Sideways markets and rising silver stocks - time to add to silver mining holdings replacing stuff assigned last month

Portfolio News

In a week where S&P 500 rose 0.36% and Europe rose 0.69%, my pension portfolio rose 0.83%. Japan lagged for a change. De Grey Mining (DEG.AX) rode rising gold mining stocks to lift ASX. Alternate energy stocks lifted US portfolio well ahead of the index

Big movers of the week were Zinc of Ireland (ZMI.AX) (30.8%), Solid Power (SLDP) (30.1%), Global Oil & Gas (GLV.AX) (30%), Anagenics (AN1.AX) (27.3%), Stroud Resources (SDR.V) (25%), NuScale Power Corporation (SMR) (24.9%), Pantera Minerals (PFE.AX) (23.3%), Blue Star Helium (BNL.AX) (16.7%), Sunrun (RUN) (16.1%), Hecla Mining Company (HL) (13.7%), Coeur Mining (CDE) (13.2%), JinkoSolar Holding Co (JKS) (12.3%), Canopy Growth Corporation (WEED.TO) (11.3%), QuantumScape Corporation (QS) (10.9%), Aurora Cannabis (ACB.TO) (10.6%), Stem, Inc. (STEM) (10%)

16 stocks in the big movers list. Alternate energy is back in demand (battery materials and technology - 4 stocks; nuclear power - 1 stock, solar power - 2 stocks). The marijuana moves continued into the new week (2 stocks) as does silver mining (3 stocks)

The leader feels like a misfit - supposedly sitting on one of the richest zinc ore bodies in Ireland, progress is slow. And then they have movement in their zinc assets in Western Australia and acquire lithium tenements in Canada. Maybe the focus should be what the name says - Zinc in Ireland.

Market mood was much the same as the last few weeks - make record highs and get nervous about inflation. With the 1st quarter done and dusted attnetion will swing back to earnings

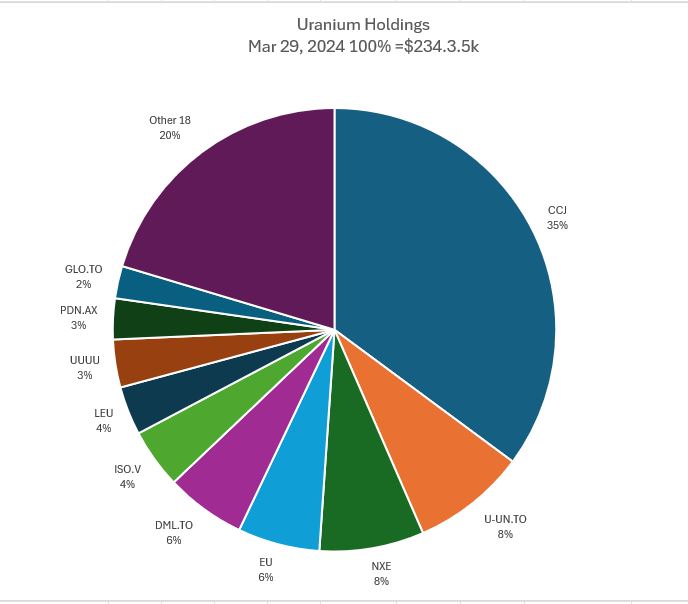

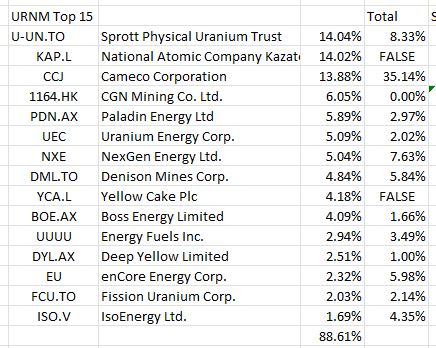

Uranium Holdings

Did add a few more speculative holdings to portfolios and now have 12.3% invested which is higher than the target 10%.

The portfolio is well out of balance with the core focus list from Uranium Insiders. Too much Cameco (CCJ) at 35%. Other holdings at 20% is in line. Best benchmark is to compare with Sprott Uranium Miners (URNM) as it has all the majors.

