The Bitcoin VS Ethereum is always an interesting debate! Will Ethereum surpass Bitcoin market cap? The flippening! Will Ethereum be more valuable than Bitcoin?

Let’s take a look at some on chain data in the last period.

We will be looking at data for:

- Unique wallets

- Active wallets

- Number of daily transactions

- Fees

- Market cap and BTC dominance

The data is extracted from https://www.blockchain.com/charts and https://ethscan.com/, for the period July 2015 – April 2021.

Although Bitcoin is around since 2009, Ethereum started with operation in 2015 and from then forward we will be making the comparisons.

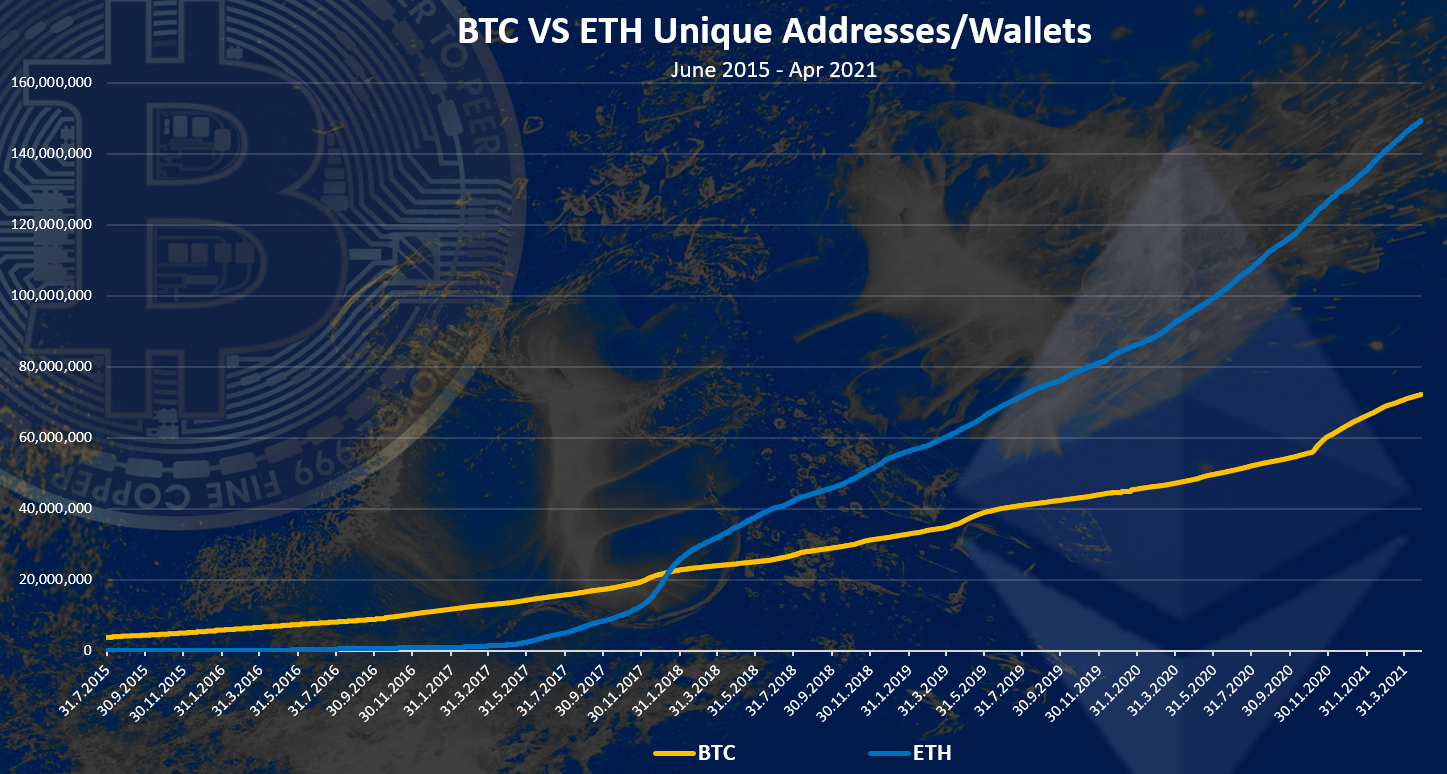

Number of Unique Wallets Created

Here is the chart for the number of unique wallets on Bitcoin and Ethereum.

