Stablecoins have become an essential part of the crypto industry. The crypto dollars have been useful for people outside of US, where there local currency is not performing at best. More people and businesses are starting to accept and work with crypto dollars.

We are now witnessing a whole new sector emerging in the crypto industry.

Tether has been the first the first stablecoin and has kept its dominance through the years. The market cap for Tether has been growing. But in the recent years as the sector has matured, we are now seeing a strong competition in this are of the industry.

USDC seems to be on a rise and the number one competitor for Tether. Lets take a look.

Tether started its journey in 2015 and allegedly it founded by the Bitfinex exchange. In general, most of the stablecoins are issued by exchanges, except some cases like DAI trough a decentralized protocol.

A lot can be said about Tether, a history with controversy, mainly around the fractional dollar reserves, or is every USDT backed by equal amounts hold in banks accounts. There have been court cases etc, but up until now Tether has been able to manage the situation and keep growing.

One of the biggest pro for Tether is the way they handled the massive withdrawals that happened in May 2022, because of the UST collapse. Around 15B was withdrawn and they managed to provide the liquidity.

With this said, lets take a look at the data for USDT.

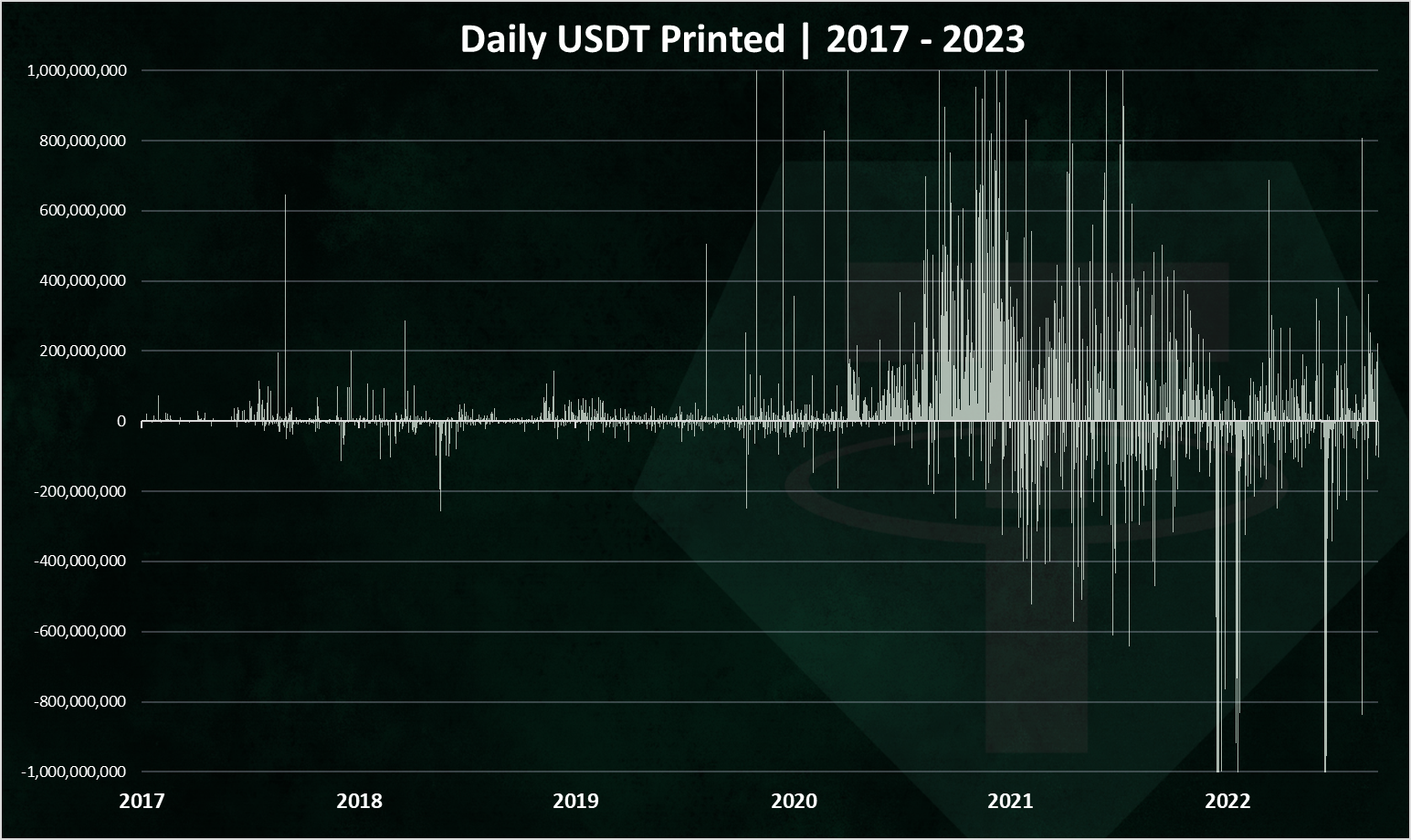

Daily Tether Printed

Here is the chart for the USDC printed per day.

As we can see in the first years there was not a lot of printing for USDT. The larger amounts started to come in 2020 and increased significantly in 2021.

On occasions there were more then 1B USDT issued or burned per day.

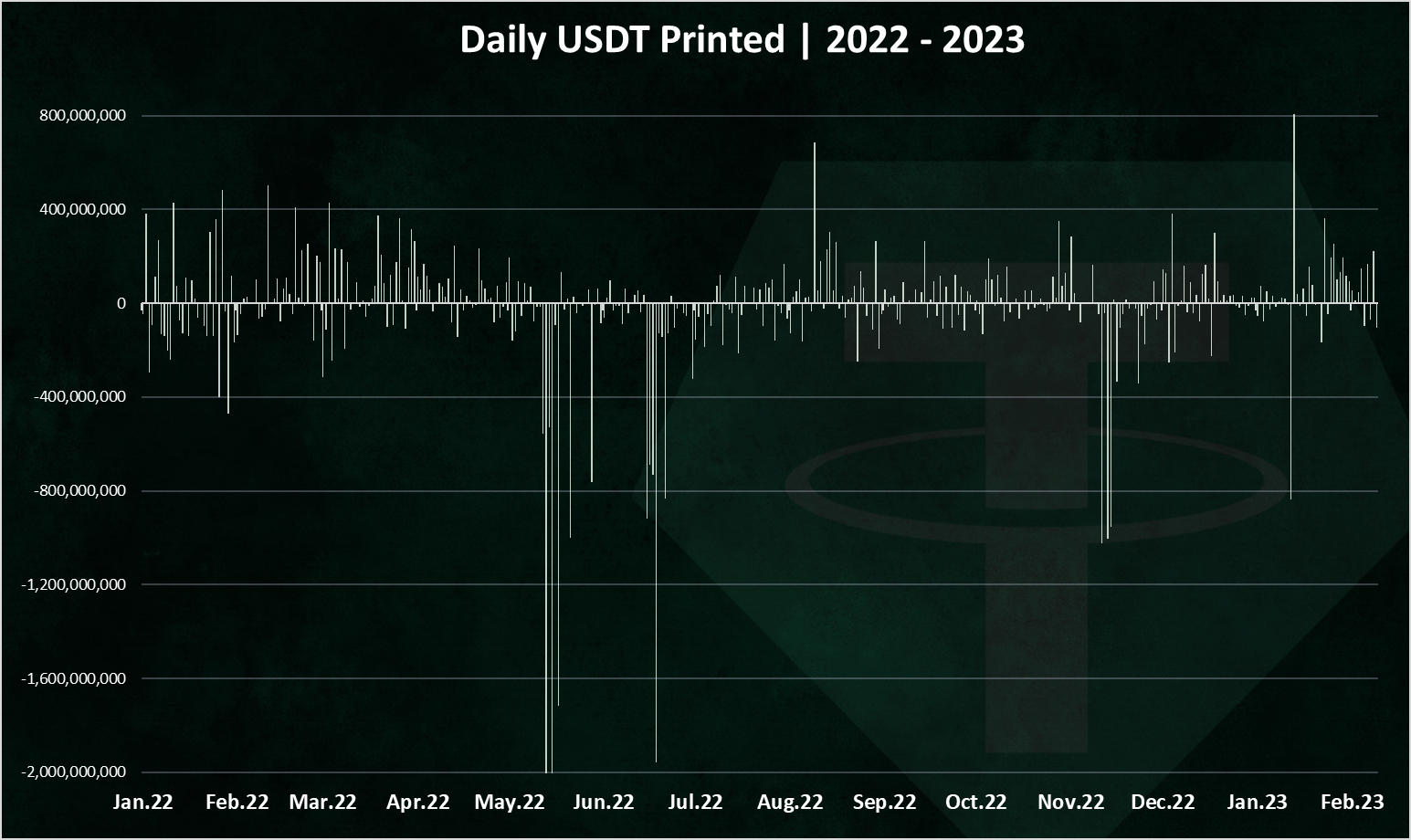

When we zoom in 2022 – 2023 we get this:

