Things haven't been looking good for Binance lately. The interventions on Twitter of its CEO Changpeng Zhao (CZ) fuding publicly competitors like Coinbase and deleting his posts have been a PR disaster. Then stating with an arrogance that they "don't owe any loans to anyone. Ask around" when a user asked him if they will do an independent proof of liabilities, was another communications red flag.

The "ask around" line is eerily familiar with Do Kwon's ""steady lads, deploying more capital" when Luna was crashing. It doesn't provide reassurance to users or the market.

To quell the fud that it might be insolvent Binance agreed to do a Proof of Reserves audit. For that, the international auditing firm Mazars was hired. Instead of a full audit, Mazars did an Agreed Upon Procedure (AUP) engagement in which sampling and materiality is agreed upon between Binance and Mazars. Interestingly, Kucoin, and Cryptocom did also AUPs instead of audits for their PoR. Again, Mazars and not any of the Big 4 accounting firms was the company tasked to do the AUP.

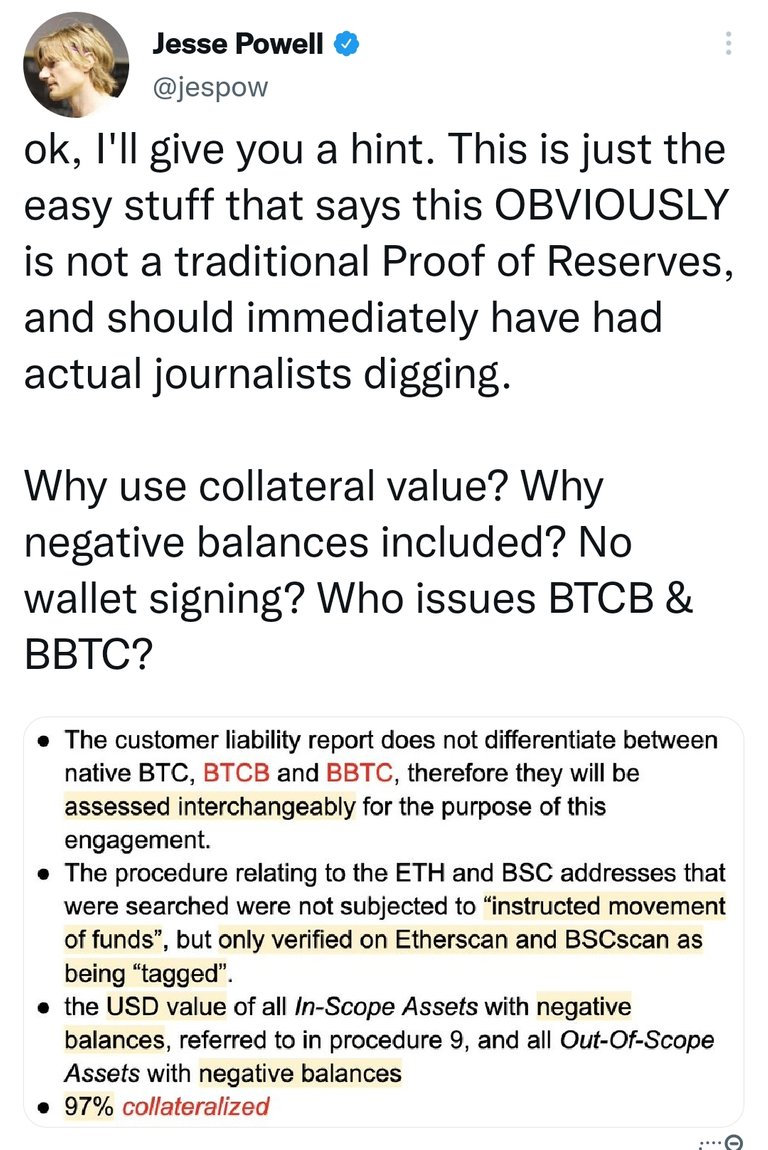

(Screenshot from Jesse Powell account on Twitter)

Jesse Powell, CEO of Kraken and a crypto OG called out Binance and the other exchanges trying to pass an AUP as a Proof of Reserves audit.

To add to all what has happened, the US Department of Justice (DOJ) is looking to charge Binance for money laundering and criminal sanctions evasion violations. Binance has been under the investigation of DOJ since 2018. During 2022, Reuters reported that Binance processed more than $10 billion in payments for criminals and entities attempting to evade US sanctions.

I don't know if Binance will follow the FTX path. That remains to be seen as more information comes to light. As for the DOJ case, Binance has been able to evade authorities so far by constantly changing jurisdiction and moving from one place to the other.

One thing is certain, in this market I don't see much upside for a normal retail user to keep assets in a centralized exchange. But, I see a lot of downsides; ergo losing those assets.

Instead, it's safer to move your crypto into your own custody. That way you will have peace of mind till the dust settles. This will only cost you a couple of dollars in fees.

At the end of the day "not your keys, not your crypto" is probably one of the best advice you can get in the crypto space.

(Main photo courtesy of freeimages.com under fair use)

(Dividers courtesy of @brando28)

Your support matters.

Consider liking & subscribing if you enjoyed reading the article

Congratulations @ceekz! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 100 posts.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

Click on the badge to view your board. Click here to check your ranking.

Thank you to our sponsors. Please consider supporting them.

Check out our last posts:

Click on the badge to view your board. Click here to check your ranking.

Thank you to our sponsors. Please consider supporting them.

Check out our last posts: