The Shanghai update enabled the possibility for everyone who staked Ethereum to the Beacon chain to be able to withdraw. This was one of the most anticipated update and there was a lot of uncertainty around it. Everyone who staked ETH was unable to withdraw it, effectively locking it until this update happens. As a remined, the beacon chain went live at the end of 2020, and its take two and a half years since then for the unstaking option to went live.

How is this affecting the staked Ethereum. Are more users unstaking or maybe staking now? Will we see a selling pressure from the unstaked Ethereum.

Image background generated with Midjoureny

Here we e will be looking at:

- Staked Ethereum by date

- Staked VS Unstaked ETH since the Shanghai update

- Share of staked ETH

- Number of validators

- Top stakers

- Change in the staked ETH by users since the update

The data presented here is mostly gathered from Dune Analytics.

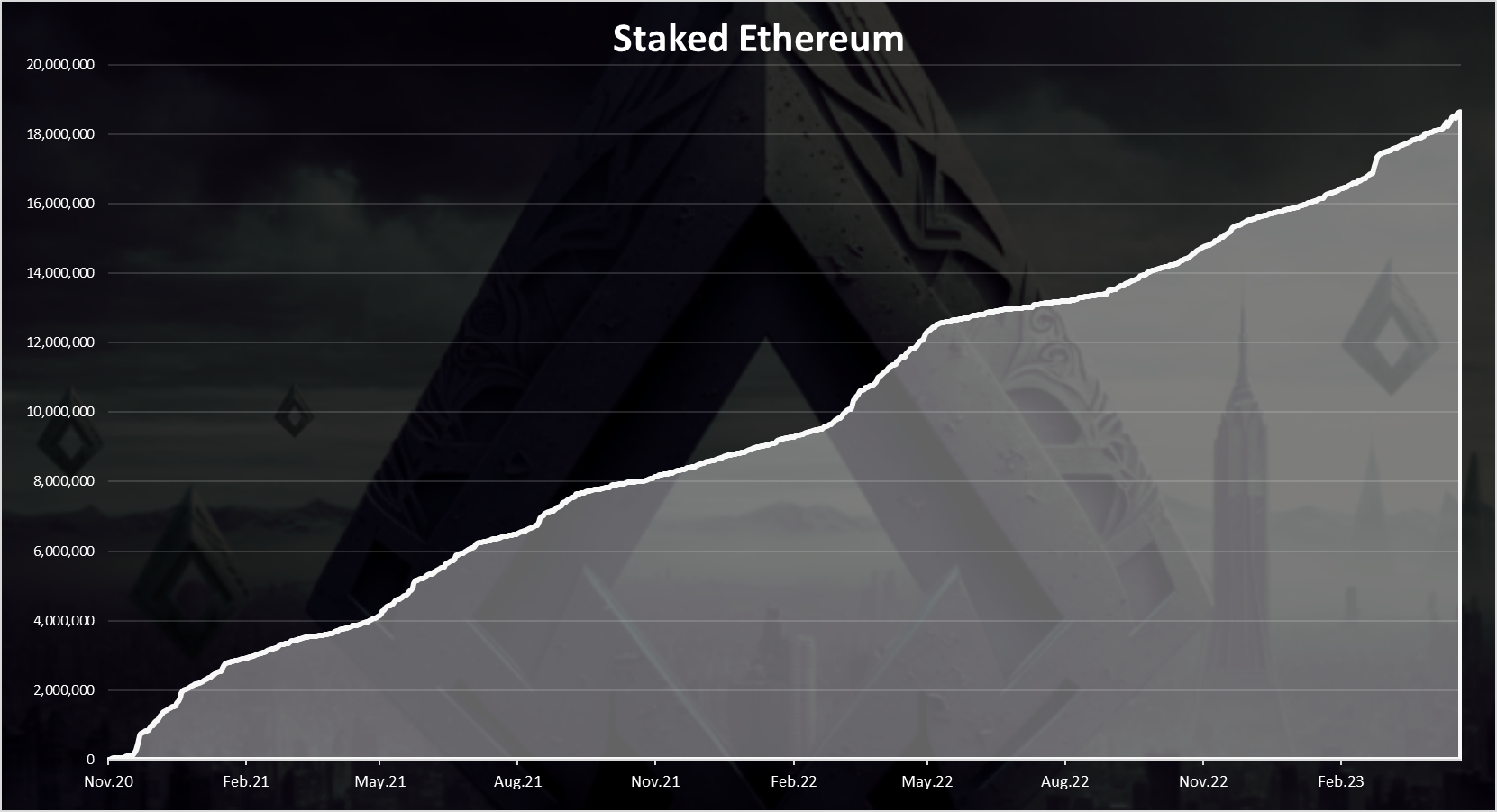

Staked Ethereum By Date

Here is the chart.

