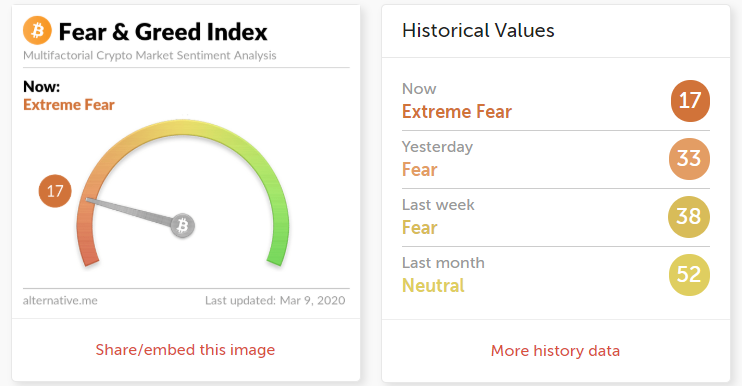

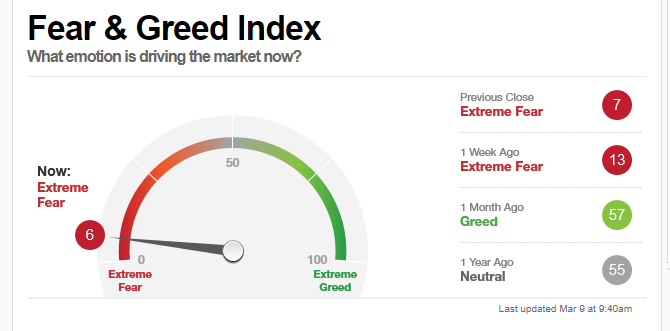

Both the equities and crypto markets are facing a massive sell-off now. Fear has gripped both of these markets but are they oversold?

Source

Source

I made a post yesterday that the SPY is likely to see some support at the 288 level. However, the market "beat" my expectations and went even lower. SPY is now struggling to hold the 150w SMA level as seen from the chart below.

In my last post, I warned about the weakness in the junk bond market being something of serious concern. Today the junk bond market continues its sell-off

The junk bond market has been sold to a level similar to December 2018. Hence, it is at a critical level in my opinion. Any further sell-off might represent serious underlying problems that have not surfaced to retail investors yet.

However, the market typically do not go vertically down for long. I am anticipating some kind of bounce soon as the RSI is near to oversold region on the weekly interval. Notice that the last time this happened was in December 2018. Hence, I am looking to sell some put options as the premiums are super yummy now :p

As for BTC, it is currently clinging on to the trendline which I drew in yellow. The 7600-7700 seems like a important support for BTC. If it convincing breaks below, then it probably will be going to the 7100-7200 range which does not look good.

However, if you ask me whether I will be selling my crypto, I will reply with a straight "no". With the Bitcoin rewards halving just less than 2 months away, I find that it will be too risky to sell now. The cryptocurrency market is one where we have a lot of asymmetry. The potential upside is so much bigger than the downside and I am certain I do not want to miss the halving pump.

Once again, this is not financial advice. Just sharing my thought process and how I am navigating this market events.

10% of post rewards goes to @ph-fund, 5% goes to @steemworld.org and 5% goes to @leo.voter to support these amazing projects.

Join the Steem ENS Discord server to interact with the community!

This article is created on the Steem blockchain. Check this series of posts to learn more about writing on an immutable and censorship-resistant content platform:

- What is Steem? - My Interpretation

- Steem Thoughts - Traditional Apps vs Steem Apps

- Steem Thoughts - A Fat or Thin Protocol?

- Steem Thoughts - There is Inequitable Value Between Users and Apps

- Make my votes count! Use Dustsweeper!

- What caused STEEM to get dumped? Why I think the worst might be over

- Steem 2020 is about having a "SMART U"

Uncertain times. So much panic and fear around at the moment. And that is what is driving the market south. Once the Covid-19 has settled down, when they have discover a vaccine, all will come back up again. 😊

The vaccine will likely still take a long while to be ready. But the hope of the vaccine being close to completion might just drive a rebound.

We shall see. 😊 !trdo

Dear @culgin

People and investors across the globe seem to be terrified. And they surely have a reason to feel that way.

