Risk management in trading is very important, irrespective of the kind of trader we are. In this post, I will explain some trading terms (trading features), put some into practice using different assets, and also enlighten us on how we can minimize risk using them. Note that this is a very lengthy post. I took my time to prepare this, so if you get tired along the way, sip a cup of coffee, or whatever liquid, would get you through the journey. Let's take a ride.

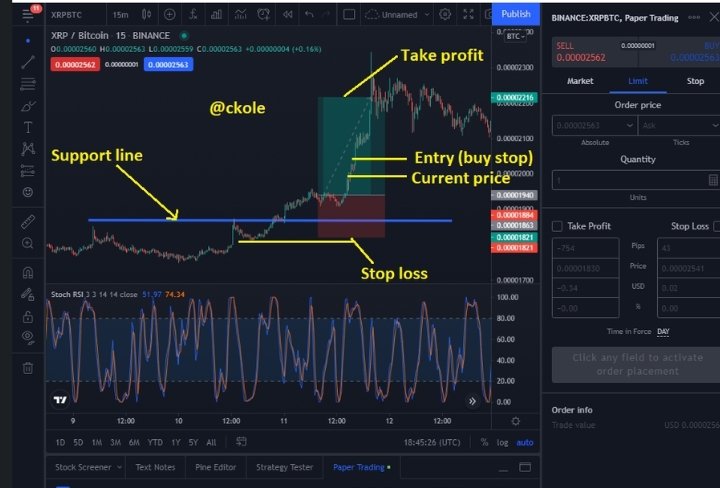

BUY STOP

The buy stop is mostly used to place the price above the current price. Let's say you want to buy an asset (XRP/BTC for instance) and you are certain that the price would follow the bullish movement, then you can use the buy stop order to place your price above the current price

Still on the XPR/BTC.

Trader anticipating to trade XRP/BTC

If the current price of the asset is $1.20

The trader wants to enter the market when the price starts going bullish

Then he places his buy stop at $1.30, as the market starts going in the upward direction

This order would fill when the price reaches $1.30 automatically

Why using buy stop is beneficial

You don't need to keep monitoring the price of the said asset always. The buy stop you set would do that for you and once the price reaches the spot, it would trigger without your consent.

You would reduce stress too. I mean emotional stress. Even if the trade goes against you, you won't go through the emotional up and down movement as the market fluctuates.

Also, missing any trade would be difficult. Once you set the stop buy, you can relax, and the system will pick up from where you stop.

Can buy stop be of disadvantage

Obviously yes! The thing we do when we use stop buy is anticipation, so how sure are we that we would have a 100% outcome. What if we have a false breakout that deceives us and after that, the price starts going the other way round. This is the major disadvantage of using the stop buy order

But there are still some ways to mitigate disadvantages

It means we have to do a proper assignment by using any form of analysis or strategy we understand well. For example, we can use the support and resistance strategy, stochastic RSI indicator, Moving averages, Ichimoku Kinko Hyo, and so on to determine the entry and exit point in our trade

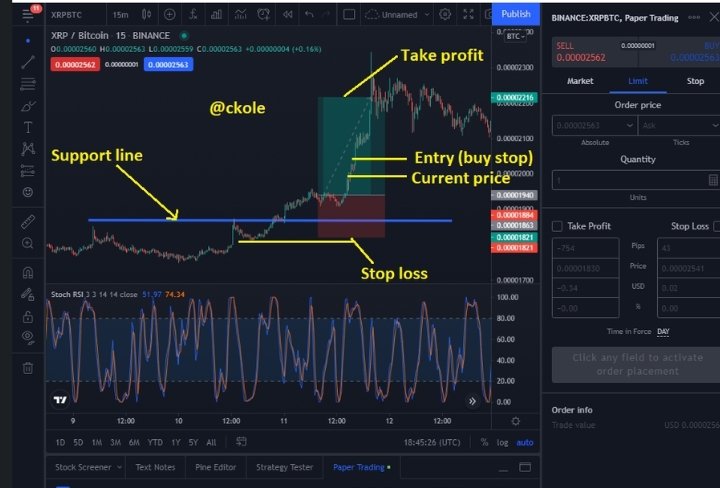

For instance, let's see the image below, as an illustration, using the stochastic