As the portfolio does not hold Kazatomprom (KAP.L) could allo up to 27% in Cameco.

Plan is to reduce holdings in Cameco as and when covered calls get assigned - proceeds will be deployed into other Top 8 with a leaning to counters closest to production. With the uncertainty in Niger, will not make any further investments in Global Atomic (GLO.TO) or Goviex Uranium (GXU.V). Also plan to exit Energy Fuels at breakeven or better (UUUU). Pension portfolio is underexposed at only 5.9% invested - will work on increasing that by adding ASX holdings.

Crypto Rebounds

Bitcoin price pushed higher to start the week and held onto 4.8% gain for the week with a trough to peak range og 7.4%

Ethereum price was a mirror with a rise of 4.5% and a trough to peak range of 7.3%

Litecoin (LTC) popped 25% against USD.

Internet Protocol (ICPBTC) jumped 34% against Bitcoin but gave half away

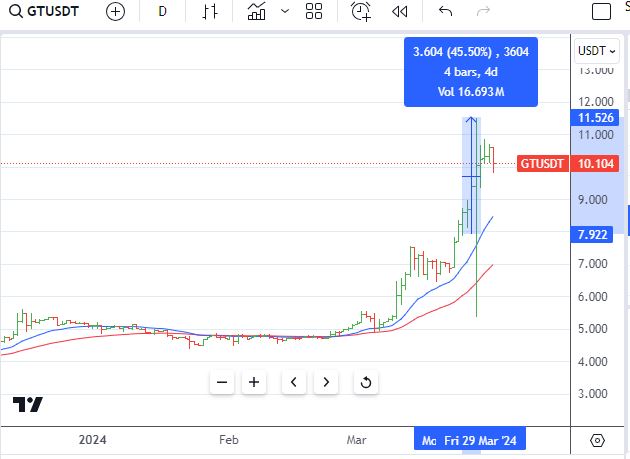

Gate (GT), native token of Gate.io exchange popped 45% against USD and also gave a third away before consolidating.

Polymath followed the move up from last week with another 85% jump.

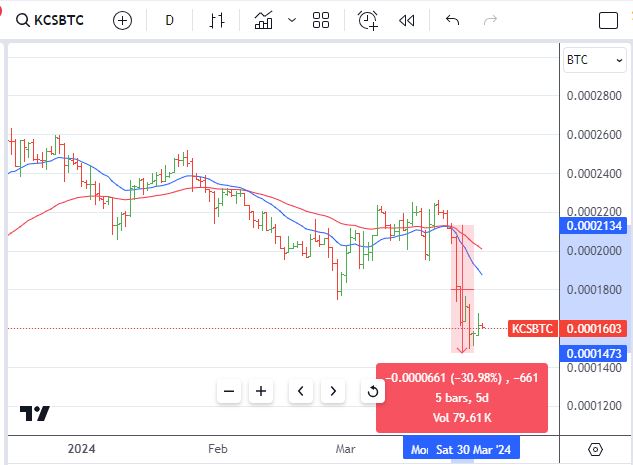

Casualty of the week was Kucoin (KCSBTC) dropping 30% on news of criminal charges being laid against their founders in US. Charges - failing to adhere to Bank Secrecy Act in concealing how many US citizens were using the exchange. Kind of weird charge as I know I had to do KYC verification for my account.

Bought

Aurora Cannabis Inc (ACB.TO): Canadian Marijuana. Followed pricing momementum to average down entry price in pesnion portfolio.

With silver mining on the move in recent weeks, averaged down entry prices on all the speculative silver mining holdings in the pension portfolio. An instinctive move without looking at charts and without being selective.

Bayhorse Silver Inc (BHS.V): Silver Mining.

Stroud Resources Ltd (SDR.V): Silver Mining.

Starr Peak Mining Ltd (STE.V): Silver Mining.

Stuhini Exploration Ltd (STU.V): Silver Mining.

Honey Badger Silver Inc (TUF.V): Silver Mining.

