The supply of a token on exchanges is a parameter that is usually closely monitored. The top coins, Bitcoin, Ethereum are especially closely monitored when it comes to the supply on exchanges. What about HIVE?

What is the share of the HIVE supply held on exchanges? What is the trend is it going up or down? How has deposited/withdraw the most in 2023? Let’s take a look!

Here we will be looking at the following:

- Daily and monthly deposits to exchanges

- Daily and monthly withdrawals from exchanges

- Top accounts that deposited to exchanges

- Top accounts that withdraw from exchanges

- Net deposits VS withdrawals

- HIVE balance on exchanges

Exchanges taken in the analysis: Upbit, Binance, Bithumb, Bittrex, Hive Engine, Huobi, Gate.io, Probit, Ionomy, MXC, and Indodax. There are few more exchanges but the volume there is quite low.

The period that we will be looking at is 2022 – 2023.

Deposits To Exchanges

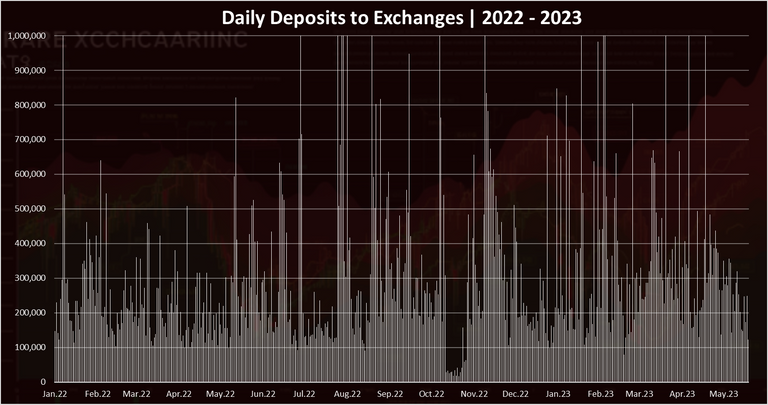

Here is the chart for the daily transfers/deposits to exchanges.

Note: Transfers between exchanges accounts are excluded from the data above.

We can notice some spikes in the data above, and the low volume in October. This was around the Hardfork when deposits and withdrawals to the major exchanges were suspended.

The overall trend seems quite steady with maybe an increase in 2023. On average there is 370k HIVE deposited daily.

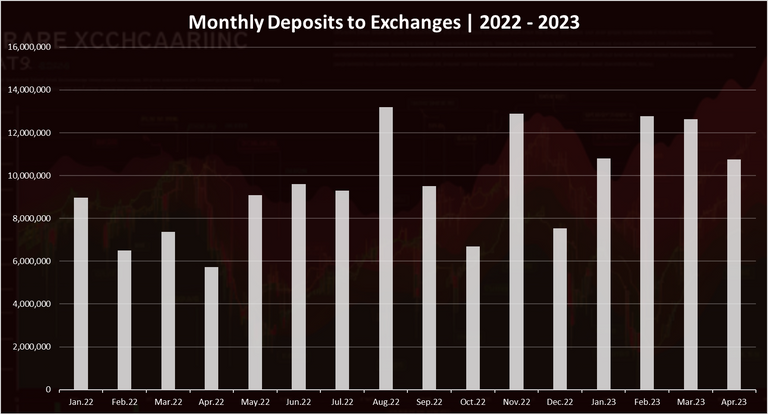

The monthly chart for the deposits looks like this.

This is a clearer representation.

October 2022 was the lowest recently and February 2023 had the highest with 13M HIVE deposits.

Note that these are not NET deposits. To get this we need withdrawals and we will look at those bellow.

