I was reading somewhere that people have started going with Unified Portfolio for all their goals which means they will invest a monthly sum of some amount in a single portfolio for all the financial goals. The portfolio will grow and when the time for each goal comes, the sum will be withdrawn accordingly.

PC: Pixabay.com

Say, for example, a person might have 5 goals, now for all the goals he will maintain the same portfolio and withdraw money from this portfolio for every goal and the final value of the portfolio should be equal to the last goal which is usually the retirement goal.

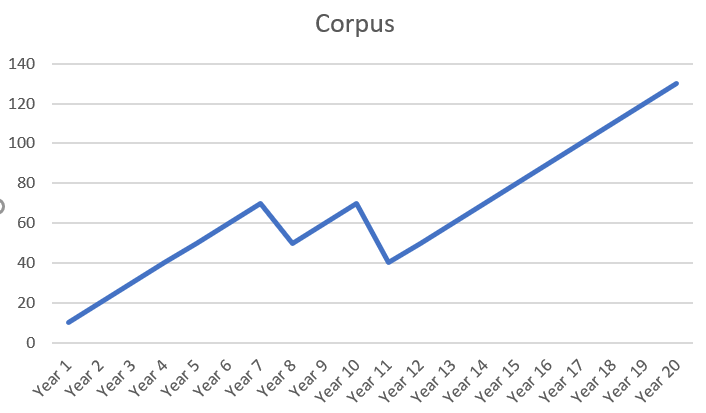

The chart will somewhat evolve like this where the dips you are seeing are nothing but redemption made to fulfil the financial goals and at the last, you have the corpus for the retirement goal. So here the main aim is to find that investment amount every month taking all the goals into consideration, including inflation, return and duration for each goal.

This strategy looks good why because it is simple i.e. fewer funds to manage as well as the investment amount is significantly lower than the amount if the goals are tracked separately.

Now the thing investors ask is whether to go with Unified or Separate Portfolio for Goals. Now the Unified portfolio is good to some extent but thinks about a scenario where you have a goal for 5 years and 15 years. You cannot have the same asset allocation for both the goals right. So again the Unified portfolio works well for only the long term goals and also if all the long term goals are 12 or 15 plus after like a Kid's Education, Marriage, and Retirement.

This is why I prefer to manage them individually under separate portfolios. I may start off with a 60% equity allocation but with time, this will change (decrease) for goals like my son’s education and not retirement. In fact, I now use 100% equity for his marriage (not a top priority to me and I am not investing enough for it. Can’t rather.).

For me, an individual portfolio works better, because it allows me to track the goals better and have appropriate risks attached to each portfolio.

So which portfolio are you managing?

Posted Using LeoFinance Beta

The rewards earned on this comment will go directly to the people(@codingdefined) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

Congratulations @codingdefined! You received a personal badge!

Wait until the end of Power Up Day to find out the size of your Power-Bee.

May the Hive Power be with you!

You can view your badges on your board and compare yourself to others in the Ranking

Check out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

Great post. I try to keep it simple and manage each portfolio separately but they are combined in one overview.

Yes I do the same too, its quite easy to maintain like that.

Posted Using LeoFinance Beta

I've always found that really hard to do. I know it is probably better for you from a interest stand point because you are able to earn more, but I have a hard time remember what money is for what. When you keep it separate from the beginning it must makes more sense and there is less chance you accidentally spend some on the wrong thing. That is just me though. I came here via Listnerds.

For me too its hard too to maintain a single portfolio, because that needs constant attention when one of the gaol is nearing. So its better to keep separate and review once in six months.

Posted Using LeoFinance Beta

Yeah, that makes sense to me. I think there is a reason a lot of financial planners tell people to use the envelope or jar method. It is just better to keep things separate.