USDC had it real market test recently when after some rumors and fud it lost the peg over a weekend. At the lowest point it was worth 0.87 that is a significant drop for a stabelcoin of its size that claims to be a one to one pegged.

Before this event, USDC was considered by most the safest stabelcoin to park your dollars. Its major competitor Tether USDT has constant rumors and speculators is it fully backed etc. The other emerging rival in 2022, BUSD was given an order to wind down its operations. USDC seems to be the only stabelcoin with a clean resume. DAI, the number one stabelcoin is mostly using USDC as the underlying collateral. But then USDC depeged and its stelar resume is no longer. It’s now part of the group that all have a depeging event at some point in their history.

Let’s take a look at the growth of USDC through some data.

USDC is issued by Circle. It is a US based company that is regulated and has regular audits on its holdings.

The events that lead to its depeg had a connection with the US banking sector. Circle had a small share of their deposits in USD in the Silicon Valley Bank that went bankrupt. The market reacted to this thinking that USDC will loose part of it reserves and its peg. On top of this, these events took place over the weekend when the banks were closed and transfer can not be made for Circle.

Lets take a look how this has affected USDC.

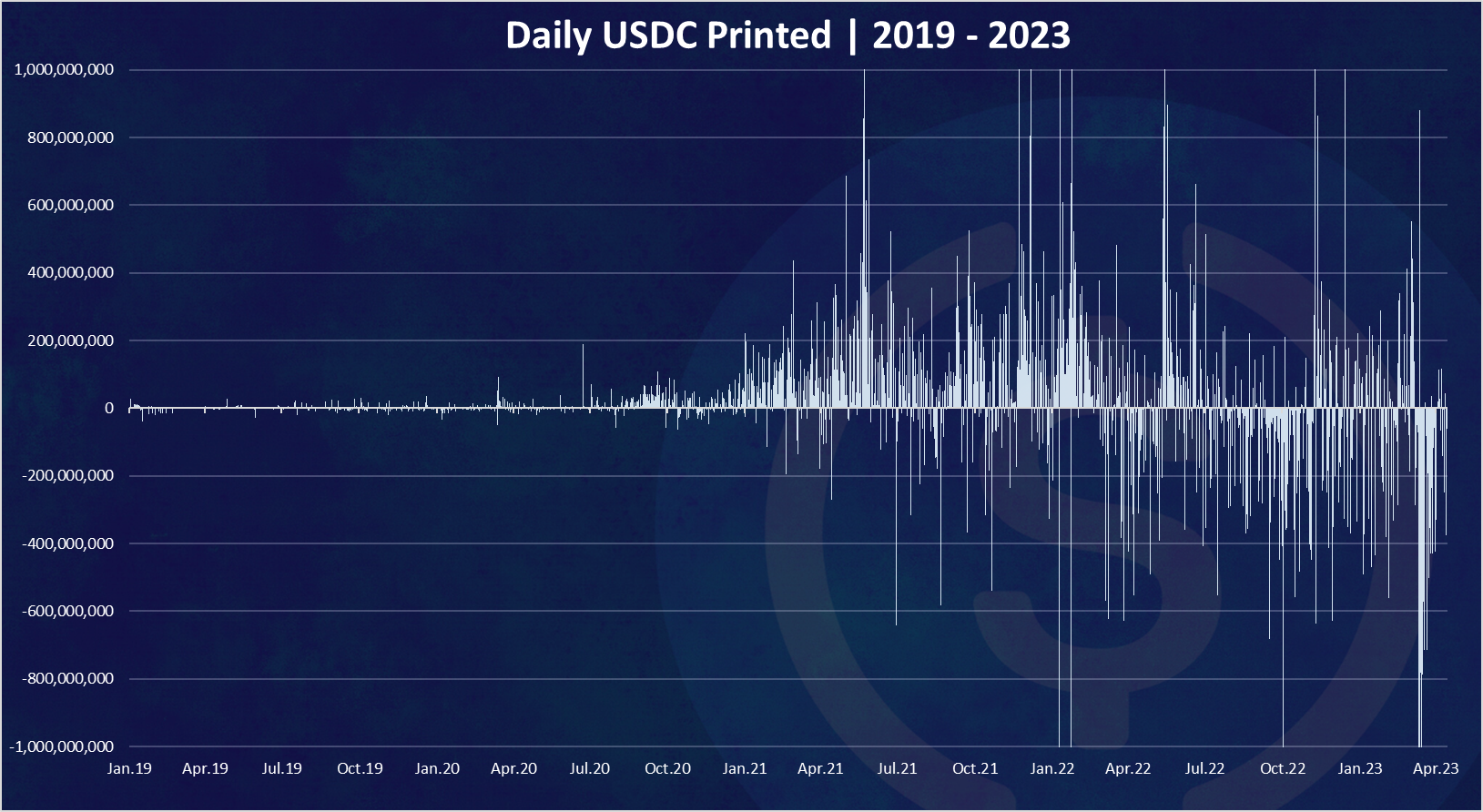

Daily USDC Printed

USDC started at the end of 2018, but here we have a data from 2019, for simplicity.

Here is the chart for the USDC printed per day.

As we can see in the first years there was not a lot of printing for USDC. The larger amounts started to come in 2020 and increased significantly in 2021.

On times there is more then one billion USDC issued per day.

We can notice the burned USDC towards the end of the chart, when users were exiting USDC and there were billions withdrawn from USDC for a few days.

