A nervy sideways week - topped a few more uranium holdings and adjusted some sold puts. Big week for crypto

Portfolio News

In a week where S&P 500 dropped 0.22% and Europe rose 1.63%, my pension portfolio dropped 0.01% = sideways. Biggest drag was in Europe, DHL Group (DPWA.DU) on back of poor earnings, and in US lithium with Arcadium Lithium (ALTM) down 12.5%. Japan was strong again

Big movers of the week were AXP Energy (AXP.AX) (100%), NuScale Power Corporation (SMR) (59.1%), Appen (APX.AX) (37.3%), Honey Badger Silver (TUF.V) (33.3%), Bayhorse Silver (BHS.V) (27.3%), AdAlta Limited (1AD.AX) (26.1%), St Barbara Limited (SBM.AX) (24.1%), 3D Systems Corporation (DDD) (19.4%), Cobalt Blue Holdings (COB.AX) (19.2%), CoreNickelCo (CNCO.CN) (16.7%), Sarytogan Graphite (SGA.AX) (15.8%), Coeur Mining (CDE) (15.5%), Heavy Minerals (HVY.AX) (15.4%), Zinc of Ireland (ZMI.AX) (15.4%), Lotus Resources (LOT.AX) (14.5%), Healius Limited (HLS.AX) (14.1%), Aura Energy (AEE.AX) (13.6%), Pantera Minerals (PFE.AX) (13.3%), Silver Lake Resources (SLR.AX) (13.1%), North Pacific Bank (8524.T) (12.6%)), Northern Dynasty Minerals (NAK) (11.7%), Clear Secure (YOU) (11.1%), Mizuho Financial Group (8411.T) (11%), Regis Resources (RRL.AX) (10.7%), Euro Manganese (EMN.AX) (10.4%), Cue Energy Resources (CUE.AX) (10%), Lithium Universe (LU7.AX) (10%)

27 stocks in the big movers list. Ignore the top one as any move from $0.001 is 100% or more. Resources continues to drive ahead - gold/silver mining (7 stocks) again, battery materials (6 but only 1 lithium stock to add to the 6), one takeover bid, and one uranium stock. The surprise was the huge pop in NuScale Power - sadly the rise in its price is netted out by fall in the covered call value. Was getting frustrated with the lagging share price and wrote a covered call 10 days ago at a tight strike price - ouch.

US markets had a nervy week - reached new record levels on Wednesday (6 days back head line) and then gave lots of that away after Jerome Powell speech - those rate cuts are a ways a way (maybe not even June)

Uranium

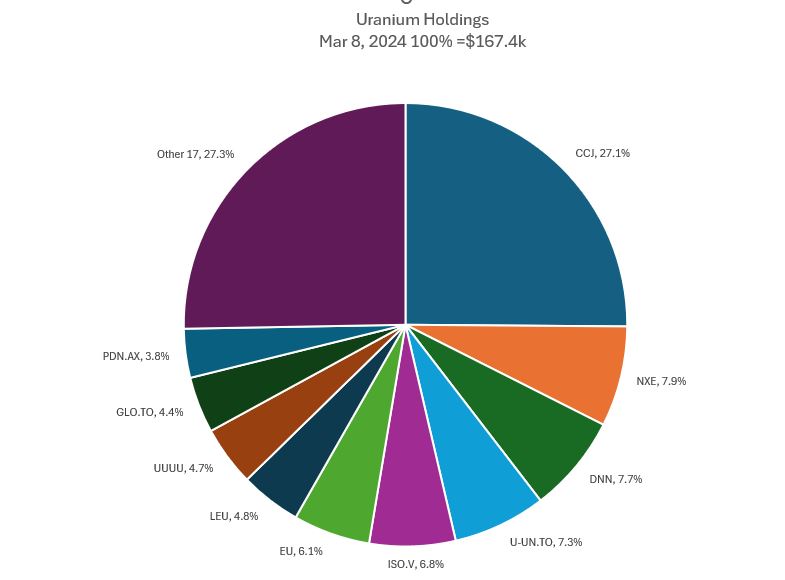

Am progressively structuring uranium strategy - target - 10% of all portfolios. Focusing in on stocks linked to physical prices and likely to produce in 2026 to 2030 time frame. Leaving 10 to 15% of the portfolio to run speculative trades - speculative stocks or options trades)