We can notice the sharp drops in May, when for a few days there was between 2 and 3 billions USDT withdrawals. Another drop happened in November when FTX happened, but not as large as the one from May. Overall the Tether supply has been going down in 2022.

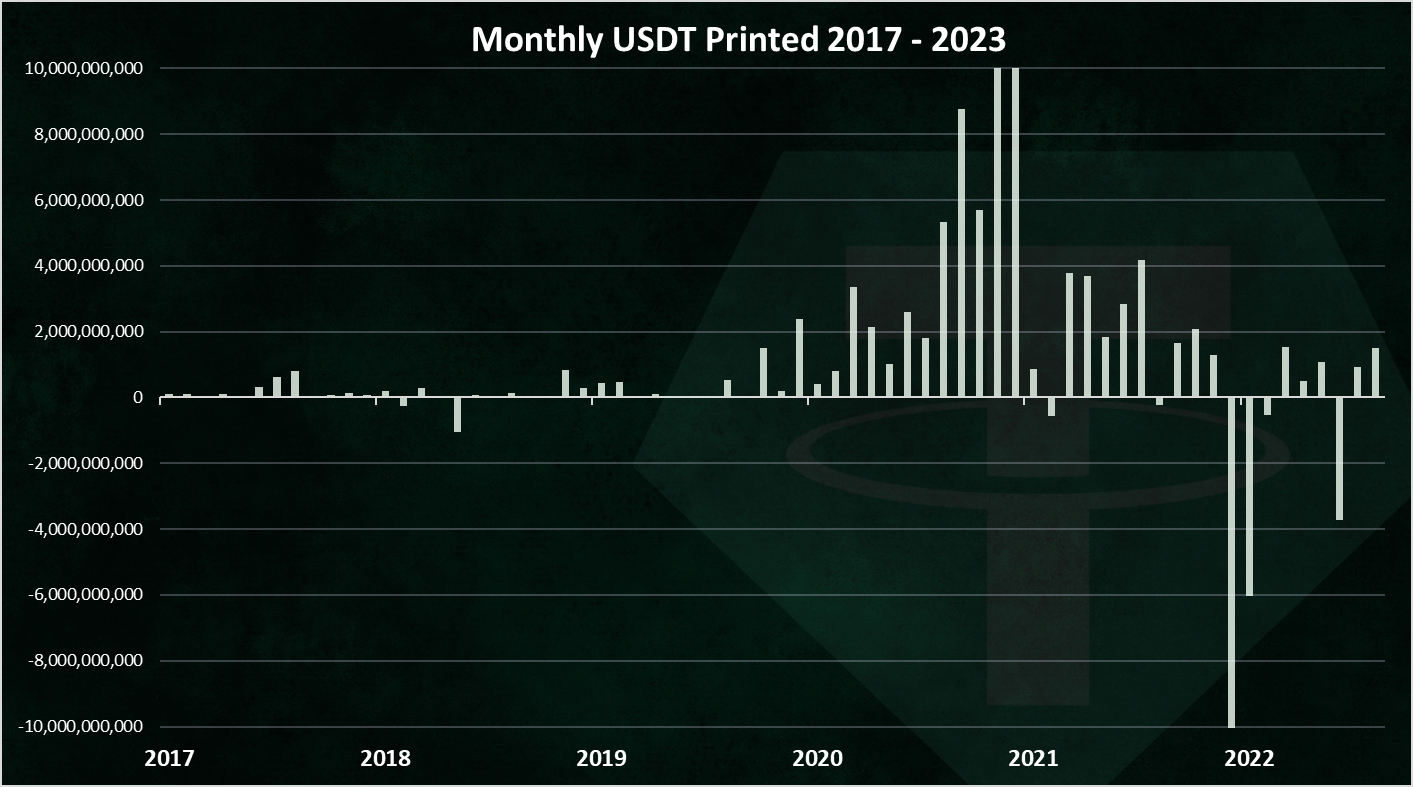

Monthly USDT Printed

Here is the monthly chart.

