A court in the British Virgin Islands ordered the liquidation of the 3AC hedge fund,

if not the largest crypto hedge fund, certainly among the largest.

According to rumors, a court in the British Virgin Islands ordered the liquidation of the Three Arrows Capital (3AC). These funds usually interact with Lending platforms (i.e., all those similar to Celsius, especially BlockFi). There is talk of more than $10 billion.

Usually collateral (even vesting tokens) are locked in and sometimes even without collateral. These funds, by locking up their assets (collateral), take stablecoin loans on Lending platforms to conduct operations elsewhere. Of course, these funds are also subject to liquidation if their collateral falls too low in price. Usually the liquidator repays part of the debt and takes part of the collateral + liquidation fee, reducing the borrower's exposure. In other cases, liquidation is total.

How to avoid liquidation? Increase the collateral or repay part of the debt (usually stablecoin) or hope that the price of the locked collateral will go back up.

Regarding Three Arrows Capital, arrangements are probably being sought with creditors, who have an interest in seeing the funds returned in the long term anyway, rather than liquidating the position.

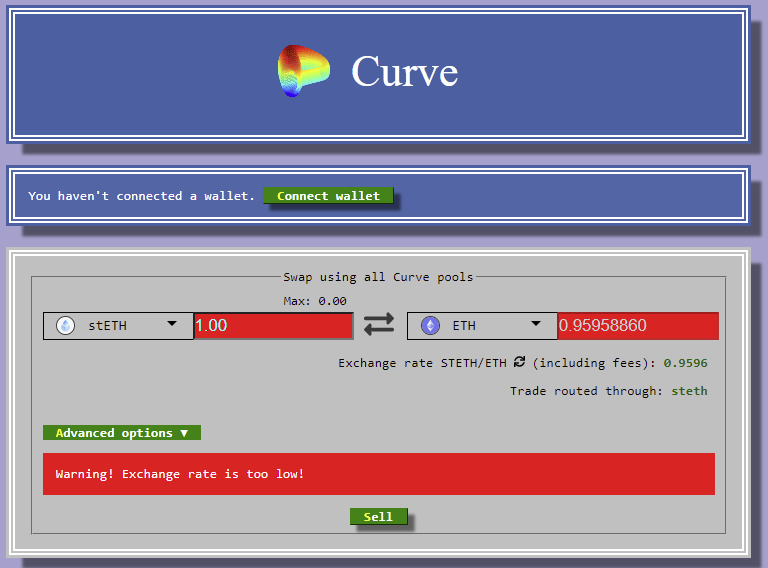

It appears that 3AC was among those to shed in greater proportions positions on stETH (Lido Finance's liquid derivative, inherent in Ethereum and trading at 0.96 ETH, as opposed to the 1:1, for which it had been given; in fact following the ETH merge, it would always be tradable for 1:1 ETH). All of which would suggest a liquidity crisis for the fund, which is one of the largest in the crypto world and would have already liquidated some of its positions. It cannot be ruled out that there are many other platforms that have interacted with it.

There are many cryptos held by the fund: from BTC to ETH, via Solana, Luna ($200 million) and Avax. Some of these altcoins in which the fund has invested have a lock-in period ("vesting") so 3AC could dump them to recover some liquidity.

In the interactions with Lending platforms and other funds, the names of BlockFi (which in recent days has reportedly laid off several employees due to financial difficulties and had also communicated that it had liquidated a large position, most likely Three Arrows Capital) and the lesser-known one of Fireblocks (among those responsible for the loss of Celsius's 35000 ETH in the Stakehound case) are noted.