This is the amount of staked ETH since the launch of the Beacon chain and the option for staking Ethereum in November 2020.

We can see a constant growth in the amount of ETH staked and on some occasions a sharp increases. At the moment of writing this there is 18.5M ETH staked.

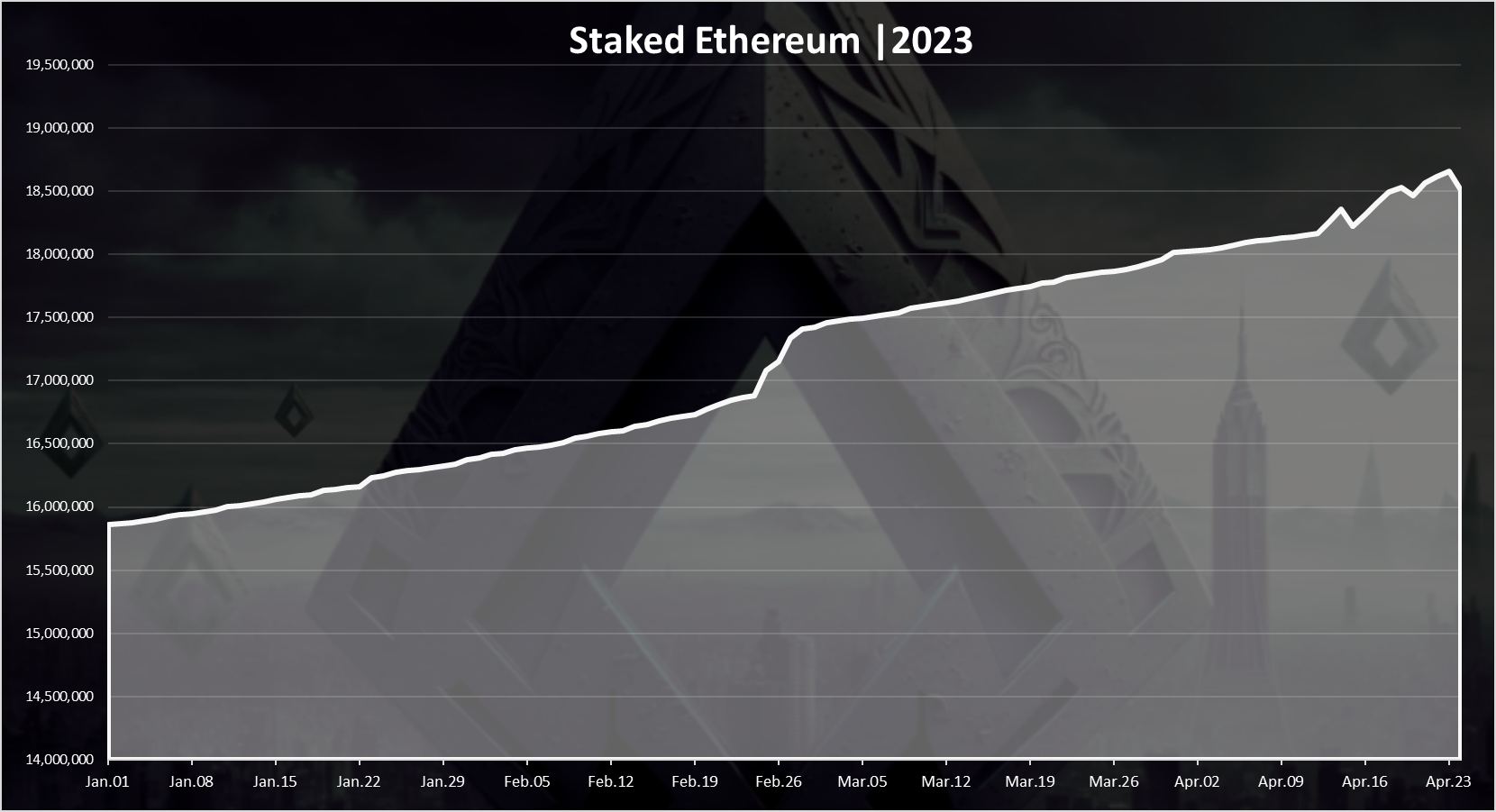

If we zoom in 2023 we get this:

Here we can notice the sharp increase in February, a steady growth after, and some up’s and downs in April. The Shanghai update went live on April 12, and there was some large staking but also unstaking events since then.