Assume we want to place a trade using the buy stop order, and we want to try to beat the possibility of the trend moving against our anticipation. From the image displayed using stochastic, we can see that the trend moved up to 100% as shown by the red line. And on a good day, between 70 and 100% mark means, over sell

So we are sure here that there would be a downward movement. In that case, we can anticipate using the sell stop order after we've confirmed a downward movement from that point, and place our stop loss and take profit, then place our buy stop order as well. I used the ratio of 1:2 in the image (which means, I'm getting double the profit and if the trade goes against me, I lose just a portion of the trade.)

So the image above shows how the stochastic indicator can help a trader to place his buy stop order, and reasonably set his stop and take profit level.

Setting take profit and stop loss

We all know that the crypto market, forex, stock, and so on are volatile, so there's a great probability that the price of the asset we place on buy stop retesting. As a good trader, we must know this

Also, we must understand that if we don't want to lose a dime, we would end up losing everything. This is where the reasoning of setting our take profit and stop loss comes in

We must have the mindset of avoiding loss by taking a reasonable risk

We can do this by setting our take profit and stop loss at 2:1, or 3:1. It means we are taking either double or triple profit and losing 1 if the market goes against our prediction/anticipation.

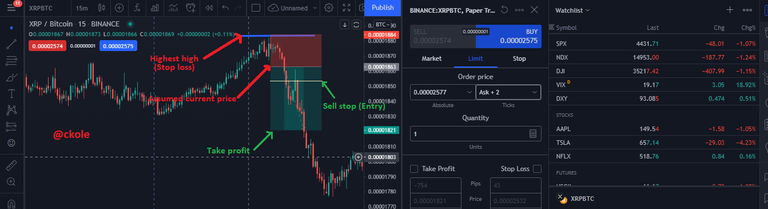

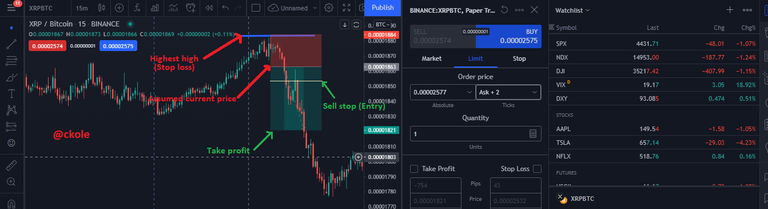

Sell stop

Sell stop is the opposite of buy stop. It works the same way as buy stop, but only in an opposite direction. Here, the price is placed below the current price. When you notice that the price of an asset might follow a downward trend, you can set your sell stop below the current price, and as the market moves downward, the price you input would fill when it touches the mark. Here is an image below

tt.png)

I explained the advantages of buy stop. The same is applicable to sell stop. Everything I discussed about buy stop happens in the case of sell stop too, except that they move in a different direction (upward, and downward movement).

