A week for cherry picking a few new ideas (tin mining, Mexican food, 3D metal fabrication) and averaging down in uranium and uranium enrichment - time to hold off for a few weeks there

Portfolio News

In a week where S&P 500 rose 1.91% and Europe rose 2.43%, my pension portfolio rose a more modest 0.78%. Doing the lifting were ASX stocks (e.g., De Grey Mining (DEG.AX) up 3.9%)), Europe with all stocks up, half of Japan, and a few select stocks in US (from the big movers list below). Drags were ASX uranium stocks and in the US a few select stocks (e.g., Sunpower (SPWR) down 29% and consumer discretionary stocks like cruising and cosmetics and in Canada, a big drop of 31.8% in Stroud Resources (SDR.V) all in one day.

Big movers of the week were AML3D (AL3.AX) (115%), Lifeist Wellness (LFST.V) (58.3%), HelloFresh (HFG.DE) (38.9%), Panther Metals (PNT.AX) (37.5%), Elixir Energy (EXR.AX) (30.4%), Vulcan Energy Resources (VUL.AX) (30%), ChargePoint Holdings (CHPT) (21.2%), NANO Nuclear Energy (NNE) (21.2%), Castillo Copper (CCZ.AX) (20%), Heavy Minerals (HVY.AX) (17.6%), Whitehaven Coal (WHC.AX) (17.2%), Condor Energy (CND.AX) (16.1%), Lightbridge Corporation (LTBR) (15.4%), VHM (VHM.AX) (14.3%), Arafura Rare Earths (ARU.AX) (14.3%), Lithium Universe (LU7.AX) (14.3%), Aeris Resources (AIS.AX) (14.3%), Blue Star Helium (BNL.AX) (14.3%), Atha Energy (SASK.V) (13.6%), CoreNickelCo (CNCO.CN) (12.5%), Hercules Metals Corp (BIG.V) (12.3%), Stanmore Resources (SMR.AX) (12.1%), Coeur Mining (CDE) (12.1%), TechGen Metals (TG1.AX) (10.7%), Lynas Rare Earths (LYC.AX) (10.6%), Guzman y Gomez (GYG.AX) (10%), Resource Development Group (RDG.AX) (10%), Standard Uranium (STND.V) (10%)

28 stocks in the big movers is a big move up compared to previous weeks. The big themes are present: cannabis (1 stock), alternate energy materials (4 stocks), nuclear technology (2 stocks), rare earths (3 stocks), lithium (2 stocks), gold/silver mining (3 stocks), uranium (2 stocks). The underlying message in the list is one is best advised to not listen to the media talking about softening markets when the list is mostly commodity stocks. The surprises in the list are two coal miners (maybe not listen to the media about climate change too). Nice to see the list topped with a stock bought this week - before the big move. One disturbing move - HelloFresh moving past sold call strike (time to average down and stay on)

US markets kept moving ahead in a holiday interrupted week. Modest jobs report raised the hopes for September rate cut and took market to record closes.

Meanwhile in Europe, headline writers were focused on the inflation report and UK election result. From Monday open it was clear the markets liked the French election result popping all my holdings especially the French ones. That news was there long ahead of all the other events.

Crypto Collapse

Crypo markets took a bashing with the release of payments from Mt Gox administrators and move by German regulators to liquidate confiscated Bitcoin.

There was a change of plan - Mt Gox chose to distribute Bitcoin and Bitcoin Cash in tokens. Given the price at the time of the hack event was $600 vs the $60k now - no surprise to see a bunch of people heading to cash

Bitcoin price tried to go up for 12 hours (3 bars) and succumbed to selling ending the week 12% lower with a peak to trough range of 16%

Ethereum fared worse dropping all week ending 16% lower with a peak to trough range of 19.9% - ouch

Altcoins followed a similar pattern - sharp drops BUT quite a few found buyers - example Aave, the lending protocol (AAVE), dropping 28% and recovering half for a bit