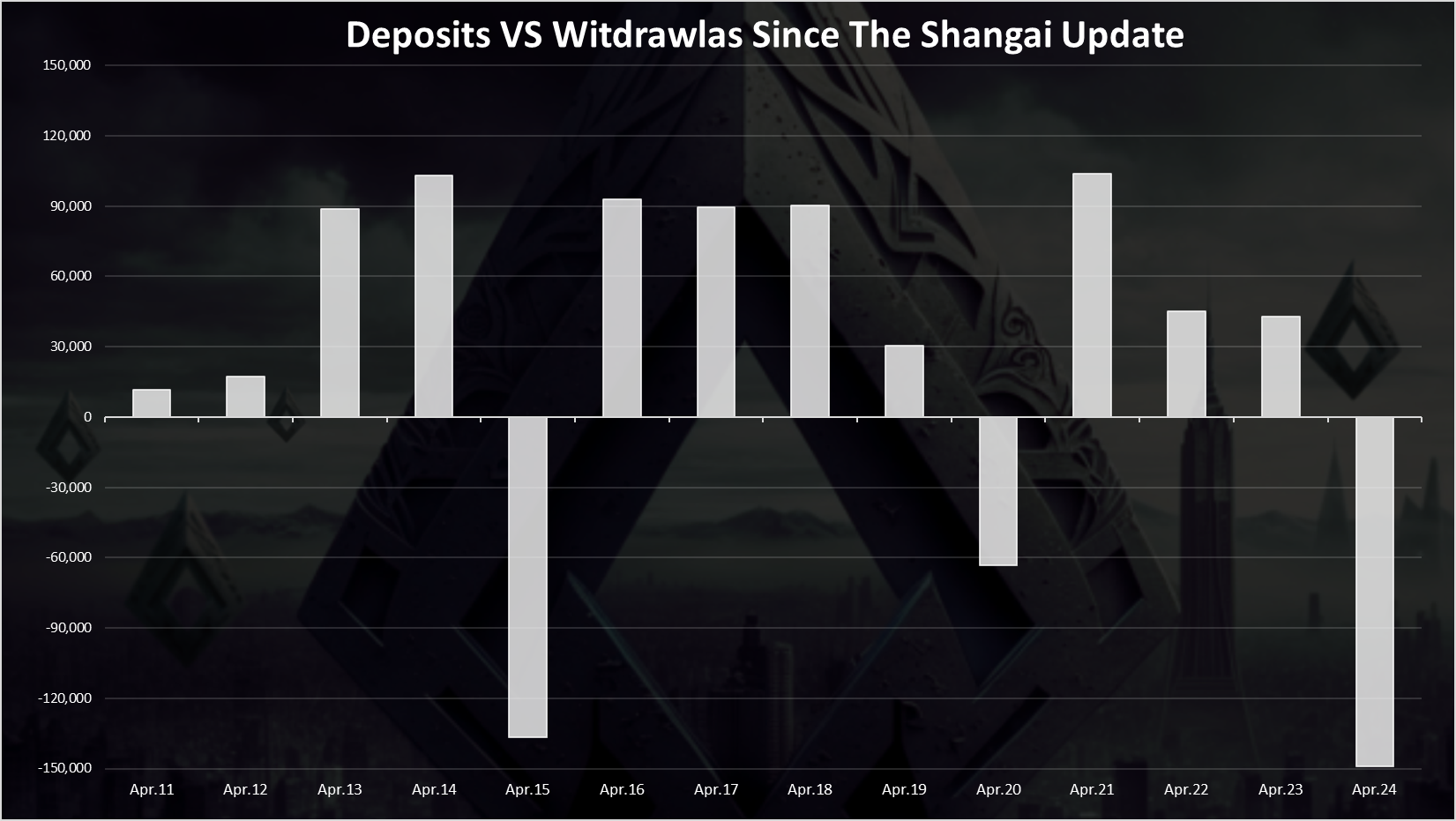

Deposits VS Withdrawals Since The Shanghai Update

If take a look at the daily deposits vs withdrawals since the update we get this:

Most of the days are in positive, meaning that more ETH is being staked in general that ustaked, even with the ustaking option enabeled. There are two big unstaking events on Apr 15 and just yesterday on Apr 24th, where more than 100k ETH was unlocked in a day.

