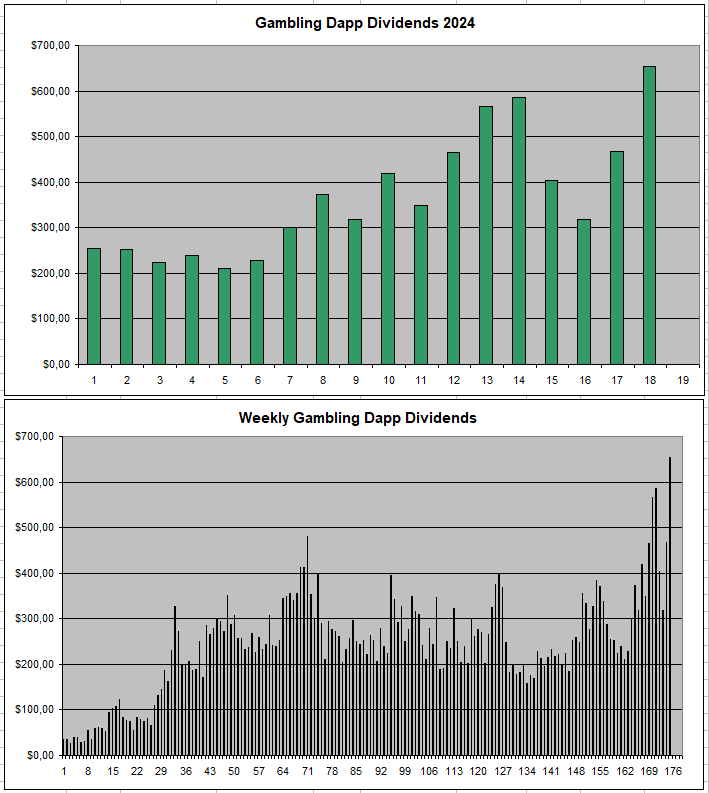

I managed to set a new record on my weekly Passive Earnings from my GambleFi portfolio which is fully aimed at actually collecting revenue from different projects. It was 653.69$ and this despite the fact that I reduced my holdings recently selling my Sportsbot from Rollbit and with Defibookie currently not paying any revenue share. Nearly all came down to my biggest and strongest holding SBET which had a very nice overall volume increase.

Sportbet.one (SBET)