Up until 2017 Bitcoin was leading in the numbers and then in January 2018 Ethereum took the lead in number of wallets and has been increasing the lead ever since.

In January 2018 the number of Bitcoin and Ethereum wallets was just above 20M. Today Bitcoin has 72M wallets and Ethereum almost 150M. As we can see Ethereum has more than double the numbers of wallets than Bitcoin.

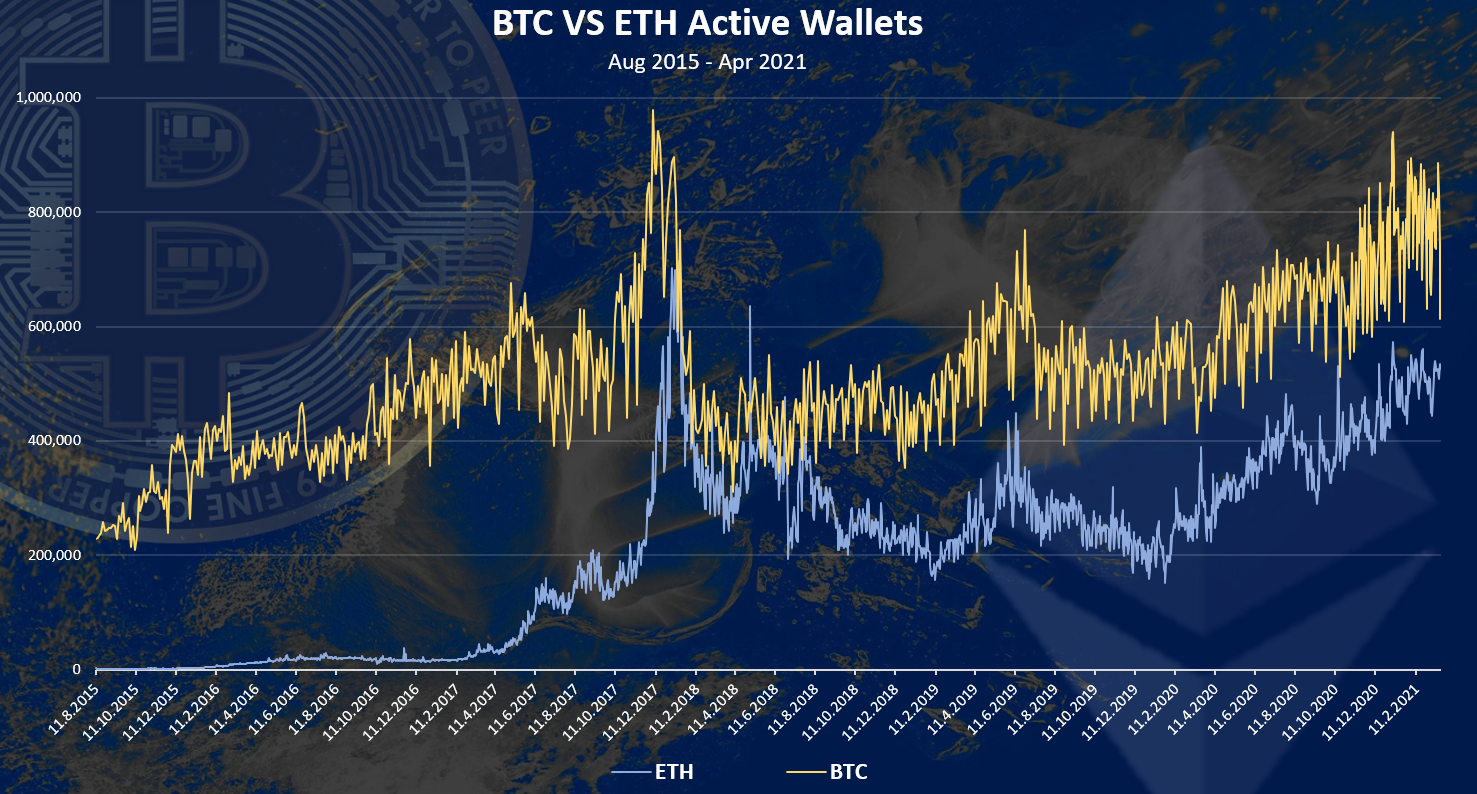

Active Wallets

The above was in terms of wallets created. How about active wallets? How many of those wallets created are actually been used? Here is the chart.

