The Hive DEX, or the internal market as it is mostly known provides a HIVE to HBD trading pair. The tricky thing is that on the internal DEX the Hive network always assumes HBD is valued at 1$. Because of this you will see HIVE is being sold for less or more then what is it on the external markets. An adjustment of the value of the HBD is needed and then it will all works out. One more thing to the Hive quirky system 😊.

The liquidity on the internal market has always been low and not very convenient for large swaps. But in the last few months we have seen and increase of the trading activity for HBD, a lot of arbitrages happening in both directions. Lets check the overall volume.

The @hbdstabilizer has also been active on the internal DEX and has increased the overall activity. This project is trying to peg the HBD price to the dollar and it is selling or buying HBD depending on the price.

Here we will be looking at the volume on the DEX, both in terms of HIVE and HBD.

We will be looking at the following:

- Daily volume in HIVE

- Daily volume in HBD

- Top accounts providing HIVE liquidity

- Top accounts providing HBD liquidity

The period that we will be looking at is January 1st, 2021 to October 20, 2021.

Daily Volume In HIVE

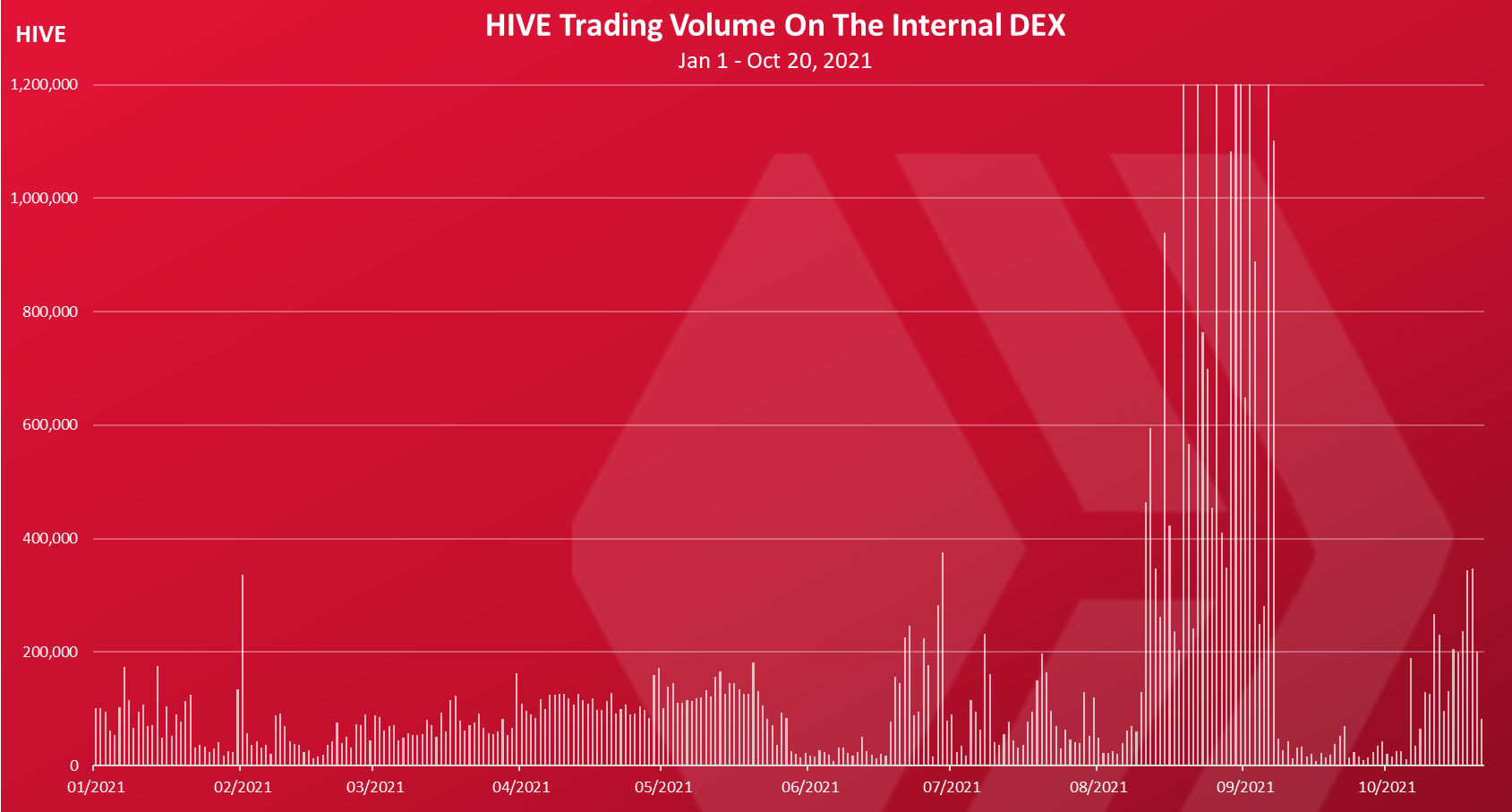

Here is the chart for the daily volume on the DEX in HIVE.