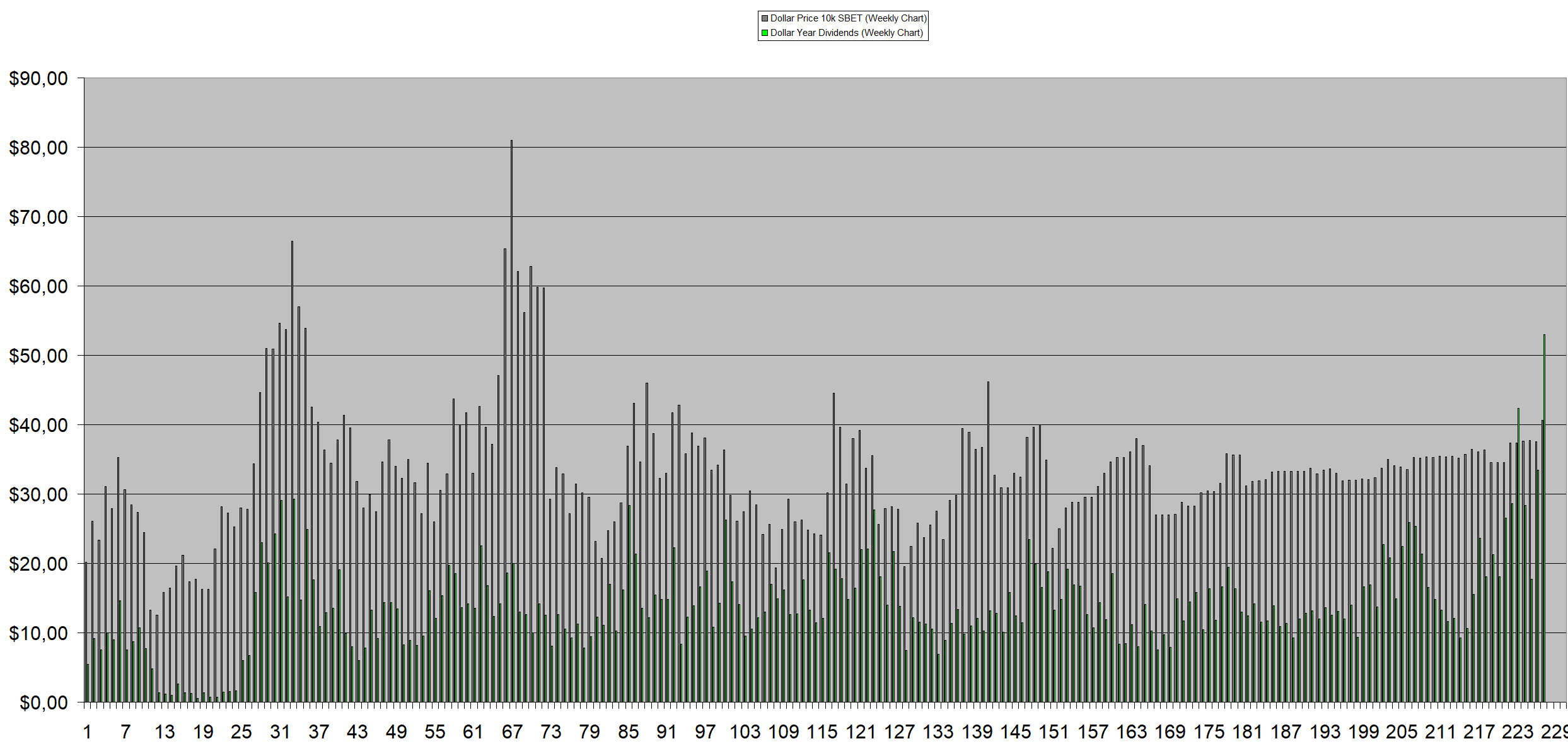

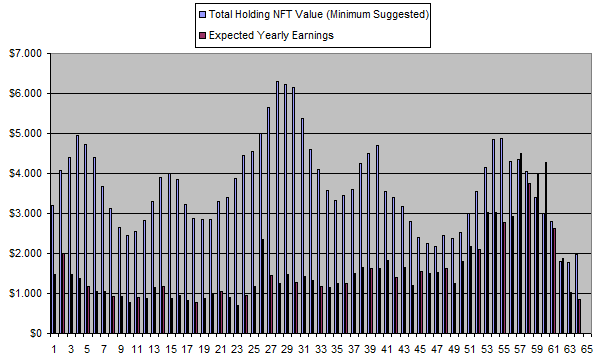

SBET continues to be my biggest holding and the best performing on over many years now. The volume and dividends has increased quite a bit the last months while the price of the token hasn't moved all too much which makes the returns very high now. Just from this week 2.667% of the cost to buy at current price would have been paid back already which equals a +138% APY.It looks like there was one buyer as the holdings on the coinstore exchange went down with around 700k while the staked SBET went up to by an equal amount. I would buy more if I wasn't already too heavily invested in this one.

I has such a long history on this one that it's hard to get the coloring right on the chart in excel.

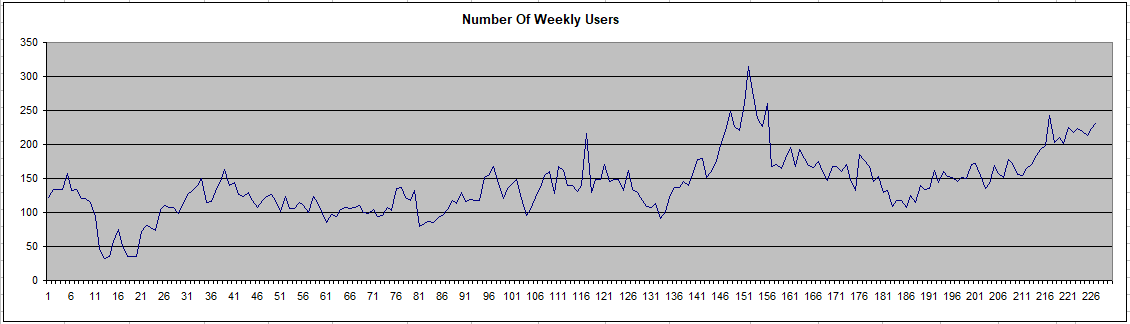

The number of active weekly users also have been going up.