When we look at the numbers of active wallets Bitcoin is in the lead. Ethereum has come close to Bitcoin in the previous bull run, at the end of 2017 and the beginning of 2018. At that time Bitcoin has reached more then 900k active wallets, and Ethereum around 700k active daily wallets.

These numbers haven’t been reached yet in this bull run, but the numbers are very close. Bitcoin has been in the range of 600k to 800k active daily wallets, while Ethereum has reached 500k active wallets.

Will be interesting to see how high these numbers will go in this year.

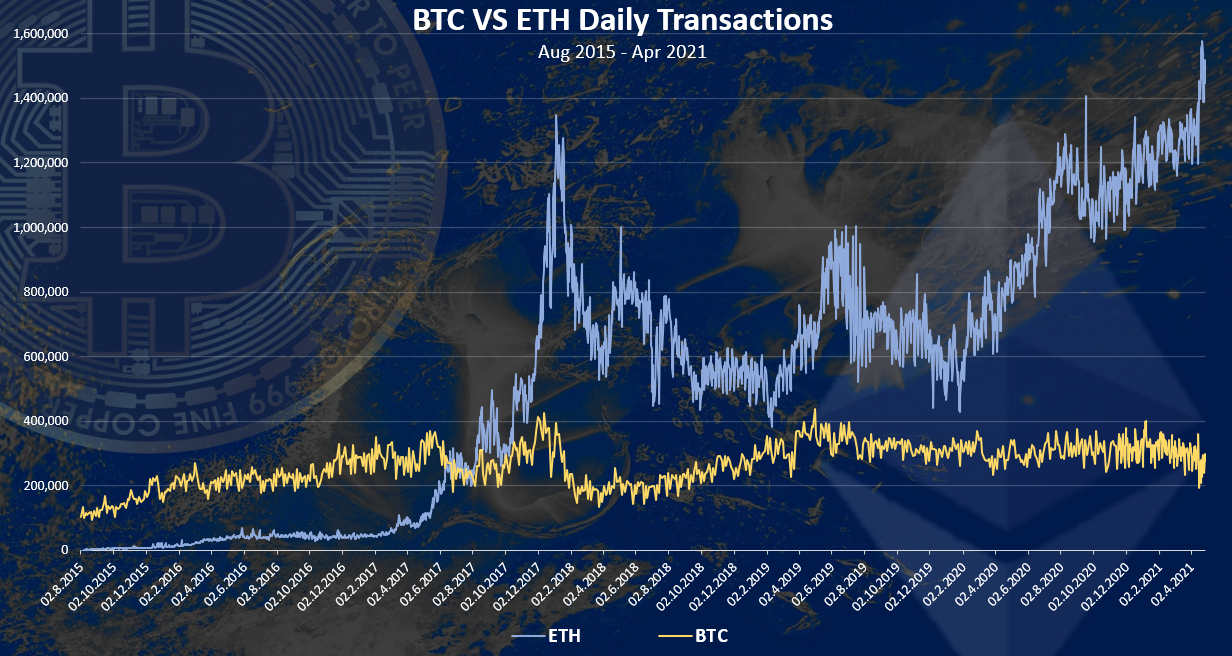

Number of Daily Transactions

Here is the chart for the number of daily transactions.

In terms of daily transactions Ethereum is now in a big lead in front of Bitcoin.