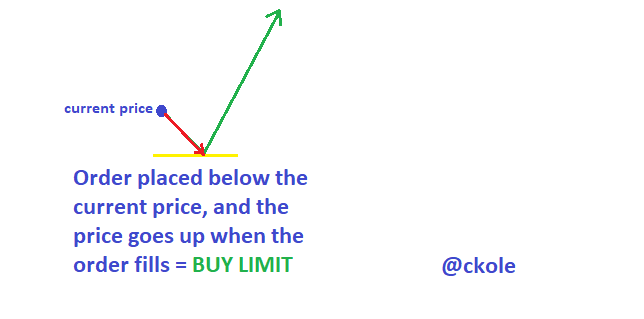

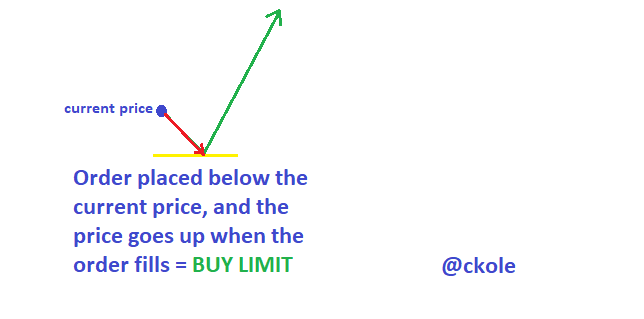

Buy limit

Buy limit is a point where a trader places an order below the set price. The buy limit order gives the trader the opportunity of limiting the amount to be paid for purchasing a particular asset. For example, John wants to buy an asset (crypto, share, gold, etc.), which is currently sold at $20 but doesn't want to buy at that price because he feels the price would drop with time after studying the movement of the price action on a daily basis. He prefers to buy at $15 then he sets a buy limit at that price. If the price drops from $20 to $15, or below, John's trade would be triggered. That's how the buy limit works

.png)

But is there any disadvantage of using the buy limit order?

One of the disadvantages is that brokers charge more on it depending on how low you set your buy limit order with respect to the current price. Also, if the price of the asset retest, but didn't hit the price you set and went back up 4,5,6x or more, you already lose out for not buying at the current price

Furthermore, since there are always many traders trying to buy low, competition sets in. Thousands of traders can be on a list of those that set a buy limit order. If the price of the asset drops to that level, the order would fill according to the queue, so if your order is far from the top lists, and the price moves up from there when your buy order is pending, then your order would remain till the day runs out

Traders can as well benefit from setting a buy limit order

When a trader places a trade using the buy limit order, he's sure of buying the asset at a fair price if it fills. It's just like when you know that they currently sell one apple for 20 cents, and you buy at the rate of 15 after booking below the current price in advance. That's pretty cool, right? Obviously

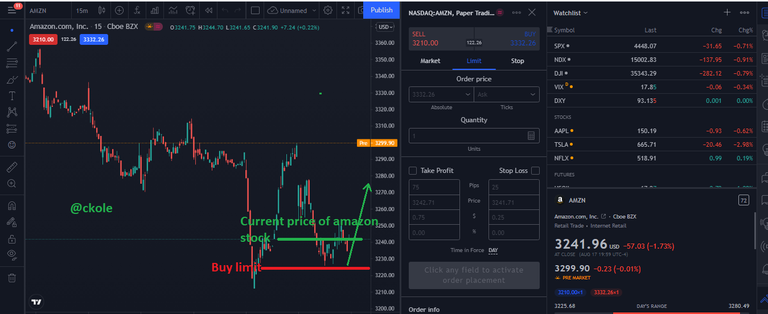

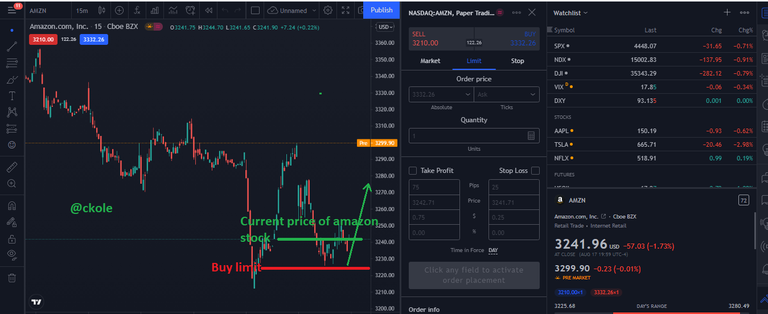

Let's see an illustration of buy limit in the chart below using Amazon chart

.png)

