January 1st of each year is one of the best days to compare annual yield of each crypto.

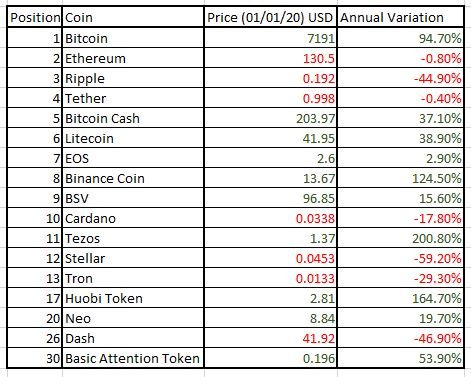

I decided to form a table in Excel, composed by 13 top cryptos (From Bitcoin to Tron), plus I included 4 cryptos more such as: Huobi Token, Neo, Dash and Basic Attention Token.

A lot of crypto investors have their marked preferences and everybody decides which cryptos to include on its portfolio.

Despite its bearish trend of the second part of the year, you might be surprised that 10 of the tokens finished giving profits to their hoddlers while 7 were on red numbers.

I have a composed portfolio and 9 of these coins are already there, in different shares of course.

From these cryptos the best performers are: Tezos (+200%). That means, who invested 100 USD in Tezos, would be getting 200 USD of profit in one year.

Huobi Token was the second best performing token, with increase of 164%. I am not surprised by this fact because Huobi Global Exchange is a really awesome place for trading, plus they have exceptional customer service.

And the third was Binance Coin, with increase of 124%.

Finally I would mention the king of cryptos – Bitcoin with 94 % of increase. Bitcoin marks his moves himself and often leads most of the crypto market moves.

I would like to mention that despite some traders appreciation: Litecoin finished the year with almost 39% of increase, Bitcoin Cash with 37% and Basic Attention Token with almost 54% of increase. So for the ones who don’t like these coins, just analyze their profits, they did pretty good also.

The highest negative yields applied for Stellar, Dash and Ripple. Even if I am into Dash, I have to recognize that it plunged almost 47%. So these are the annual numbers; numbers are sometimes cold but we can have here reference for longer term hoddler’s analysis.

The market cap for many of these coins has changed however the top 3 cryptos have remained in the same position.

This annual comparison can give us a historic comparison for these cryptos but it is not of course any definite tool for selection or purge of your crypto portfolio. For that purpose you have to do the following:

- The latest fundamental analysis for each crypto

- The latest technical analysis of each crypto.

- You have to be also willing to accept that some coins will bring you certain profits or losses.

- Select the appropriate time horizon for your investment

For example, it may look that Tron wasn’t a good investment for 2019. Definitely it looked more promising during 2018 but the coin has started to consolidate in the sideway trend in the last weeks and I personally started to see interesting recent updates for this coin.

Sometimes when we are about to select, we will pay attention to its last records but at the same time some heavily discounted cryptos can bring also good profits but it depends on each case. For example Basic Attention Token seemed to find a nice support between 0.15 and 0.16 USD for the last 3 months. Since then this coin recorded nice bull run in October but also retracement in November and December. So the profits and each coins performance have to be monitored on weekly and daily basis as well.

I absolutely don’t pretend to influence your crypto selection strategy, everybody should do his/her independent analysis and remember there is no 100% certainty that the coins will execute certain specific expected trends due to each crypto volatility.