Ethereum has overtaken Bitcoin in the previous bull run in 2017 and has been leading since then. In the last period Ethereum has increased the lead with more than 1.5M transactions per day, while Bitcoin is around 300k transactions per day.

As we know Ethereum as a smart contracts platform has a lot of different operations and transactions that can be made on chain, while Bitcoin is been used only for one purpose, and that is transferring tokens from one wallet to another.

Ethereum has a smaller number of daily active wallets than Bitcoin, but obviously those wallets are making much more transactions then the Bitcoin wallets.

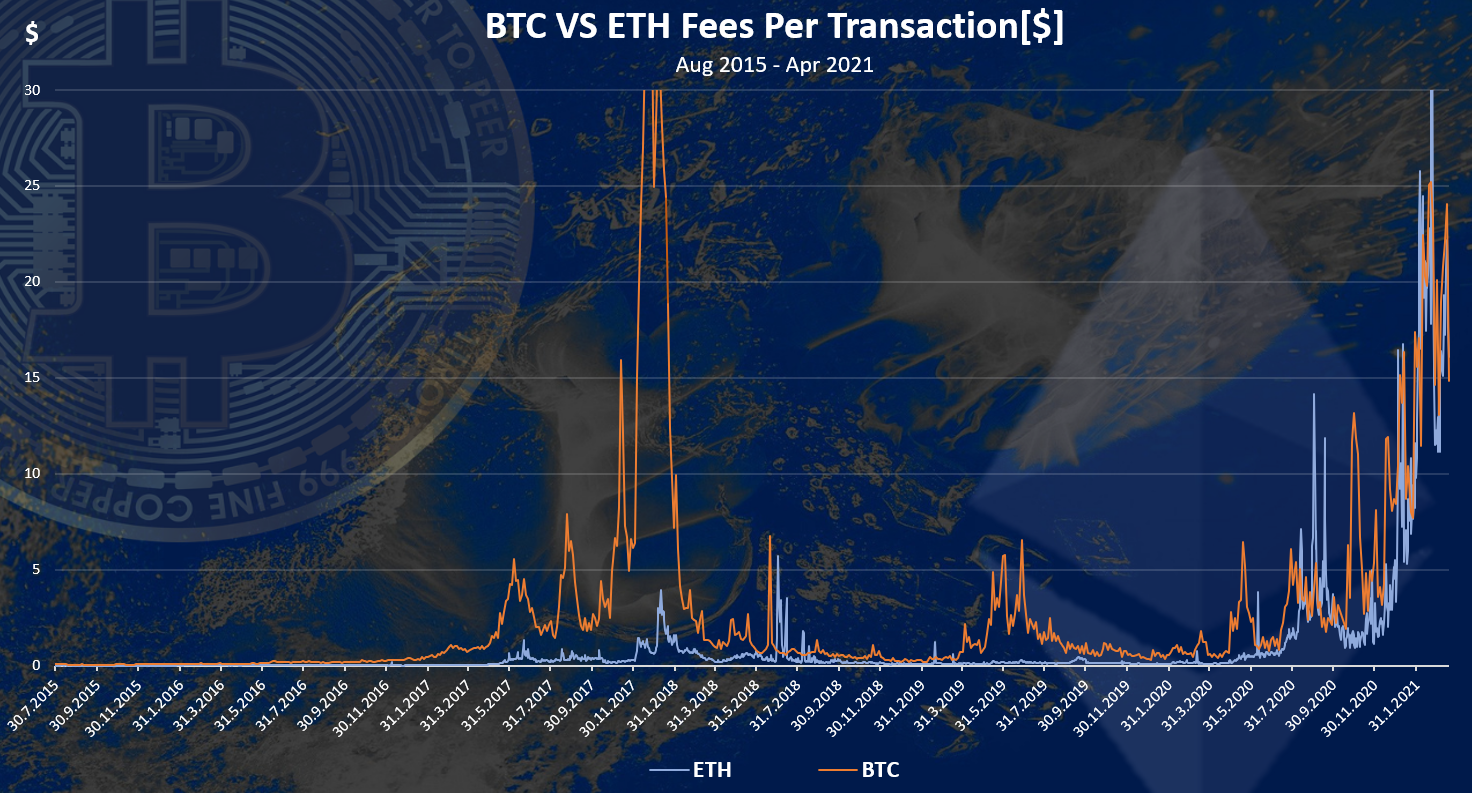

Fees

The chart for the fees looks like this.

