A quiet week in a down market with a few hours testing out a new investing service in Australian stocks AND some solid profit taking to buy a new house.

Portfolio News

In a week where S&P 500 dropped 1.18%, my pension portfolio dropped a larger 1.67% dragged down by a bigger exposure to Europe and Japan and in US, shipping, semiconductors, solar and marijuana.

Big movers of the week were Latin Resources (LRS.AX) (+31%), Nordic American Tankers (NAT) (+30.35), Direxion Daily 20+ Year Treasury Bear 3X Shares (TMV) (+17.9%), JSC National Atomic Company Kazatomprom (KAP.IL) (+15.8%), US Masters Residential Property Fund (URF.AX) (+15.6%), United States Natural Gas Fund (UNG) (+10.9%), ProShares UltraPro Short QQQ (SQQQ) (+10.1%), Yooma Wellness (YOOM.CN) (+10%).

Latin Resources followed up with a another big week.

The rest of the portfolio story is about a looming recession - short Nasdaq and short interest rates got on this list. The other big moves are to do with the war out fall - higher gas prices and more nuclear power demanded as the gas crunch grows.

Yields are rising and the 2-10 year curve remains inverted. This inversion is an indicator of recession coming. The problem with its role as an indicator is it does give false positives and it is not that helpful with timing.

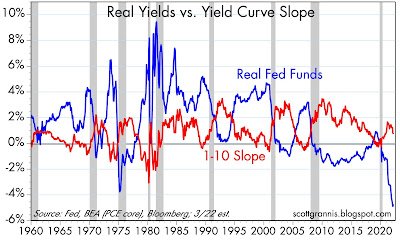

Perfect timing to receive a Scott Grannis Calafia Pundit newsletter with his thoughts. He likes to use the relationship between the Real Fed Funds rate (blue line) and 1-10 Year slope (red line).

When the red line goes below zero is his prediction point - check the grey shaded areas on the charts which are the last 9 recessions.

Join his newsletter for the best read on interest policy and money supply in US

The other key news was the attempt by Putin to get his oil and gas customers off paying with dollars

Whatever it is he did it did bring the rouble back to where it was before the war started

Crypto Drifts

Bitcoin price drifted all week in a quiet week finishing the week 8% lower than the open.

HIVE dropped 20%. The witnesses moved to offering 20% APY on HBD savings. This will have created selling pressure on HIVE to buy HBD. Liquidity in HIVE is low - hence a bigger dent in price

Most altcoins followed the drift lower. There were a few exceptions - biggest move up was NEAR

COTI was not far behind - always good to see a coin pushing higher the week after I make a top up.

Bought

Barclays PLC (BARC.L): UK Bank. Averaged down entry price in one portfolio. Wrote a covered call at 0.68% premium with 5.6% price coverage and two weeks to go.

Webjet Limited (WEB.AX): Travel Services. Received an email from Webjet offering $25 of Webjet shares on new trading platform called Sharesies.

This is operated out of New Zealand by Sanlam, the large South African life assurance compnay. The design concept is to make small scale investing easy like Robinhood has done. The key to that for ASX and NZX trading is to crunch trading costs and to allow partial share purchases. I opened an account with $1,000 and collected my 4.50645324 free Webjet shares. I will get another $25 of shares for making a deposit over $50. I rounded up the holding to $100 = pretty sure travel is going to be a rebound now we see borders opening up and vaccine mandates dropping.

I decided to focus Sharesies test on ASX shares. So I ran the price screens - price to book, price to sales and price earnings with stocks showing signs of turning up and a one month high. The investing idea is to find beaten up stocks that are showing signs of life. This was a good week to run a test like this as the market mood was down. Any stock making a one month high is going against the pattern.

Mineral Resources Limited (MIN.AX): Mining Services. Bought 2 shares for $120 - then I learned I could have kept it at round number amounts and hold partial shares. Dividend yield 4.49%

Costa Group Holdings (CGC.AX): Farm Products. Was a bit hesitant on this because of ravaging floods affecting the East Coast. Dividend yield 3.05%

Kelsian Group (KLS.AX): Transport Services - mostly rail and bus in Australia, Singapore and UK. Formerly known as Sealink operating ferries from UK. I expect this to be a good reopening opportunity coming into European summer. Dividend yield 1.84%

Woolworths Group (WOW.AX): Australian Supermarkets. Screened on Price to sales and Price Earnings screens. Dividend yield 2.06%

Aurizon Holdings (AZJ.AX): Australian Railroads. There is some risk here as we do not know the flood impact on the rail network in SE Queensland. Dividend yield 6.50%

KMD Brands (KMD.AX): Apparel Manufacturing. KMD was renamed in March 2020 from Kathmandu following he acquisition of RipCurl surf gear business. I listened to a podcast with the CEO which pointed to strong turnaround opportunity with reopening into Australian winter (Kathmandu's main product line) and Europe/US summer (Rip Curl main market). Dividend yield 3.72%

The chart shows the 80% drop with the first wave of lockdowns and 24% with the second (June 2021). Price is still 50% below the highs but has broken the downtrend. The dividend has been declared with record date in June.

AMP Limited (AMP.AX): Australian Asset Management. AMP has been hammered by a series of management and regulatory problems. They are still hunkering down but price did make a one month high.