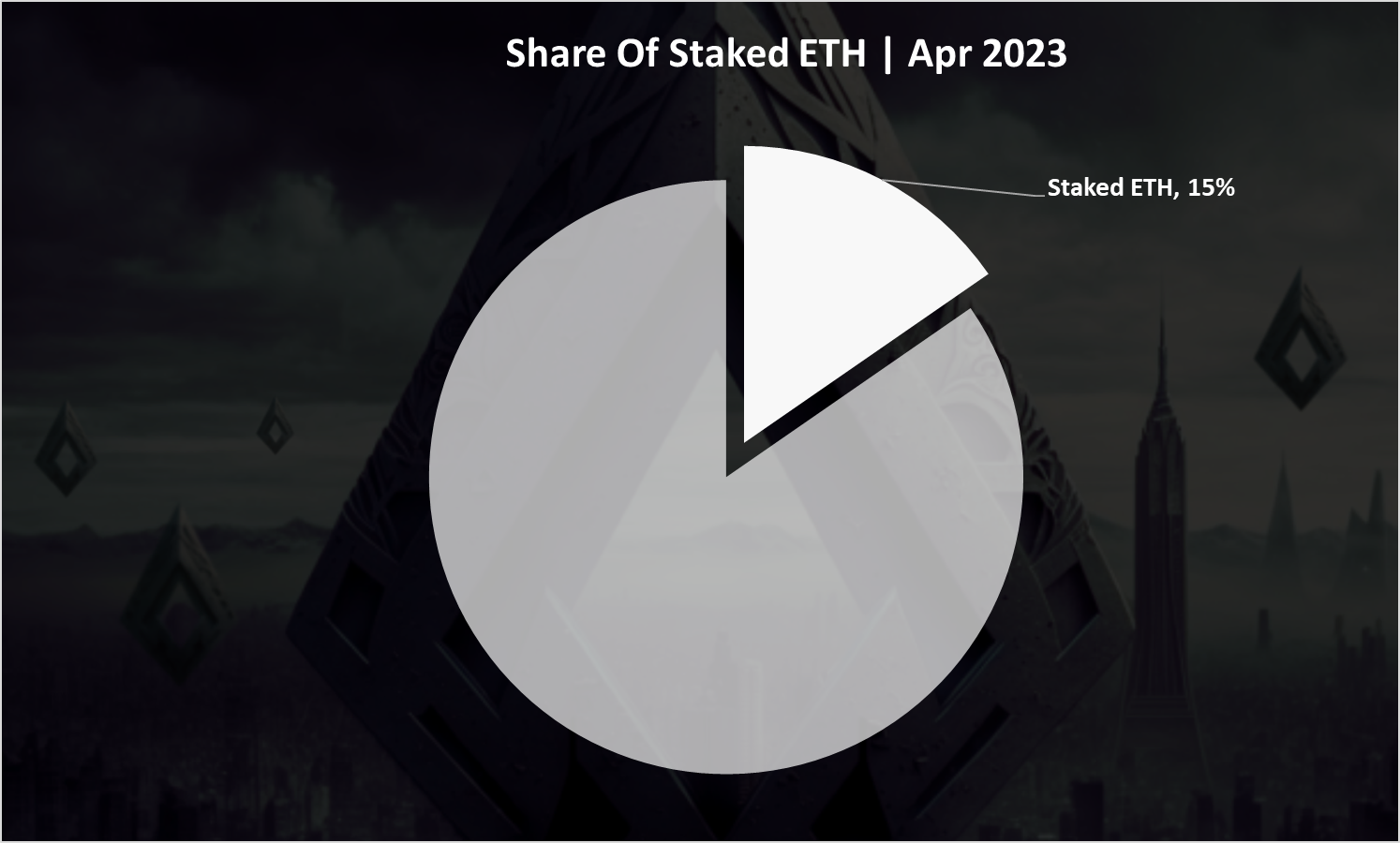

Share Of Staked Ethereum

What is the share of staked Ethereum?

