Big Money On The Verge of Entering Crypto

I am not talking about some hedge funds, or more companies like Micron/Tesla buying Crypto. We are talking about a tidal way of new capital that has never before had exposure to crypto currency investment directly being unlocked.

There are so many companies pushing for a BTC ETF - and while this isn't new, the US is now lagging behind. You have major players to open ETF's. VanEck, WisdomTree, Valkyrie, Fidelity, Goldman Sachs - this are big institutions, and they can't be ignored for long. As we all know politics takes a lot of money, and you can't piss of the banking sector too long and expect to keep you job.

Considering Canada and Brazil are already approving ETF's the gates are open and the sharks can tasted the blood in the water.

Why ETF's matter - In My Opinion

Short Answer - IRA and 401k's. You have a lot of investors who have a large portion of their money tied to these retirements accounts. While many may choose to simply put the fiat into funds and go the long route, there is alot of capital.

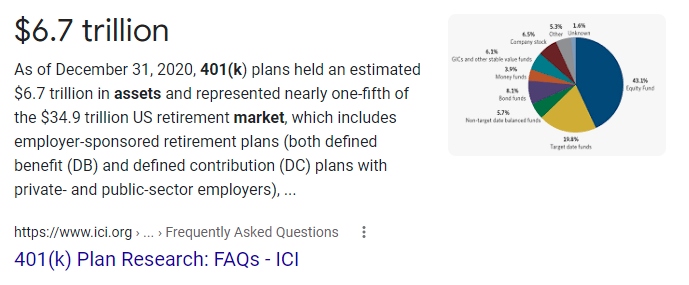

401k's 6.7 Trillion in Assets

That is good amount of money to have sitting there unable to invest in crypto assets. Even if only 10% of the money was directed towards ETF's that would push 670 Million towards crypto in a short window.... supply is limited by design and demand will buy up the books. Could be a good run - with new money coming in every month like clock work.

IRA's 19 TRILLION!

If these sources are right, IRA's have an amazing 19 Trillion locked away.. taking the same 10% factor, that would be an *additional * 1.9 Trillion coming to crypto. That is a massive influx of cash, what will happen with prices for the top 5? What will BTC do with such a short supply.

I picked 10% to do lazy math, sure it could be less, but honestly if you are going to diversify into a new asset class, 5-10% feel pretty standard. Overall you are looking at 2.5 Trillion in new money that could flow into crypto just from the US when the ETF's are opened. This is also ignoring pensions, endowments, standard interment accounts that don't have access.

What happens to other investors when the prices starts to pump. We all know everyone loves to jump into the wave up - supply will be short, and prices may get to levels only once joked about.

What If They Don't Approve

Money goes where its treated well, and the markets will find a way. I have already heard of several solutions, that while are not as easy, will give more options. What happens when we create mutual funds or indexes that only invest in companies like Micron that publicly state they are going to buy and Hodl BTC? It might not be the same a a direct investment in the underlying currency.

If enough other countries list ETF's, those may be a choice, or at least companies can publicly state they will be buying these ETF's, Futures, and directly buying blockchain assets.

No matter what happens in 2021, the influx is money is coming I just don't know if we are talking months, or another year. I honestly don't think it matters either way, but I am willing to bet when it does get approved, the insider trading activity will be everywhere and likely never prosecuted!

What I am going to do.

I plan on HODL what little I have, and I am planning on buying more BTC and ARRR in the next week. While I am sure I will miss out on several good coins and opportunities, I want my money with the biggest name that will hit every news station, and I want more privacy.

What are you going to do?

sincerely,

@cluelessinvestor - aka a random nobody on the internet spewing nonsense

This post NOT financial advise, it contains my personal opinion and experience and is intended for educational purposes. Perform your own research and analysis prior to making investment decisions.

Posted Using LeoFinance Beta