Markets make records is a good time to be a bit on the side-lines. Nibbled away at a few more uranium stocks - some in the more speculative area.

Portfolio News

In a week where S&P 500 rose 2.23% and Europe rose 0.28%, my pension portfolio rose 0.58%.

Biggest drag in US portfolios was NuScale Power (SMR) down 46% with a double whammy on stock holding and sold puts. Other drags were in lithium with Latin Resources (LRS.AX) down 15.9% plus a few others

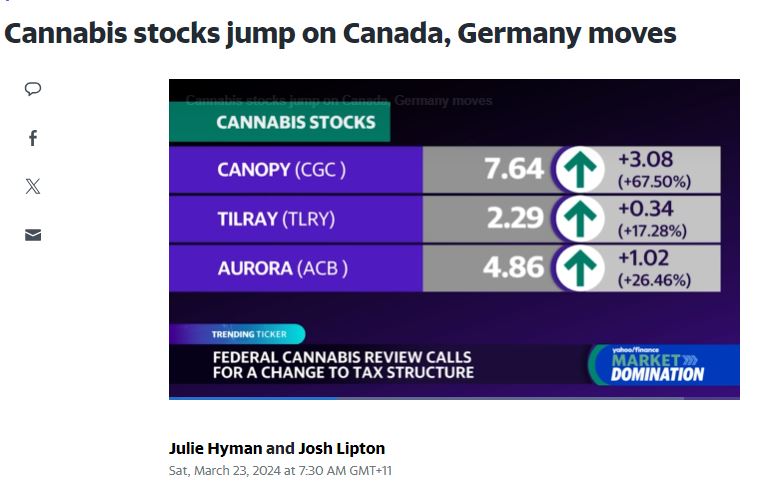

Big movers of the week were Canopy Growth Corporation (WEED.TO) (150%), Aurora Cannabis (ACB.TO) (52.1%), Castillo Copper (CCZ.AX) (50%), Tilray Brands (TLRY) (33.5%), Cronos Group (CRON) (24.3%), Bannerman Energy (BMN.AX) (22.4%), Mipox Corporation (5381.T) (21.1%), Quantum Graphite (QGL.AX) (20.4%), Global Oil & Gas (GLV.AX) (20%), Deep Yellow (DYL.AX) (17.7%), Delivra Health Brands (DHB.V) (16.7%), Paladin Energy (PDN.AX) (14.9%), Sunrun (RUN) (14.8%), Solis Minerals (SLM.AX) (13.6%), Solid Power (SLDP) (13%), Skyharbour Resources (SYH.V) (12%), enCore Energy Corp (EU.V) (11.2%), Gannett Co (GCI) (10.4%), Northern Minerals (NTU.AX) (10.3%)

19 stocks in the big movers list with a massive jump in cannabis (5 stocks) and some catch up in ASX listed uranium stocks (3 stocks to add to one from US). Battery materials also make a showing with copper, lithium and graphite. One oil stock moving on the back of major discovery news in offshore Peru fields.

Cannabis stocks surged on news that Germany decriminalised recreational use of cannabis and Canada starts an official review into reducing excise taxes.

US markets were in the same mood as the week before - pushing new records and getting a little nervous on inflation talk - BUT new records are new records. Soft landing are the words being used - feels like something quite different. Not a landing but a take-off. Europe is more of the challenge - Germany feels like a harder landing

Crypto Drifts

Catch up post - will just report two prices for the week

Bitcoin price drifted lower all week ending 2.5% lower wth a peak to trough range of 11.3%

Ethereum price did much the same ending 8% lower on the week with a peak to trough range double that 1t 16.2%

Uranium

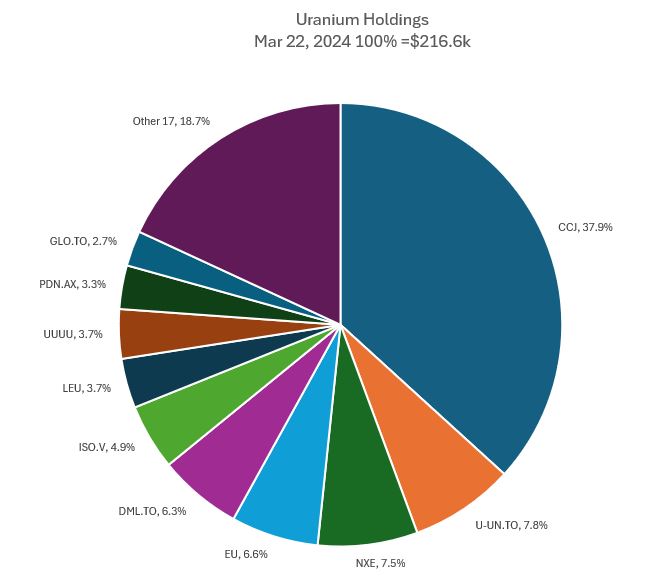

The week had a few additions to uranium holdings up to 11.4% of total portfolio value. This is higher than the target 10%