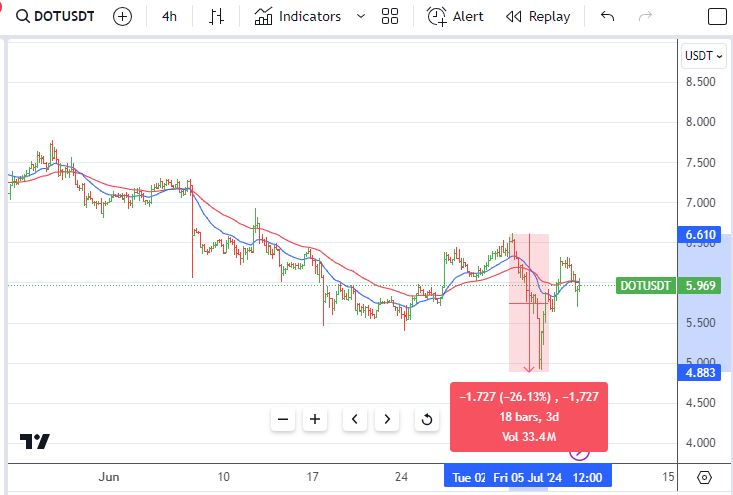

Polkadot (DOT) down 26% and recovering more than half

Shiba Inu (SHIB) dropping 27% and recovering all and then giving away a third of the recovery again

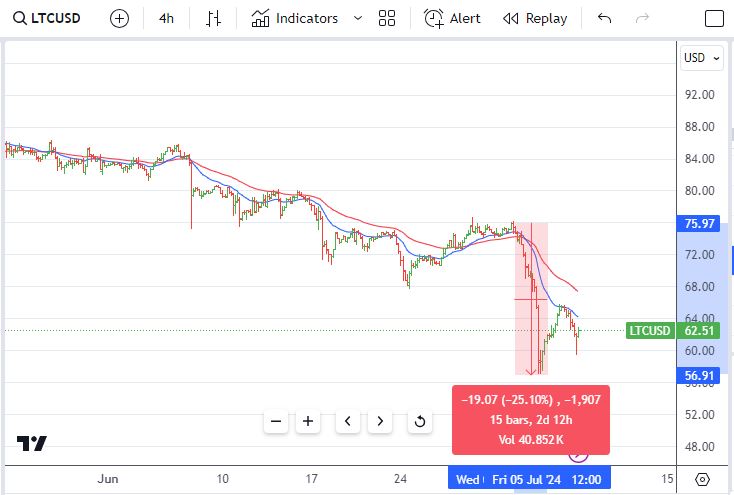

Litecoin (LTC) also dropping 25% and recovering close to half and then sagging again but off those lows.

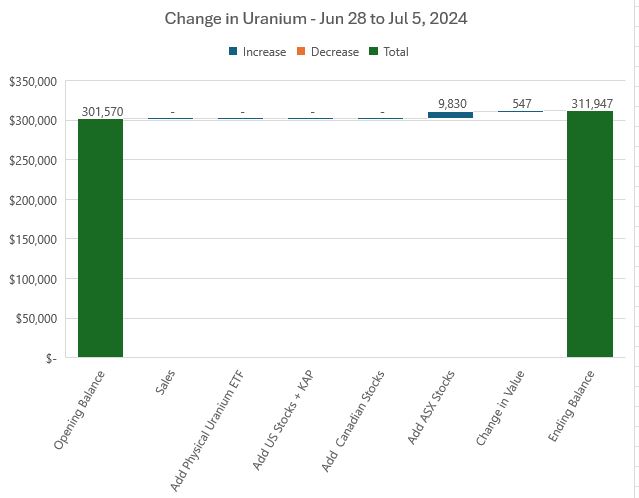

Uranium Holdings

A slightly better week for uranium holdings with a 0.18% increase in valuation (after two down weeks in a row). The ASX adds does include GTI Energy (GTR.AX) added in a share placement the week before. Share of total portfolios when up a little to 14.2% becasue of the additions.

Small change in the mix of holdings with Denison (DML.TO) swapping places up with IsoEnergy (ISO.V). IsoEnergy did announce in the week that Toronto Stock Exchange has approved their main board listing. Price should improve with the promotion from the venture exchange. The share of Others went up 2 points to 36.5%.

