The ETH VS BSC duel has been going on for a little while now and the most notable is with their frontrunners Uniswap VS Pancake.

I have been following the data on the both chains and platforms for a while now and even made the animated line chart race ETH VS BSC in terms of transactions, where BSC has already overtaken ETH.

Now let’s take a look at the Uniswap VS Pancake data laid out side by side.

Before going further into the post I just want to note here that while these comparison THIS VS THAT are fun and interesting, the overall sentiment (and data) is that we are still early on in this space so there is enough space for growth for all the platforms and much more new ones that will come out in the future.

The pro and cons of these two are clear, Uniswap being decentralized (more secure) but expensive in terms of fees, while Pancake is cheap in fees at a cost of centralization.

Here we will be looking at:

- Total Value Locked TVL

- Trading Volume

- Numbers of users

- Top pairs

- Price

The period that we will be looing at is form September 2020 to February 2021.

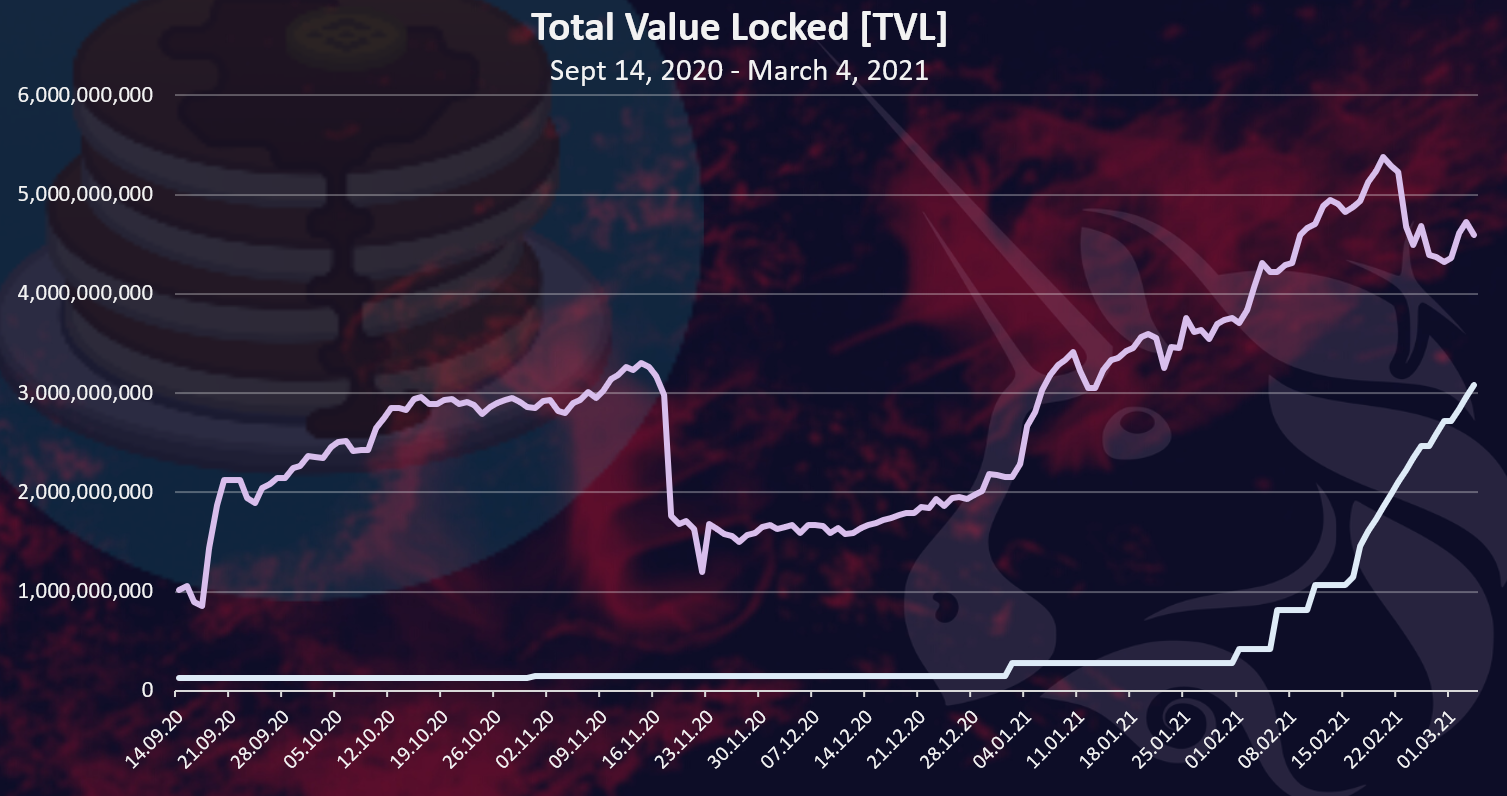

Historical Data on Total Value Lock on Uniswap VS Pancake

Here is the chart.

Note: I wasn’t able to find clean data on TVL on Pancake so it’s a rough representation.

Uni clear in the lead here with Pancake catching up fast.

As we can see up to January 2021 the TVL on Pancake was quite small in terms of hundred of millions. Then in January it started to grow and really exploding in February 2021, reaching more than three billion.

Uniswap had some up and downs in the period, but much more stable than Pancake, starting with around 2B in September 2020, reaching a 3B, then a drop and the a growth since December 2020 to February 2021 reaching a five billions in TVL. In the last week or two the TVL on Uniswap has dropped a bit.

In the whole period above Pancake has never got close to Uniswap in terms of TVL.

Here are the numbers for TVL as of March 4, 2021.

| March 4, 2021 | TVL |

|---|---|

| Uniswap | 4,590,829,710 |

| Pancake | 3,081,494,879 |

Uniswap is basically seating at 50% more in TVL than Pancake.

Will be interesting if at some point in the future both of these numbers are in 100x 😊.