Rollbit.com (RLB) & Rollbot/Sportsbot NFTs

It looks like this week, the ones who still had RLB on the Solana Chain were liquidated seeing all their coins burned. This equaled a 2.922% of the supply burn or 8.2 Million Dollars. I guess many more passive investors who aren't actively following the project will wake up one day to see their coins kind of gotten rugged. I didn't include this burn in the chart as it would screw it up and it's beyond the purpose of it.

I also fully got out of my RLB position mainly because I see more of an edge and fun in memecoins. While fundamentally in the long run RLB looks great, the reality is that it has stayed flat in a very long time now and there is a high centralization risk. With all the forced KYC, I opted to get funds out of their platform which leaves me just with the 2 Rollbots that I still own there and get some earnings from. I didn't have any issue whatsoever with withdrawals.

It also looks like the big whale Stakestink reduced his betting so I guess the revenue share especially on sportsbots might go down. Mine which I sold a couple weeks back while it was at 148$ monthly claim now seems to be down below 100$ again.

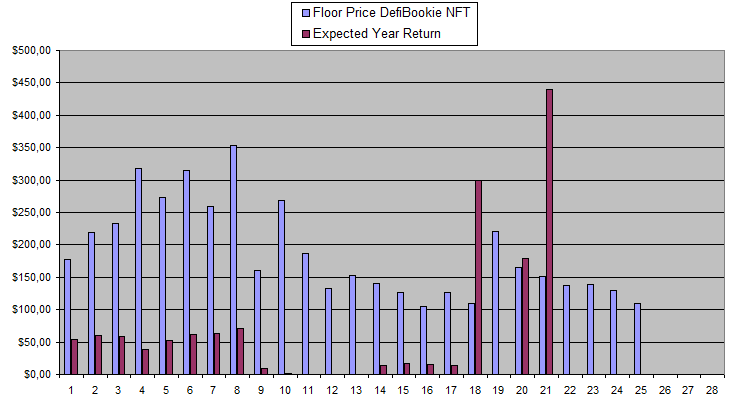

Defibookie (NFTs)