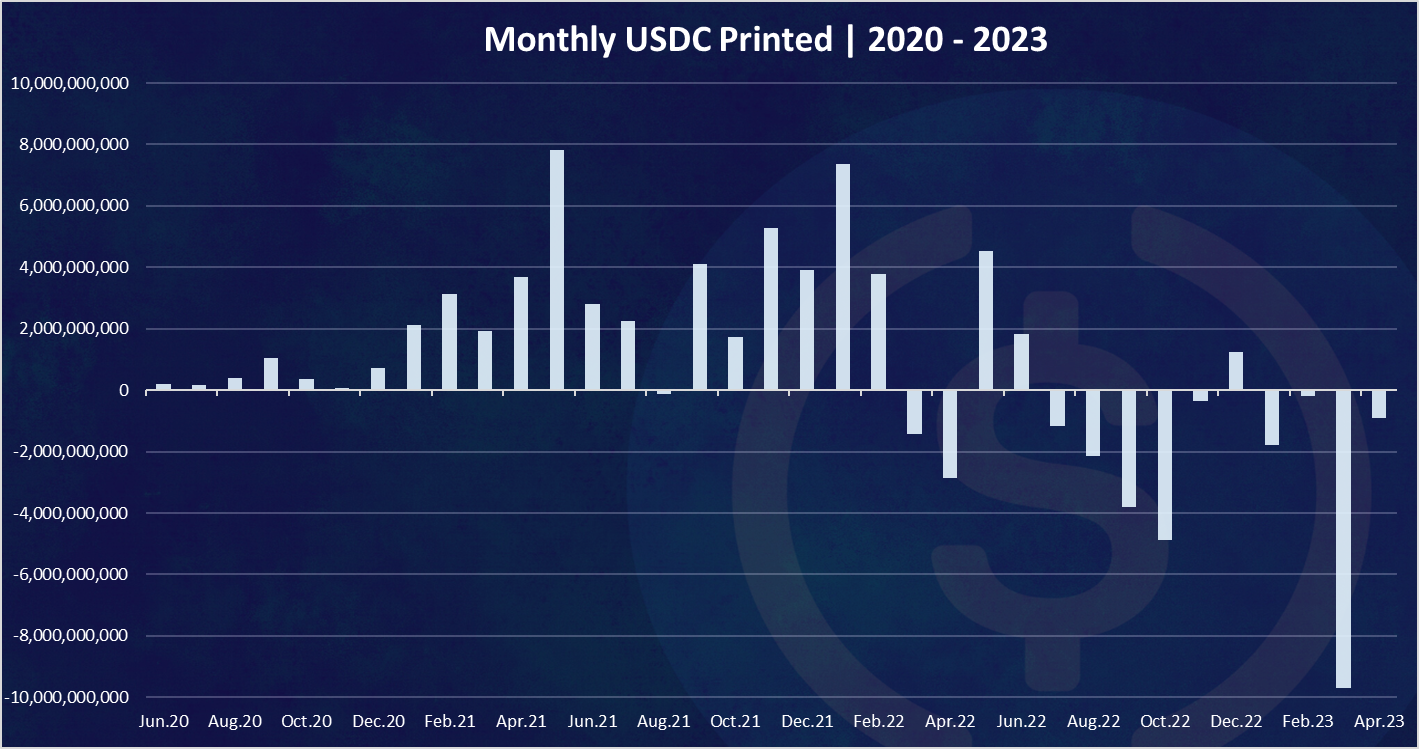

Monthly USDC Printed

Here is the monthly chart for better visibility.

Almost 10B exited from USDC in March 2023.

While this looks like a lot, when the Tether fud happened back in June 2022, there was more than 20B withdrawn from USDT in a period of a month.

We can see how harsh the market can be on these assets. Instant liquidity is needed for them to operate stable at all times. Long term lock ups are not an option here.

On the positive side, the record month for printing USDC was back in May 2021 when almost 8B were issued in a month.