The record for USDT printing on a monthly level is in April and May 2021, with 10.5 billions printed in each of these two months. On the down side the record for USDT burned has been May 2022, with 10.7 billions burned in that month. A totally opposite situation in just one year.

June 2022 has a negative of 6 billions and November is around 4 billions. In the last months, December and January 2023 there is a small expansion in the Tether supply.

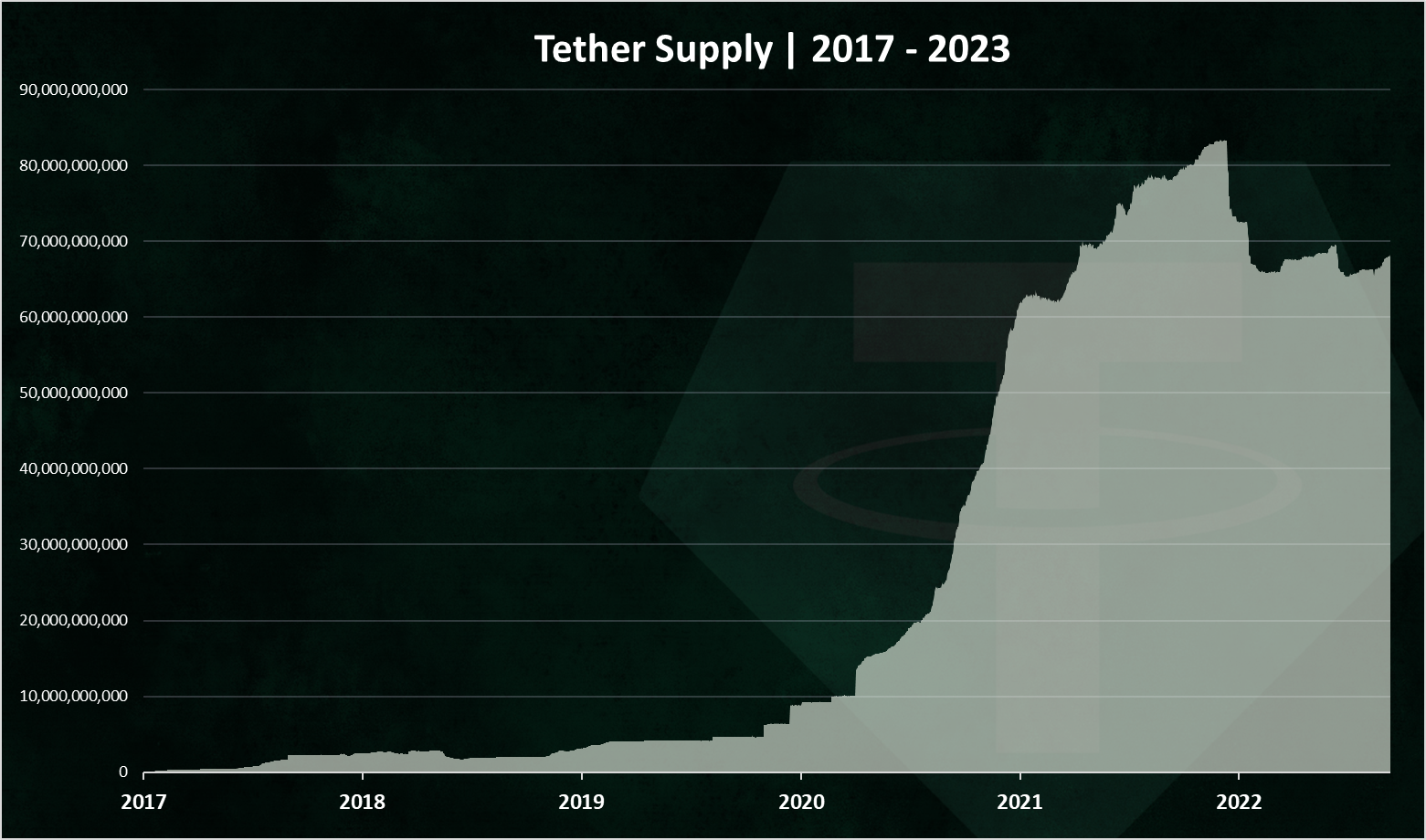

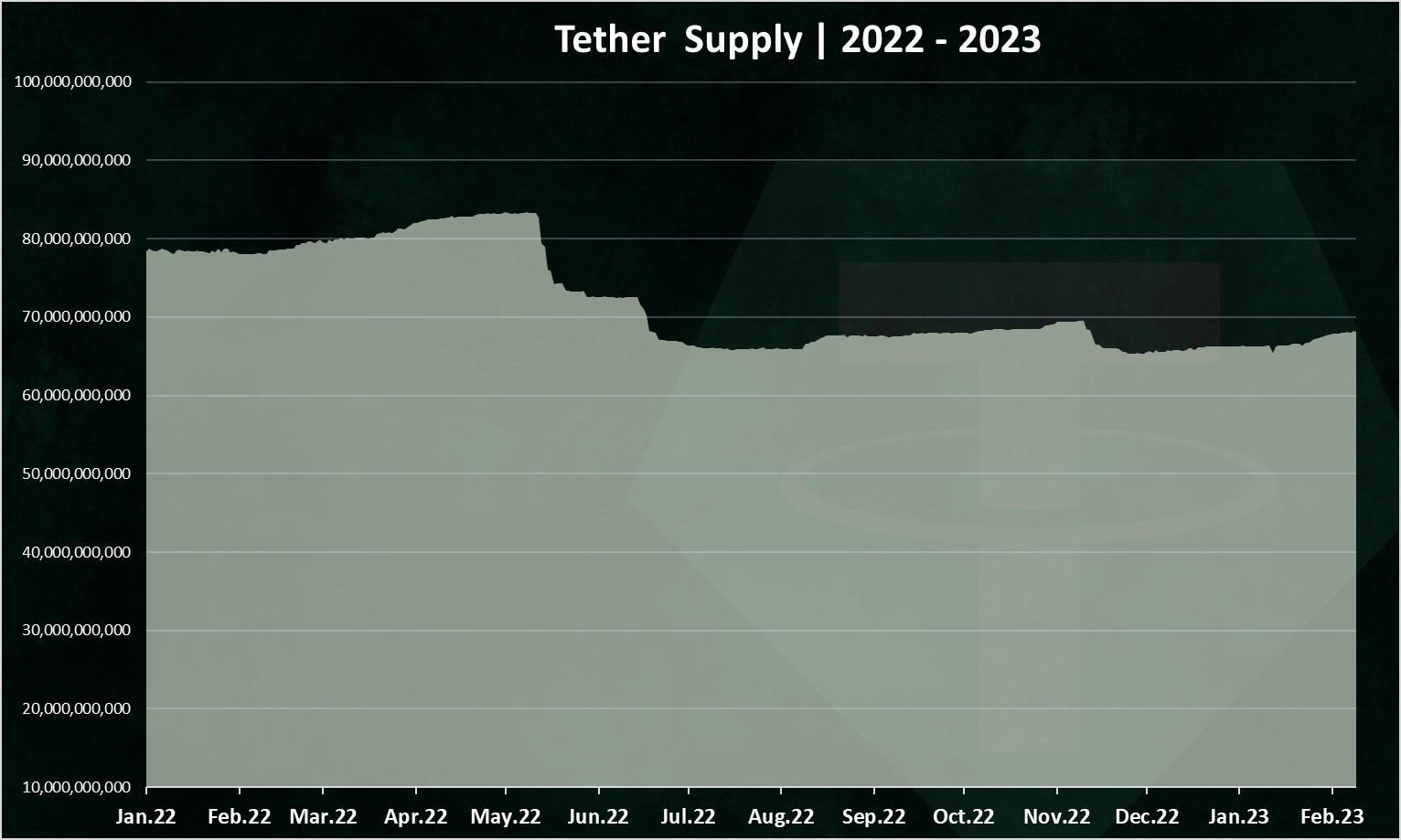

Tether Supply

The chart for the USDT supply looks like this.

Quite a big increase in 2020 – 2021 period. Then in 2022 in May a big drop and some ups and downs afterwards.