When compared to the total ETH supply that is around 120M now, the 18.5M staked ETH represents a 15% of the supply.

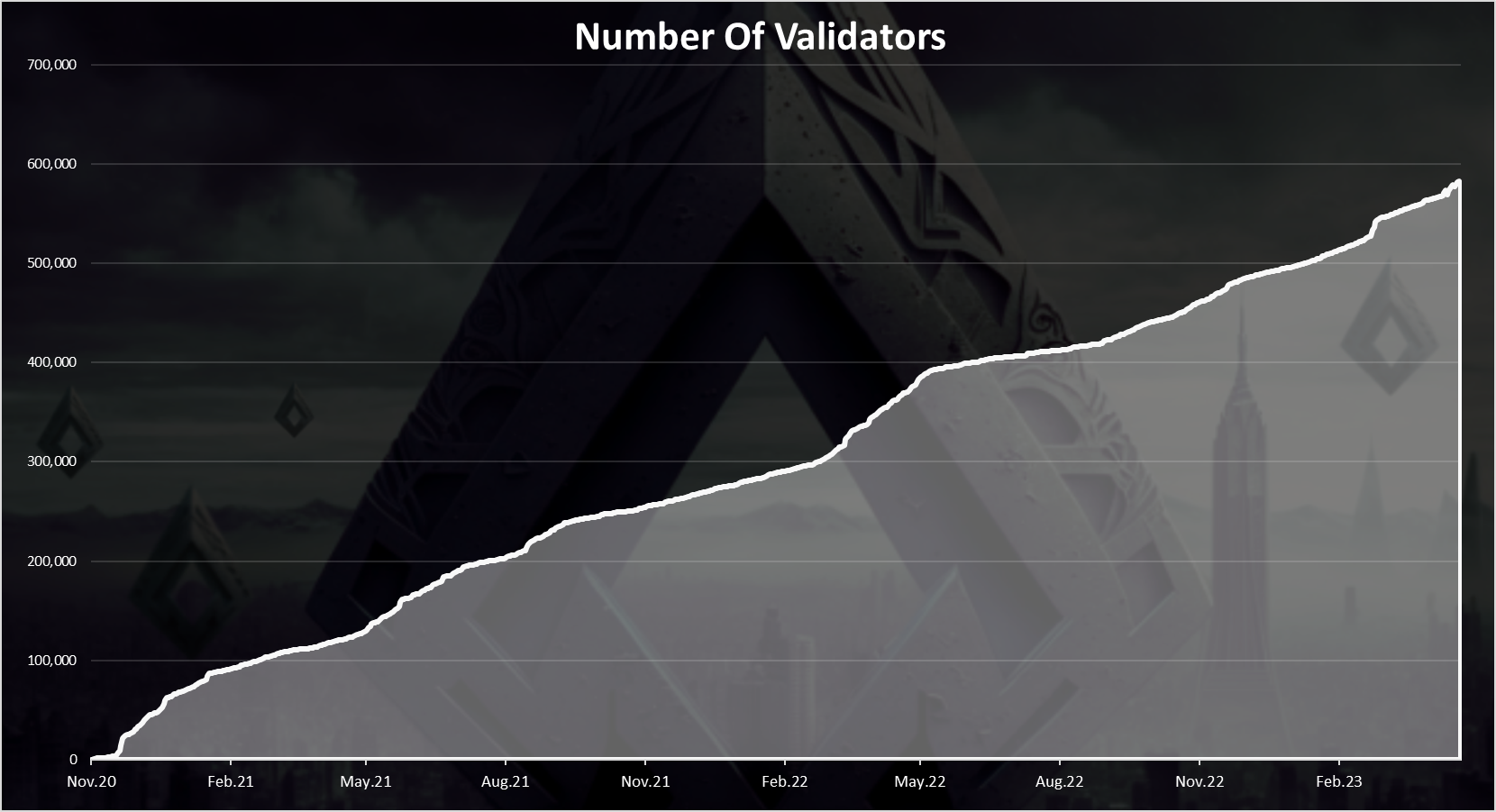

Number Of Validators

Here is the chart.

The number of validators has also continued to grow. At the moment there is close to 600k validators, or 580k to be more exact.

Note that these are not unique validators, as most of them are represented by a pool or some type of CEX.