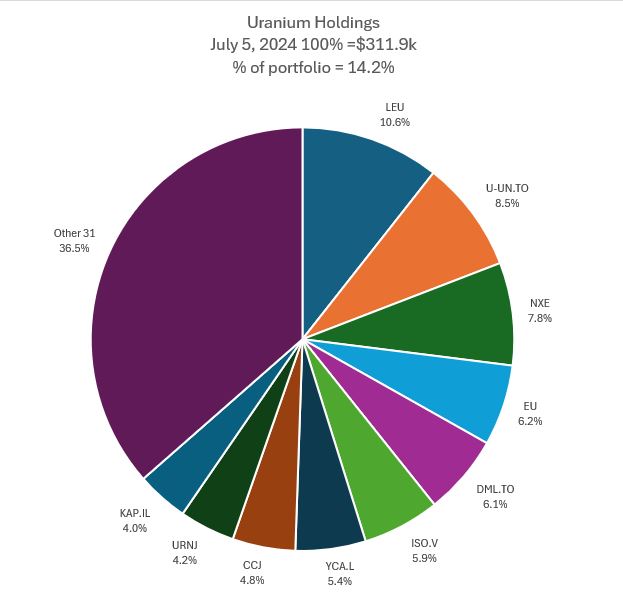

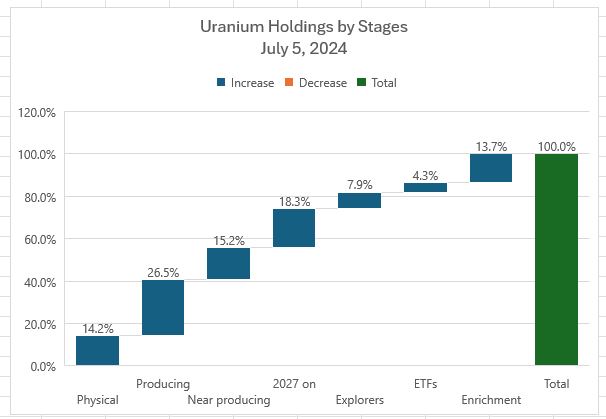

Did add in a new analysis in the week. The strategy has been to invest in stocks that are well connected to the prevailing price - physical uranium and producers and near producers with a small allocation to speculative plays. Next chart show the mix cut that way

It shows that more than half the stocks are linked tightly with current prices (14% physical, 26% producing and 14% enrichment) with another 15% near to producing (2025 and 2026 coming on stream). Next level analysis would be to factor that by mlbs (quite hard to do but the data is there). UI suggest 10% in speculative plays - doing that well enough with only 7.5% there. This mix suggests the number of stocks is less of an issue - it is about proximity to production.

Did watch Triangle Investors interview with Mike Alkin - Sachem Cove Partners. Was a very good dig into the data rather than a waft of opinons. The most notable statment is 25% of the required demand (2028 to 2030) is not even built yet.

Alternate Energy

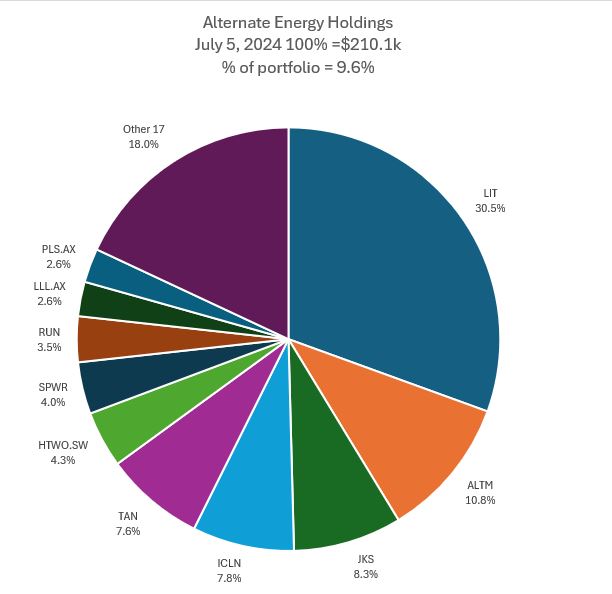

Over the last few weeks I have been reviewing holdings in one of the other big themes - starting out on lithium stocks and then widened into alternate energy stocks (not including uranium and nuclear technology).