Now for the analysis - first chart compares iShares Silver Trust (SLV - the bars) to leading silver miners that have been in the portfolios. Comparison goes back to cycle low in September 2022 and includes Global X Silver Miners ETF (SIL - purple line). This fund is lagging the pure silver miners as there are a mix of holdings that include gold mining and smelting that dominate the numbers. Clue - invest in gold miners.

Next chart slots in the Canadian miners bought in the week - with the exception of Bayhorse Silver (BHS.V - dark blue line) all are lagging by a wide margin. Hence the tagging as speculative - produce silver and they will take off.

Added to uranium holdings in pension portfolio - two choices - explorer in Athabasca Basin and the largest planned mine coming on stream in 2031 or thereabouts

Atha Energy Corp (SASK.V): Uranium. Athabasca Basin explorer

NexGen Energy Ltd (NXE): Uranium. Rook I project in Athabasca Basin

Dutch Bros Inc (BROS): US Restaurants. Replaced stock assigned at last month options epxiry for 1.7% premium to assigned price.

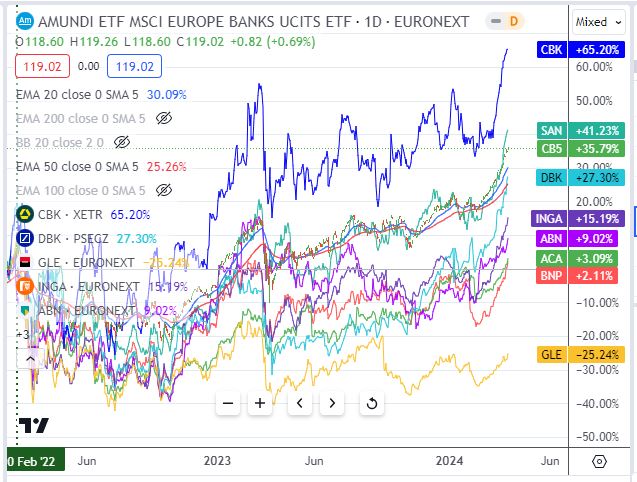

Société Générale SA (GLE.PA): French Bank. Added holding to managed portfolio. Wrote covered call for 0.91% premium with 3.3% price coverage.

Chart shows comparison with Amundi Europe Bank ETF (CB5.PA - the bars) and goes back to cycle high. SocGen is lagging appreciably (same applies taking chart back to cycle low in 2021). Of note is the bottom 3 banks are all French with Dutch banks the next worst.

Coty Inc (COTY): US Consumer Products. Added holding to managed portfolio. TheStreetPro idea

Pan American Silver (PAAS): Silver Mining. Replaced stock assigned last options expiry at 2.6% premium to assigned price. As the laggard in the silver mining comparison, happy with the instinct to add this one back.

POSCO Holdings Inc (PKX): Korean Steel. Added holding to managed portfolio. Interest in Posco has more to do with its ambitions in battery technology rather than steel making.

Sold

Valaris (VAL): Oil Services. Long standing pening order hit on Call Warrants Apr 28 Strike 138.88 with 541% blended profit since April/June 2021. Warrants arose from bankruptcy proceedings for Ensco.

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 30% profit or 20% if 52 week high is lower than 30% advance. New buys are in $400 lots. Scale ins and top ups in $200 lots

New Buys

Karoon Energy Ltd (KAR.AX): Oil and Gas.

Chart shows a classic break out after breaking the downtrend and forming a W (inverse head and shoulders) at the lows. Broker target is well above the 2023 highs.

Top Ups

Incitec Pivot Ltd (IPL.AX): Fertliser. Dividend yield 4.60%

Chart shows two entries when the downtrend was first broken. Stock could not hold that momentum and tested back to the previous lows - quite a few times. This break looks a littlke more convincing - the 40% target is at the previous highs. That feels like a stretch.

AMP Ltd (AMP.AX): Financial Services. Dividend yield 3.20%

Chart shows this trade looking more like a scale in than a top up with price confirming upward price momentum from the 2023 lows.

