Kelly Sikkema "unplugged black cord" @kellysikkema on Unsplash. Released under Unsplash License

The regulatory crackdown on crypto by the Chinese government continues to alienate major network miners. Dubai-based investment firm IBC Group plans to end its Bitcoin (BTC) and Ether (ETH) mining operations in China.

IBC Group has large mining operations in China, and plans to roll out its operations in the United Arab Emirates, Canada, the United States, Kazakhstan, Iceland and several South American countries. The company recently relocated its headquarters to Toronto, Canada.

Khurram Shroff, president of IBC Group and CEO of iMining, said the ban on cryptocurrencies in China is actually very good news for the rest of the world:

"A move of crypto-mining operations outside of China will be a huge opportunity for Canada. The Toronto Stock Exchange recently listed the world's first ETF on Bitcoin, so the nation is already leading the way in terms of mainstream cryptocurrency adoption."

China has turned its attention to the mining industry's energy consumption in the wake of continuous power outages in the Xinjiang region in mid-April. These were followed by stricter government oversight, sparking panic throughout the cryptocurrency market.

Nonetheless, industry experts have since agreed that although the initial impact was terrible for the industry, the migration of miners out of China will make cryptocurrencies more decentralized.

Galaxy Digital's Mike Novogratz called the recent developments extremely positive for the Bitcoin ecosystem in the long term. Brandon Arvanaghi, former security engineer at cryptocurrency exchange Gemini, pointed out that the Chinese government crackdown means Bitcoin is working, not failing:

"It's creeping entire nations out. [...] Bitcoin is the largest store of value in the history of planet Earth, there is nothing comparable. We're going to start valuing our wealth in terms of Bitcoin, and volatility is the tax we pay for being on the right side."

In previous posts we had reported the news that several Latin American countries, are moving in desperate search to attract miners, and with them large amounts of foreign capital.

The first to have moved was El Salvador, the first country in the world to make BTC legal tender (but this has not made it the only currency, let alone untied the local currency from the U.S. dollar), but there are projects under discussion in Paraguay, Panama and Mexico, but the countries that could really benefit from this migration are the countries with cold climate and low cost of electricity (Canada, Russia, Kyrgyzstan, Argentina, Norway, Iceland etc., source).

At the same time, there are investment projects worth several million dollars in the USA (see our article Atomic energy for Bitcoin).

In June, BTC.com, a major mining pool operated by BIT Mining and controlled by 500.com, announced the relocation of its first batch of mining machines to Kazakhstan.

BTC.com was founded by Jihan Wu, and was operated by Bitmain and Bitdeer until its acquisition by 500.com in February this year. It is currently the fifth largest mining pool in the world: it validates 10.4% of all blocks on the Bitcoin (BTC) blockchain.

Lower hashrate, lower difficulty, higher profits

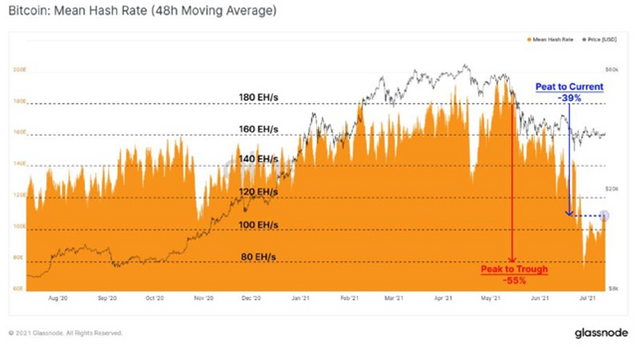

As we had a chance to explain in our previous article ...., the Chinese ban suppressed an amount of blocks (i.e., active computers) that were supplying the network with about 38%-49% of the global hashpower (computing power and therefore global production power).

As a result, the total bitcoin hashrate (the rate at which new bitcoins are produced) declined from the high of 180 EH it had in April to a low of 65 EH on June 28.

However, we mentioned that every couple of weeks a reshuffling of the difficulty happens based on the change in the other parameters.

That is why, after a couple of weeks, the hashrate has risen from the minimum of 65 EH to the current values, around 88-100 EH, thanks to the fact that in the meantime the difficulty has remodeled, reducing.

The reduction in difficulty brings an increase in revenue for the remaining 50% of miners who are still operating in the rest of the world. Those miners, without having to increase expenses, have seen their profitability increase by almost 2x, approaching similar profit levels as in April. Basically, it's as if the Chinese government has done these miners residing outside of China a "favor"....

Conclusions

The bitcoin industry thus seems more resilient than many others and reacts better to sudden supply and demand imbalances that would bring down any other traditional industry. In addition to this greater resilience, there are also structural socio-economic factors such as the more favorable political and institutional landscape, the inflationary trend triggered in fiat currencies and the risks of central bank monetary policies.

André François McKenzie / @silverhousehd on Unsplash. Released under Unsplash License

Other factors affecting traditional industries, such as the possibility of financing with banks and the derivatives market, are also starting to matter more in the crypto industry.

All of this contributes to composing a mixed picture in which aspects specific to this industry begin to mix with aspects typical of traditional production sectors.

The autonomy of producers and their extraneousness to traditional financial mechanisms is shrinking, but the technological advantages of blockchains remain, making them resilient by nature, as we have just seen with the Chinese ban.

The Cryptosniperz Team

SOURCES

https://cointelegraph.com/news/china-crypto-ban-a-huge-opportunity-for-canada-mining-group-head-says

DISCLAIMER

We are not giving any financial advice regarding cryptocurrencies, but rather giving applicable advice for new, intermediate and experienced people who are currently into cryptocurrencies or someone who is just now realizing what it is. Before you read this I must say that this blog will be based on the assumption that you have already done some research on cryptocurrencies and the Blockchain ecosystem. We will continue to provide explanations and details to the best of our ability, however we encourage you to do your OWN research because only YOU will know how this second financial revolution will best fit into your life. Thank you for reading our contents.

Posted Using LeoFinance Beta

Congratulations @cryptosniperz! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 300 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPSource of plagiarism 1

Source of plagiarism 2

There is reasonable evidence that this article has been spun, rewritten, or reworded. Posting such content is considered plagiarism and/or fraud. Fraud is discouraged by the community and may result in the account being Blacklisted.

Guide: Why and How People Abuse and Plagiarise

If you believe this comment is in error, please contact us in #appeals in Discord.

Our mistake:

Thank you for your report.

Posted Using LeoFinance Beta