Withdrawals From Exchanges

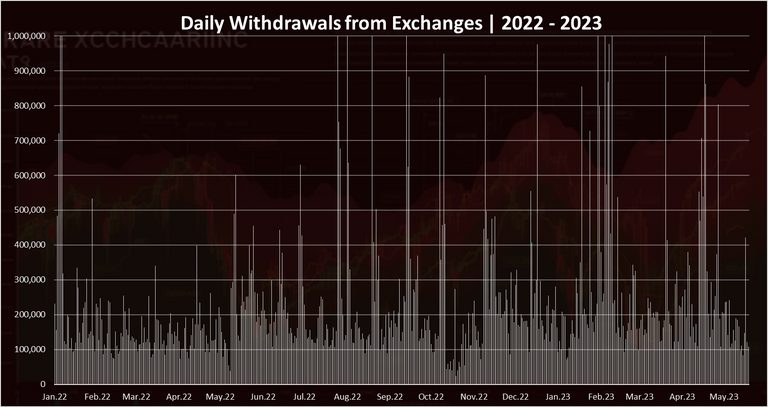

The chart for the daily withdrawals looks like this.

As for the above, here as well the transfers between exchanges accounts are excluded.

Ona average there has been 332k HIVE withdrawn from exchanges on a daily basis, in 2022.

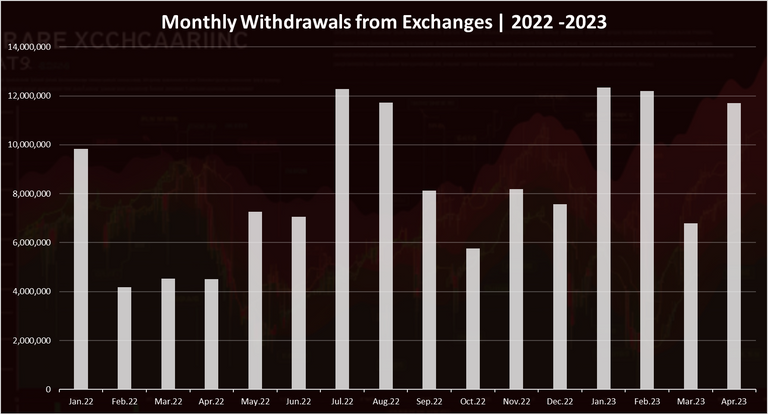

The chart for the monthly withdrawals looks like this.

An oscillation between 4M up to 12M per month.

Again, October 2022 was one of the lowest in withdrawals, but also March 2023. In the other months January, February and April 2023 there is 12M HIVE per month withdrawn from exchanges.

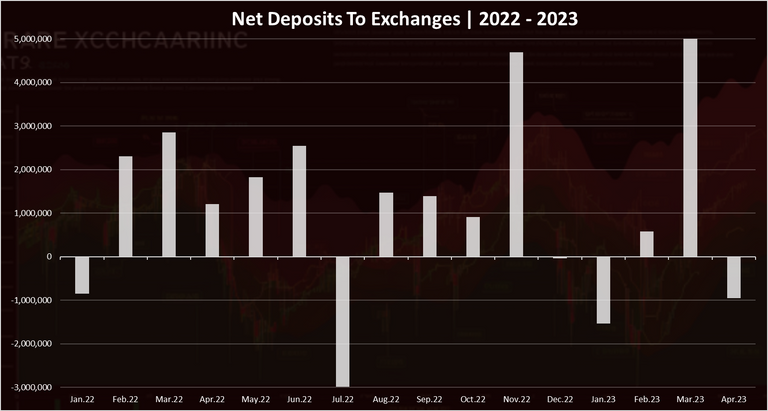

Monthly Net Deposits VS Withdrawals in 2022 - 2023

When we add the deposits and withdrawals on a monthly basis the chart looks like this.

We can notice in the recent months that there is more months where the withdrawals of HIVE from exchanges, but with one big spike in March 2023, where there is a net 5M more deposited on exchanges. Aprils is around 1M HIVE net withdrawn form exchanges.

In summary a total of 4M net HIVE was transferred to exchanges in 2023. While positive it still not as big number. For comparison 2022 had more HIVE deposited to exchanges, a total 15M, while 2021 had more HIVE withdrawn from exchanges, a total of 2.5M.