I'm not sure if TA can be of any use in times of general panic or FOMO. Support levels are build partly on confidence and trust - and this is gone.

On top of that currently FED and other central banks are manipulating market to degree we've never seen before. And TA definetly cannot take this into consideration.

They do not. Assuming that companies on stock market will still survive. And it seem that many of those corporations are nothing but "zombies" - on the edge of shutting down completely and going bankrupt.

Upvoted already,

Yours, Piotr

@crypto.piotr my friend, you sounded too pessimistic. TA is actually built on human psychology. Many psychology concepts come into play in a TA, recency bias, anchoring effect, self-fulfilling expectations and etc. So as long as humans are still humans (and not cyborgs), TA is still relevant.

The COVID-19 virus is serious and nobody can predict how it will end. However, do remember that its close cousin, SARS, disappeared suddenly after spreading to 32 territories and killed 8000 people. In addition, viruses' mortality rate has the tendency to get weaker over time. This is because viruses need a host to survive and transmit. If the host is killed too soon, the virus has lower chance of spreading. Hence, due to natural selection, viruses' mortality rate drops over time. Of course there will be exceptions but COVID-19 does not seem like an exception if we can trust the numbers from China.

Finally on Fed manipulation. Of course, we all know fundamentally the world is pretty screwed by modern day monetary policies and the fiat system. That is why you and I are invested in cryptocurrencies. Hopefully it is a way out for us.

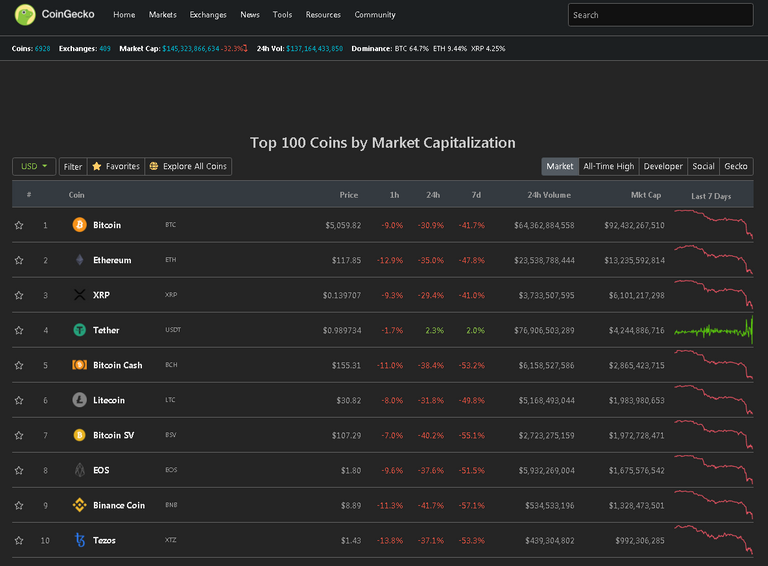

Speaking of the cryptocurrency market, today I saw a general drop in almost all of them, in fact if I look at the top 10 in the list it is seen that the drop is around 50% of the value they had last week.

Caught me by surprise too 😅

I was too focused in the traditional market and neglected signs in the crypto markets.

:)

Glad to contribute something you weren't reviewing recently.

I think that what you were analyzing could also be related to this collapse of cryptocurrencies and may be a plus sign of a very unstable world economic situation today.

Well, I think you should wait because I trust that with halving the prices will balance and you will have a great hype.

A good analysis.

Thanks! I still have faith on crypto

Thanks for the very detailed analysis here. It's really hard to predict the market yet intelligent guesses are always good to read. Cheers!

Thanks for your kind comment 😁

It’s an great time to enter in market if want to buy at good price

If you have a long-term horizon, yes. Worth taking the risk now to DCA.

I think junk bonds are like stocks, have a similar volatility. And both bonds and stock valuations depend on interest rates or sovereign yields.

VIX is on levels of the beginning of 2009. Do we have a similar crisis?

IMHO, the current situation is quite similar to the global financial crisis in 2008/09. I just wrote a new piece on a technical analysis and I also compared the VIX level between now and then.

Silver showing the same pattern today as in August 2008.

Resteemed already. Upvote on the way :)