No 10% is to much and it happens only to low liquid coins. Usualy its far less bellow 1%

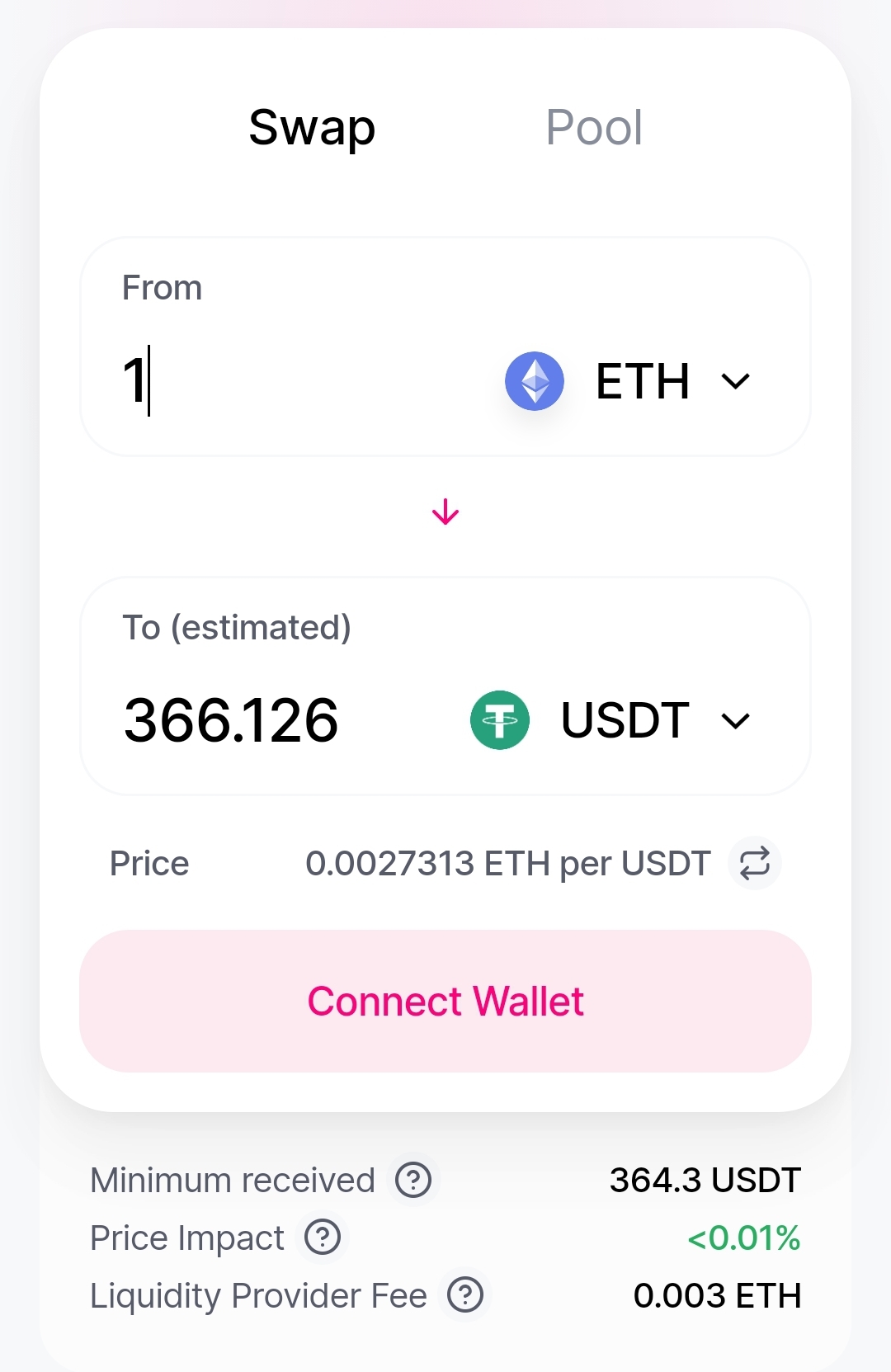

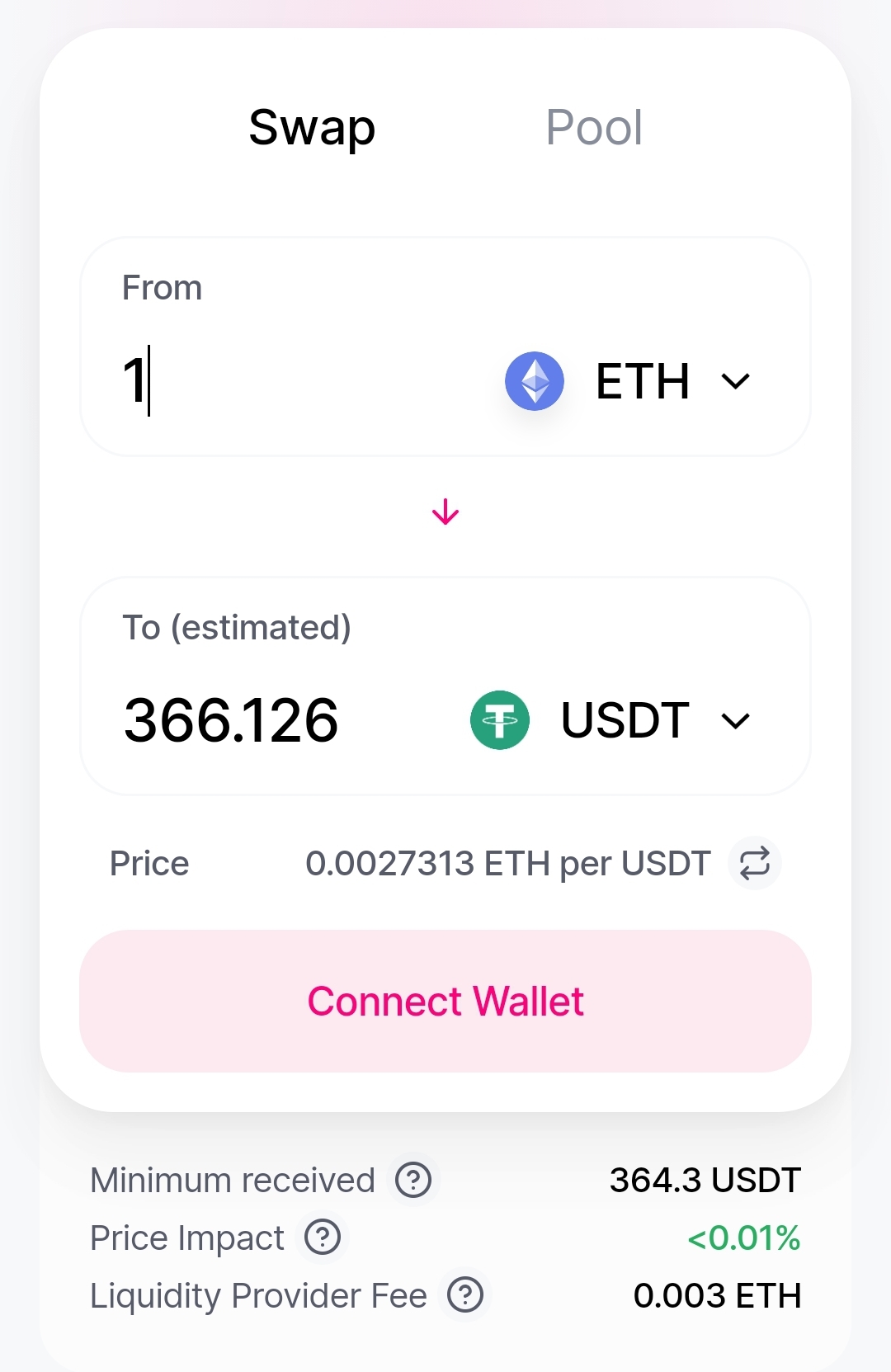

Check the screenshot above. There is a price impact note bellow. Its less than 0.01%

10% or more can happen only in very low liquid tokens.

No 10% is to much and it happens only to low liquid coins. Usualy its far less bellow 1%

Check the screenshot above. There is a price impact note bellow. Its less than 0.01%

10% or more can happen only in very low liquid tokens.

That's ETH-USDT. That's the platform's main trading pair. The main pair usually has a spread around 2%. (But there are 'gas' fees to take into account here.)

You need to look at a minor pair like wLeo-ETH, and you need to look at both what it would cost you to buy and what you would get if you sold, and then calculate the difference.

Uniswap will calculate it for me :)

Just as for the examole above. This is beffore you execute the swap.

The example above is only a sell.

You need to do a buy too (how much USDT will it take to get 1 ETH).

And then calculate the difference.

As I said, the ETH-USDT major pair will have a relatively small spread. Do the same operation with the smaller pairs and I'm sure you'll find that they have much bigger spreads.