Top 10 holdings includes three ETF's - one for lithium (LIT) and one for solar power (TAN) and one for clean energy (ICLN). Those three plus one for electric vehicles (KARS) will be the basis for ranking holdings in the next stage of analysis. Suffice to say that alternate energy accounts for 9.6% of portfolio value with solar power and lithium the largest shares. This share is down considerably from the peaks with the collapse in lithium and solar panel prices.

Bought

Mithril Resources (MTH.AX): Silver Mining. Share placement at small discount to market scales up holding considerably for the minimum investment allowed. Drill results from Mexico property are encouraging

Also encouraging is Jupiter Gold and Silver fund acquiring a stake above the placement price. Keen to get hold of Mexican silver.

Boss Energy Limited (BOE.AX): Uranium. Added to holdings - like the profile of Honeymoon, South Australia project coming into production and Alta Mesa project in US coming back on stream at the same time. Good to see announcement of first shipments from Honeymoon after the purchase

Boss set to ship first U308 from Honeymoon. Ramp-up running ahead of Feasibility Study schedule, with more than 57,000lbs of uranium produced to date; Construction of NIMCIX columns 2 and 3 almost complete, paving way for ongoing production increases

Chart from last week's post for context. Price is below 200 day moving average (green line) but Relative Strnght Index (RSI - lower panel) has diverged and is reversing.

Bannerman Energy Ltd (BMN.AX): Uranium. Added to personal and pension portfolio when trading halt for the placement ended - and dragged price down to the placement level

Chart shows price has just dropped below the 200 day moving average (green line) and RSI (lower panel) has dropped below 30% but not reversed. That suggests trade may have been a bit hasty.

Guzman y Gomez (Holdings) Ltd (GYG.AX): Restaurants. Read an Intelligent Investor interview with CEO. Sounds like a solid business model producing quality food at fast food pace - and with high ROI's for corporate and franchised stores. Projecting some solid future growth aiming for 1,000 stores (more than doubling)

Mineral Resources Limited (MIN.AX): Base Metals. Averaged down entry price in pension portfolio - a reallocation of investments with a little less lithium exposure.

Silex Systems Limited (SLX): Uranium Enrichment. Added to holdings on the back of this announcement. GLE are licensing Silex technology.

Global Laser Enrichment has signalled its intention to take part in the bidding process under the US Department of Energy’s Request for Proposals to establish a robust domestic supply chain for low-enriched uranium, which was published last week.

AML3D Limited (AL3.AX): 3D Printing. Next Investors idea on this metal fabrication 3D printing business serving customers in Australia, Singapore and US.

Manufacture more superior, high-strength parts from a wide range of feedstock material grades using patented Wire Additive Manufacturing (WAM®) technology.

News of the ARCEMY sale to US Navy supplier popped price a few days later when news was understood (or people started looking). Not often that a Next Investors idea pops 115% after purchase - they frequently front run stuff that they are already invested in - it is how they get paid.

88 Energy Limited (88E.AX): Oil Exploration. Long standing pending order hit in personal portfolio to scale up holding by one third. Scaled in holding in pension profolio the following day at same price.

Maiden internal Prospective Resource estimate completed at Project Leonis. Alaska with Total estimated net mean Prospective Resource of 381 million barrels (MMbbls) of oil1,2

recoverable from the Upper Schrader Bluff Formation (USB).

Note: 88 Energy are just starting seismic survey work in Namibia oil fields - one of the last untapped oil reservoirs.

