Markets make new highs. A few additions on uranium stocks building to 10% in each portfolio. ASX portfolio ticks along with some profits taken

Portfolio News

In a week where S&P 500 rose 1.67% and Europe rose 1.77%, my pension portfolio dropped 0.73%. Drags were a few ASX resources stocks, especially Latin Resources (LRS.AX) down 9.5% and in the US, Fiverr (FVRR) down 16.7% on earnings miss and solar power stocks. Uranium took a hit across ASX, Canada and US - not a lot of green showing. Fiverr drop multiplied by the naked put holding on the stock.

The lack of technology stocks in my portfolios is hurting. Sad as I am a techno junkie - what has happened is the covered call writing has seen stocks assigned and then not replaced - will work an options strategy to build back.

Big movers of the week were APM Human Services International (APM.AX) (59.6%), Appen (APX.AX) (33.8%), Delivra Health Brands (DHB.V) (33.3%), MITSUI E&S Co., Ltd. (7003.T) (30.6%), 88 Energy (88E.AX) (20%), Earths Energy (18.7%), Mipox Corporation (5381.T) (15.6%), Bega Cheese (BGA.AX) (13.7%), Loop Industries (LOOP) (11.7%), Barclays PLC (BARC.L) (11.6%), Marriott Vacations Worldwide Corporation (VAC) (11.3%), Air Liquide (AI.PA) (10.7%), Aeris Resources (AIS.AX) (10.5%), Coty (COTY) (10.1%)

14 stocks in the big movers list with only 3 vaguley fitting into alternate energy theme. The moves are all earnings or news related. Leader of the pack is a takeover situation - offer rebuffed might work toward a profitable exit. 2 are news about cmpleted share placements - oil drilling and geothermal energy.

Markets were a little nervous the day after the US holiday fearful about Nvidia earnings - they need not have botherd as the earnings were solid and S&P made record closing highs

Japan's Nikkei 225 Index also made a record high - last seen 34 years ago.

Crypto Drifts and Booms

Bitcoin price drifted lower all week ending 1.3% lower with a peak to trough range of 4.6%

Chart set up on the right like that hides what happened after

Ethereum price was quite different just pushing higher with a range of 8.7% and a move up of around 8.5%

A few altcoins got into the action - Arweave (ARBTC) up 39%

Chiliz (CHZBTC) up 19% to reach levels close to teh last pump a few weeks back

Gala (GALABTC) up 21%

The Graph (GRTETH) up 27% following the jump the week before - not far off the 50% target from the last entry (the blue ray)

The surprise move was Uniswap (UNIBTC) up 84% after releasing a fee sharing governance proposal. That put a light under a few DEFI tokens.

The other rocket ship was COTI - up over 100% and smashing my profit target to bits.

Bought

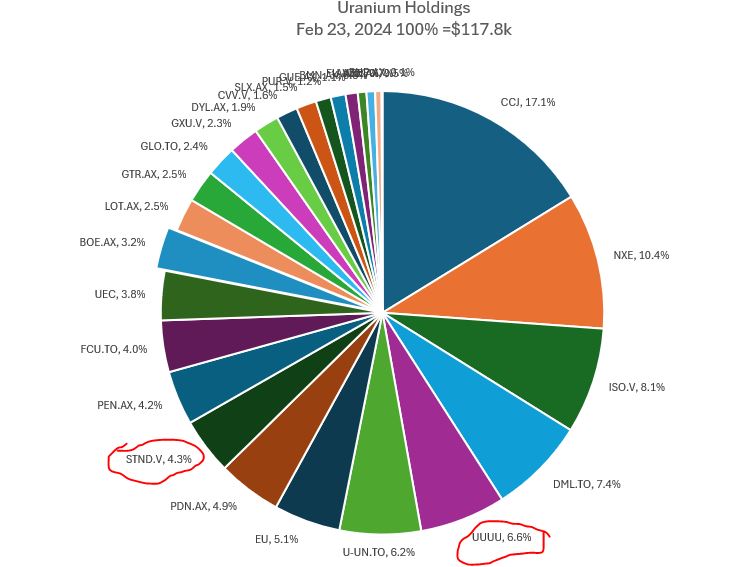

Started the process of scaling up uranium investments in pension portfolio. A down week following the Cameco (CCJ) earnings made for good timing. This portfolio has quite a few more speculative holdings - will focus in on businesses that are closer to production or who have large development plans likely to deliver from 2026 onwards.

