After last week's heavy decline, stock indexes are trying to climb back up. The S&P 500 has preserved the 3800 points and today gains nearly 2 percent, while the dollar index is falling to its lowest levels since May.

Now the eternal question arises: trend reversal or a simple "dead cat" bounce?

Objectively, there is no particular reason for a decisive reversal.

Inflation continues to bite aggressively.

This week there will be the release of more reports on major U.S. companies, and it is likely that they will contain negative data on a par with those that featured Walmart last week.

On the crypto front, there is no particular news to report. Bitcoin closed its eighth consecutive bearish weekly candle (first time in the asset's short history), while altcoins continue the slow and gradual weakening, although we have not yet seen a real capitulation.

All indicators are definitely overstretched, signaling good chances for at least a short-term rebound (assuming equity markets do not decide to go revisit last week's lows).

I believe technology company stocks are entering attractive areas for long-term (12-24 months) buying.

A comment on the weekly metrics published by Glassnode

After the sell-off following the collapse of LUNA and UST last week, the crypto market entered a period of consolidation. Bitcoin has been trading within a relatively narrow price range, between a high of $31,300 and a low of $28,713.

The spot market has thus returned to hibernation, with very few trades and little use of new blocks, either for btc or eth.

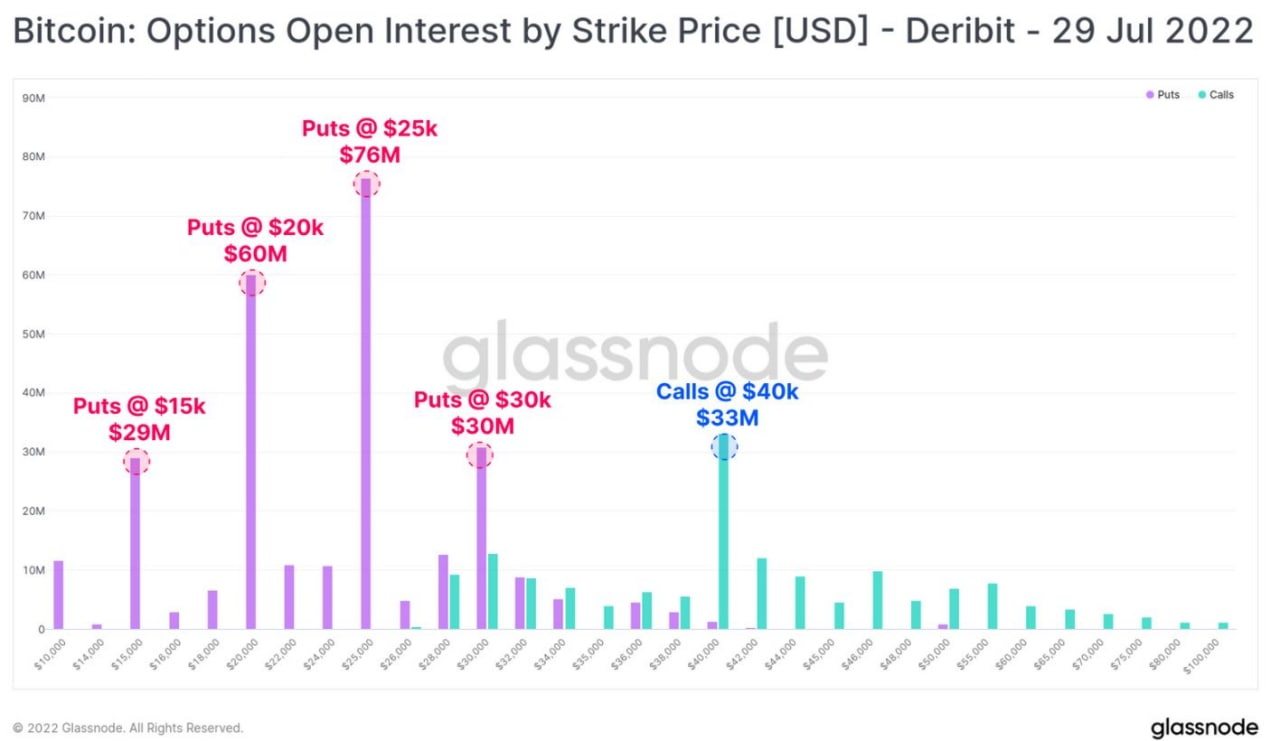

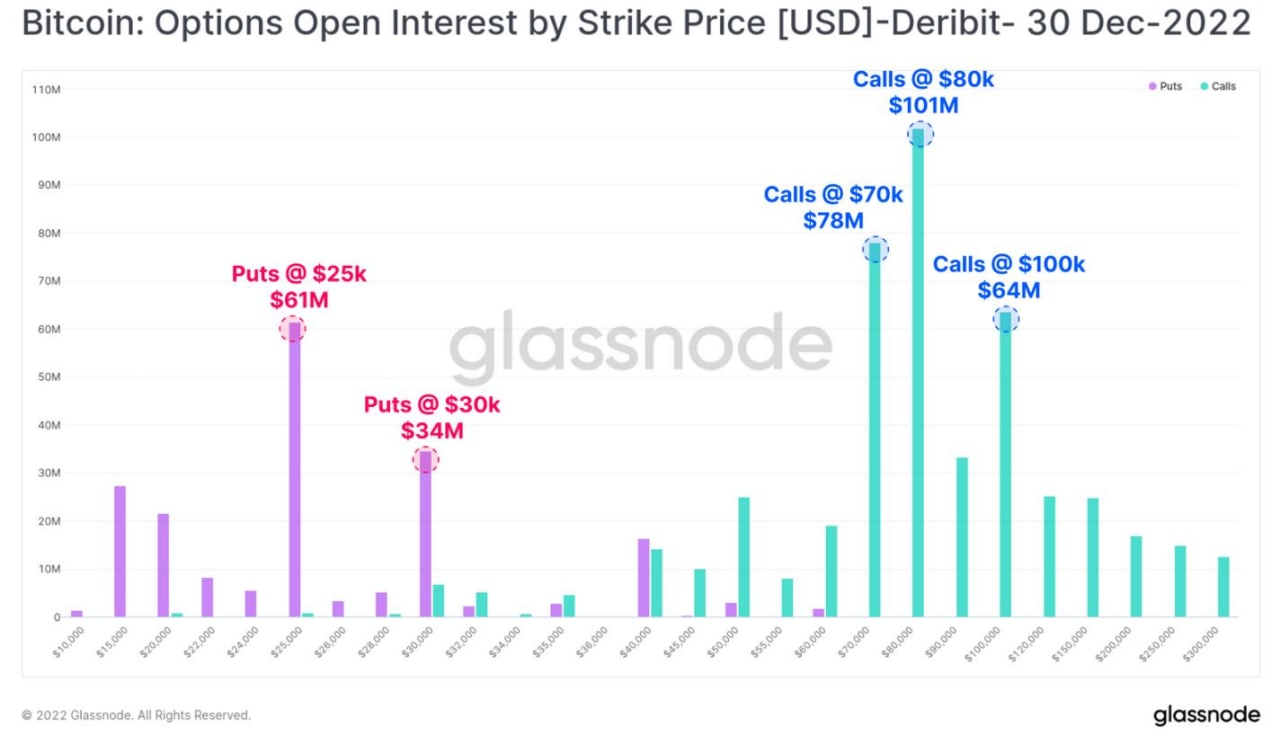

Under these conditions it is the derivatives market that can create appreciable price swings.

In fact, Glassnode currently shows us a pronounced bias in the options market that could trigger some volatility in the future...

As seen here, in the short term there is a concentration of bearish options (puts) that are betting on a decline in the next 2-3 months (or are protecting long positions for the same time frame).

In contrast, open positions for the end of the year have a predominance of call (upside) options with an assumed price per btc between $70,000 and $100,000.

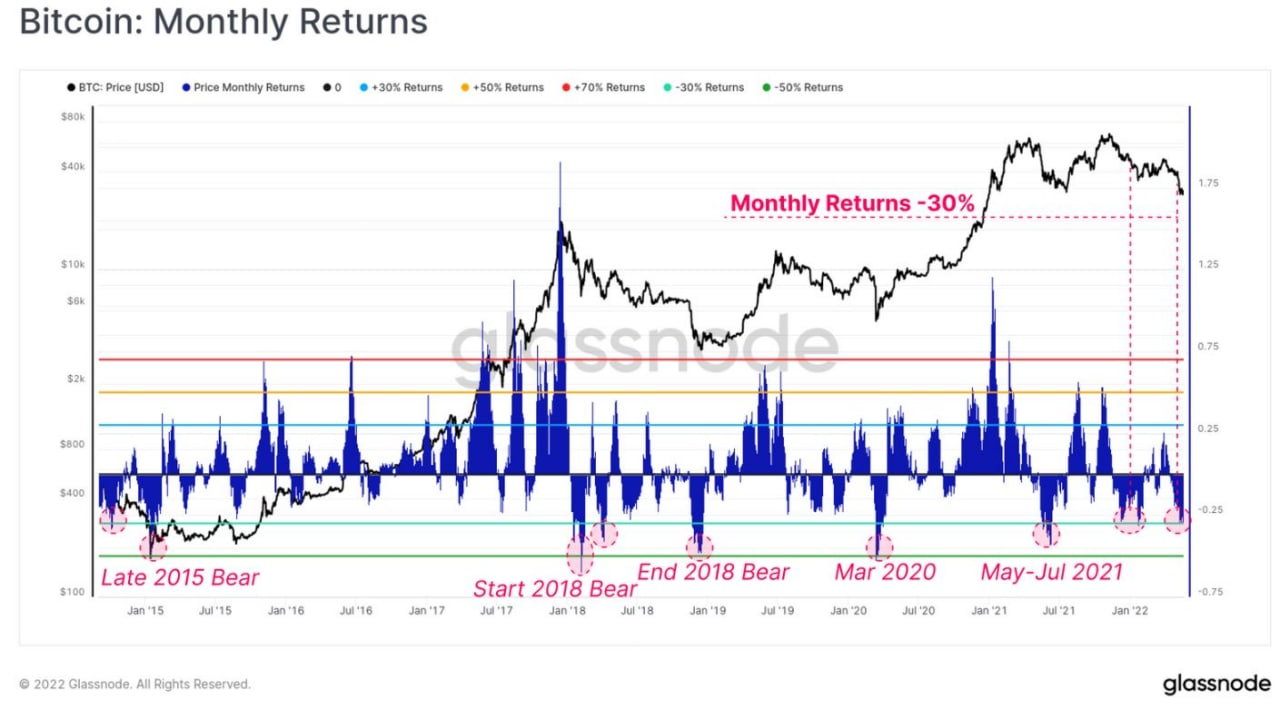

Monthly profits have been declining since the end of the last bull market in May 2021. The last 3 pink circles on the right show a sequence of these events, adding to other oversold conditions seen last week.

On the other hand, spot market conditions do not allow for any stable reversal of the current bear market.

SOURCES

https://insights.glassnode.com/the-week-onchain-week-21-2022/

Posted Using LeoFinance Beta

Yay! 🤗

Your content has been boosted with Ecency Points, by @cryptomaster5.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

Congratulations @cryptomaster5! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 4000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPSupport the HiveBuzz project. Vote for our proposal!