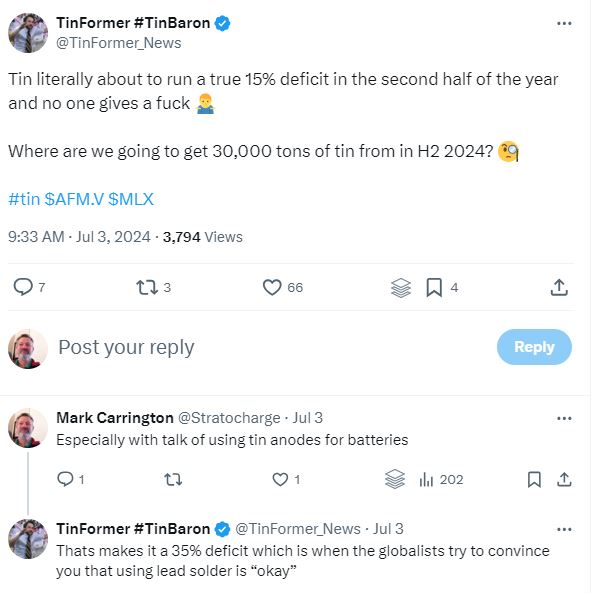

Metals X Limited (MLX.AX): Tin Mining. Read a tweet about a 15% deficit in 2024 for tin. Added in a factoid I read about using tin as anodes in batteries - that bumps up the deficit.

Went looking for tin stocks - picked this one mining in Tasmania.

Have done some price relatives with the world's largest tin miners (not all are listed). Going back to the cycle high, tin stocks are 22% to 48% down with the largest (Yunnan Tin 000960.SZ - the bars) down 40%. That is encouraging for a 40 percent lift

Going closer in to the cycle low sees a big divergence with the two ASX listed miners (SRZ.AX - blue line and MLX.AX - yellow line) pretty much in line but ahead of the big Chinese producer (000960.SZ - the bars). The laggard is Indonesia’s PT Timah (IDX:TINS) - not sure I want to invest in Indonesia. Maybe time as the large nickel producers are there too.

Research in this article

FMC Corporation (FMC): Food Products. Assigned early on sold put. Wrote August expiry covered call for premium of 1.31% of assigned price and coverage at 16.7% of close (Jul 3)

SonicShares Global Shipping ETF (BOAT): Shipping. Red Sea shipping is being hampered by Houthi rebel action from Yemen. This is pushing up shipping rates because of delays and rerouting along longer routes - around Africa or toward Panama Canal. When I first started investing in shipping there was a Guggenheim Shipping ETF - it was disbanded. That led me to investing in specific shipping stocks (with good results). Found that there are now two ETFs - this one and U.S. Global Sea to Sky Cargo ETF (SEA). Chose to invest in this one as it covers shipping only.

Sold

LU-VE S.p.A. (LUVE.MI): Building Products. Pending order to raise capital in managed portfolio taken up for 9.3% profit since May 2024. Stock screen idea. Picked this stock to sell as it has no options market.

iShares Core MSCI Europe UCITS ETF EUR (IMEU.L): Europe Index. Pending order to raise capital in managed portfolio taken up for 75.9% profit since April 2011. This holding was set up when the account was first opened and equates to a 4.44% compound annual growth rate - better than the inflation that has ruled over that time but a lot less than US stocks did.

Global X Uranium ETF (URA): Uranium. With price opening at $29.93 started first steps of addressing July expiry 33/28 credit spread - may not need to have protection down below. Sold the 28 strike bought put (one of 4 contracts only) for 88% loss since February 2024. Still working out the best trade management approach

Chart shows price is respecting the previous lows (around the 29 level) and could confirm a reversal. Price is unlikely to get to the sold put level (33) by expiry. Makes sense to free up premium for the bought put (28) and use the funds to kick the 33 strike sold put down the road.

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 35% profit or 25% if 52 week high is lower than 35% advance. New buys are in $400 lots. Scale ins and top ups in $200 lots

New Buys

Duratec Limited (DUR.AX): Engineering Services. Dividend yield 3.30%

Chart shows price breaking a short term downtrend but has only dropped half way to the previous lows. There is 40% profit opportunity back to the highs. Did the price comparison with 2 competing stocks Monadelphous (MND.AX) and MacMahon (MAH.AX). Going back to the Covid lows, Duratec has led BUT going back to its own previous high it is lagging by more than 40 percentage points.

Top Ups

New Hope Corporation Limited (NHC.AX): Coal Mining. Good timing for scaling into holding with the sale of Yancoal (YAL.AX) below and Anglo American (AAL.L) closing their Grosvenor Mine in Queensland on safety concerns following an underground fire.