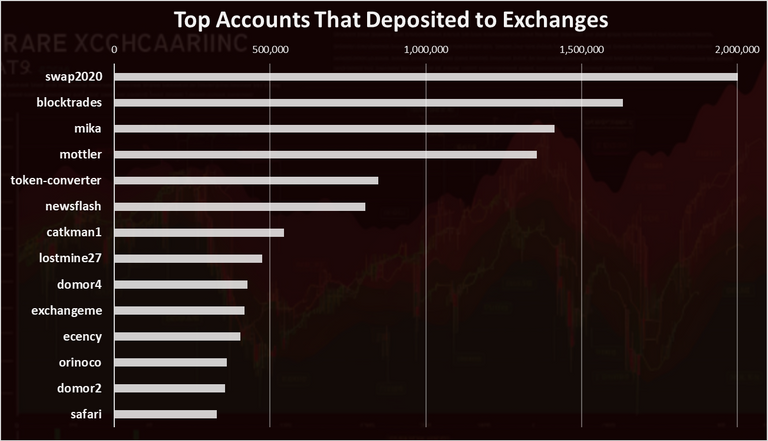

Top Accounts That Deposited To Exchanges in 2023

Who has transferred the most funds to exchanges? Here is the chart for the year.

The @swap2020 account is on the top with more than 2M HIVE deposited, followed by @blocktrades, @mika and @mottler.

Note that this is a net HIVE deposited to exchanges, with both deposits and withdrawals taken into account.

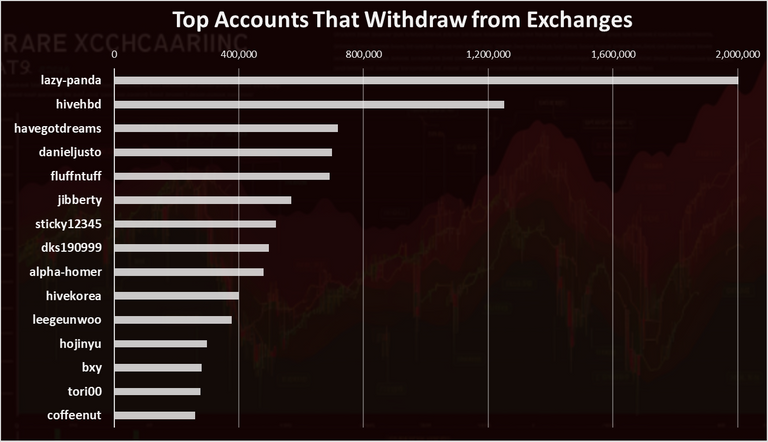

Top Accounts That Withdrawn From Exchanges in 2023

Who has withdrawn the most funds from exchanges? Here is the chart for the year.

The @lazy-panda is on the top here with 2M HIVE withdrawn from exchanges, followed by @hivehbd and @havgotdreams.

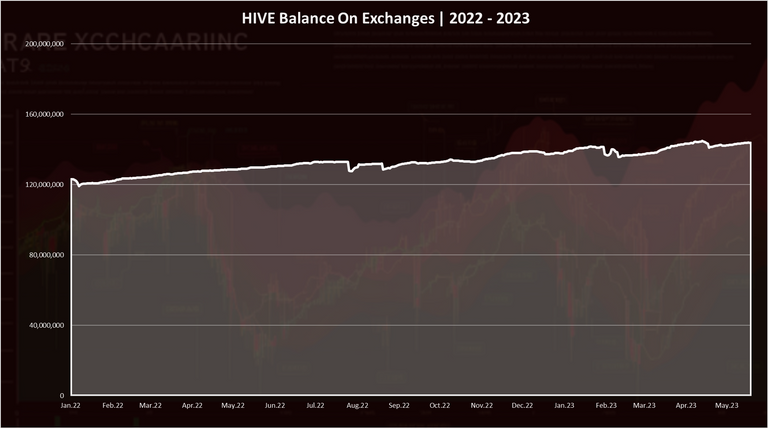

HIVE Balance On Exchanges

What is the amount of HIVE on exchanges?

Here is the chart.

