Finally Spent Some Dry Powder

I wrote the other day about finding a few potential investments by trying to look at current dividend yields vs long term historical yields to find assets that might be temporarily trading below traditional ratio's. While nothing is ever perferfect, this is one approach I love because companies protect dividends by all means, and love to increase it. Cutting a dividend means a massive share price hit.. and the C-Suite is going to lose a lot of cash. It is saved for the last resort.

Companies also love to raise the Divy - even in hard times as a way to tell the street they are still super confident in their business plan and ability to excecated. Why else give away perfectly good capital that could be used to invest and grow the business. Once that faith returns, share price should move with it.

In my Prior Post I mentioned 3 potential stocks I would buy, they were,

- PM Philip Morris

- CVX Chevron

- MO Altria Group

I decided to jump into two of them

Chevron (CVX) @ $101

Chevron looks like a great opportunity to make a solid 10-20% in the next 12 months with or without defends included in that calculation. I think they are they are trending in the right direction, and if summer travel picks up like I expect, could get there soon. I am considering pulling the rug as soon as I hit my target range and pull back to cash while looking for more opportunity.

Altria Group (MO) @ 47

I couldn't ignore the 7% Divy... even if share price lags, I can hold this a long time and collect 7%. In fact at some point share price returns start to mean little when you generate this much cash. I would be nice to double dip, grab a few dividend payments plus get share price to pump $15, but I won't hold my breath.

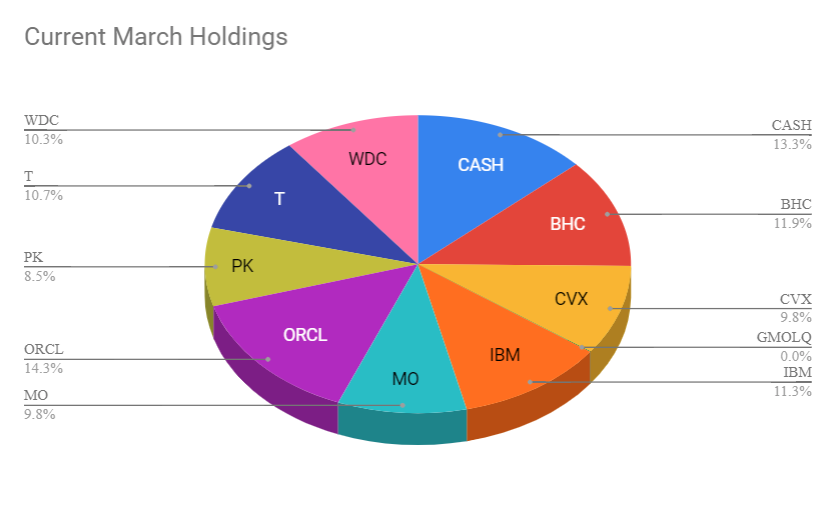

Current Portfolio

Less Cash - More Opportunity

I think this looks a bit more balanced. I am ok holding Cash still, I have about 1.5 of my normal investments left in cash. Depending on what I find next I may either take a smaller position than normal, or dump it all in. then again, with how slowly I seem to move these days I might sell something prior as well and be flush again. I have several I am considering just taking my money and running. Taking profits is both easy and hard... especially when you think you could get more.

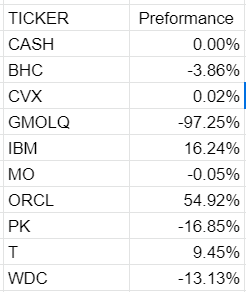

Portfolio Performance Standing

Mixed bag still. Recent trades are doing well - but so is the whole market. My Trades for AT&T (T) and IBM are both looking great. IBM is getting close to where I might pull out and see. Ideally I would love to see it pump to about 160 - but not sure I will get that far - avg dividend yield rate for the past 5 years only puts it $151 a share, or $10 more from current levels. I have a long ways to go before I think AT&T is going to slow down, and will hold for bigger returns. I have yet to even get my first dividend payout from either.

ORCL has been doing well - while it has recently fell $5 from its high of $79, I think we might be ready for another run up towards $90. Eventually I need to sell some, I know my returns are already great, but I think they can keep running until they break that $80, and then I will may have to sell half, or more. While it could keep going, not taking the profit would hurt me more mentally.

sincerely,

@cluelessinvestor - aka a random nobody on the internet spewing nonsense

This post NOT financial advise, it contains my personal opinion and experience and is intended for educational purposes. Perform your own research and analysis prior to making investment decisions.

Posted Using LeoFinance Beta

Big winner on IBM thus far. Feb, March, April have been pretty tough for me as well.

Posted Using LeoFinance Beta

IBM was the one I actually worried vs AT&T, but has clearly exceeded my expectations. I will have to take another look and see where my exit points are. 16% in a few months and I get tempted. I have have that money idle the rest of the year and still meet my goals.

I will add time held for my next update - some of these are just old dogs I have held onto for the stupid reason of not wanting to sell for a loss - even when I see other opportunities.