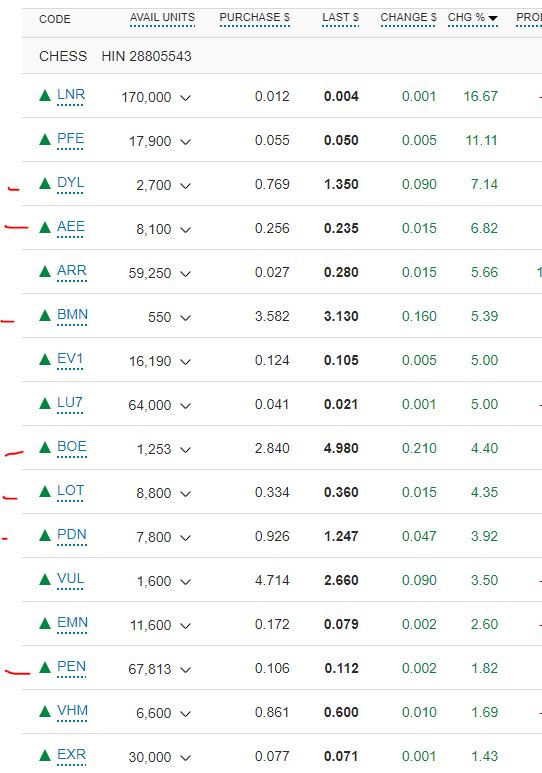

ASX commodity stocks popped to start the week - uranium in amongst them - time to do some topping up - see below

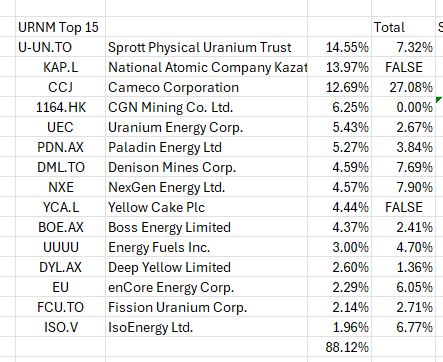

Streamlined the summary chart to focus on Top 15 (75% of portfolio). Value has increased from the week before because of new deployments and is not from price moves. Have also consolidated report of dual listed stocks (Denison and Encore Energy)

Most of the top holdings are in the Uranium Insiders focus list - with some key differences. They do not hold Cameco (CCJ) and my plan is to reduce those holdings as and when covered calls hit assignment. Centrus (LEU) holding is an enrichment opportunity - not in their list. Energy Fuels (UUUU) is the frustrating holding as they are slated to begin producing in 2025 but seem more interested in their rare earths holdings.

Helpful to compare holdings vs the Top 15 of the Sprott Miners ETF (URNM). Their top 3 holdings are tied to physical price and add up to 40% - mine is 34%.

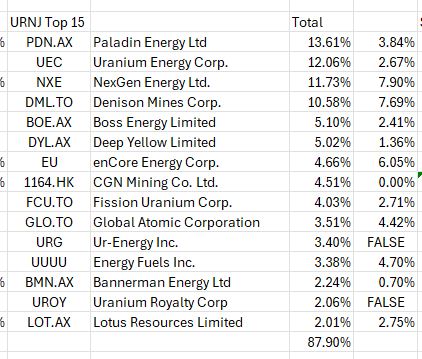

Same comparison for Sprott Junior Miners (URNJ) - my portfolios are leaning more to the majors rather than the juniors.

Crypto booms

The big market move is in crypto with another record set for Bitcoin (and Ethereum). There is a lot of guesswork as to why this happening - Bitcoin halving is coming up. Bitcoin ETF's are certainly growing and then there is Forbes talking about a China-Rurria plan to use a blockchain-based currency to take on the US Dollar.

Bitcoin price pushed higher with a small test lower finishing the week 9.5% higher with a trough to peak range of 17.5%

Ethereum price did much the same ending 11.7% higher with a trough to peak range of 24%

Almost all altcoins got a bid - example Basic Attention Token (BAT) popping 32% against the US Dollar - i.e., half as much more than Bitcoin.

The notable moves are the coins that went up relative to Bitcoin or Ether.

Arweave (ARBTC) up 58%

Enjin (ENJBTC) up a more modest 34%

Fantom (FTMBTC) up 40% - not quite enough to take out profit target

Gala (GALABTC) up a massive 86% and giving back one third of that

The Graph (GRTETH) following last week's move with a 71% pop - that did hit the profit target

NEAR Protocol (NEARBTC) popping 63% and still moving and not far off 2023 highs

Harmony (ONEBTC) moving ahead 52% - also likely to take out profit target

Throrchain (RUNEETH0 making a sharp reversal and popping 79%

Move of the week in my holdings was 0X (ZRXBTC) racing up 149% in a spike similar to one seen in 2023 (and giving back one third of that)

Bought

Centrus Energy Corp (LEU): Uranium Enrichment. The growing demand for uranium has to flow through to a demand for enrichment - my thoughts. Started a new position in Centrus - one of the leading HALEU enrichers in US.