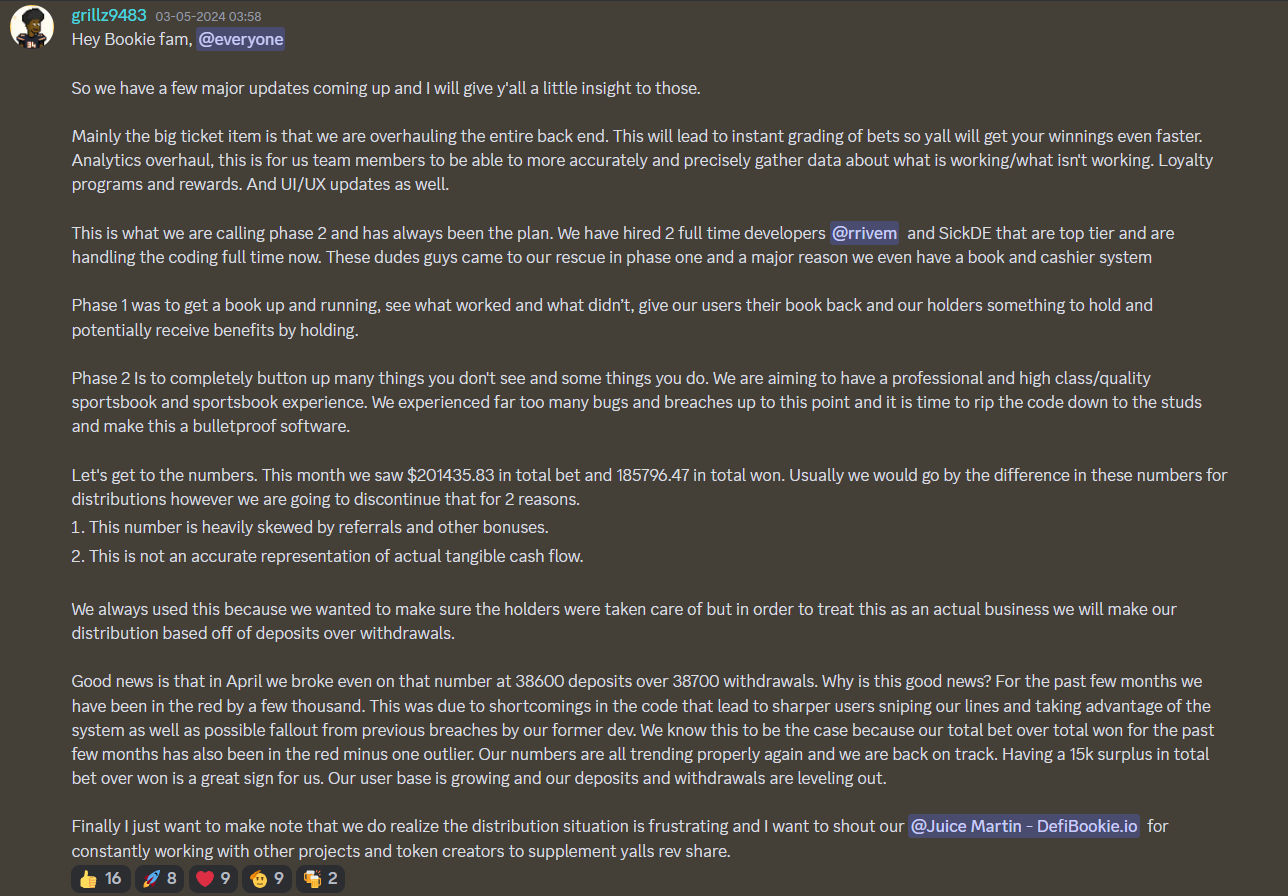

Some drama for Defibookie this week as they showed a 15k overall profit on the month but they aren't doing a revenue share as the free bets and the affiliate payouts aren't in those numbers that forced them to change the calculations. From here on out it will be Deposits -Withdrawals-Account Balances-Costs to determine the monthly revenue. So the main question at this point is how trustworthy the devs are. After that, it's how successful the platform potentially will become, and after that it's how regulation might at one point become an issue. So a lot of questionmarks.

I haven't really seen any scammy behavior but I might be blind to it, they say they attracted a couple more devs and from the looks of it, the leak of slowly adjusted odds which leaves them vulnerable has been fixed. With prices of DefiBookie NFT's going down and the total marketcap below 173k Dollars, I'm willing to get in a bit deeper so I just bought 2 more of them putting my total at 18. I'm quite sure there at least will be some airdrops coming in.

I expect them to either be a total steal or dead money with good enough odds for the first one to be worth the risk.

This is what was said on the discord.

For me, I honestly prefer money to go to giving out more freebets while giving holders some airdrops instead of at this stage of the project already giving out too much of the revenue which slows things down.

The newly bought NFT's will be added next week.

| Week | Invested | Floor | Current Value | Week Divs | Total Divs | Recovered | Total |