These are the average daily fees per transaction in $ value.

We can notice that during the previous bull run the Bitcoin fees have went much higher then the Ethereum fees. Back then BTC reached more than 50$ fee per transaction for a short period of time. The Ethereum fees in the previous bull market were bellow 5$.

These days both, Bitcoin and Ethereum fees are increasing in parallel with Ethereum taking the lead.

The average fees for transactions in the last days are above 20$. For Ethereum the fee depends a lot on the type of operation, usually a lower fee for simple transfers, a higher fee for swaps on dexes like Uniswap, and even higher fee for minting NFTs etc.

Bitcoin And Ethereum Market Cap

The interesting topic for Bitcoin and Ethereum is the flippening, or will Ethereum surpass Bitcoin in terms of market cap and become no.1 crypto.

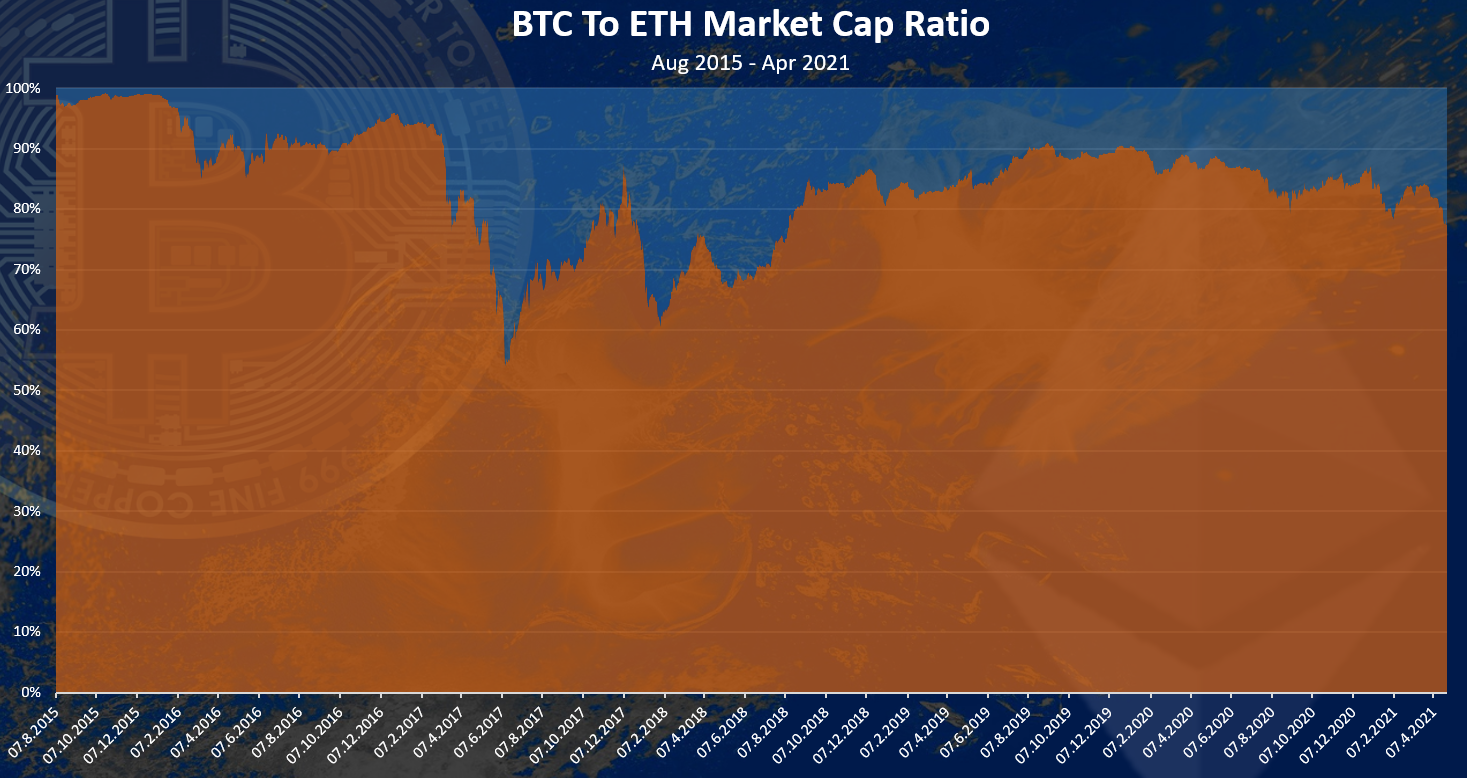

Here is the historical chart for the Bitcoin VS Ethereum market cap.

We can see that at first Ethereum has very low market cap compared to Bitcoin. As time progressed in the bull run of 2017 Ethereum has come close to the market cap of Bitcoin on few occasions, but only for a short amount of time.

In 2018 the ratio of Ethereum to Bitcoin market cap dropped from above 30%, to under 20% and it stayed there until now. In the last few days Ethereum has gained against Bitcoin and the ratio in market cap is now above 20% for the first time since 2018.

At the moment Ethereum has around 300 billions market cap, while Bitcoin is around one trillion.

Ethereum came closest to Bitcoin on June 12, 2017

On this date Bitcoin had a market cap of 43 billion and Ethereum 37 billion. This is before the major bull run that happened late in 2017.

The chart for the share in market cap on this date looks like this.

The closest that Ethereum came to Bitcoin.

This is pretty close. A 43 to 37! A 6 billion more ant Ethereum would have flipped Bitcoin. Looks like the flippening is not impossible 😊. A 54% to 46% ratio.

Finally from the metrics above things stands like this:

- Unique wallets – winner ETH

- Active wallets – winner BTC

- Number of transactions – winner ETH

- Fees – draw

- Market cap – winner BTC

Two for BTC, two for ETH and one draw.