Lotus Resources Limited (LOT.AX): Uranium. Just completed placement to sophisitcated investors to reopen the Kayalekeera uranium mine in Malawai. Also added to personal portfolio to average down entry price.

Chart shows price testing down to 50 day moving average. Now the capital raising placement is complete, price can start to move again.

enCore Energy Corp (EU): Uranium. Added to US holding in pension portfolio as it has an options market - will switch off the Canadian Venture market holding when it touches its 52 week high.

NexGen Energy Ltd (NXE): Uranium. New position in pension portfolio.

The key to each of these additions is that they are all planning to come into production in the 2024 to 2026 timeline. All 3 plus Silex below are on the Uranium Insider core list.

Silex Systems Limited (SLX.AX): Nuclear Enrichment. New position in pension portfolio.

Chart shows tidy reversal above the 50 day moving average and relative strength indicator (lower panel) reversing from oversold status.

Quick update on the uranium holdings across my portfolio - despite the increase in positions by around $5k, portfolio dropped $6k. The important part is the mix is evolving to focus on those stocks already producing or likely to produce in the 2026 to 2028 timeline.

Have ringed a few holdings that are under review. Energy Fuels (UUUU) earnings release was all over the place - we really need them to focus on their uranium assets and less on rare earths and their uranium stockpile. A few of the stocks did complete capital raisings this week - LOT.AX and GUE.AX - good to see investors back them.

Banca Monte dei Paschi di Siena S.p.A. (BMPS.MI): Italian Bank. Replaced portion of stock assigned at 2.4% discount to assigned price.

ChargePoint Holdings (CHPT): Electric Vehicles. With price opening at $2.10 (Feb 21) set in place an August expiry 2.5/3.5/1.5 call spread risk reversal.

[Means: Call Spread Risk Reversal. Buy a bull call spread and fund the premium by selling an out-the-money put option below the strikes for the call spread]

Bought an August expiry 2.5/3.5 bull call spread for a net premium of $0.17 offering maximum profit potential of 488% if price moves 74%. This premium was fully funded by selling a 1.5 strike put option with same. This is 25% lower than the opening price - if price goes that far down, the business will be bankrupt.

Let's look at the chart which shows the bought call (2.5) as a blue ray and the sold call (3.5) as a red ray and the sold put (1.5) as a dotted red ray with the expiry date the dotted green line on the right margin. Have chosen a small price move scenario - the purple arrow - from the last move off what was a support line then (the horizontal red line). Trade just needs a move like that. The sold put is below the last low. Earnings are coming up (see the E below) with the last two showing red = not pretty. That is where the risk lies - that and a 77% debt to equity ratio.

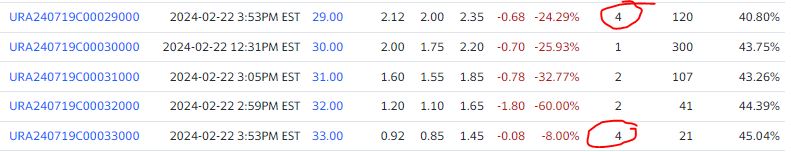

Global X Uranium ETF (URA): Uranium. Been studying the charts looking at options ideas. Broad idea is to set up a bull call spread with the sold call somewhere near the top of the parallel channel. That channel is not beyond the realms of the impossible as the blue arrow is a clone of the last run up in late 2020/early 2021. Then fund the call spread at a level below the last cycle low. If one buys the parallel channel idea, one could write a spread with the sold call as high as the top of the channel (say 38). Chose to write with a $5 width (the thumbs up level) which is the middle of the channel a few months from now. The sold put goes below the last cycle low (the red cross)

The plan was to write 28/33/26 call spread risk reversal with July expiry.

Did not quite work out thet way - somehow did that as puts. With closing price of $28.35 (Feb 21) have the sold put I wanted in place (26) and quite happy to buy at that price. Have a bought put at 28 strike - which is currently out-the-money (just) and a sold put at strike 33 which is in-the-money. Going to take some work to unravel that mess. If price moves up, the unravelling can be done at a profit.

Step one of the unravelling - next day - bought the call spread (29/33) - as price had moved above the initial 28 idea). Bought a July expiry 29/33 bull call spread for $1.20 net premium which offers 233% maximum profit potential with a 16.6% price move from the $28.10 open (Jan 22). The call spread was fully funded with a July expiry 26 strike put option which is 8.1% below the market price.