As we can see the overall HIVE balance on exchanges has been growing throughout 2022 and 2023, with some dips along the way. Recenlty there were small dips in April and one more in February 2023.

The year started with 139M HIVE on exchanges and now we are at 144M HIVE on exchanges.

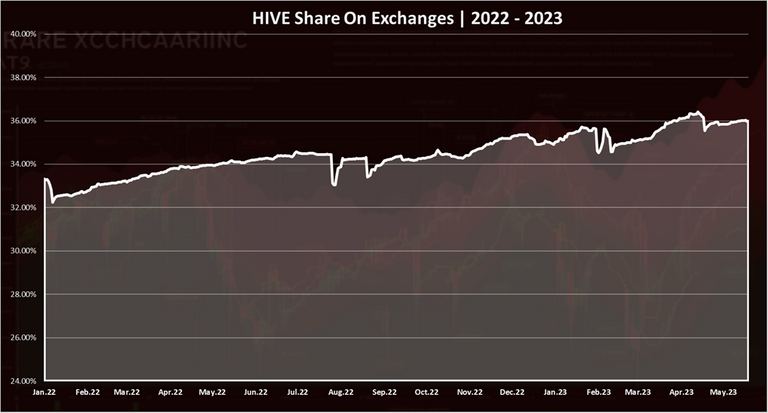

When we plot the balance on the exchanges against the total HIVE supply, we get this.

HIVE share on exchanges.

From the chart above we can say that the HIVE balance on exchanges has been growing both in absolute and in relative terms.

There was some oscillation in 2023, a drop back in February, a steady increase in March, a drop again in April and somewhat a steady share in May 2023.

At the begging of 2023 there was 35% of the HIVE supply on exchanges and now there is a 36% or a 1% increase. In 2022 there was an increase from 33% to 35%.

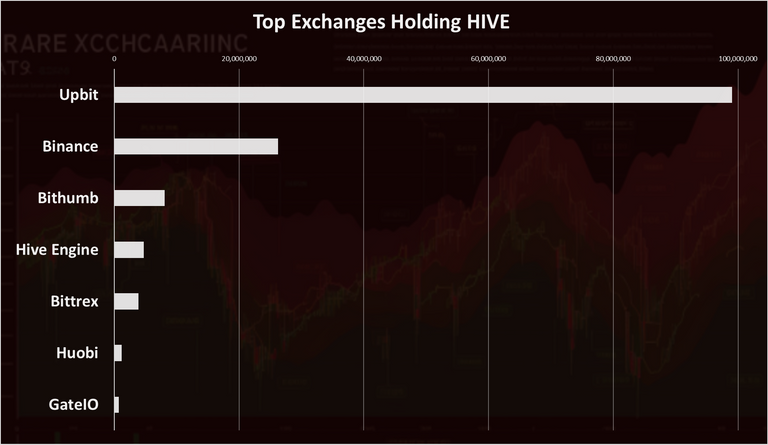

The top exchanges that hold HIVE are the following:

Upbit is abslutly dominant with almost 100M HIVE. On the second spot is Binance with 26M, followed by Bithumb.

More HIVE has continued to flow on exchanges in 2023 athough maybe at slower pace. Upbit solidifying its number one position with now close to 100M HIVE or around 25% of the supply.

In percent share the growth is 1%, from 35% to 36% of the total HIVE held on exchanges. Even if we go two years back this number was around 33%.

Getting HIVE on more DEXs will be a significant improvement and I hope that this will happen in the future as more second layer solutions are built on HIVE, but also expanding HIVE to other smart contract platforms and apps like Uniswap.

All the best

@dalz

Does anyone else feel that the upbit vacuum is absurd?

I can't rationalise why air-dropping a community that completely abstains from actually using hive, not to mention actively voted during the witnesses wars to arguably hurt the good cause, deserves such a massive hold on the liquid supply of coins.

To get an idea of just how much Upbit controls..

Liquid supply ~ 232 Million

Supply on upbit ~ nearly 100 Million

It's even worse because Upbit can't even be used by non-korean entities.. which is probably 99% of the actual Hive users.

