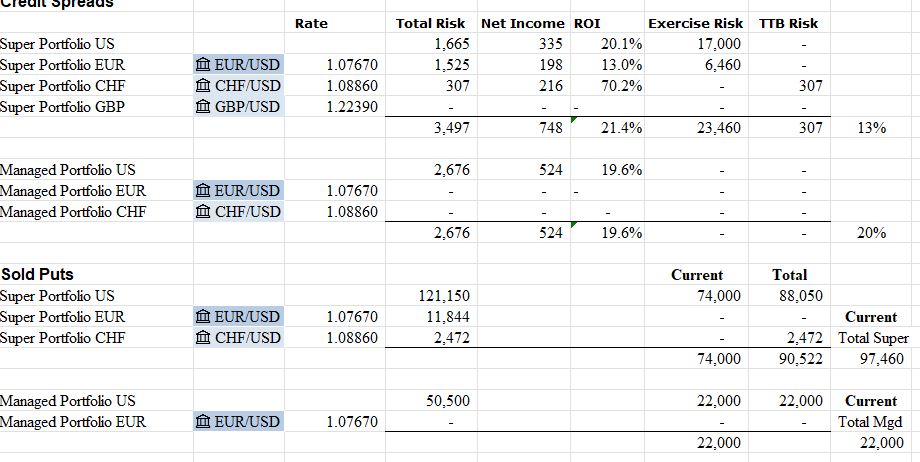

Credit Spreads

Four new credit spreads added - keeping exposure lower this month

UBS Group** (UBSG.SW): Swiss Bank. ROI 10.3% Coverage 1.9%

Adyen SA (ADYEN.AS): Payment Services. ROI 70% Coverage 14.1%

Wynn Resorts, Limited (WYNN): Gaming. ROI 16.6% Coverage 8.2%

Applied Materials, Inc. (AMAT): Semiconductors. ROI 22.2% Coverage 4.7%

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

March 20 - 24, 2023

Posted Using LeoFinance Beta

This really interesting as you said in financial advice, your has to be considered first before others that's really good one from you

All this blog is about is recording what I do. It is absolutely not financial advice. It is what I did the last week. Maybe the way to learn is t read the other 647 posts in the series to see if it is any good. What I do know is it pays all my bills as I do not have a job.

Good morning, please what is my offence you down voted me, I was thought to comment on people's post to keep my account active through engagement, since am still new in the system base on when i started, you would have being a helper for me based on building me through, than to down vote me with 100% am really sad😔 and discourage with this...

You have to clear me where I have gone wrong

Thank you...