Pricing Assets against something other than the USD dollar.

Dow Jones Industrial

One of the biggest averages out there - when people talk about the market moving, they usually mention the DOW first. I wanted to take a look at the market in a different view, and compare the value against sound money of Gold and Silver to see what I can learn about trends and performance cycles.

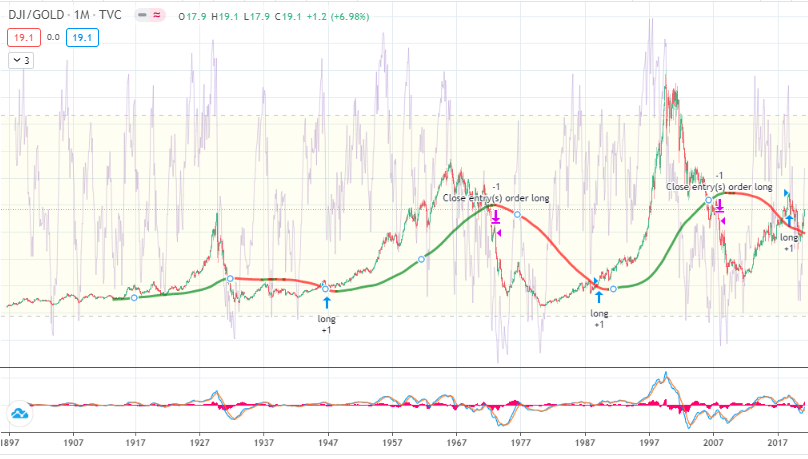

GOLD MONTHLY CHART

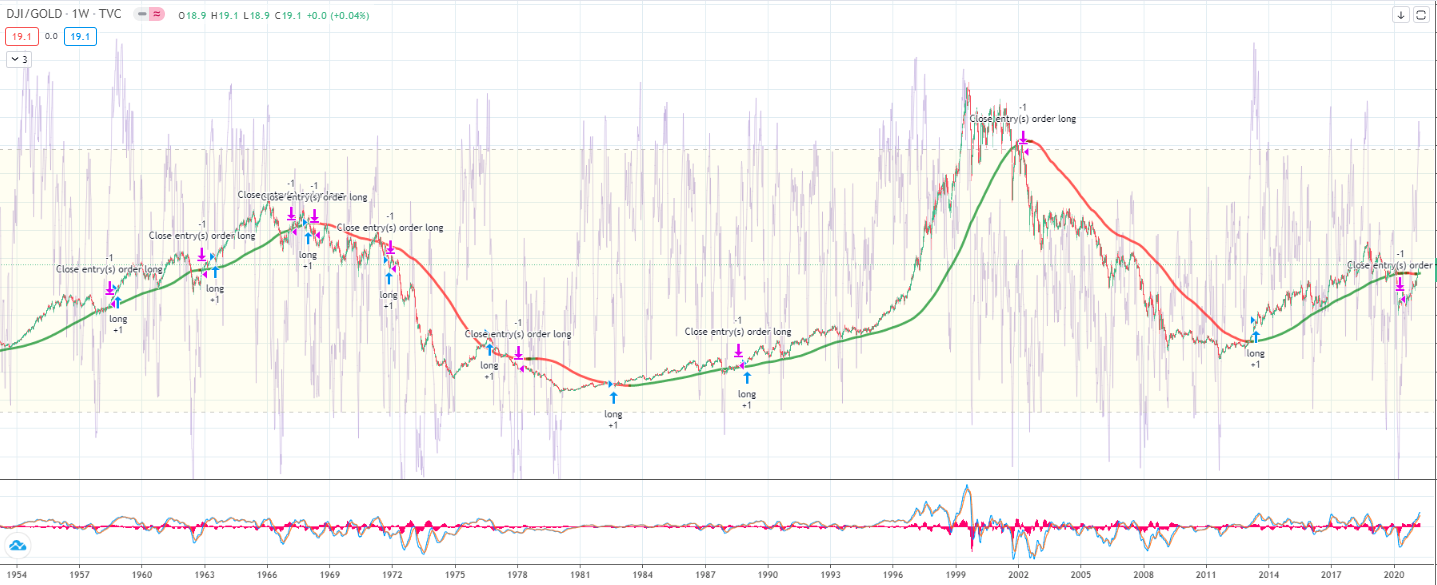

WEEKLY CHART

TAKE AWAYS

Looks like we have a very nice cyclical set up here. I am no expert, but it looks to me like there some pretty clear movements between Gold and the DOW - and the cycles are really long. These are mega trends and much harder to take advantage of efficiently.

The weekly chart looks a little different, it looks like the chart just changed is going to turn negative. Looks like an indication that Gold has some real strength coming for its position

