How Much Debt Is Too Much Debt?

When I read these figures the other day it was kind of mind boggling as having $32 trillion in debt paying back $1.3 billion per day in interest payments alone is crazy. That is the equivalent of $54.16 million per hour or $900K per minute and that is not reducing the debt, but simply making the interest payments. Whilst researching my earlier post I came across different stats and figures which I couldn't ignore and how I came onto this topic. Seriously big numbers involved which is hard to comprehend and possibly what scares everyone, but the government.

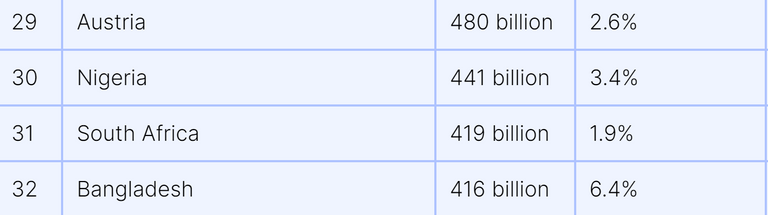

The US has a reported GDP of $23.3 trillion per year which is the biggest by some margin compared to other countries. The interest paid out annually is the equivalent of some country's GDP which puts everything into perspective. $1.3 billion per day x 365 days is $475.4 Billion annually which would rank as high as 29 against other countries GDP's.

The worry is that the debt ceiling is already seen out of control by many as how high can this go as you have to think the number is already unpayable owing more than 130% debt to GDP. The US is still not the worst when it comes to debt however as there are far worse candidates taking that mantle.

Japan spends 22% of it's national budget on interest payments annually which is expected to rise to 25% within the next 2 years. As most of us already know japan has an ageing population which means they are shrinking in size. The imbalance means the social welfare with pensions and health care is out of sink with what we see elsewhere.

The big worry is at what point is the debt too much and countries start to default on payments. Japan spending 25% of their national budget on debt repayments each year has to have long term consequences as I can only see this slowly rising until there is a point that they cannot pay it back. They are only covering the interest and not paying back the debt so this is not looking good long term.

The United States is not looking so bleak as their National Budget of $6.2 Trillion is only affected by the $475 Billion interest payments accounting for around 8% only. For the US to reach the Japanese levels they in theory could triple their debt which would not be advisable or a recommendation.

Personally I do think the concern by many is not with the US defaulting on their loans but finding themselves increasingly under more economic pressure. The world is changing and countries that were once seen as friendly trading partners are no longer playing the American game. They are choosing to trade in other currencies besides the US Dollar which would have been frowned upon in the past. The impact of this on the US economy is an unknown for now, but it has to have implications which could be disastrous long term. Countries cannot just turn on the money printer when they need some extra cash as this does not solve the existing problems and only exasperates the situation long term.

Posted Using LeoFinance Alpha

The working-age population in the US is about 207 million people. This means that we're paying roughly $6.28 per person per day just to cover debt repayments made for interest on things a lot us didn't even approve. It's not horrific, but these figures will only continue to increase. It's unsustainable in the long term.

Thanks for your article. 😊

Yes it is not overly bad right now in comparison to what it could become. Some common sense is required otherwise future generations are just going to be left with this burden. Thanks for reading and commenting as I enjoy looking into things that interest me and hopefully others have a similar interest.

Posted Using LeoFinance Alpha

Expecting common sense from our leaders is quite a dream haha.

🤯 1,3 billion per day, wow. That’s a lot of Dollars. And it’s simply for keeping your debt „alive“. It’s no productive investment.

Standing still payments and not reducing the outstanding balance which is absolutely crazy.

Posted Using LeoFinance Alpha

If the price of it continues to be going up, then we will see that it will be difficult for the people to live there. If we all pay taxes in the same way, it will be very good for our country, but if the text is made so high that people will not be able to do it, then we will face difficulties.

It's awful wrong to blame other countries for the current and potential US fiscal irresponsibility and the consequences. The divestment from using the dollar in International trade is borne out of the years of economic repression of other countries by the US, weaponizing the dollar, and the likes. The neo-colonialistic tendencies of the US, have shown them to be detrimental partners. Countries who are shying away from the dollar, do so to save their economy, people and sovereignty. To say it doesn't solve the problem shows that one might not even understand the problem in the first place or maybe for that person, it's a case of the only problem that matters, is the impact on the US. US policies have been wreaking havoc on developing and underdeveloped nations of the world and if they seek to fix that by shying away from the dollar, they are very much in their right and thinking of their best interest like they should have always done.

Who is blaming other countries as this is all self inflicted. This post has nothing to do with the weaponizing of the US Dollar and more about how the Government has chosen to use an economic theory that does not work over a long period of time. The weaponizing of the dollar is another story entirely and will have consequences for many countries who cannot afford to lose their trade with the US.

The debt has to increase at an exponential rate or else the entire system collapses in on itself. The debt ceiling is a charade. A reset is in the works.