If the current price of Amazon stock is 3240 as shown on the chart, and the buy limit is placed at 3225. The reason buy limit order is placed at that is because it's believed that when the price hits the 3225 marks, it's going to fill and reverse because It's placed at the floor level, and once there is a reversal, profit is imminent

But what if the price fills, retest and come back even below the previous limit, and keep going down

Anything is possible in trading, that's why it's good to have a good risk management idea. Setting stop loss and take profit is also essential, since buy limit expires at the end of the trading day, the stop loss and take profit can be useful

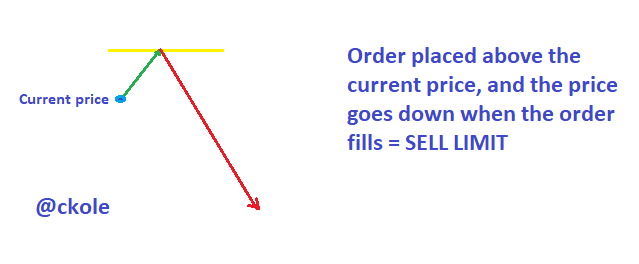

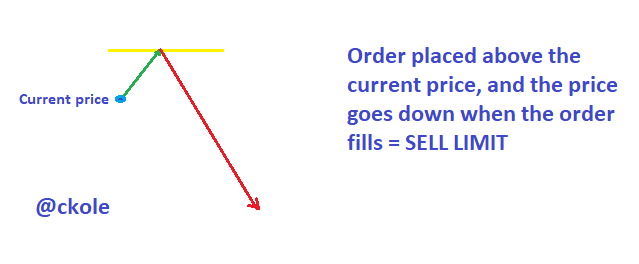

Sell limit

Sell limit is the opposite of buy limit. It's a point where an order is placed above the set price, with the mindset of the price falling when it reaches or a little above. So when the sell limit is placed, we anticipate a downward trend at the specified point, which is seen as a bearish reversal (A bearish reversal occurs when a bullish market in an uptrend begins to move in the opposite direction). Once the price hits the sell limit and starts coming down, we have made a good trade, but it's also important to take profit at the right time

.png)

For example, John believes that the price of an asset would fall after carrying out his analysis, and placed a trade above the current price with the anticipation of a bearish trend after the order is filled. If he set his sell order, there would be a bearish movement. From the image below, we can see the approach.

.png)

Trailing stop loss

A trailing stop loss is a point below the current price where a trader is willing to sell, but it would go up as the price goes up, and it would halt when the price starts going down. To further understand trailing stop loss, let's see these examples below

.png) As the current price go up, the trailing stop loss follows it maintaining the percentage between them.

As the current price go up, the trailing stop loss follows it maintaining the percentage between them.

You put in an order at 44850.00, and you set a trailing stop loss to follow at 4463.91. The trailing stop loss created would stay at a point until the price starts moving upward. When the price goes up, the trailing stop loss you create moves up with it and at the end, the trade might end up in your favor if the trailing stop loss you set follow above the initial entry point before the downtrend finally hit the mark

.png)

That's why it's different from stop loss where you run at a loss when the price of the asset hits the point marked. So I can say that

Risk management

Trading is always a probability game. As a trader, you always need to protect the downside, so once you understand that, you have to implement a risk management strategy. Risk management is the process by which losses is reduced or prevented

Why most of us blow our account is because of lack of proper risk management. When I was introduced to the IQ option some years ago, I didn't understand risk management. My mindset was to always hit big and make more money, so I entered the market with all my funds and before I could say jack, a heavy spike blew up my account. I was standing and looking like someone that missed his Bus. If I've used a portion of the money, I would have saved some. Lol (I learned a lesson)

Certainly, we cannot profit if we don't wanna lose a dime. So, we must take risks to make a profit, but we need to take a reasonable one.