Let's look at the chart which shows the bought call (29) as a blue ray and the sold call (33) as a red ray and the sold put (26) as a dotted red ray with the expiry date the dotted green line on the right margin. Have chosen a small price move scenario - the blue arrow after the last mini-dip and consolidation. The trade needs a move maybe a little bigger than that and also needs to respect the last low as support (the X)

The options chain shows this was the volume for the day. - also received commission for the trade. Implied volatility at 44% is high

Sold

Global X MSCI Portugal ETF (PGAL): Portugal Index. Global X decided it was in the best interests of the Funds and their shareholders to liquidate a bunch of Funds which were in total less than 1% of their assets. Nice of them to ask - liquidated at net asset value for 10% blended loss since August 2017/January 2024. My investing theses in adding to the holding the previous month was to work through the next cycle higher. Loss in managed portfolio was 13% as had not averaged down.

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 30% profit or 20% if 52 week high is lower than 30% advance. New buys are in $400 lots. Scale ins and top ups in $200 lots

New Buys

Iluka Resources Limited (ILU.AX): Mineral Sands. Dividend yield 0.92%

Chart shows price breaking the downtrend in late 2023 and having a few goes at moving ahead and now showing a few higher highs and higher lows. Plenty of scope to make 40% profit target.

Scale Ins

Ricegrowers Ltd (SGLLV.AX): Food Products. Dividend yield 4.40%. Tracking spreadsheet was indicating price near 52 week high. 20% target is quite some way beyond the 52 week high but in the range of 18 month high. Decided to scale in rather than set a sell order. Got hit with a very bad price right at the top of the day's range - followed by a big fall off. Might start to use limit orders for thinly traded stocks - one more step in the process.

Chart shows a messy trade set up - stock is trading in a $1 wide channel with no real sign of breaking upwards.

Top Ups

Integral Diagnostics Ltd (IDX.AX): Healthcare. Dividend yield 2.70%. Ex date Feb 29.

Chart shows another example of trade entries each time the stock cycles higher. This last entry does average down after a big drop after earnings. Note: Each of E markers are coloured red - market does not like the way the earnings announcements go. Exit will be taken when price gets back toward those 2023 levels.

Bapcor Ltd (BAP.AX): Automotive. Dividend yield 3.84% Ex date March 7.

Insignia Financial Ltd (IFL.AX): Financial Services. Dividend yield 6.60% Ex date March 8.

Ansell Ltd (ANN.AX): Healthcare. Dividend yield 2.60% Ex date Feb 26

Sold

oOh!Media Ltd (OML.AX): Advertising. Closed at profit target for 31% blended profit since July/September 2023. Time to up the profit targets to 35%.

GWA Group Ltd (GWA.AX): Building Materials. 52 week high target hit for 42% blended profit since June/July/December 2023.

Cryptocurrency

Coti (COTIBTC) - big spike in price took out 50% profit target on trade set up a week earlier as a scale in. The blue arrow is the level of first entry years back - might get that back if this momentum has legs. (Feb 24 trade)

Income Trades

A slow start to income trades as had forgottent access card for 3 portfolios at hoem - 25 covered calls written in pension portfolio (UK 2 Europe 10 US 13)

Naked Puts

Added a few sold puts on stocks I am happy to own and as income trades - chose to not go credit spreads for these - not concerned about the riskiness

First Trust NASDAQ Cybersecurity ETF (CIBR): Cybersecurity. Return 0.64% Coverage 4.8%

QuantumScape Corporation (QS): Battery Technology. Return 2.33% Coverage 14%

Eleveance Health (ELV): US Healthcare. Return 0.21% Coverage 9.1%

Added a few sold puts as part of long running strategy to claw back losses.

Adyen N.V. (ADYEN.AS) Payment Services. Return 2.85% Coverage 14.3%

Volkswagen AG (VOW.DE) Europe Automotive. Return 0.83% Coverage 8%

Credit Spreads

Added a few new credit spreads

American Water Works Company (AWK): US Utility. ROI 4.7% Coverage 5.4% - ROI a bit low as spread is too wide.

UBS Group AG (UBSG.SW): Swiss Bank. ROI 20% Coverage 1.7%

Air Liquide (AI.PA) Specialty Chemicals. ROI 15.6% Coverage 3.4%

Exercise risk across the portfolios is within margin limits but is a little uncomfortable in the pension portfolio. Given the size of some of the exposures, will look to kick a few down the road sooner rather than later - e.g., FVRR, TAN, TLT.

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

February 19-24, 2023