A huge spike in the volume in August and the first half of September. An increase again in the last few weeks.

The record high for a daily HIVE volume is on September 2nd, with 2.5M HIVE traded per day.

The trading volume usually increases when HBD goes of the peg and it is trading above or under a dollar. In August it was trading above one dollar and these days it is trading under a dollar.

In August there is a total of 16M HIVE traded and in September, 8M HIVE.

Daily Volume In HBD

Trading volume are usually valued in USD. Here we will be looking at the trading volume on the HIVE DEX in terms of HBD. Here is the chart.

A similar pattern as for the HIVE volume here as well. A spike at the end of August and the beginning of September.

Although in the previous period the volume for HBD is even lower then for the HIVE, this mostly because of the low HIVE price.

A 7.5M HBD traded in August 2021 and 5M HBD, in September 2021. An average of 250k HBD a day in August or 170k HBD in September. A one million HBD per day will be a decent volume.

Top Accounts Providing HIVE Liquidity

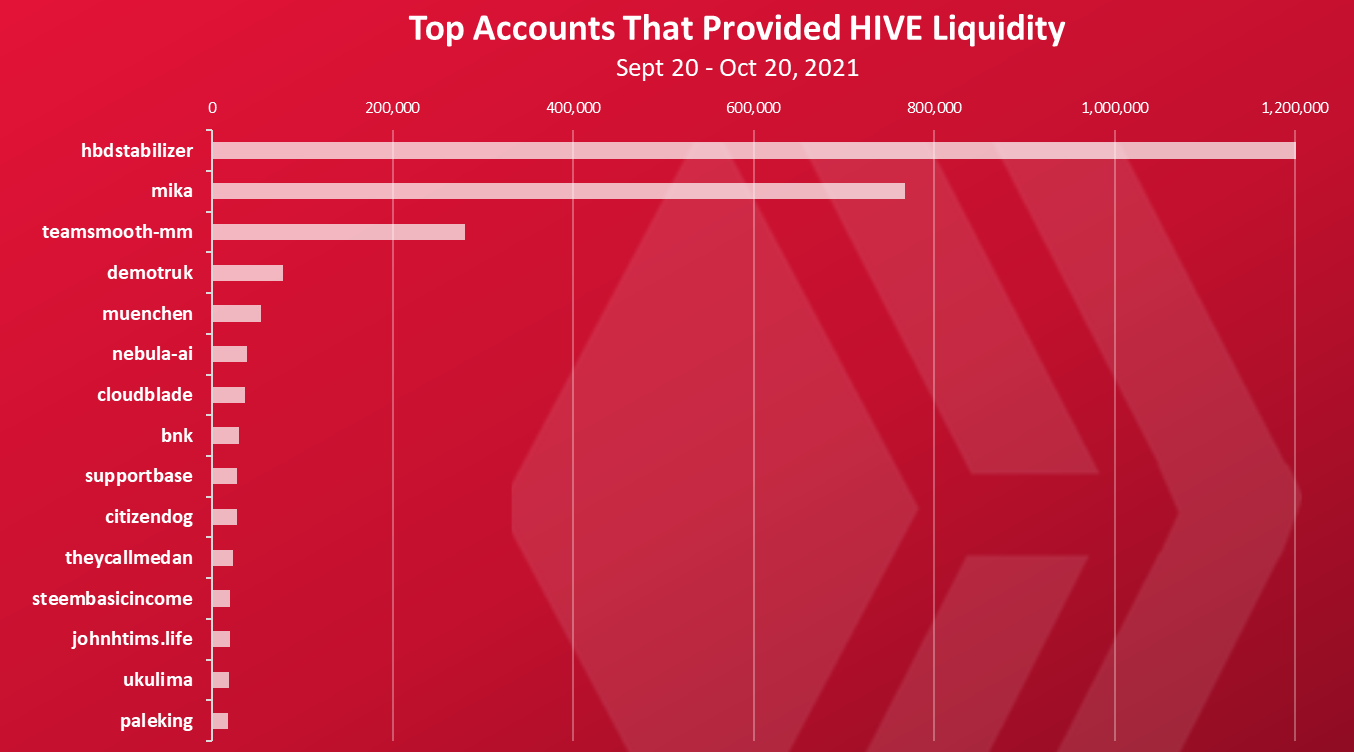

How are the accounts that trade the most? Here is the chart for the accounts that provided the most liquidity for HIVE in the last 30 days, or in short selling HIVE on the internal market.

The @hbdstabilizer is on the top here with 1.5M HIVE sold in the last 30 days. @mika is second with 770k. The stabilizer and the rest of the big accounts are mostly selling HIVE in the last month (buying HBD) because of the low price of HBD.