|---|---|---|---|---|---|---|---|

| Week 01 | 1424$ | 180$ | 2340$ | 0$ | 0$ | 0.00% | +916$ |

| Week 02 | 1424$ | 156$ | 1927$ | 0$ | 0$ | 0.00% | +503$ |

| Week 03 | 1424$ | 177$ | 2191$ | 13.67$ | 13.67$ | 0.96% | +780$ |

| Week 04 | 1421$ | 219$ | 2708$ | 14.92$ | 28.59$ | 2.01% | +1315$ |

| Week 05 | 1421$ | 233$ | 2875$ | 14.49$ | 43.08$ | 3.03% | +1497$ |

| Week 06 | 1421$ | 318$ | 3932$ | 9.444$ | 52.52$ | 3.69% | +2563$ |

| Week 07 | 1421$ | 273$ | 3374$ | 12.95$ | 65.72$ | 4.62% | +2016$ |

| Week 08 | 1421$ | 315$ | 3894$ | 15.24$ | 80.97$ | 5.70% | +2554$ |

| Week 09 | 1421$ | 259$ | 3199$ | 15.97$ | 96.94$ | 6.82% | +1875$ |

| Week 10 | 1421$ | 353$ | 4365$ | 17.67$ | 114.61$ | 8.06% | +3058$ |

| Week 11 | 1421$ | 161$ | 1988$ | 2.13$ | 116.74$ | 8.22% | +684$ |

| Week 12 | 1421$ | 269$ | 3325$ | 0.332$ | 117.07$ | 8.23% | +2021$ |

| Week 13 | 1421$ | 187$ | 2314$ | 0.092$ | 117.16$ | 8.23% | +1010$ |

| Week 14 | 1421$ | 133$ | 1640$ | 0.000$ | 117.16$ | 8.23% | +336$ |

| Week 15 | 1421$ | 153$ | 1885$ | 0.000$ | 117.16$ | 8.23% | +581$ |

| Week 16 | 1421$ | 140$ | 1728$ | 3.310$ | 120.47$ | 8.47% | +427$ |

| Week 17 | 1421$ | 127$ | 1564$ | 4.410$ | 124.88$ | 8.78% | +268$ |

| Week 18 | 1421$ | 102$ | 1287$ | 3.850$ | 128.73$ | 9.06% | -5$ |

| Week 19 | 1421$ | 126$ | 1561$ | 3.320$ | 132.05$ | 9.30% | +272$ |

| Week 20 | 1421$ | 110$ | 1361$ | 74.680$ | 206.74$ | 14.55% | +147$ |

| Week 21 | 1421$ | 221$ | 2730$ | 0.000$ | 206.74$ | 14.55% | +1515$ |

| Week 22 | 1421$ | 164$ | 2044$ | 44.626$ | 251.36$ | 17.69% | +874$ |

| Week 23 | 1421$ | 151$ | 2008$ | 118.52$ | 369.88$ | 26.03% | +956$ |

| Week 24 | 1710$ | 137$ | 1956$ | 0.000$ | 369.88$ | 21.6% | +615$ |

| Week 25 | 1822$ | 139$ | 2114$ | 0.000$ | 369.88$ | 20.3% | +661$ |

| Week 26 | 1822$ | 129$ | 1968$ | 0.000$ | 369.88$ | 20.3% | +515$ |

| Week 26 | 1822$ | 110$ | 1673$ | 0.000$ | 369.88$ | 20.3% | +221$ |

| Week 27 | 1822$ | 81$ | 1242$ | 0.000$ | 369.88$ | 20.3% | -211$ |

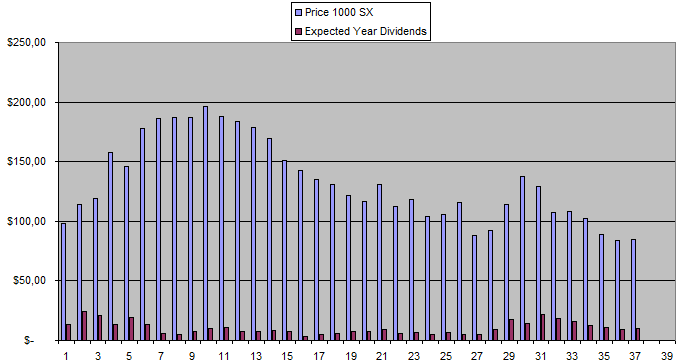

Sx.Bet (SX)

Not much news from what I can see in SX.Bet and I hope that the Grand Slam Tennis which tends to be good for exchanges and the European cup will make things spike. Despite the 0% fees it remains hard to really attract new users since what is offered by the site takes quite some juice and more players offering/requesting bets at better odds is needed. So it's the classic catch 22. More activity is needed to get more users while more users are needed to get more activity.