So how can we take a reasonable risk

In this illustration, I would explain some points

1.

The first risk management strategy is using 2 or 5% of your fund for trading. Before any other plans set in, we must consider this. If for instance, I have $100, I should follow the stipulated percentage by using 2 or 5% which is 2 or $5 to enter a trade. We should understand that accumulation is what later turns out to be a huge profit. We always want to win big, so we like to invest big, and in the long run, ruin the journey.

No equity curve is a straight line. If it doesn't bend, then there's no line at all

<center>[My quote]()</center>

This means, we cannot always have a winning trade, so we should learn to use a meager portion of our fund in case the clock refuses to go clockwise.

2.

Using stop loss is also essential. While using the 2 or 5% strategy to set up your trade, setting stop-loss too would help to further enhance your risk management strategy. It's like using one stone to kill two birds. So in the end, you might end up profiting or losing a fair portion of your investment

3

The trailing stop loss is part of what I love. Monitor your trade by tying your loss to your profit. When the price goes up, your stop-loss follows and further reduces your loss. It might end up as profit. This is a fantastic way of implementing risk management

4

If you don't have the time to monitor your trade, set your take profit in case of necessity. It would take your profit automatically if the price tallies

.png)

How you can use a Moving averages trading strategy to demonstrate risk management

First, understanding moving averages is important. A moving average can suggest moments when the market is oversold and overbought relative to the trend of the market, and certainly, overbought and oversold in the market serves as a trading opportunity. So the market oscillates around the mean, creating oversold and overbought

It's also used to identify trends and confirm reversal. When the price of the asset is above the moving average, we confirm the instrument to be in an uptrend, and when it's below, it's a confirmation of a bearish trend. Also, if there's a break in the moving averages, we can say it's a trend reversal

What about the areas of support and resistance? The moving averages is also good at spotting it.

Now using moving averages to demonstrate risk management. Let's see the image below

We have to set up our moving averages on the chart using the 20, and 50 MA, so the green line is the 20, while the red is set as the 50 MA.

.png)

Using the moving average to show how much I understand risk management, I labeled part of the chart to explain the risk management strategy using a risk ratio of 2:1 (Take double profit, and sacrifice 1). I prepared to enter the trade when the green line (20MA) crosses the 50MA, and delved in after confirming the bullish trend multiple times. I didn't use only the confirmation of the crossed lines, because the fact that the market reacted to the cross-over in the past doesn't guarantee it's going to repeat. So, it's important to watch, and be sure that the market is trending at that period before entry

If I'm using the trailing stop loss in this chart, I would reduce my risk ratio to 1:1 just as seen below using a moving average calculation.

.png)

From that image, I might end up taking my profit from any region where I draw the green lines because the reversal at that point would hit my trailing loss and I would end up winning the trade with some profit. Conversely, if it goes up a little, and comes down to hit my stop loss, I would lose a reasonable amount. The Moving average helps me in this case to know the right point of entry and implementing my risk management principle was made easy.

Conclusion

There is a bird that builds its nest and scatters it the second day with its mouth. This is because it lacks proper management skills as they say. We all like building up our account, but the lack of management takes us back to starting afresh and we keep funding our account after we've blown it, or probably quit.

I've learned about many aspects of risk management, like using the stop loss, trailing stop loss, buy limit, sell limit, and so on. It's pretty interesting and useful.

Risk management is very important in anything we do, whether it's financially, or anywhere we find ourselves. I believe risk management is one of the greatest disciplines a man can possess that would help him go a long way in life because every step we take in life is a risk.

Thanks for reading.

This is ckole the laughing gas. One love

Posted Using InLeo Alpha

Posted Using InLeo Alpha

tt.png)

.png)

.png)

.png)

.png)

.png) As the current price go up, the trailing stop loss follows it maintaining the percentage between them.

As the current price go up, the trailing stop loss follows it maintaining the percentage between them..png)

.png)

.png)

.png)