A note at the end that comparing these two blockchains just in terms of the numbers above is quite interesting and useful, but might be misleading as well.

These two blockchains have taken a different role now. Bitcoin as a scare’s asset a digital gold, while Ethereum as the leading smart contract platform enabling innovations, new dApps and use cases for crypto. Personally, I would like to see both of this two perform well.

All the best

@dalz

Posted Using LeoFinance Beta

There is no BTC vs ETH.

The language itself is rooted in competition and zero-sum game-theory.

It's more like BTC and ETH.

Both are stronger when paired together.

Both.

Both are better.

Yes it does.

It's the world we live in today that doesn't make sense.

Anyone who disagrees is drowning in scarcity-mindset.

Posted Using LeoFinance Beta

But sir, wen flippening?

WEN!

After Ethereum goes Proof of Stake vs. Proof of Work, watch out!🚀 The Ethereum ecosystem alone will provide incredible demand.

The only resource that can provide demand are human consumers themselves.

It is impossible to "provide demand".

All we can do is provide supply to new/existing markets.

Which is exactly what ETH upgrades will do.

This is extremely counterintuitive because it doesn't make sense that ETH price would go up when it is providing an abundance of supply. However, that abundance of supply allows the network to scale up and capture a lot more value given the exponentially larger ecosystem. Kinda weird when you actually start thinking about it.

Posted Using LeoFinance Beta

I just use zcash for the increased privacy and not to mention its only about 1 cent per transaction.

That is a great decision from you....@phusionphil

The transaction fee is affordable....@phusionphil

Bitcoin as a scare’s asset a digital gold, while Ethereum as the leading smart contract platform enabling innovations.

can't agree more

Posted Using LeoFinance Beta

Congratulations @dalz! You received a personal badge!

Wait until the end of Power Up Day to find out the size of your Power-Bee.

May the Hive Power be with you!

You can view your badges on your board and compare yourself to others in the Ranking

Check out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!