DEXUS Property Group (DXS.AX): Property. Dividend yield 6.30%

Chart shows entry points coinciding with the tops of trading cycles apart from one in late 2023 which was a scale in purchase and not a top up. With all the entries below the first entry there has been a degree of averaging down.

Next chart goes back to weekly and the start of the RBA rate increases - this is the story. First rate increase in May 2022 coincided with the start of the fall. Price did try to recover and bounce when the pace of rate increases slowed at the end of 2022 (no increase in Jan 2023). With only one increase in the last 8 months, price has a chance. Would be good to see some rate cuts

Income Trades

Seven covered calls written across 3 portfolios. (Australia 1 Europe 1 Canada 1 US 4)

Naked Puts

iShares 20+ Year Treasury Bond ETF (TLT): US Treasuries. Rolled out 97 strike sold put for 26.2% profit and 13.8% cash positive.

Wrote a set of naked puts on stocks am holding which could be assigned or for pure income purposes

Société Générale SA (GLE.PA): French Bank: Return 1.1% Coverage 3.1%

3D Systems Corporation (DDD): 3D Printing. Return 2.5% Coverage 9.7%

Norwegian Cruise Line Holdings Ltd. (NCLH): Crusing - two trades at different strikes Return 1.89% Coverage 6% and Return 0.83% Coverage 11.1%

Sunrun Inc. (RUN): Solar power. Return 4.75% Coverage 7.7%

Nov Inc (NOV): Oil Services. Return 0.83% Coverage 5.8%

Wrote a set of naked puts on stocks in TheStreetPro buy list - looking for entries below current prices on technology stocks

Advanced Micro Devices (AMD): US Semiconductors. Return 2% Coverage 5.6%

Elevance Health (ELV): US Healthcare. Return 0.8% Coverage 4%

QUALCOMM Incorporated (QCOM): US Semiconductors. Return 0.71% Coverage 5.7%

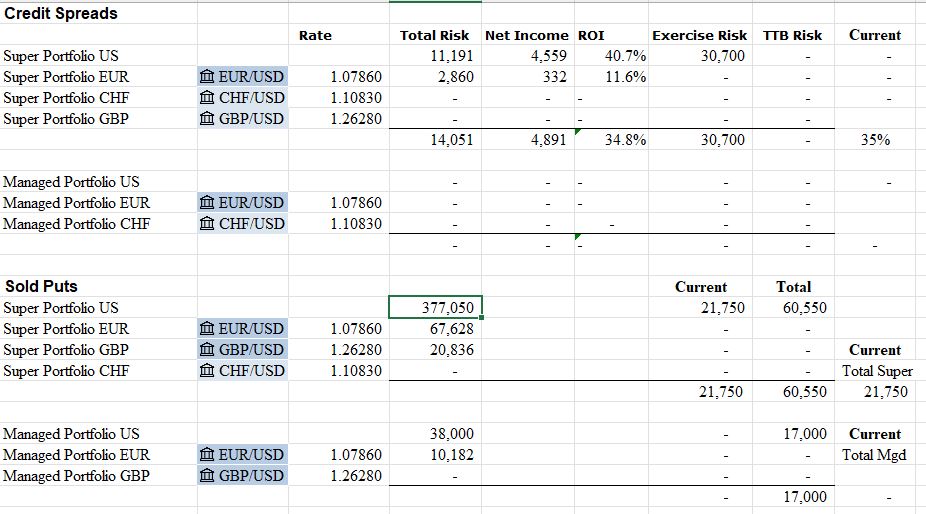

Credit Spreads

NuScale Power Corporation (SMR): Nuclear Power. With price dropping to $4.53 (Mar 27 open) put in place a pending order to sell bought put on 7/4 credit spread. Partial fill for 32% profit. Buyback of sold put (7) incurred 83% loss but was 7.4% cash positive

One new credit spread on Nvidia (NVDA) offering ROI of 10.4% with coverage of 12.9%.

Current exercise risk is well within cash margins - but overall capital risk in the pension portfolio is a little high with the high ticker sold puts added this week.

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

March 25-29, 2023