I do still believe they have a good shot at succeeding and if price dips more I might be willing to add to my holdings.

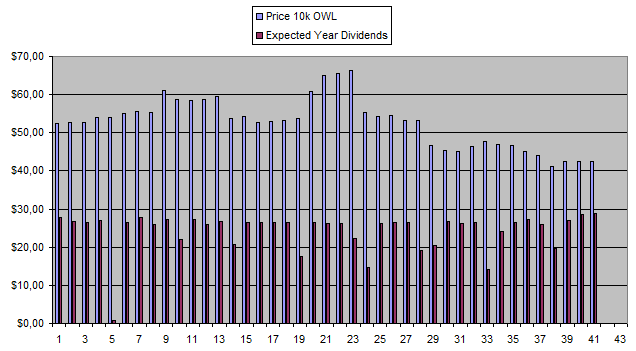

Owl.Games (OWL)

I continue to slowly but surely set my initial investment safe earning 30$+ weekly. Overall there is very little movement.

| Date | Hold | Invested | Value | Week Divs | Total | % recov | Total |

|---|---|---|---|---|---|---|---|

| 08/08/2023 | 395k | 1954$ | 1850$ | 13.76$ | 21.9$ | 1.12% | -82$ |

| 05/09/2023 | 500k | 2636$ | 2437$ | 20.30$ | 83.9$ | 3.18% | -115$ |

| 03/10/2023 | 500k | 2636$ | 2600$ | 21.15$ | 182.99$ | 6.94% | +147$ |

| 07/11/2023 | 600k | 3179$ | 2877$ | 30.43$ | 310.14$ | 9.75% | +8$ |

| 05/12/2023 | 600k | 3179$ | 2851$ | 20.12$ | 421.99$ | 13.27% | +94$ |

| 01/01/2024 | 600k | 3179$ | 3521$ | 25.76$ | 538.76$ | 16.95% | +881$ |

| 08/01/2023 | 600k | 3179$ | 2933$ | 17.00$ | 555.76$ | 17.48% | +310$ |

| 15/01/2024 | 600k | 3179$ | 2879$ | 30.35$ | 586.11$ | 18.43% | +286$ |

| 23/01/2024 | 600k | 3179$ | 2888$ | 30.45$ | 616.56$ | 19.39% | +325$ |

| 30/01/2024 | 600k | 3179$ | 2825$ | 30.45$ | 647.01$ | 20.35% | +293$ |

| 06/02/2024 | 600k | 3179$ | 2825$ | 22.16$ | 669.17$ | 21.05% | +315$ |

| 13/02/2024 | 600k | 3179$ | 2469$ | 23.57$ | 692.74$ | 21.80% | -17$ |

| 20/02/2024 | 600k | 3179$ | 2407$ | 30.74$ | 723.48$ | 22.76% | -48$ |