Also added a July expiry 45/55/35 call spread risk reversal.

Bought 45/55 bull call spread for $2.04 net premium which offers maximum profit potential of 390% for 24.9% price move. Funded that premium fully selling a 35 strike put option with 20.5% price coverage. Breakeven should that sold put go to exercise is $34.15. Trade looks a little uncomfortable with price dropping to $40 (Mar 5) on Super Tuesday.

Let's look at the chart which shows the bought call (45) as a blue ray and the sold call (55) as a red ray and the sold put (35) as a dotted red ray with the expiry date the dotted green line on the right margin. The sold call (55) is the top of the last run up. Price is currently in no mans land - or is it?

Have drawn in a Fibonacci retracement for the last big run up (the left hand blue arrow) which is cloned to the next run with same steepness and length. Of note is the reversal went as far as the 0.618 fib level and bounced with a purple arrow bounce. Just happens that price is now testing the new 0.618 level - it is not hard to believe a reverasl of that size around those levels - that will be a comfortable win with at least a month grace before reversing.

[Means: Call Spread Risk Reversal. Buy a bull call spread and fund the premium by selling an out-the-money put option below the strikes for the call spread]

Did similar trade in pension portfolio with April expiry. Have superimposed the expiry as dotted yellow line - and cloned the price scenario. That move would have to start straight away and is only likely to get just past half way to $55 if it does (say$52). Poor trade setup

Global Atomic Corporation (GLO.V): Uranium. Deployed some of the proceeds from CanAlaska sale below in the upcoming Dasa, Niger project. Global updated PFS increasing life of mine to 23 years and production to 68.1 Mlbs - AISC did go up to $35.70 with IRR jumping to 38.4% (was 22.3%).

https://finance.yahoo.com/news/global-atomic-updates-dasa-project-120000465.html

DHL Group (DPWA.DU): Europe Logisitcs. Assigned early on naked put. Kind of weird reporting - not seeing reports as bad as this from Fedex or UPS. Breakeven after income trades is €42.87 = 9.6% premium to €39.10 close (Mar 7). Going to take some time to get that back. Taking in previous stock moves - breakeaven is €40.83. Trade came about from setting up naked put when price passed covered call strike in January.

DHL Group, doesn’t expect to see a broad economic upturn in the first half of 2024 and expects volumes to decline further in some markets before global economic momentum picks up in the second half of the year.

Did the analysis of pension portfolio holdings in uranium - topped up a few from the UI focus list

Denison Mines Corp (DNN): Uranium. Athabasca Basin JV with Orano and own Phoenix project

enCore Energy Corp (EU): Uranium. Texas and Wyoming ISR's coming into production in 2024 onwards

IsoEnergy Ltd (ISO.V): Uranium. Reopening US mines from 2025

Lotus Resources Limited (LOT.AX): : Uranium. Just completed capital raising to reopen Kayalekera in Malawa.

Silex Systems Limited (SLX.AX): Uranium Enrichment. Australian enrichment technology provider

Cameco Corporation (CCJ): Uranium. Assigned early on naked put in personal portfolio at $47. Going to take time to recover with price closing on assignent day at $44.07 (Mar 7). Price dropped 10% from there.

Assigned on 43/40 credit spread that expired in-the-money. Not included in the uranium report earleir as reporting was only done after the weekend. Breakeven - $42.25 = 2.4% premium to $41.23 closing price (Mar 8)

BHP Group (BHP.AX): Base Metals. Deployed some of precceds from sale of South 32 below (a switch to a more relibale producer). Wrote covered call for 0.41% premium with 3.5% price coverage for two weeks.

Sold

CanAlaska Uranium Ltd (CVV.V): Uranium. CanAlaska announced very high grades on latest drilling which popped price. Closed out holding for 50.8% blended profit since September/December 2023/January 2024. Part of strategy of focusing in on a shorter list of miners able to deliver in 2026 to 2030 timeframe. Trade cost of 0.67% reinforces interest in using US listings and not Canadian listings. C$28 vs US$1 for a US trade

L'Air Liquide S.A. (AI.PA): Specialty Chemicals. Closed out at 52 week high for 10.2% profit since December 2023. Trade made to raise capital in pension portfolio. Will keep running credit spreads to capture the hydrogen potential

South 32 (S32.AX): Base Metals. Resaerch note from Intelligent Investor reviewed recent earnings report. They did not like the economics of the new Arizona acquisition bought to replace Cannington, Western Australia managenese resource. Suggested a sell.