When we zoom in 2022 – 2023 we get this:

At the beginning of 2022 Tether was around 79B, and grow slowly to around 83B, that marked the peak in April. A sharp drop afterwards to 65B in June, a small increase to 70B, and again a drop in November to 65B. Now again a small increase to 68B where Tether is standing now.

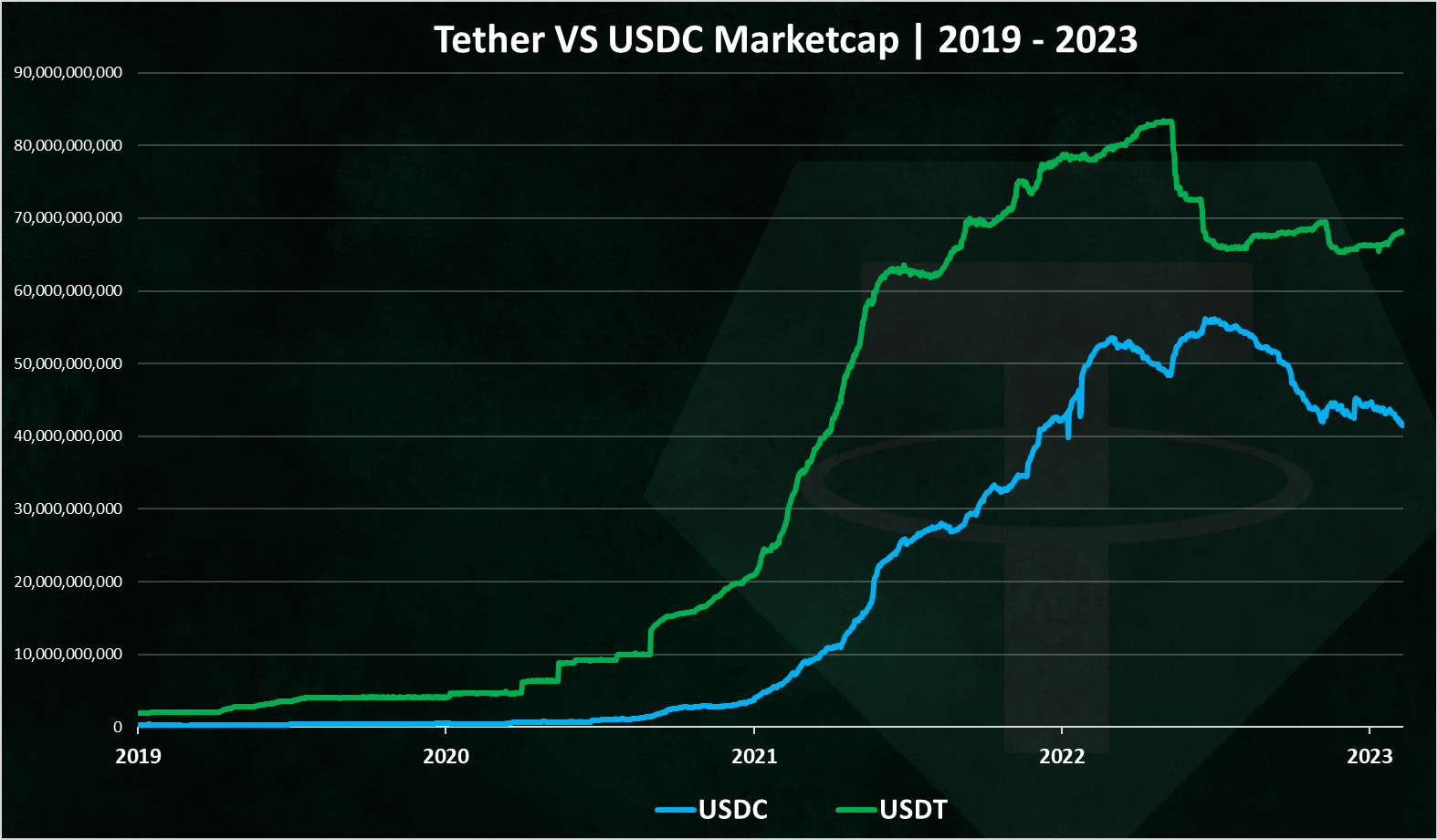

USDC VS USDT

How is Tether doing against the number one competitor USDC? USDC has came a bit later to the scene so it has some catching up to do.