Silver Set Up Monthly & Weekly Charts

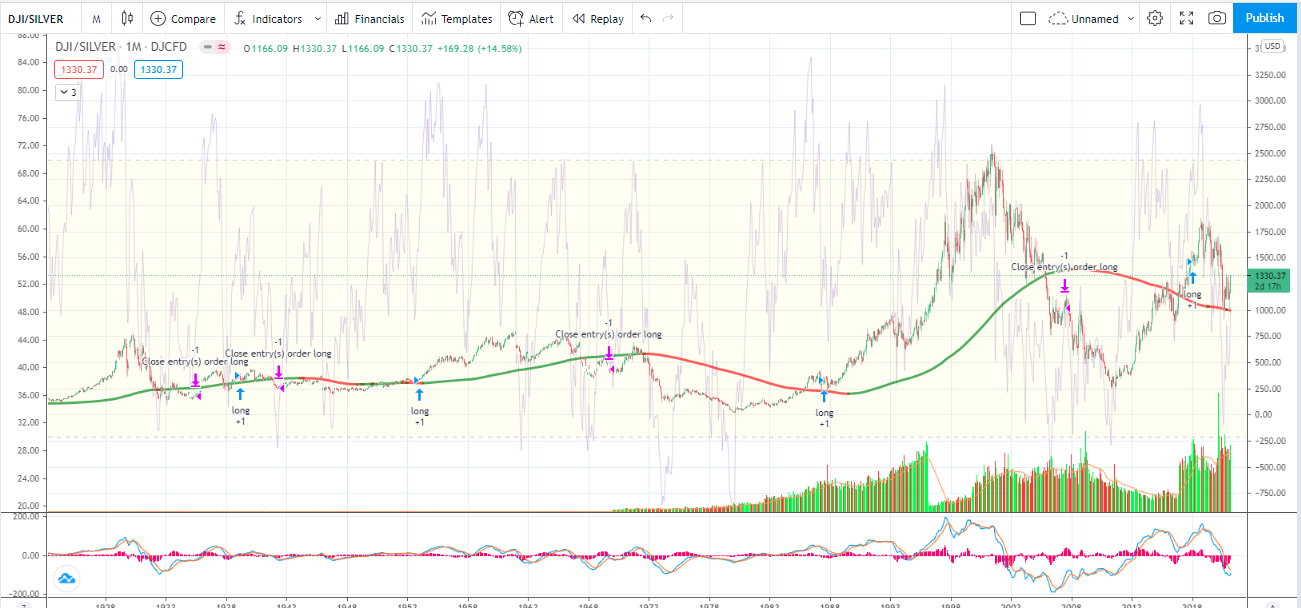

MONTHLY

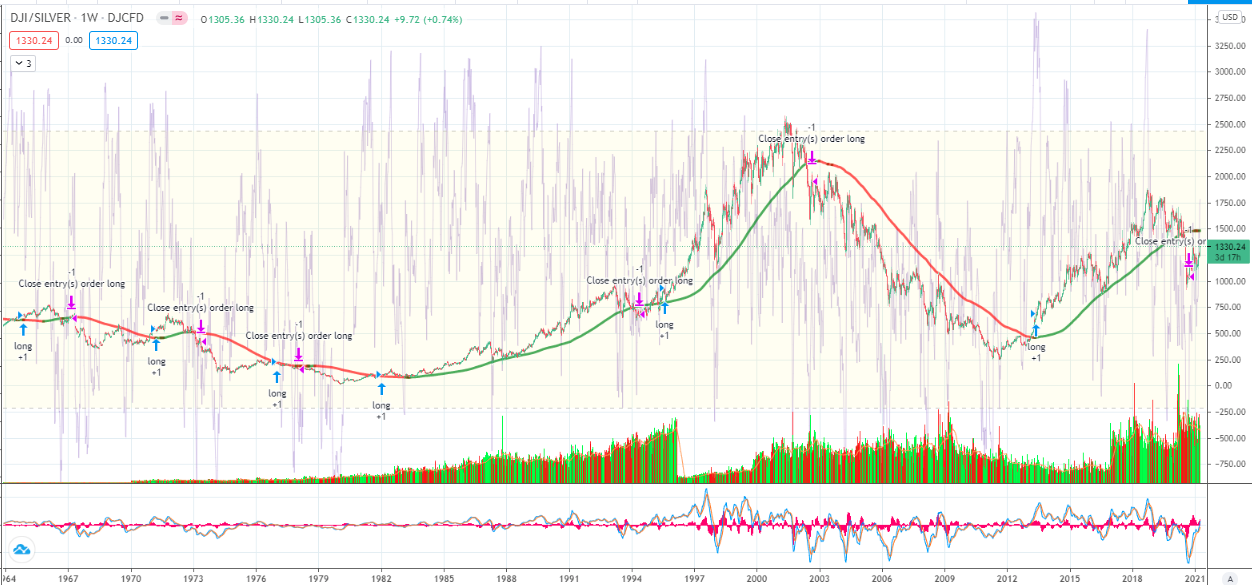

WEEKLY

Looks close to but not the same as gold. Clearly silver is much more volatile on shorter time frames. I think they both may point it might be good to add more precious metals to your portfolio to help mitigate risk.

GOLD/SILVER could rise - or this could mean some hard times ahead in the market. Either way I think I may try to add some GOLD and Silver to my portfolio, but physical, and institutional as a hedge. It also goes without saying, I will be adding some of that digital gold to my assets.

I am not sure what any of this means - but I will continue to look for ways to compare asset vs asset and remove the dollar as my base comparison.

sincerely,

@cluelessinvestor - aka a random nobody on the internet spewing nonsense

This post NOT financial advise, it contains my personal opinion and experience and is intended for educational purposes. Perform your own research and analysis prior to making investment decisions.

Posted Using LeoFinance Beta

There are a lot of gold bugs that feel the Dow to Gold ratio will favor gold if we have a major correction in the market. I'm in this camp, the dow look way overvalued to me.

Posted Using LeoFinance Beta

I agree- but the part I don't understand is usually when the market has felt high to me, we have not been creating money at this rate. As we keep creating and spending - are we going to keep the stock market bubble inflated till we stop? I agree the P/E rations are really off for a large groups of companies, but I guess if we devalue the currency enough we can get the P/E to fall - just wont mean as much,

Posted Using LeoFinance Beta