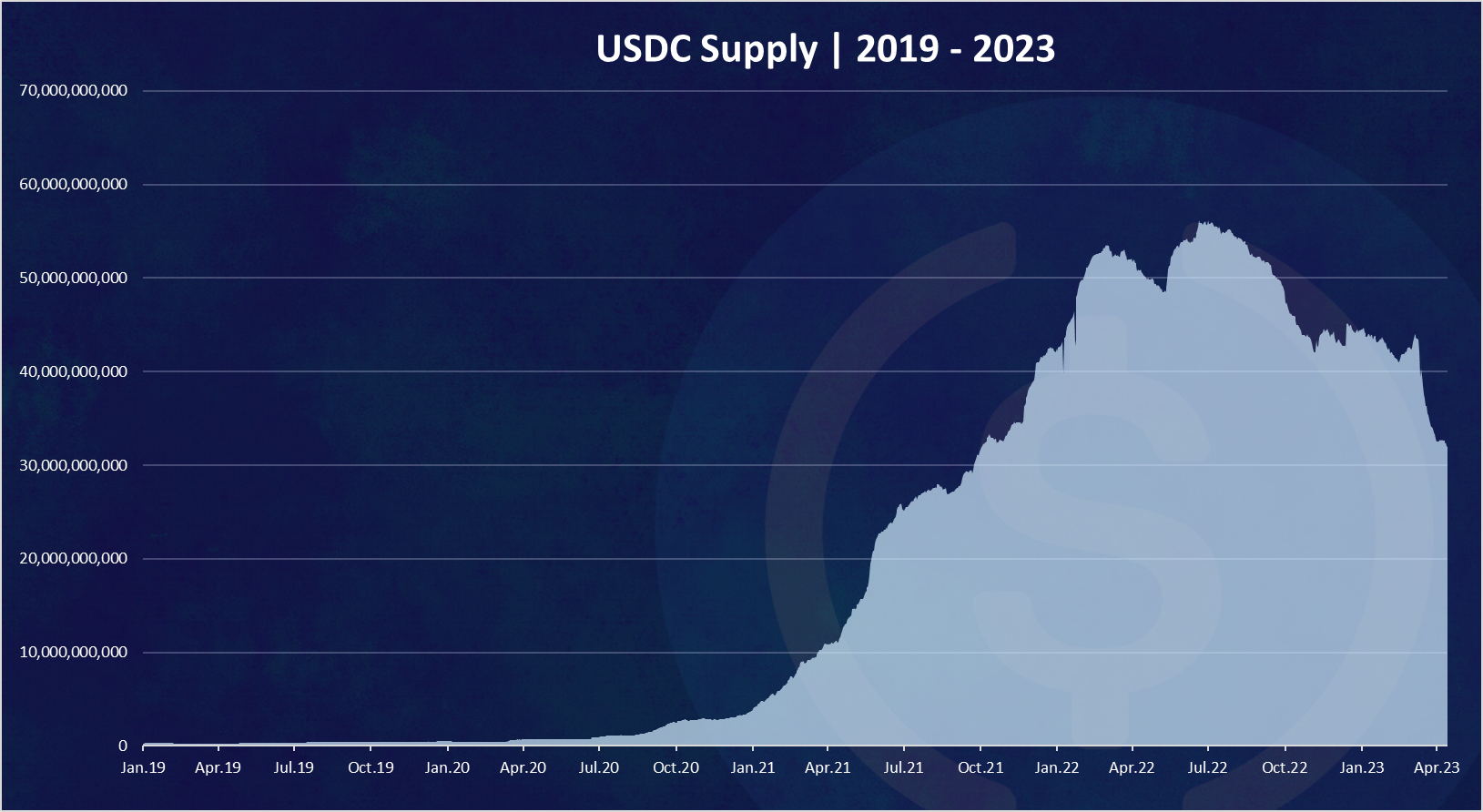

USDC Supply

The chart for the UST supply looks like this.

We can see that prior to 2020, the market cap of USDC was negligible, with under 1B in supply. Then a huge increase in 2021 when there almost 40B USDC added to the supply.

The peak for the USDC market cap was in June 2022, with around 55B in market cap. At this time Tether was experiencing FUD, and a lot of the stablecoins were transferred to USDC. We can notice the sharp drop at the end of the chart.