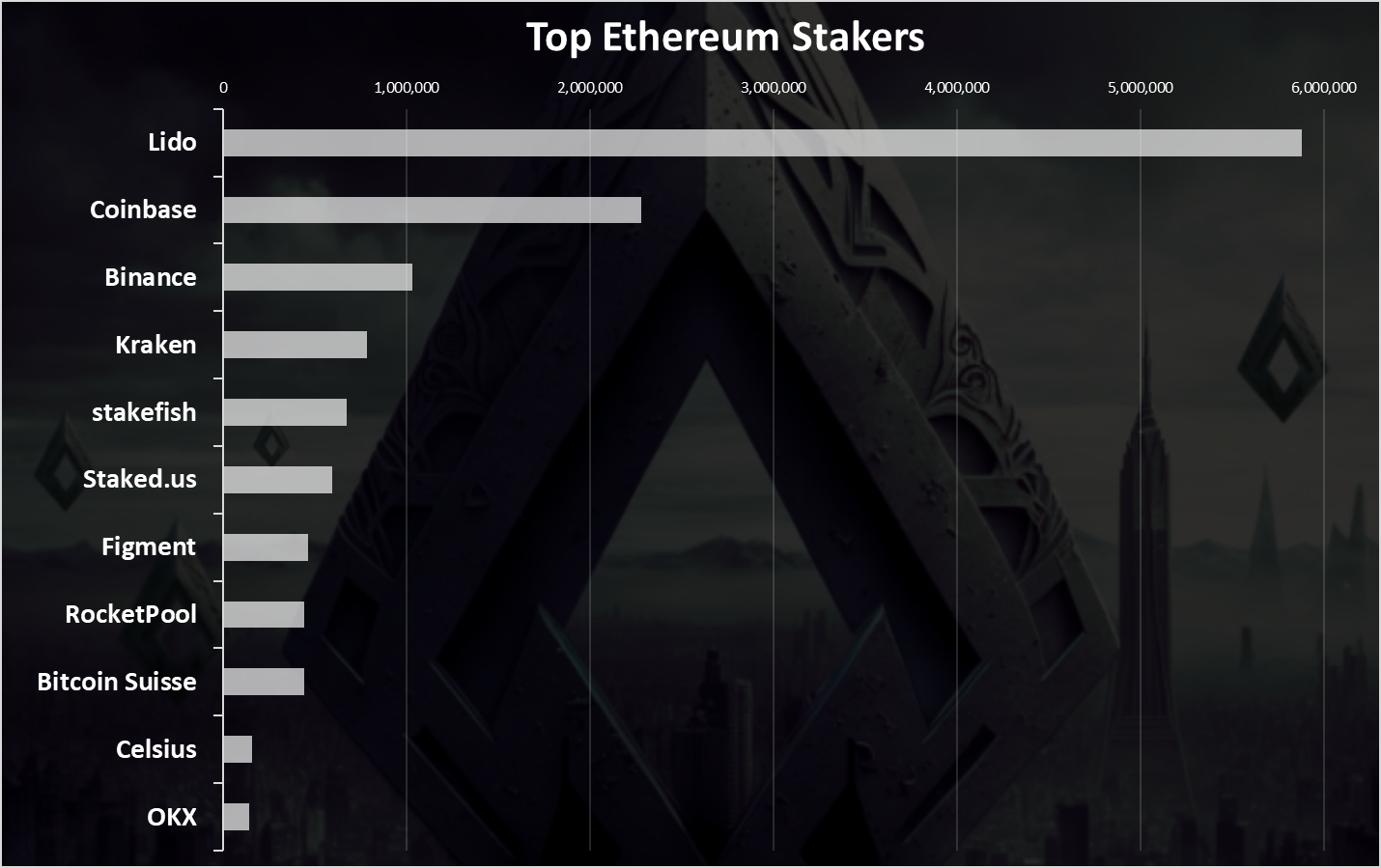

Top Ethereum Stakers

Who is staking the most? Here is the chart.

The Lido pool is on the top with almost 6M ETH staked. This pool has even its own token for governance. On the second spot is the Coinbase exchange, followed by another exchange Binance. Kraken is next, on the list, but this exchange is already in a process of unwinding its staked ETH as it got a fine from the SEC for offering staking as a service.