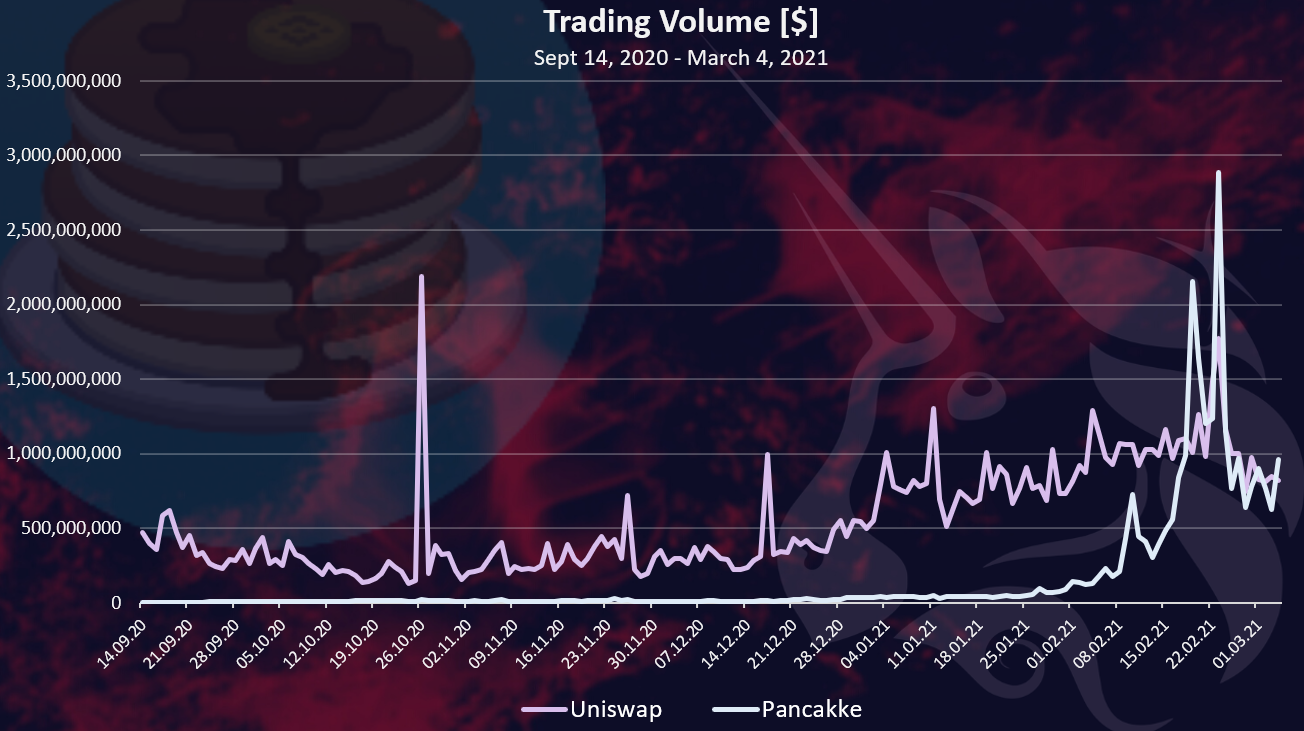

Trading Volume

Here is the chart for the trading volume.

This one is a bit more interesting than the TVL. We can see here the explosive growth on Pancake in February 2021 surpassing the trading volume on Uniswap. Pancake has reached a record high trading volume on February 23rd with 2.8 billion. It has dropped afterwards to around 1B.

Uniswap has a steady growth in the whole period with a small drop in the last week or two. It also had the ATH in trading volume on February 23rd with 1.7B.

The latest numbers looks like this.

| March 4, 2021 | Trading Volume |

|---|---|

| Uniswap | 821,000,000 |

| Pancake | 961,584,707 |

The trading volume has been volatile on both platform in the last weeks with these to swapping the no.1 position all the time.

A note on the trading volume. Unlike the TVL where capital is locked in smart contracts, the trading volume can be played a bit with wash trading. Since the fees are smaller on BSC its cheaper to wash trade there. It also can be happening on Uniswap as well. The main point here is that the trading volume should be taking with some reserves due to possible wash trading. Still more legit than most of the CEXs where the trading is on a central servers and zero fees 😊.