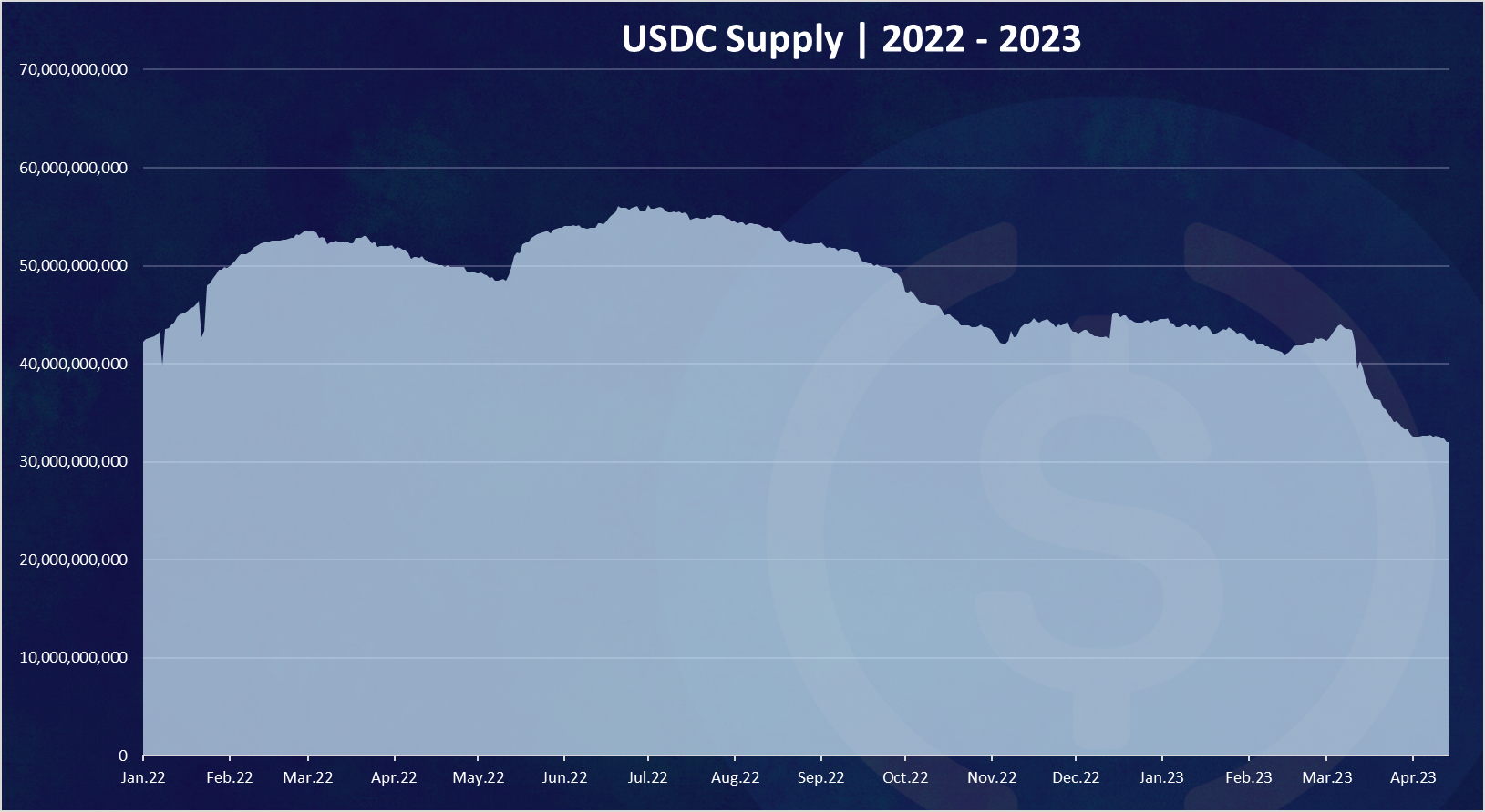

If we zoom in we have this.

A drop in March 2023 from 42B to 32B where USDC stands now. Far from the ATH of 55B.