| 27/02/2024 | 600k | 3179$ | 2385$ | 30.27$ | 753.75$ | 23.71% | -40$ |

| 05/03/2024 | 600k | 3179$ | 2464$ | 30.67$ | 784.42$ | 24.67% | +69$ |

| 12/03/2024 | 600k | 3179$ | 2527$ | 16.29$ | 800.71$ | 25.19% | +148$ |

| 19/03/2024 | 600k | 3179$ | 2485$ | 27.72$ | 828.43$ | 26.06% | +134$ |

| 26/03/2024 | 600k | 3179$ | 2470$ | 30.70$ | 859.13$ | 27.02% | +150$ |

| 02/04/2024 | 600k | 3179$ | 2393$ | 31.35$ | 890.48$ | 28.01% | +104$ |

| 09/04/2024 | 600k | 3179$ | 2330$ | 29.95$ | 920.43$ | 28.95% | +71$ |

| 16/04/2024 | 600k | 3179$ | 2184$ | 22.75$ | 942.18$ | 29.60% | -53$ |

| 23/04/2024 | 600k | 3179$ | 2245$ | 31.25$ | 973.43$ | 30.60% | +39$ |

| 30/04/2024 | 600k | 3179$ | 2245$ | 33.02$ | 1006.45$ | 31.66% | +72$ |

| 07/05/2024 | 600k | 3179$ | 2246$ | 33.40$ | 1040.85$ | 32.74% | +107$ |

** The High 7% cost to go from buying to having it staked and the 5% tax to sell is fully included in the numbers.

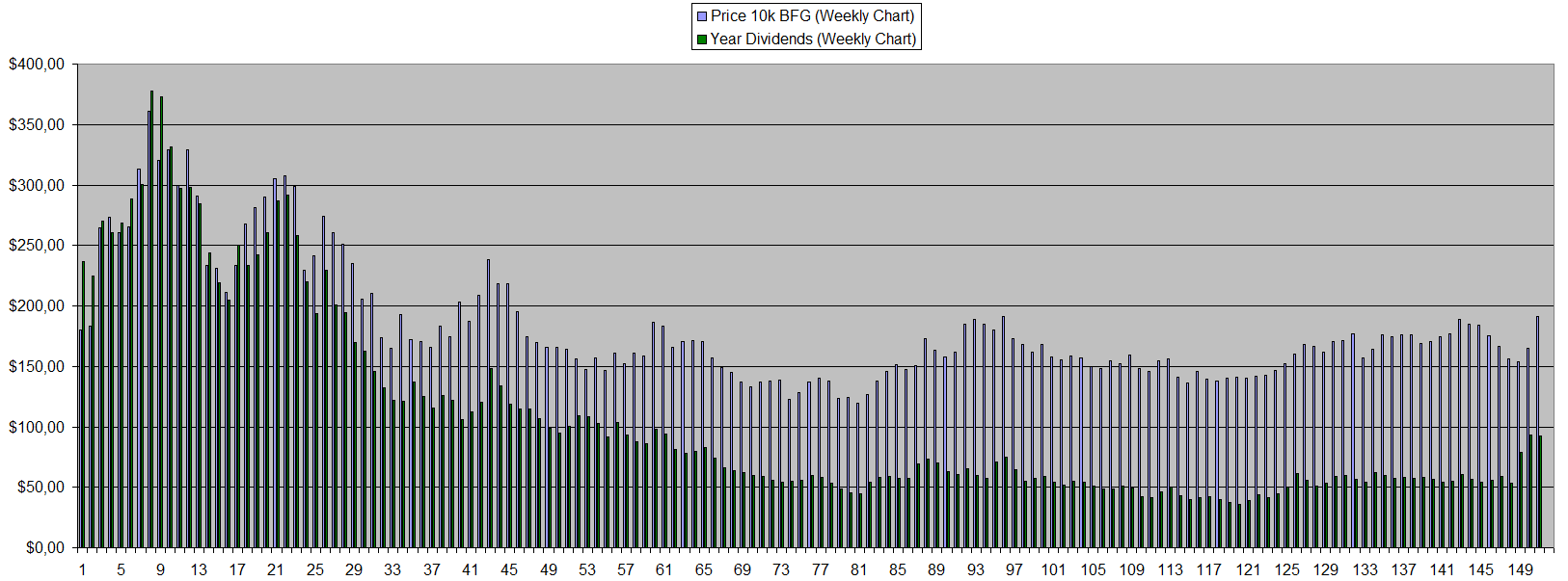

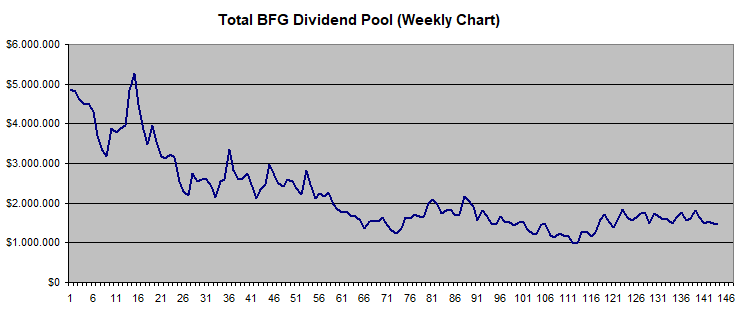

Betfury.io (BFG)

The increased dividends remained as it looks like not everyone is willing to stake their BFG for a year. The strategy so far in working at the price of RLB is going up. There was also a -5.31% of RLB that was 'unstaked' or withdrawn from the site which means more Dividends for the rest of us. The monthly burn of 0.1% of the supply also happened.

