anomadsoul's free visual support

Greetings Friends, I hope everyone is fine. This publication underscored the general impact of deflation to cryptocurrency holders. I believe you would love to go through.

First, what is deflation? This in response to crypto terminology is a continuous decrease in the prices of cryptocurrency. Although this does not imply a perpetual decrease but a significant reduction in the prices of crypto assets.

There are millions of crypto users in the world and everyone of them is either positively or negatively affected at each trend of the market, either as a HODL or a trader. The crypto trend will never have a dual effect on each investor at a particular time given the fact that you would either be at loss or profit at a given period.

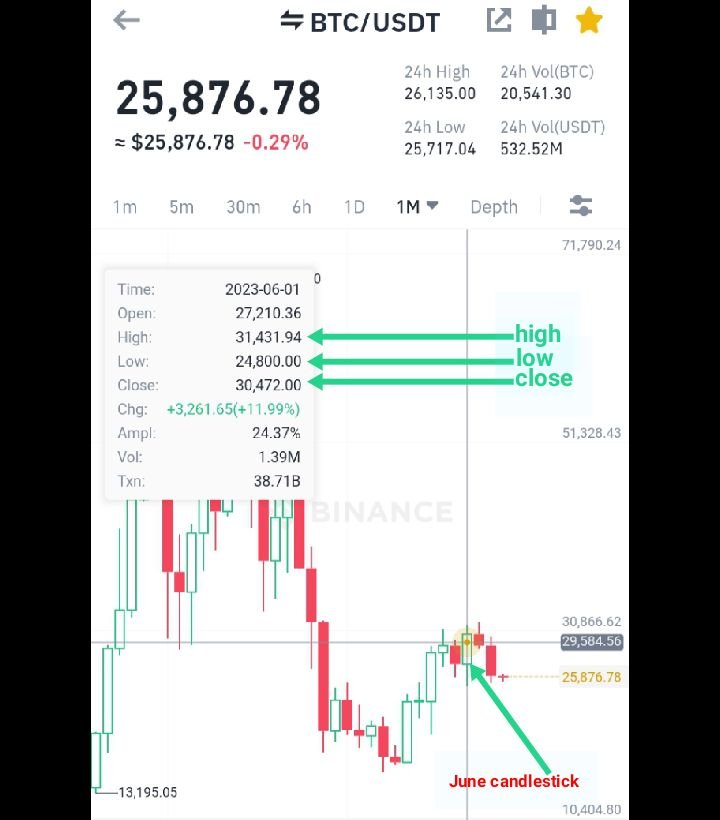

Binance for instance is reported to have about 50 million Bitcoin wallet addresses with a non zero balance. It was further noted by a feed streamlined by crypto_on_india on Binance that 78% of Bitcoin HODL in Binance were in profit while 22% were in loss on the 24th of June 2022. Another observation showed that Bitcoin traded at a peaked position of $31,431.94 and a low position of $24,800 while closing at $30,472 and further observation using the monthly candlestick in this market scenario, tracing from the peak it has fallen indicated that the June candlestick although was taking a short bull, it was also captured in a devaluated Bitcoin market price. This is indicated from the screenshot below.

Hence, the above annotation proved, going with the bear market chart indicator in June. Although the Bitcoin price beared, it also favored 78% of its HODL in the same exchange, meaning that the market had a negative impact on 22% of Bitcoin holders on Binance. In essence, it's either you're at loss or in profit given any market scenario.

We know that the opposite of deflation is inflation and these two major concepts play a great role in the crypto invention. Although the latter has its implication on cryptocurrency in general but it's rather preferred than deflationary crypto trends, these major market concerns validate the saying that one man's meat is another man's poison.

Further, we would observe the positive and negative impact of deflation on investors from indications below.

At this point, we would be considering the credible effect of the deflationary cryptocurrency trend on potential investors in general.

Increased Accumulation.

During the deflationary trend in cryptocurrency, holders and traders are in a better position to increase the rate and volume of their purchases although based on preference and one's level of disposable income.

By default, potential Investors are prone to increase the level of their holding given to their knowledge on the operation of the crypto invention that there is never a particular trend in perpetuity.

Finally given to an investor's disposable income, if he was stacking 20 pieces of his preferred crypto when the price was around $1 in a week given to his disposable income, he will definitely double his stacking position if his preferred token price is devalued from $1 to $0.5. At this point, he'll be stacking 40 pieces of his preferred token still given to the same level of his disposable income.

Potential of Becoming a Whale.

This phase of the market has the proclivity to easily turn smaller investors into Whales. Everyone needs a bigger pie in the crypto invention but since the saying is valid that all finders aren't equal, smaller investors who couldn't buy much of a token during the bull period can easily turn to whales given to the bear trend.

Increased Rate of Returns.

We know that everyone has his way in the crypto invention. Majority of the investors buy tokens to stake in liquid pools to have an increased rate of returns. The bear market is an advantage for farmers to farm more of a token by Increasing the rate of their purchases although the rate of returns during the bear market may depreciate but they stand to gain when the market revamps again.

We can also deduce that the benefit does not only accrue to liquidity stakers, it also acts as a value added position to the portfolio of respective investors who removed the fear market psychology to stack more of a particular token during the bear market period.

anomadsoul's free visual support

Reduction in The Value of Investors Portfolio.

No one ever wishes to lose but nature and even crypto mechanisms have taught us that life exists in a dual state. This trend in cryptocurrency reduces the portfolio values of all Investors holdings leaving them without choice.

It's highly disheartening whenever the market trend enters this phase. Although one may not be needing the values in his portfolio for anything, seeing it going down causes a lot of distraction to investors.

Detraction of Engagement.

We know that there are different inputs to earning cryptocurrency. Most people earn through airdrops, buying, and blogging. In this regard, many blockchain bloggers reduce their technical input in the blockchain given to the reduced rate of remuneration from engaging in the blockchain.

Consequently, this also affects hive bloggers. I observed that there is a reduced rate of engagement in the hive blockchain whenever the price of hive goes down than when the price is up. Although some bloggers stop blogging at this period, most other bloggers get distracted by the devaluation in their hive values despite having nothing to do with it at the moment.

This phase of the market scenario which may be considered as a bad side of token prices also serve as a great opportunity to some other investors, and given to everyone's choice and analysis of what is good and bad in the market, we can infer that it has a dual effect than concluding it to be the worse trend in crypto concerns.

No trend is meant to last forever which is exactly what the bear market will always intercept to teach investors and in response to this, every Investor has to engage wisely against waiting for eternity to regain incurred market deficits.

Finally, trade and invest wisely, hold and farm what you don't necessarily need at the moment. Although this doesn't not absolutely serve as an investment advice, everyone is at liberty for further market research on the underscored context for optimized personal Investment analysis, thank you for visiting bye.

References:

Shared on Twitter

Posted Using LeoFinance Alpha

https://leofinance.io/threads/davchi2/re-leothreads-2oumf778b

The rewards earned on this comment will go directly to the people ( davchi2 ) sharing the post on LeoThreads,LikeTu,dBuzz.

Nice submissions Dave. Just as we already know the cryptocurrency market is highly volatile as such investors should stick to the golden rule, which is; invest what you can afford to lose.

And on the other hand, the bears and the bulls makes the market go round. It's the dynamics of economics.

On point Bro, the market has the proclivity by default to mutate at distinct instances but then we need to invest wisely as you maintained.

Yes.. i love the structuring of this article hence i will say that you have said it all patterning to investing wisely and letting us know that there no trend that last forever which is true. Nice writeup, keep it up