Top Accounts Providing HBD Liquidity

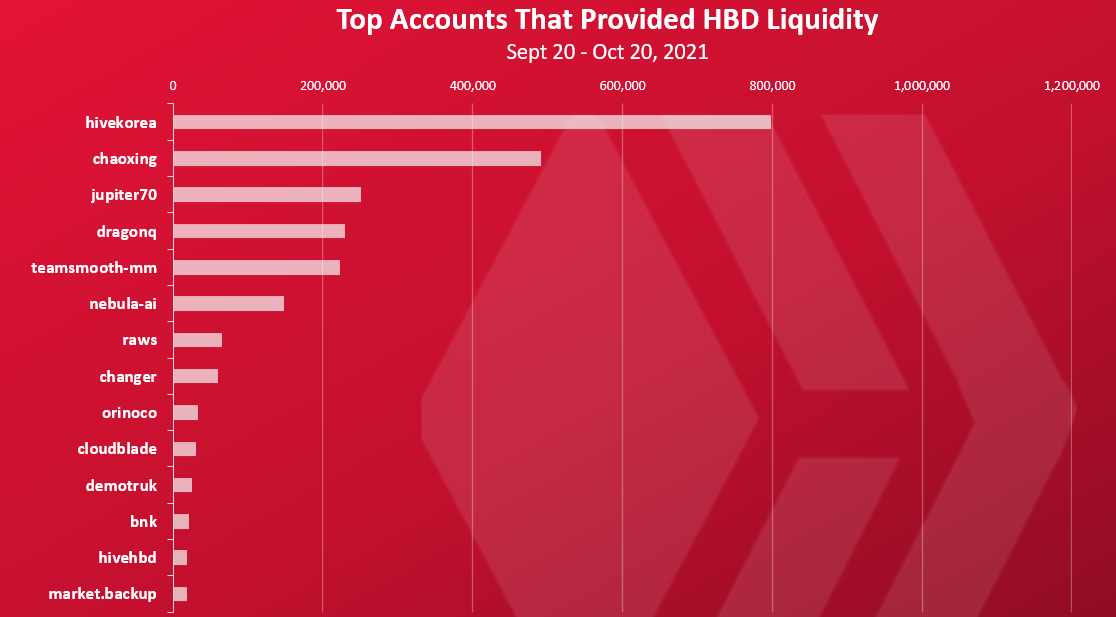

The chart for the HBD liquidity providers looks like this.

05.png

The @hivekorea is on the top here, that is basically selling HBD on the internal market. This account is probably arbitraging between the Korean exchange Upbit, where the price of HBD is lower than the internal market. @chaoxin, @jupiter70 in the top as well, doing the arbitrage as well.

Overall, 2021 has a more dynamic internal market, mostly incentivized by the @hbdstabilizer, but also from the option to convert HIVE to HBD with the latest hardfork. With this everyone can create HBD from HIVE, and the opposite option that was available before.

All the best

@dalz

Posted Using LeoFinance Beta

HBD is the most underrated, underutilised aspects of Hive.

With the blockchain now offering the ability for anyone to profitably create HBD from HIVE when price moves too far up, this should provide enough of a cap to let the arb bots do all the really heavy lifting.

And absolutely cash in for doing so!

It's these arbitrage bots that are key to stabilising HBD and surely one of the biggest untapped opportunities in all of crypto right now.

Will be interesting to watch how this senario continues to play out.

Posted Using LeoFinance Beta

Yea interesting times .... we already see some improvements, probably will take a bit more time to create higher liquidity, and more use cases

August : 16M HIVE

September: 8M HIVE

It's a healthy trading volume on the HIVE DEX in terms of HBD for sure.

Posted Using LeoFinance Beta

Not bad at all ... can be better, geting there

These are some really cool numbers. It never really occurred to me to convert my Hive to HBD when it hit a dollar. I'm adding that to my "must-try" list.

Posted Using LeoFinance Beta

I know where to find Hive Engine, LeoDex, and Tribaldex. I wasn't able to locate Hive Dex at <hiveprojects.io>. What's the URL for Hive Dex?

Posted Using LeoFinance Beta

https://wallet.hive.blog/market

Thanks for the link to the Hive Internal Market. I don't see where I can view any of the charts you included in your post (especially Top Accounts Providing HBD Liquidity, given the recent pumps-and-dumps coming from South Korea). Is there a URL anyone can visit to get those charts, or is that data only accessible to select people?

Posted Using LeoFinance Beta

There is no such charts for anyone .... I'm creating those manually using the hive sql database

Ah, OK. I was asking because I was looking for a place which offered similar data for Layer 2 tokens as well. No worries, thanks for letting me know.

Posted Using LeoFinance Beta

Nice article

Innit

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

I like getting this update because it motivate me to put More effort on my post.

Posted Using LeoFinance Beta

Thanks

U welcome :)