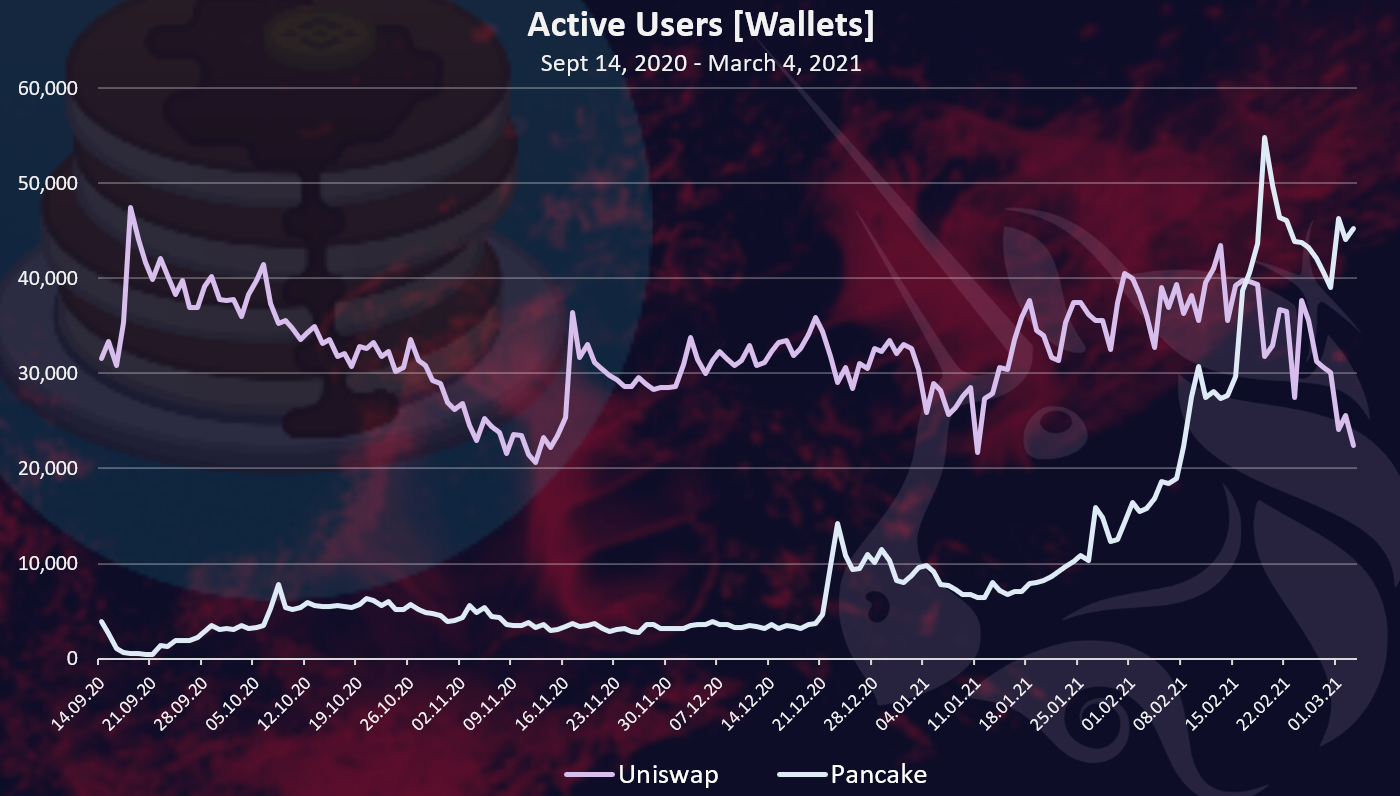

Numbers of users

This is an interesting chart as well. Pancake has overtaken Uniswap by a lot in terms of numbers of users, and its having an up trend, while the numbers of active wallets are down on Uniswap.

This might be mainly because of the low fees on BSC, where more can afford them, while the high fees on ETH are just for large users.

At the moment things stands like this:

- In TVL the winner is Uniswap

- In terms of trading volume it’s a draw

- In numbers of wallets the winner is Pancake

This is the current situation and as we know in crypto it can change fast.

Top Pairs

Here is the table for the top 10 pairs on March 5, 2021.

| No | Uniswap | Liquidity | Pancake | Liquidity | |

|---|---|---|---|---|---|

| 1 | ETH-BTC | 364,365,253 | BNB-CAKE | 429,601,883 | |

| 2 | ETH-USDC | 239,460,912 | BNB-BUSD | 131,410,307 | |

| 3 | ETH-WISE | 192,335,297 | BNB-BTC | 72,248,426 | |

| 4 | ETH-RAI | 187,797,639 | BNB-AUTO | 67,186,571 | |

| 5 | ETH-USDT | 182,123,940 | BNB-ETH | 54,503,616 | |

| 6 | ETH-UNI | 161,586,379 | BUSDT-USDT | 51,213,744 | |

| 7 | ETH-DAI | 130,819,708 | BNB-DOT | 40,541,723 | |

| 8 | HKMT-USDT | 105,359,351 | BUSD-VAI | 35,970,712 | |

| 9 | FRAX-USDC | 95,762,620 | BNB-UNI | 33,427,493 | |

| 10 | ETH-LINK | 88,356,396 | BNB-USDT | 31,329,954 |

Note that the Pancake interface is out of sync at the moment, so the numbers are probably slightly bigger than the above.

What can be concluded from the above is that on Uniswap we have a more even distribution in the top 10 pairs, starting from 364M going to 88M. On Pancake the liquidity is more concentrated in the top two pairs, BNB-CAKE and BNB-BUSD, especially in the no.1 that is closing to a 500M and has more liquidity than the no.1 pair ETH-BTC on Uniswap.

Out of the top 10 pairs on Uniswap, eight are paired with ETH. On Pancake out of the top 10 also eight are paired with BNB.

In terms of price both tokens have performed extremely well. UNI has traded at 4$ on October 1, 2020 and now is around 27$. CAKE has traded around 0.4$ and now is 11$.

Both of these platforms have updates on the roadmaps.

Defi has really been the hot thing in crypto in the last six months. Will be interesting to see how things go in 2021.