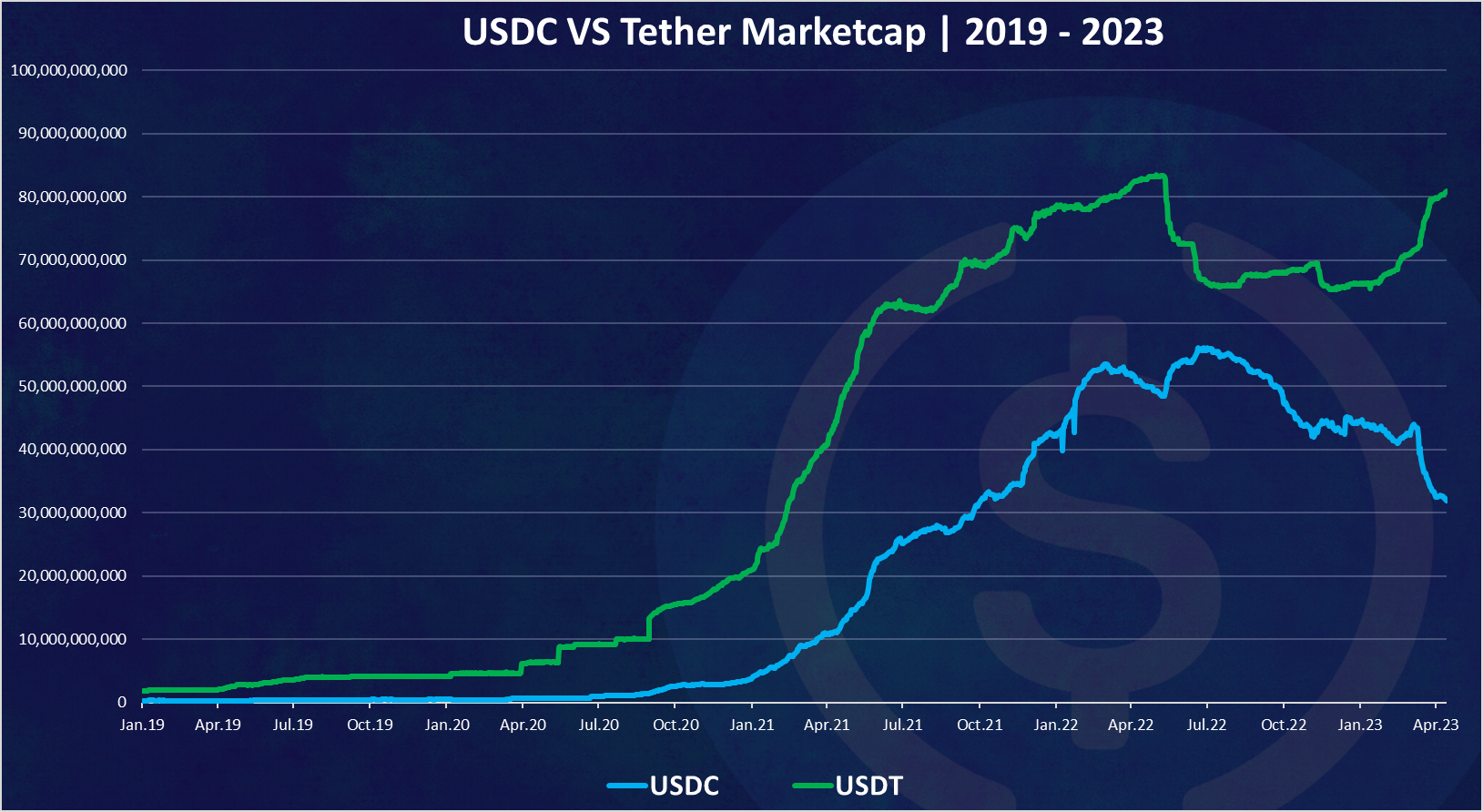

USDC VS USDT

How is USDC doing against the number one stablecoin Tether? Tether was funded three years before USDC, so it has some head start. Is USDC managing to catch up?

Here is the chart.

A similar trend for growth up until last year.

We can see that in the last period these two acts in the opposite direction. When the one is going down, the other is climbing and the opposite.

Obviously the overall growth in the industry has stopped in the last year and the same assets are being swapped around.