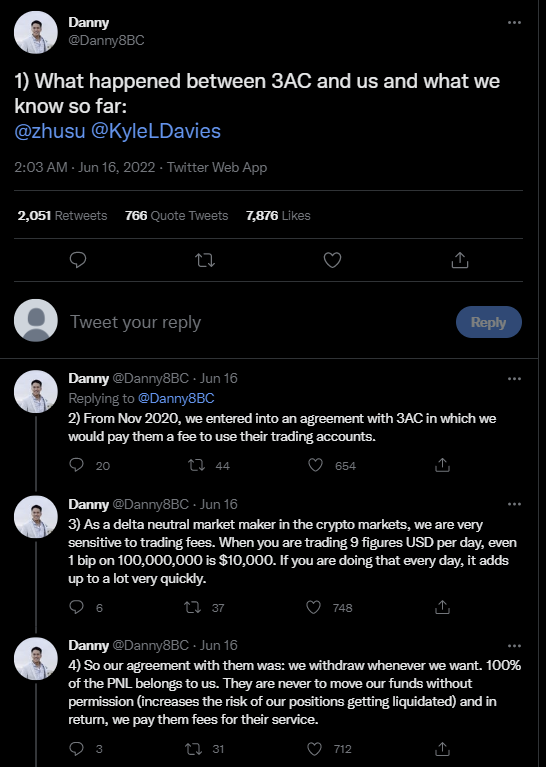

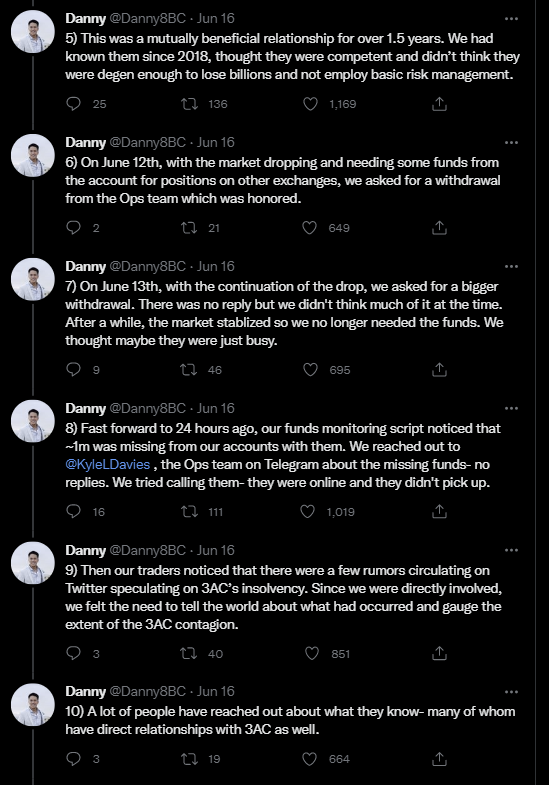

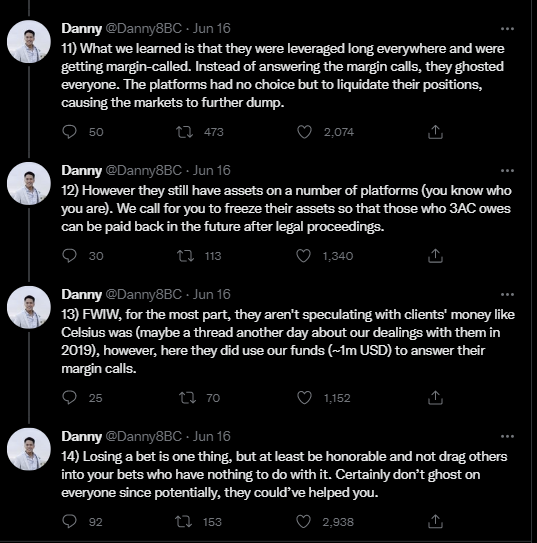

The behavior of the executives had already appeared as suspicious a few days ago, when references to, precisely, the crypto world were removed from Zu Shu's Twitter bio. Reportedly there are actually several groups in the Lending industry that are allegedly involved (in addition to the aforementioned Celsius). The co-founder of Three Arrows Capital, Kyle Davies, has reportedly disappeared into thin air for several days and can no longer be found. According to a Twitter thread by Danny Yuan, among the founders of Trading 8 Blocks Capital, Three Arrows Capital withdrew the funds without first informing them, in violation of an agreement between the two companies. Yuan stated in the thread that 8 Blocks Capital, a Market Maket company in the cryptocurrency markets, has been trading capital from Three Arrows Capital in exchange for fees for more than a year and a half (the agreement began in November 2020). He further added that the relationship has been "mutually beneficial" so far. Yuan explained that after the cryptocurrency markets started to fall heavily on June 12 and 13, however, things became more difficult. He said his company had requested a withdrawal on June 12, which was "honored," but the next day, when they requested a larger withdrawal, Three Arrows Capital did not respond. What happened next, according to Yuan, was that they discovered that $1 million was missing from their account. He added that attempts to reach the fund's operations team and co-founder Kyle Davies were unsuccessful. The trader went on to say that after being in contact with others with "direct relationships" with Three Arrows Capital, they discovered that the fund was "leveraged long."

"Instead of responding to Margin Calls, they ignored everyone. The platforms had no choice but to liquidate their positions, causing the markets to fall further."

Margin Call means that the fund was close to liquidation and would have to add more margin in order not to be liquidated. Yuan added that although Three Arrows Capital has been liquidated on many platforms, there are still assets owned by the company left on some exchanges and Trading platforms.

In addition to BlockFi, the fund would also be liquidated by Genesis Capital, Coinbase and Crypto.com. Today, Genesis CEO Michael Moro tweeted that his digital asset brokerage "mitigated losses" with a large counterparty that failed to meet a margin call earlier in the week. Moro said New York-based Genesis sold and hedged all of the counterparty's liquid collateral that failed to meet the margin call to minimize any losses and that no client funds were affected. Genesis also manages Ledn's funds.

Posted Using LeoFinance Beta