Those who have access to Upbit, also have access to other markets, but not the other way round. And because of the dominating float of hive on that exchange, they frequently try to corner the market resulting in very distasteful price action which absolutely does not reflect the health of the underlying holder base.

Yea I have been saying that Upbit is a systemic risk to Hive now. But the tokens went there purely because higher prices and market forces... when the HF happened back in March 2020, Upbit was on the third spot with around 20M HIVE. First was Binance, then Huobi. But in the last three years Upbit constantly increased their supply, while others have went down. Huobi especialy ... it was even a no.1 exchage for a while, with 40M HIVE, and now its close to zero. Bittrex is down as well. So we lost two major pools and added zero, leaving Upbit to dominate. DEXs now seem the logical next step, with Uniswap on the top, even if we need to pay LP incentives from the dao.

P.S. I forgot Hive Engine, as a new home made pool and has around 5M HIVE now...with all its limits it is wildly used from the userbase

So more deposits than withdrawals. Although the margin is narrow. Flow into exchanges is seen as a sell signal for major coins in general.

As seen from above, most of Hive is on Upbit and it depends from the actions there

Yes, you are right.

Would be great to see HIVE and HBD available on more exchanges and with deeper liquidity. If HBD would be added to Binance, that would make a killing for this entire blockchain.

I wonder if something can be done about that. What does it take to "Apply" (so to speak) to get HBD listed on Binance or any other centralized exchange for that matter?

As always Nice report! Thanks for the insights.

The ratio is quite same, not much difference between deposit and withdrawal happening daily...

Tho, is it possible you add which exchange had most volume of hive deposit/withdrawn.?

Do you think it's worth trying to get HIVE on more exchanges to counter the amount on HIVE on UpBit and increase visibility of HIVE?

Or maybe just try to get it back on Huobi and/or Bittrex.

I feel like a lot of folks use centralized exchanges because of ease of use and perhaps lack of technical knowledge.

Maybe this plus developing more decentralized methods of exchanging HIVE.

At this point I think DEXs, like Uniswap, and some kind of bridge with Bitcoin are the way to go.

Uniswap is now the second exchange by trading volume in the world, just after Binance. We just need to setup the tech to create decentralized wrapped hive token on Ethereum, and if needed even provide liquidity providers incetives trought the DHF.

We already have BHIVE on BNB Chain and PHIVE on Polygon. Unfortunately, there's no liquidity yet.

Yes, but those are done by the LEO team in centralized manner. We need a multisig like custodians elected from the community who will operate the bridge in order to have something like a support from the DHF for LP incetives.

Nice one Dalz! Appreciate the overview.

Nice stats!

Thanks for sharing

It is important to have the token spread on the most possible trading exchanges around. Liquidity is an important health factor for a token.

i think that 2m withdrawal of lazy panda was when he was buying a lot of HBD for his savings, it is insane amount!

We need them to be distributed among more exchanges and especially DEX exchanges.

Upbit exchange really has a lot of Hive on it when compared to other exchanges. I hope the balance gets tipped in the future. It will be great when exchanges start listing HBD too. Thanks for the comprehensive stats :)

I like!

Dzieki

Thanks for the insights!

!PIZZA

$PIZZA slices delivered:

@kuhnchun(1/5) tipped @dalz

Congratulations @dalz! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 11500 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

Can't help but see that 2M deposit by swap20202 and 2M withdrawal by lazy-panda and think, "Change of hands"?

Even now if we look at the situation, there are more buyers in the market and few sellers. When the market goes down, the situation changes a little and people start selling it. And as we remember the earlier SBD was also stand a dollar and after some time when people started buying it and steem convert into SBD, we saw that the price went up a lot even then. And when it comes to the exchanges, something similar is going to happen.

#hive #posh

Some of the names I expected to see. I would like to see HBD gain some additional exchange support. There's not much of a backup, which given certain conditions could become a problem.

It's always nice to know about this occuring in the blockchain and thanks for sharing.