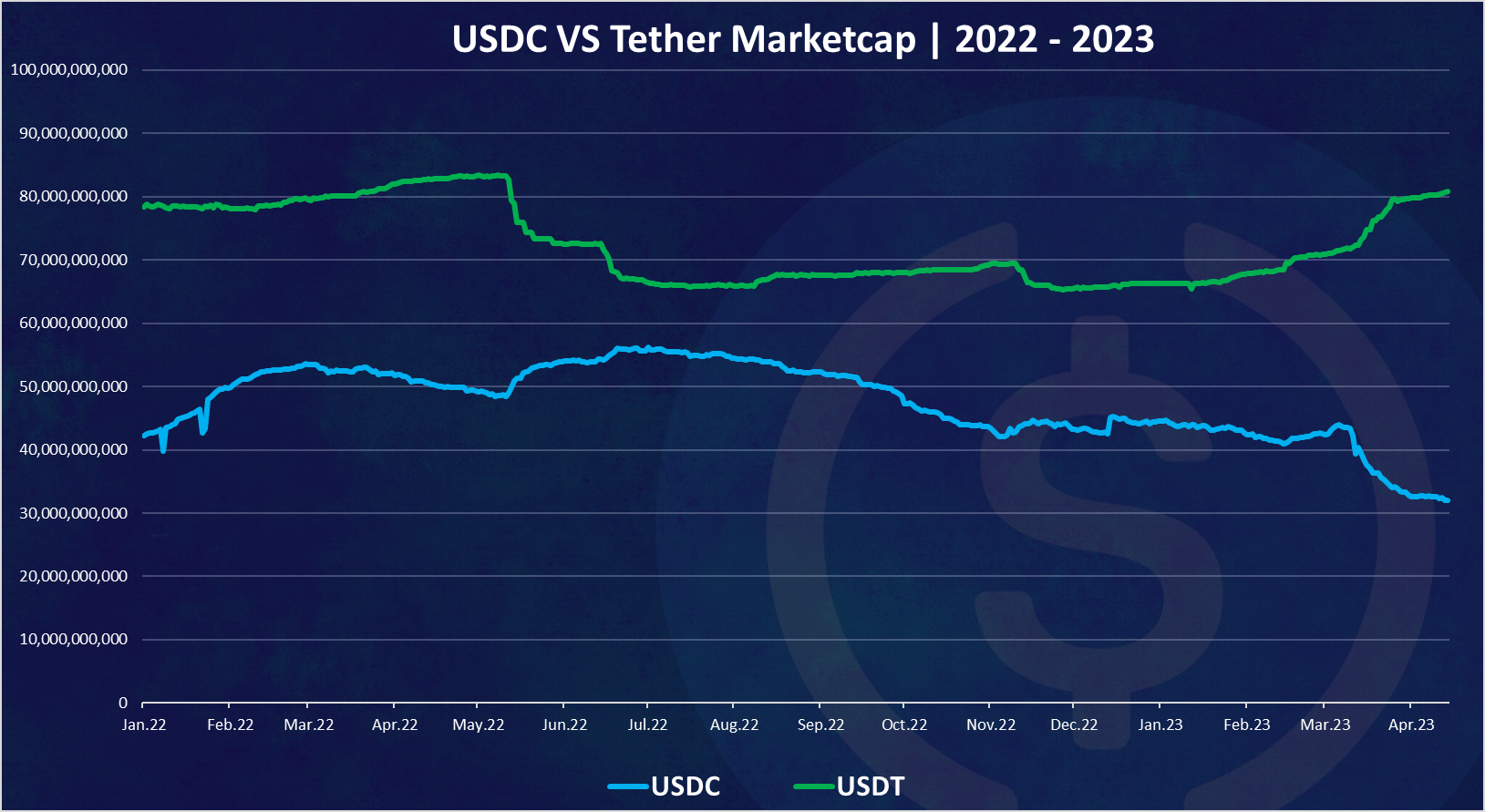

If we zoom in we got this.

We can notice the first inverse correlation of these two happening back in June 2022. At the time Tether USDT went down, while the USDC market cap increased. In the following period the USDC market cap gradually decreased, while Tether grew. In March 2023 the USDC market cap decreased by a lot, while Tether increased again.

USDC is now at 32B, while Tether is at 80B and is close to its all time high in market cap.

The fall of SVB and the depeging of USDC have left a big mark of the market cap. USDC has lost a big share to its rival Tether. After a year of turmoil in the industry Tether has kept its dominance and is still the bigger stabelcoin. USDC has come close but it has taken a step back in the last month. We will see how thing progress forward, will USDT keep its dominance, or maybe it will be under more pressure from regulators, that might give USDC another chance.

All the best

@dalz

Posted Using LeoFinance Beta

Also, I feel like a lot of people are used to USDT already

I have never invested in USDC before

Great knowledge about it. Keep it up and you will get the goal soon.

USDT is more popular and more trusted I think. Personally I also never hold USDC and I think I am not gonna do this in future until things keep changing. So it very harder to beat USDT in stablecoin list.

The rewards earned on this comment will go directly to the people( @dalz ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

You are absolutely right the way we saw some time ago that there was a lot of effort to bring down the constitution and a lot of misinformation was given in the market which led people to sell it. had done and because of that he had come down, we belong to the team that brought him back to the top of the same position. When it came down to it, the people who were on top of the project had bought in a huge amount and made a very good profit.

Quite interesting seeing USDC, which was considered one of the safest stablecoins before the depegging losing market share to its rival Tether after the event.

However we shouldn't also forget that the stability of stablecoins like USDC and Tether is crucial for their users, and the recent depegging highlights the importance of instant liquidity for these assets. As the article mentions, long-term lockups are not an option for stablecoins.

Posted Using LeoFinance Beta

It was a very interesting article.🙏 I only used the USDT asset once, but I really have no desire for stablecoins!😁 I consider having an asset, not its stability! So my preference is HBD and I prefer it for investment!😎

I can somewhat understand why USDC might depeg. However, I don't understand that it matters in the grand scheme of things as you still get $1 when you redeem for fiat. On the market, it's the market price. But on redemption, it's $1 always.

Posted Using LeoFinance Beta