Here is the chart.

Up until May 2022, both of the stablecoins have similar pattern. The UST happened and the market cap for Tether decreased while the market cap for USDC increased.

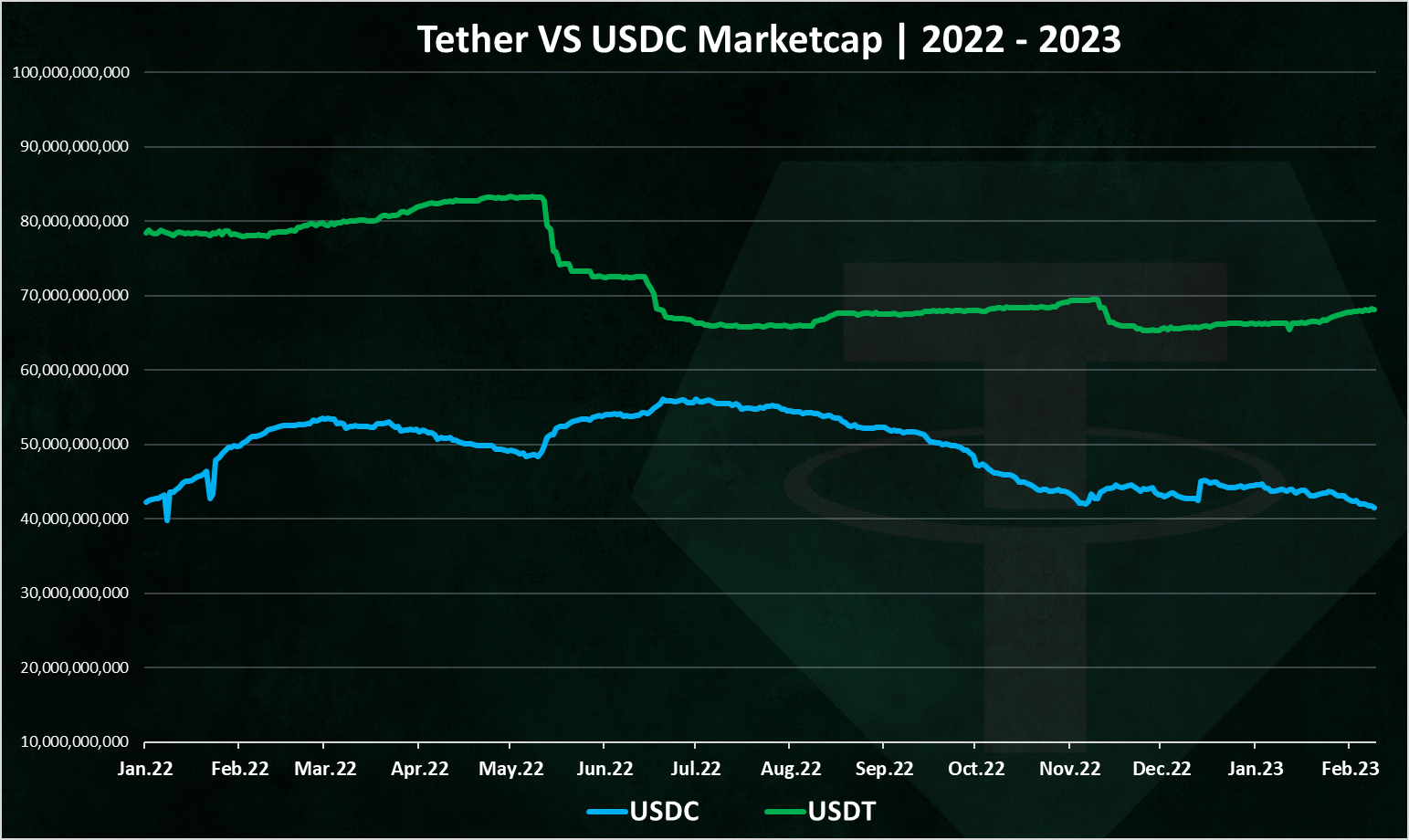

If we zoom in 2022 - 2023 we got this:

These two are moving almost in the opposite directions. We can see the downtrend for Tether in May 2022, and the increase for USDC. In July 2022, USDC was the closest to Tether with 55B to 65B. Since then, Tether has managed to increase its lead again and now we are at 68B to 41B. Interesting that the market cap for USDC has been going down in the resent months, even with the positive movements in the crypto markets.