Chart shows price having a second go at pulling away from 50 day moving average (red line) and heading back to the blue arrow price scenario drawn at the time of the first trade (left hand blue ray)

Auto Invest

2nd monthly cycle of uranium stocks - all averaging down entry prices.

Terra Uranium Ltd (T92.AX)

Elevate Uranium Ltd (EL8.AX)

Global Uranium and Enrichment Ltd (GUE.AX)

Global X Uranium ETF AUD (ATOM.AX)

Silex Systems Ltd (SLX.AX)

2nd month of balanaced index investments - 50% Australia and 50% International.

Vanguard Australian Shares Index ETF (VAS.AX): Australian Index. Yield 3.8%

Vanguard MSCI Index International Shares ETF. International Index. Yield 3.5%

Sold

Yancoal Australia Ltd (YAL.AX): Coal Mining. Closed around 52 week high for 32.9% blended profit since August/October 2023/January 2024. Coal is on the move.

Cryptocurrency

Uniswap (UNIBTC)

Chart shows price dropping back to 50 day moving average (red line) and testing that a few times. Took the entry at same size as previous exit (the red ray). 50% profit target is at the level of the previous partial exit (left hand red ray)

Income Trades

7 covered calls written across 3 portfolios (Europe 3 Canada 1 US 3) a few for August expiry.

Naked Puts

Kicked a few sold puts down the road on up days when buy back cost came off a bit

- iShares 20+ Year Treasury Bond ETF (TLT): US Treasuries. 212.5% loss on buy back. 24.8% cash positive. Did get a bit messy on this trade with mismatches on expiry dates. Able to fix the error with a $30 profit. Normally trading errors are expensive to fix.

- Fiverr International Ltd. (FVRR): Internet Services. 86.5% loss on buy back. 26.4% cash positive.

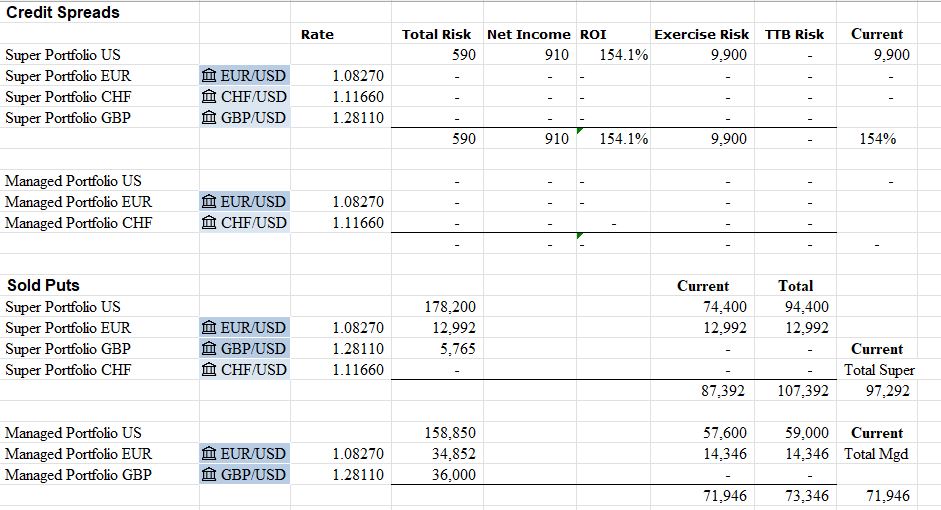

Credit Spreads

With sale of one contract on Global X Uranium (URA) now have 3 contracts in the spread and one naked put (strike 33) open

Exercise risk is still a bit high especially in the pension portfolio. Will kick a few more down the road this week - probably uranium and solar power.

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Gate.io offers a solid range of coins many of which have been delisted elsewhere. Have chosen to share the commission rebates. 40% is the rate - split 30% for me and you get to keep 10% for any people you invite. https://mclnks.com/gateio

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

Jul 1-5, 2024

#hive #posh

Wow brother, pretty interesting to see how your portfolio shifts with specific sectors like uranium and mining. Diversification is definitely key here.

Not invested much in mainstream topics. Always looking at contrariness and long term themes

I think the long-term themes are great