The mix of holdings is dominated by Cameco (CCJ) with the holdings below that lining up reasonably well with the Uranium Insiders core list. Plan is to write tight covered calls on Cameco and use the assignments as a way to reduce the holdings - might as well earn income on the way along the path.

Bought

BHP Group (BHP.AX): Base Metals. Rounded up holding to write covered calls after multiplier reverted to 100 following dividend payout. Averages down entry price.

Fiverr International (FVRR): Internet Services. Assigned early on naked put at 30 strike. Have been rolling this 30 strike sold put for many months - breakeven on this tranche is $22.03 = only 1.8% premium to $21.63 close (Mar 22). Two months of covered calls will recover that.

The chart tells a story of a market falling out of love with a stock. Price has tested down to a support level (the lower green line) which is not far off the breakeven price.

That support level goes all the way back to 2020 and the spike is over 1400% - could do with a few doublings like that to recover capital invesed in the early tranches

Skyharbour Resources (SYH.V): Uranium. Added to holding in Athabasca Basin to average down entry prices following sale of US uranium assets below.

enCore Energy Corp (EU): Uranium. Added to holding in small managed portfolio with proceeds of sale of Advantage Solutions (ADV) the week before - part of a process of focusing this small portfolio entirely in uranium. Wrote May expiry covered call for 2.5% premium with 23% price coverage - better than the 1% a month benchmark

Fission Uranium Corp (FCU.TO): Uranium. Added holding in managed portfolio as one of the speculative holdings.

Atha Energy Corp (SASK.V): Uranium. Added holding in managed portfolio as one of the speculative holdings - focusing in on Athabasca Basin in Canada.

One chart comparing each of the buys against the Sprott Junior Uranium Miners ETF (URNJ - the bars). The two stocks closest to and/or producing are on the top (EU - yellow line and FCU.TO - dark purple line). The laggards are all explorers with Premier American Uranium (PUR.V - light purple line) the better of them.

Aurubis AG (NDA.DE): Europe Specialty Chemicals. Averaged down entry price in managed portfolio. Wrote covered call for 0.51% premium with 7.8% price coverage - premium lower than target as strike is above average cost.

Chart is somewhat frustrating - price has brken downtrend twice and then recovered a little only to fall over a third time - maybe this time

Glencore plc (GLEN.L): Base Metals. Replaced stock assigned in last options expiry at 4% premium to assigned price in personal portfolio

Sold

Premier American Uranium (PUR.V): Uranium. 114% profit since December 2023. Holding arose from spin-off of American uranium assetts from Consolidated Uranium (CUR.V) ahead of its merger with IsoEnergy (ISO.V). Focusing speculative holdings in Athabasca Basin

ASX Portfolio

No trades

Cryptocurrency

No trades

Income Trades

35 covered calls written across 3 portfolios making a slow start to the month (UK 2 Europe 5 Canada 1 US 28)

Naked Puts

A few naked puts written on stocks happy to buy at a lower entry level

Barclays PLC (BARC.L): UK Bank. Return 0.63% Coverage 10.4%

Technology Select Sector SPDR Fund (XLK): US Technology. Return 1.25% Coverage 2.6%

Adyen N.V. (ADYEN.AS): Payment Services. Return 1.06% Coverage 8.1%

Volkswagen AG (VOW.DE): Europe Automotive. Return 0.60% Coverage 5.3%

Credit Spreads

Commerzbank AG (CBK.DE): German Bank. ROI 27% Coverage 2.1%

Deutsche Bank AG (DBK.DE): German Bank. ROI 25% Coverage 2.3%

L'Air Liquide S.A. (AI.PA): Specialty Chemicals. ROI 5.8% Coverage 4.3% - spread a bit wide.

With all the assignments the week before portfolios have strong cash holdings relative to exercise risk on sold puts. Will report again on exercise risk next report.

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

March 18-22, 2023