2022 has been a challenging year for Tether, especially in May. Tether managed to provide a 15B in liquidity in a short period of time and has proven that they can act fast and pool out liquidity if needed. If for any reason they were not able to pull out the needed liquidity, the consequences for the whole industry would have been catastrophic.

Its also interesting to notice how whenever there is some type of crisis in the crypto market, the Tether market cap goes down, and the USDC goes up. Its an obvious sign that users have bigger trust in USDC. But even with this, Tether has managed to keep its number one position as a stablecoin, and has increased the lead as the market turns in the last months.

All the best

@dalz

Posted Using LeoFinance Beta

Are they doing their monthly audits yet? So much shady stuff around Tether.

Not sure about their audits.... but honestly speaking seeing them how they handled the UST collapse and providing 3B daily exit liquidity, and a total of 15B in a month.... beats every audit ...

Some time ago there was a lot of bad news about it but people still believe in it and still people who sell coins keep their money in USDT. I am also keeping all my money in this USDT right now. But with the way the news is coming out I'm also thinking of switching to another stable coin that's stronger than tether at the moment.

Tether was in news couple of times that it is about to collapse, that's when people started to believe more in USDC, but on the whole, people still believe more in Tether. I Personally believe in tether, and my tokens in to tether if needed.

I hope tether can survive on staplecoin because otherwise the crypto world will suffer its reputation damage.

Its cool to see that they maintained their dominance over the years. I think that is super impressive and it is also inspirational for new competitors to see as they try to develop better alternatives.

Very good information my friend. Theter, despite all the FUD that has been thrown at you you are still holding your own. With what happened with Luna it is very difficult to trust the emerging stablecoins.

I guess on this industry there are situations that ppl cant denied who was the first to execute the idea and still be standing, in my short time in crypto I have seen many times how ppl call Tether a scam although no heavy legal action has been taken it doesnt mean it cant be a scam none the less they were the first and that counts, but still good reason for the second place USDC to get a lot of their liquidity, thx for sharing ✌️

great info, we all know HBD is better :)

@tipu curate

Upvoted 👌 (Mana: 42/52) Liquid rewards.

Yes :)

~~~ embed:1623698340830388230 twitter metadata:NzUwNjk4MDQ2NDg5NTgzNjE2fHxodHRwczovL3R3aXR0ZXIuY29tLzc1MDY5ODA0NjQ4OTU4MzYxNi9zdGF0dXMvMTYyMzY5ODM0MDgzMDM4ODIzMHw= ~~~

The rewards earned on this comment will go directly to the people( @dalz, @alberto0607 ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

https://reddit.com/r/CryptoCurrency/comments/10yfe7l/can_tether_keeps_its_dominance_in_the_stablecoins/

The rewards earned on this comment will go directly to the people( @acidyo ) sharing the post on Reddit as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

I am not a fan of Tether. I prefer USDC and HBD. This is due to a lack of trust in Tether, as stated in your post. Tether is more active in terms of marketing. They provide more incentives to potential users, such as exchanges, blockchain ecosystems, etc. The crypto community should force them to be more conservative and transparent as they can create a systemic risk.

I believe decentralized algorithmic stablecoins such as DAI and HBD are the ideal solutions. They are compatible with the spirit of crypto.

Posted Using LeoFinance Beta

Your content has been voted as a part of Encouragement program. Keep up the good work!

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

I find your Monetary System too confusing for the average person... It should be simple and easy to understand... I prefer the thought of U.S. Electronic Coinage, backed 100% by "Corrected" U.S. Silver and Gold Coinage, that Circulates...

Only time will tell, but despite the odds, I believe that Tether has been, is, and will always be the best stablecoin on the market. Certainly, Tether has some fails, but they are still there, at the head of the sector. Can things change in the future? who knows?... The entire cryptographic sector is subject to that possibility, but for now, that's the way things are in my view. Good post. Greetings.

Posted Using LeoFinance Beta

Converting FIAT to crypto only to find it back at a Bank for providing a „stable coin“. Something tells me that non algorithmic stable coins will all have to perish again.