Bitcoin is trading in the red for the eighth week in a row. Overall losses were 44.59% to a low of $26,700 and 37% to the current price of $30,118. The correlation of the first cryptocurrency with the S&P500 index is 0.78 and 0.75 for 30 and 90 weeks, as well as 0.93 for 30 and 90 days (daily indicators are inaccurate, since the cryptocurrency is traded on the weekend).

The cryptocurrency market remains dependent on the US stock market. The stock market is storming due to the tightening of the monetary policy of the US Federal Reserve. The regulator fights high inflation by raising rates.

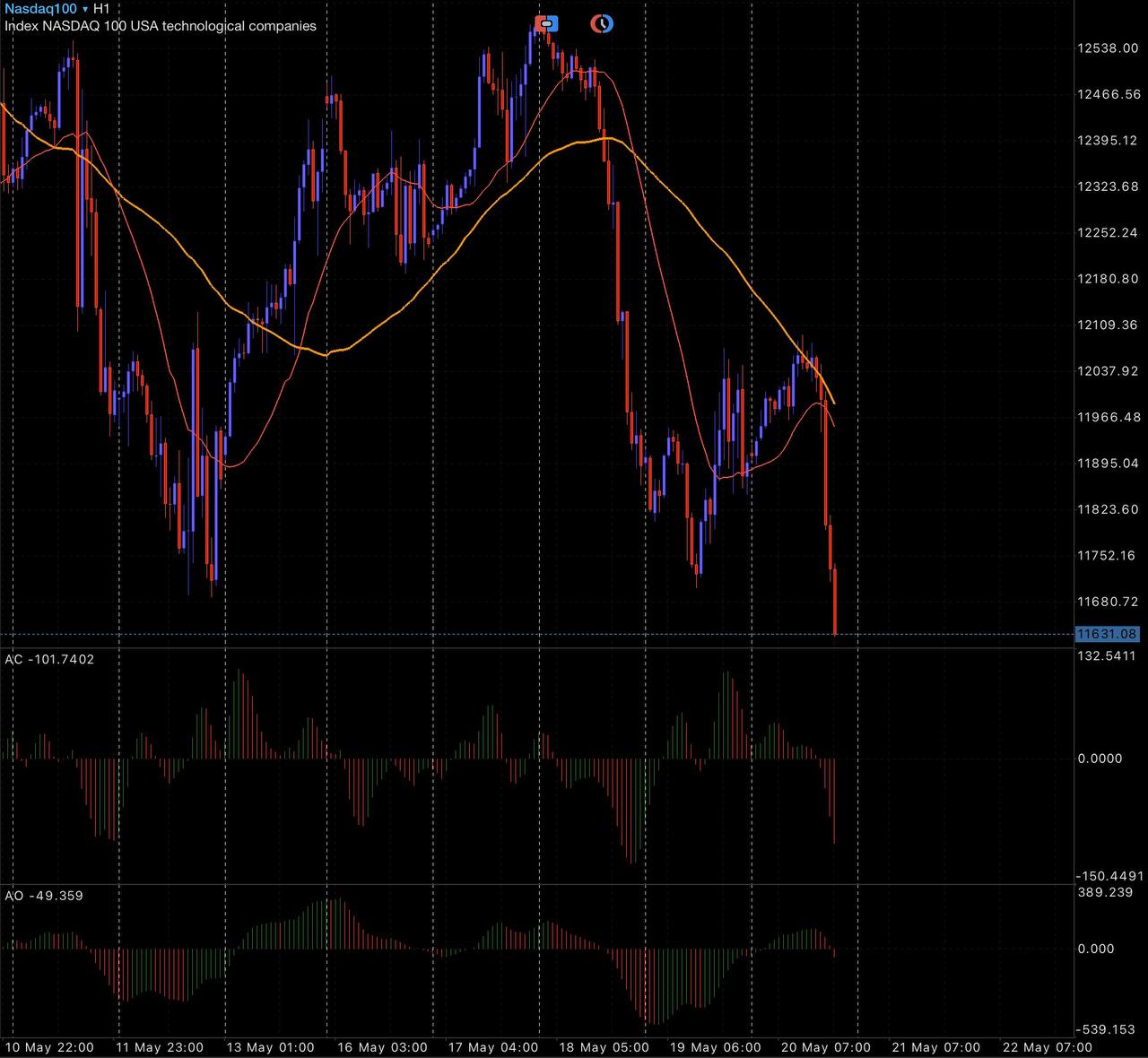

At the end of the week, the S&P500 and Nasdaq Composite also recorded the seventh negative week in a row. The series is the longest since the end of the dot-com bubble in 2001. On Friday, the US dollar corrected slightly against world currencies, but is still trading at maximum levels.

For 10 days, the BTC/USDt pair has been trading near the trend line, which was drawn through the lows of $3782 (March 13, 2020) and $10136 (September 23, 2020). Its puncture took place on May 11-12, 2022. Against the backdrop of a rebound in the indices, buyers protected the $28,500-29,500 zone, but are still vulnerable to a further fall to the $20,000 level. It is unlikely that demand will return to risky assets in the near future.

On Friday, the S&P500 index won back all the losses and closed in a meager plus at 0.07%. The rebound gave hope to buyers in the crypto market over the weekend to return to the $30,300 area.

The situation for cryptocurrencies remains critical. Buyers are hanging by a thread. The bearish trend is intensifying and you don’t know where help will come from and what news will trigger a new rally in the stock and cryptocurrency markets.

On Monday I'll see how the currency and stock markets open, and closer to 10 GMT + 3 I'll unsubscribe according to the mood of market participants. A breakout of buyers towards 31700 will begin to form technical conditions for a deeper correction.

Posted Using LeoFinance Beta

Bitcoin seems to be consolidating at this level. But which way next?! up is looking more likely the longer it hovers here. but who knows!?

Posted Using LeoFinance Beta

No Bro. Most likely just down. The United States, to put it mildly, is in a financial hole, and to be honest, I have little idea of the probabilities that would make it possible to overcome the crisis. And during the crisis, there are very few investors in high-risk assets, which include cryptocurrencies.

But the end of this month (maximum next week) will show whether the crypto winter has come or we will still see bitcoin at 72k this year

Posted Using LeoFinance Beta

Thanks for your insights. Please keep us updated!!

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

The current economy is hurting everyone whether they are invested in the stock market or crypto. It will bounce back. Hang in there.

Posted Using LeoFinance Beta

From bear market records...

1966: 171 days

Current only 96 days