Magellan Financial Group (MFG.AX): Asset Management. Dividend yield 12.99%

Kogan.com (KGN.AX): Internet Retail. Kogan was not on any of my screens but came across it as a comparative with Woolworths. Price has been hammered back to the levels after the covid crash but it has made a higher low.

The chart shows price has not yet made a higher high. The red arrow is 50% of the gap to Woolworths - make that up will return a good profit

Sold

Started to sell some holdings in my personal portfolio to raise funds for new retirement house purchase.

American Rare Earths (ARR.AX): Rare Earths. 900% profit from shares bought in Broken Hill Prospecting as a cobalt investment in January 2017. This trade offset against first tranche which was the most expensive tranche of my holdings. Cobalt assets were spun off into Cobalt Blue (COB.AX) and focus shifted to developing rare earths tenements in Arizona.

Allkem Limited (AKE.AX): Lithium. 236% blended profit from shares originally bought in Galaxy Resources going way back to August 2013 and topped up in April/May 2016, January 2017 and November 2019. Galaxy merged with Orocobre. This was a lithium investment well ahead of the market.

Arafura Resources (ARU.AX): Rare Earths. 128% blended profit since March/May 2010, December 2011, March 2012, May 2013, May 2017. This has been a good case study of averaging down and taking advantage of share purchase plans with the first tranche in this series not profitable. Arafura are developing a rare earths facility in the foothills behind Aileron in the Northern Territory. I first heard about them around a campfire when I cycled through there in 2006.

Firefinch was Mali Lithium was Birimian (FFX.AX): Gold/Lithium. 317% blended profit since April 2016. Birimian started life as a lithium exploration opportunity in Mali. More recently they have added in some gold exploration in nearby areas in Mali. This investment has been a good example of participating in the share purchase plans along the way - each one comes at a discount but there is not certainty that the next one will be a lower entry or not. They have often been that way which is a bit dispiriting as it feels like a bottomless pit.

iShares MSCI Europe UCITS ETF (IMEU.L): Europe Index. Reduced exposure to Europe in one portfolio locking in 50% profit since April 2011 - not quite 5% a year did cover inflation but not shooting the lights out. In the same time frame S&P500 went up close to 5 times that amount.

This ETF is listed in GBP - there is 13% forex appreciation to Australian Dollar in that time to add to the 50%.

Hedging Trades

United States Natural Gas Fund (UNG): Natural Gas. With price opening at $20.09, rolled up the expiring 18 strike sold put to April 14 expiry strike 19. I am happy to take delivery of the stock at $19 if price moves that way - I cannot see it the way the Russia gas story is playing out.

Deutsche Lufthansa AG (LHA.DE): Europe Airline. With price opening at €7.33 (Apr 4), rolled out short put option to April 14 7 strike. This is part of a diagonal put spread paired with a long 6.4 June strike. So far I have recovered half the premium of the long put - some way to go. Friday close of €6.96 has the short put in-the-money with one week to go - I am hoping market nerves ease off so I do not get assigned.

Shorts

Pfizer Inc (PFE): US Pharmaceuticals. I have had a pending order outstanding on a January 2024 40/30 bear put spread. I adjusted pricing to get the trade in place as price has confirmed the start of a downtrend and I want this long run shot in place (excuse the pun). I have been paying close attention to the emerging data on adverse effects from the Cominarty vaccine. They are a ticking timebomb and lawyers will be let loose before too long. With price opening at $51.78 a 40 strike seems a long way away. How did I arrive there?

First chart compares Pfizer to Moderna (MRNA - the bars). Moderna has dropped 62% from the August 2021 highs and peak to trough was 74%. In the same time Pfizer has gone up 5%. If the court cases hit, Pfizer price could drop at least half of the Moderna drop - say 37%.

Net premium on trade was $1.89 which offers a maximum profit of 429% for a 72% drop in price. The next chart draws in the 37% range from the 2021 high. That comes in around the breakeven level for this trade and the 74% level is where the sold put (30) is.

There are some key differences between Moderna and Pfizer. Moderna is a one-trick pony business of mRNA therapies. Pfizer is a more diverse business with a much wider drug pipeline.

Separately the weekly 49.5 sold put option expired in my favour. This is part of June 52.5 diagonal put spread

Cryptocurrency

Bought FLOWBTC and sold AAVEBTC

Income Trades

A quiet week with 4 covered calls written (US 3 UK 1) and one naked put (US 1)

Credit Spreads

ABB Ltd (ABBN.SW): Europe Industrials. With price opening at SFr29.84 (Apr 6), I adjusted the April 31.5/30 credit spread by selling the bought put (30) and replacing with a 29 strike. This was a profitable trade (200%) but it did widen the risk capital in the spread = chalk it down to still learning. Current net credit premium is SFr0.83. Breakeven if I am assigned is SFr30.67 which is 3.8% premium to Apr 11 opening price.

On the other credit spreads, there are 3 trades open which could be assigned - Sunrun (RUN -12.2%), AMD (-16.1%), Nvidia (-10.4%)

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades whn you open an account on this link https://mclnks.com/kucoin15

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

April 4-8, 2022

Posted Using LeoFinance Beta

The 20% APR applied to the HBD interest is a massive move in the blockchain as this would really make individuals store more HBD in savings and that's a nice move in making more profits in the nearest future.

The 20% hive drop shouldn't be a surprise in the blockchain as it's a win-win scenario in the blockchain which is definitely an opportunity to invest more for better rewards to be achieved when we experience a better pump in price.