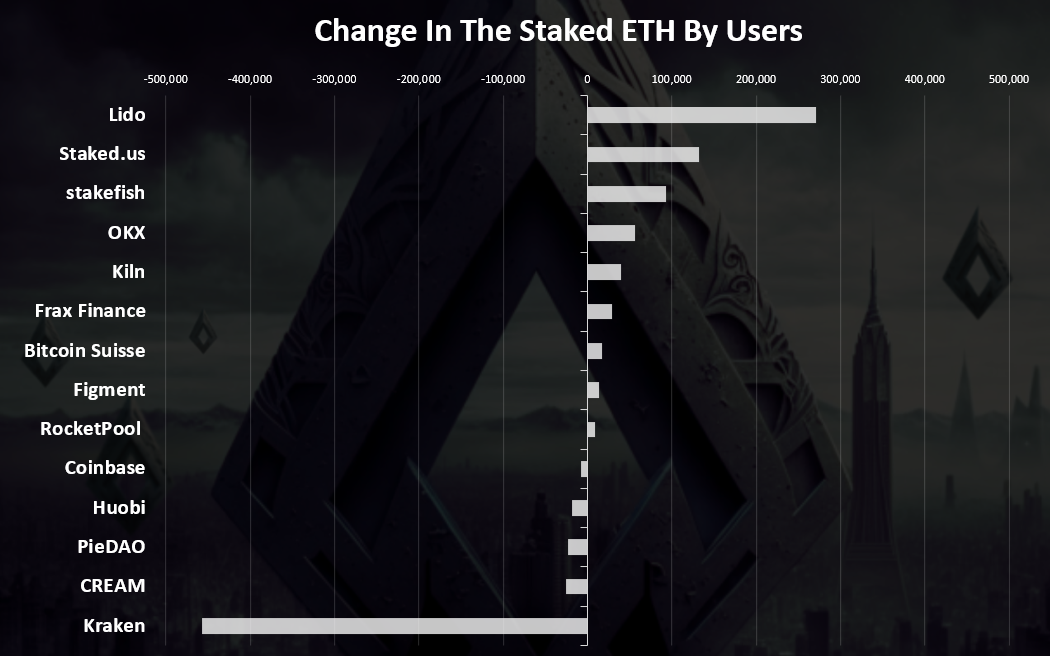

Who Has Been Staking/Unstaking The Most Since The Update

Here is the chart.

Kraken is the outlier here with almost 500k ETH unstaked since the update. This is most likely due to the legal issues the exchange has with the SEC.

On the other side of the spectrum is the Lido pool, who has increased its staked ETH for almost 300k since the update.

Summury

The Shanghai update allowed users who had staked their tokens to the Beacon chain to withdraw them, a highly anticipated move after two and a half years of locked funds. Despite the option to unstake, the overall trend shows that more Ethereum is being staked than withdrawn. Currently, 18.5 million ETH are staked, representing 15% of the total supply. Notably, Kraken has unstaked nearly 500k ETH due to legal issues with the SEC, while Lido pool has increased its staked ETH by almost 300k since the update. Cumulatively since the update there is a total of 360k more ETH staked.

All the best

@dalz

Posted Using LeoFinance Beta

The rewards earned on this comment will go directly to the people( @idksamad78699 ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Eth stakers and validators are staying strong even after the Shanghai upgrade. What it captured my attention is that only 15% from the Eth supply is staked and I consider that's pretty low. If more would be staked, also the price might appreciate faster.

Posted Using LeoFinance Beta

Yes you can say that, having in mind on Hive it is much more :)

It is impressive to see that following the Shanghai update, ETH staking has increased by approximately 360k. Many were worried that people would withdraw their staked ETH as soon as it became available on the Beacon chain. Despite the legal difficulties with the SEC, the amount of ETH staked on Kraken is surprising. I appreciate the update. Thank you.

Nice informative content about Shanghai Update and stake or unstake Ethereum related content.

https://reddit.com/r/CryptoCurrency/comments/12yo9th/is_ethereum_withdrawn_after_the_shanghai_update/

The rewards earned on this comment will go directly to the people( @acidyo ) sharing the post on Reddit as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Great report as always!

Few expected this ETH upgrade will result in more ETH to be staked than withdrawn... Inverse reaction !LOL It's going to be interesting time what SEC will come up with to shake investors Confident.

Great post. Good to know about that 👍.

More people are still choosing to keep their Ethereum staked rather than withdraw it.

Thanks for updating!

Thanks for providing this information about this Ethereum update, your post has everyone who needs to read about the latest Ethereum update. Love to see people have so much trust in Ethereum.