Sold for 20% blended loss in personal portfolio since November 2022/January 2024 and 255.5% blended loss in pension portfolio since March 2022/August 2023/January 2024. Switching part of proceeds to BHP and uranium.

Chart shows the rationale for switching to BHP - the lag appears to be structural and may not be closed.

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 30% profit or 20% if 52 week high is lower than 30% advance. New buys are in $400 lots. Scale ins and top ups in $200 lots

New Buys

Nickel Industries Ltd (NIC.AX): Base Metals. Dividend yield 6.70%

Top Ups

Bank of Queensland Ltd (BOQ.AX): Bank. Dividend yield 6.20%. Averages down entry price.

Auto Invest

Vanguard MSCI Index International Shares ETF (VGS.AX): International Index. Dividend yield 1.6%

Vanguard Australian Shares Index ETF (VAS.AX): Australian Index. Dividend yield 6.5%

Cryptocurrency

NEO (NEOBTC): Chart shows price breaking downtrend and reversing off a double bottom. 50% profit target is below the November 2023 highs.

What is NEO: Native functionality provides all the infrastructure you need to build complete decentralized applications

Polkadot (DOTETH) Averages down entry price by around 20%

Chart shows price breaking short term downtrend and reversing a little higher than the November 2023 lows. 50% profit target is above the late 2023 highs

The Graph (GRTETH): 50% profit since May 2023. Price has come close a few times to the profit target - made it this time

Income Trades

Seven covered calls written across 3 portfolios (US 7). Next week will close out pending orders for March and start writing early for April.

Naked Puts

A few naked puts written on stocks that could be assigned on covered calls.

Banca Monte dei Paschi di Siena S.p.A. (BMPS.MI): Italian Bank. - new (very low return after trading costs)

Deutsche Bank AG (DBK.DE): German Bank. - scaled in

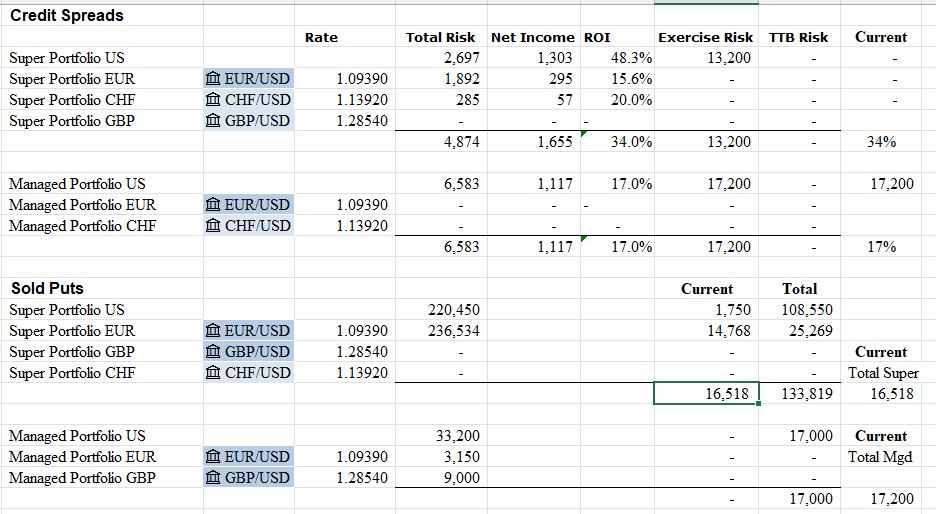

Credit Spreads

No change ins spreads.

With the work done last week in kicking the can down the road and raising capital in the pension portfolio, exercise risk is under control - biggest problem child is Fiverr (FVRR)

Currency Trades

Sold US Dollars to raise Australian Dollars to cover next two months pension payments.

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

March 4-9, 2023

You do have a great investment diversification here, it shows that you really know the subject, I am currently only betting on my crypto portfolio which is composed of 7 coins in total, and among them is the BTC, I have not managed to buy ETH in time, but it really is also having an incredible revaluation.

My last 18 months strategy in crypto has been focused. Set aside an amount you are happy to invest every now and then. 50% Bitcoin, 25% Ethereum - same each time you can set aside an amount. Other 25% into one of the other Top 10 by market coins, excluding stablecoins and TRX - will never invest in anything Justin Sun touches. The 4th 25% is a challenge - best winner has come from there - Solana

Congratulations @carrinm! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 140000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!