In the end, what counts the most is the dividend pool which remains rather flat. The good thing is that it at least isn't going down further. The early numbers also aren't the reference since there was a lot of action just to mine BFG.

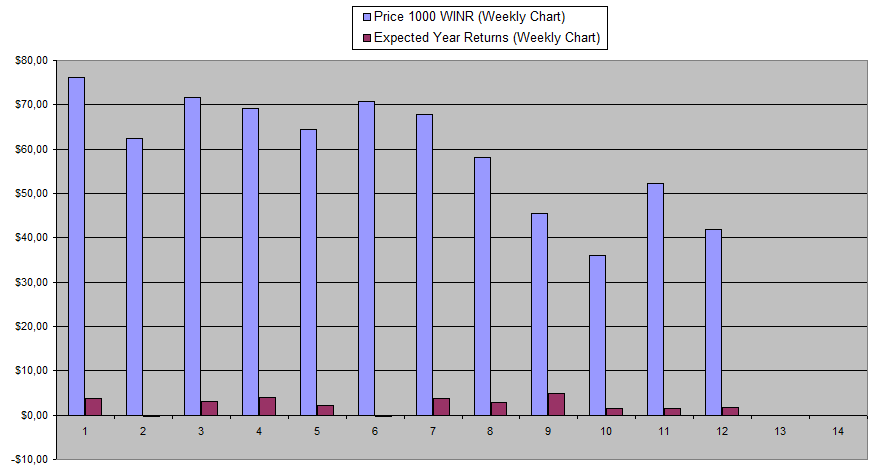

WINR Protocol

WINR remains one of those platforms that on paper looks promising but it's all just way too complicated.

APY Based on Current Price and Dividends from the last 7 days

All these numbers are based on prices of Monday

| Project | APY |

|---|---|

| Sportbet.one (SBET) | +138% APY |

| Betfury.io (BFG) | +48.59% APY |

| Rollbit.com (NFTs) | +43.35% APY* |

| Owl.Games (OWL) | +68.31% APY |

| Sx.Bet (SX) | +11.43% APY |

| Defibookie.io (NFTs) | +0% APY |

| WINR Protocol (WINR) | +4.11% APY |

Note: Token prices going up or down have a major influence on the actual returns going forward either amplifying them if they go up or destroying them when the price would dip. These are my personal numbers and RLB varies based on the trait of the Rollbot NFTs you own and (*) they are based on the minimum suggested by prices which can be way lower than the actual prices.

Personal Gambling Dapp Portfolio

Overall there has been a very positive evolution lately in my GambleFi portfolio which gave 653$ in passive earnings last week for holding 5M SBET | 500k BFG | 2 Rollbot NFTs | 600k OWL | 25k SX | 16 DefiBookie NFTs | 10k WINR. I'm still looking to diversify with other good gambling dapps that pay the losses or fees from the gambler to those holding a token. Anyone that has tips on this, please leave a comment below...

Crypto & Blockchain-Based Bookies and Exchanges that I'm personally using with some allowing anonymous betting with no KYC or personal restrictions...

Play2Earn Games that I am Playing...

Posted Using InLeo Alpha

I only have BFG and haven't yet opted to stake for a year. For now - sort of playing a wait and see game.

Congrats on the SBET candle - you have had that token in your portfolio for years now so its good to see the patience pay off.

BFG reacted good on the change with the price now up above 0.021$. However, the key number of the actual dividend pool hasn't gone up yet. So it remains to be seen how sustainable this pump is. Regardless, it has been a good source of reliable weekly revenue. Each week just continues to add up in that regard similar with all the other investments. It really is the thing I like most about gamblefi.

Good Luck!

These reports are super interesting. Dont have any tips of any other platform you could try out but hope someone else can give you a tip so you can try them out.