All the best

@dalz

Posted Using LeoFinance Beta

Great informative analysis as always. I think Binance did a great job copying what was already working in the decentralized space and introducing a massively cheaper version of it to an existing market of Binance users.

It's all Ethereum's fault. They should have worked on scaling and fees. It is also the fault of DAPP platforms like EOS for not creating feeless competitors fast enough and promoting them instead of committing $150 mullion into VOICE.

Posted Using LeoFinance Beta

THIS. They thought they had a monoploy forever and were slow to address fees. Now they have a viable competitor and I don't think BNB is going away any time soon.

Posted Using LeoFinance Beta

Funny thing is BNB is not even a proper decentralized chain. It is a rip off of Ethereum with better scalability and fees. That is all it took to create another behemoth in cryptocurrency space.

Posted Using LeoFinance Beta

thanks for this comparison! DO you know of a tutorial how to provide liquidity on pancake?

This post from rivese might help :)

https://leofinance.io/@revisesociology/binance-smart-chain-a-more-affordable-route-into-defi-than-eth

Posted Using LeoFinance Beta

👍🙏

Thanks for this. Using both swaps but only a little bit so far.

Anyway a !BEER for you

Thanks!

Posted Using LeoFinance Beta

I value decentralization but the fees are just too high on Ethereum. Plain and simple. It's not a knock on Ethereum, it's just reality. Not everyone is a whale.

Posted Using LeoFinance Beta

When we see layer 2 in Ethereum I don´t hope a big variation in this schedule. People trust BSC and from my point of view it is more accesible and easy

Posted Using LeoFinance Beta

Gr8 analysis. I can see why my post interested you as well, we're kinda looking at the same issue from different angles.

It is interesting to note that pancakeswap is above uniswap in two of the three charted metrics. It shows just how much the BSC defi ecosystem has grown over the last 6 months.

What you said about the active users makes sense too, and this could be one of the metrics that evens out to equal, or even uniswap take over later in the summer. Only time will tell.

Interesting times ahead :)

Posted Using LeoFinance Beta

Great analysis. I am rooting for the development of the total defi space across chains. Having said that, i am glad that i got to enjoy defi games due to relatively low fee structure on Binance. I am yet to see a sushiswap equivalent clone dex on Binance. There are many but none is significant yet.

Posted Using LeoFinance Beta

Great work as always, dalz.

The BSC v ETH battle is intriguing to me.

We always like to talk up how important decentralisation is, but ease of use and cost is still HUGELY important to most.

Posted Using LeoFinance Beta

I wonder what's the next chain to surpass both of these. Imagine if it's Thorchain.

Posted Using LeoFinance Beta

This shows pretty clearly to me how much huge fees are holding ETH platforms back.

Posted Using LeoFinance Beta

the growth rates are super crazy. 14 days 1B :O

Posted Using LeoFinance Beta

Personally I think CAKE is rather undervalued at $11. Looking at market cap vs TVL, as well as real user adoption. I believe the $20 mark was a more accurate price, which it has reached. Probably also moving in tandem with BNB, so it will be interesting to see where it goes as the market makes its next move higher.

Posted Using LeoFinance Beta

#defi is a way to move money around

and make money by helping others.

Hopefully these two system will grow and expand.

Definitely both systems worth watching

Posted Using LeoFinance Beta

In a funny comment that I did, UNI will win and PANCAKE is the loser! UNIT will stab PANCAKE at the center and eat it! LOL, But this 2 token was really amazing!

Posted Using LeoFinance Beta

Pancake has grown so much that I acquired mine at $0.2 price. I just hodl instead of staking. I'm planning staking this year though. Hopefully Defi remains relevant and huge.

Posted Using LeoFinance Beta

View or trade

BEER.Hey @dalz, here is a little bit of

BEERfrom @detlev for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Congratulations @dalz! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 75000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Have you seen goosedefi.com? it's basically a copy of pancake

Posted Using LeoFinance Beta

Yes I'm in that one to :)

Posted Using LeoFinance Beta

That was a quick rise

Posted Using LeoFinance Beta