The haircut rule is simple: when your hair gets long and shabby, get it cut.

The Hive haircut rule is tricky. I don't understand it.

This Tweet thread by Twitter user @ACQuinn_ helped me understand things further. I really liked his clear and simple and logical approach with examples. That is, I like the way his brain processes tricky things.

Three things though:

- Not sure I'm 100% on board with the math and economics.

- 20% still seems high to me.

- Still don't get the haircut rule, but I'm getting closer.

Let me address them in reverse:

A user commented that the haircut rule wasn't really addressed and the OP acknowledged that. I think we all understand the gist of the rule: when drastic times come, a hard-and-fast drastic rule kicks in for the sake of stability.

Regarding the 20% inflation rate on HBD savings, my gut tells me that's a high number to continually chase in perpetuity. But, that's my gut speaking, not my brain. I do like ACQuinn_'s notion that HBD is perhaps somewhat insulated from "normal" inflationary rules of ridiculous token emission rates. This, because though it is thought to be "pegged" to the dollar, it is actually pegged to HIVE. More precisely, it is pegged to HIVE's USD exchange value. Cashing in your HBD means leapfrogging over to HIVE and getting the current USD exchange rate's quantity or HIVE in return. When the prices and values and exchange rates alter, it's just not as simple as getting 20% APR. This requires much more thinking on my part (and actually fits perfectly with a blog post I currently have have written and need to think on further and then finish).

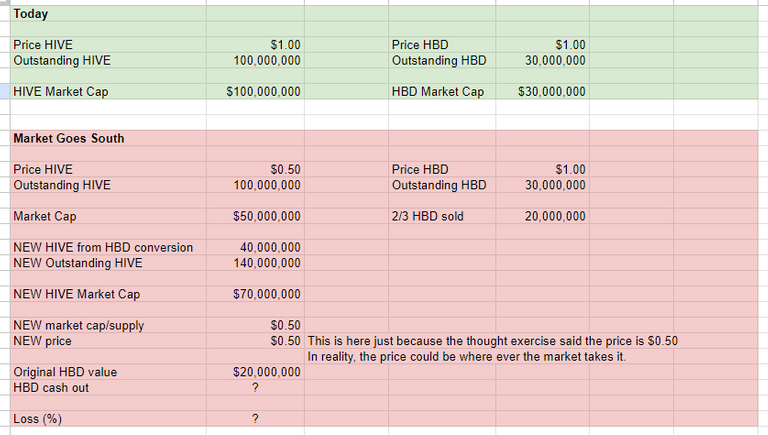

Regarding the math in the thread when the "Market goes south", my chipmunk brain followed until number 12/16. The market price drop from $1 to $0.50 and people convert 20 M HBD into HIVE.

Now the total supply is

-140 M hive

-But the market cap is still $100 M

First, is that how it works? When going from HBD to HIVE, are new HIVE minted? I guess I was thinking that when I "sold" my HIVE to HBD, someone, or a DAO or smart contract bought them and they were simply held elsewhere. Then, when I switch back from HBD to HIVE, I'm buying those HIVE from whomever or DAO/smart contract. The author says that new HIVE are minted, and I really don't know how it works, so I'll believe him.

Secondly, I would think the market cap is not still $100 M, but that it is $70 M (because the price is now $0.50).

140 M tokens x 0.50 = $70 M market cap

Also, I'm not sure I agree that the "new price" is $0.36 per HIVE. Going with the math shown in the Tweets, is that implying a market price of $0.36 per HIVE? I don't think that would be accurate. That 0.36 is the market cap/divided by circulating supply, but that's not the same as the market price. The market price is reflected as the balance between buy and sell orders on an exchange. It's not every token in existence at play. What we see as "the price" is defined only by those tokens that are in play on exchanges being bought and sold and flipped. It is the "last trade" price that blips on the chart...that is the "new price."

For instance, if Hive users put every single token we own up for sale on an exchange, I'm pretty sure that $0.36 "new price" would plummet.

This kind of returns us back to my point #2 above, the one regarding conversion of HBD to HIVE via the current HIVE-USD exchange rate. That rate is based on the current market value as defined by the buy/sell orders and particularly by last price, not the market cap divided by total HIVE supply.

Back to the "Market Goes South" theory. Since the thought exercise said the price of HIVE was cut in half from $1 to $0.50, we have that $70 M market cap now. And, HIVE is trading at $0.50.

I'm not really sure where the author gets the $14 M "HBD cash out" value and kind of got stuck right there.

To my thinking, those $20 M HBD will be rewarded in a quantity of HIVE reflective of the current exchange rate or price. If it's $0.50, they'll get 40 M HIVE. The "HBD cash out" value would still be $20 M though, right?

My head hurts, I'm done. I appreciate ACQuinn_'s Tweets as they helped me think on this conundrum. Maybe someone else can figure out it for the rest of us. 😀

Google Sheets spreadsheet, editable, have at it:

https://docs.google.com/spreadsheets/d/1uFNA3IInZvpSRNPUrBpI5desOAz3i--u/edit?usp=sharing&ouid=105472558317743463205&rtpof=true&sd=true

Screenshot of spreadsheet:

Not on Hive yet? Watch the animation I made: The Hive Story Animation and you'll learn all about it. The top benefits of the Hive blockchain: (1) no ONE person/group runs it, (2) YOU own and control your content, and (3) YOU earn the rewards that your content generates. Learn more or consider using my referral link to get your free account here and I'll support you as you begin. Alternately, you can see other sign-up options here.

Posted Using LeoFinance Beta

I guess we are minting new Hive whenever we convert HBD into Hive and that is why it takes over three days.