I really am a story teller, if the title surprised you. I love writing convoluted stories, with classical titles like this, describing in details what the character does. Because any good story has a hero journey, and this one is no exception.

Here the hero is obviously HIVE, and the journey just began, our character is barely one year old. In real life, he would just start to walk consistently. In crypto times, though, this is a lot more than that. Not only it walks, but it jumps.

But enough with the introduction. Or, as George Carlin would say: "skip the clouds, get to the fucking".

New ATH: $3.41

Yesterday, HIVE jumped to a new ATH: $3.41, something which was not only unthinkable a couple of weeks ago, but is just a digit mismatch away from the famous PI constant, 3.14. And we all know, PI goes on forever. Which is exactly what we wish for HIVE too.

On this jump, volume started to pick up a little, and in BTC we reached as high as 5808 satoshi, which is a respectable number of satoshi to be contained in just one tiny HIVE.

So, the token did vanquish some foes, namely the ones that didn't believe it can jump like that. FWIW, I always saw HIVE stopping somewhere around $8. So there are quite a few fights left to fight til we get there.

Reward Pool Shrinking In Absolute Numbers, Exploding In USD, Activity Picking Up

A quick look at the reward pool shows an unusual low number: 769,465. That's the number of HIVE printed in one week window. So, while the number of tokens goes down, the same numbers in USD picks up dramatically, we are at over $2 million. That's a lot. $2 million in rewards for a web3 community, for a week, is a LOT.

The fact that the number is lowering means activity is picking up. Every tiny HIVE counts.

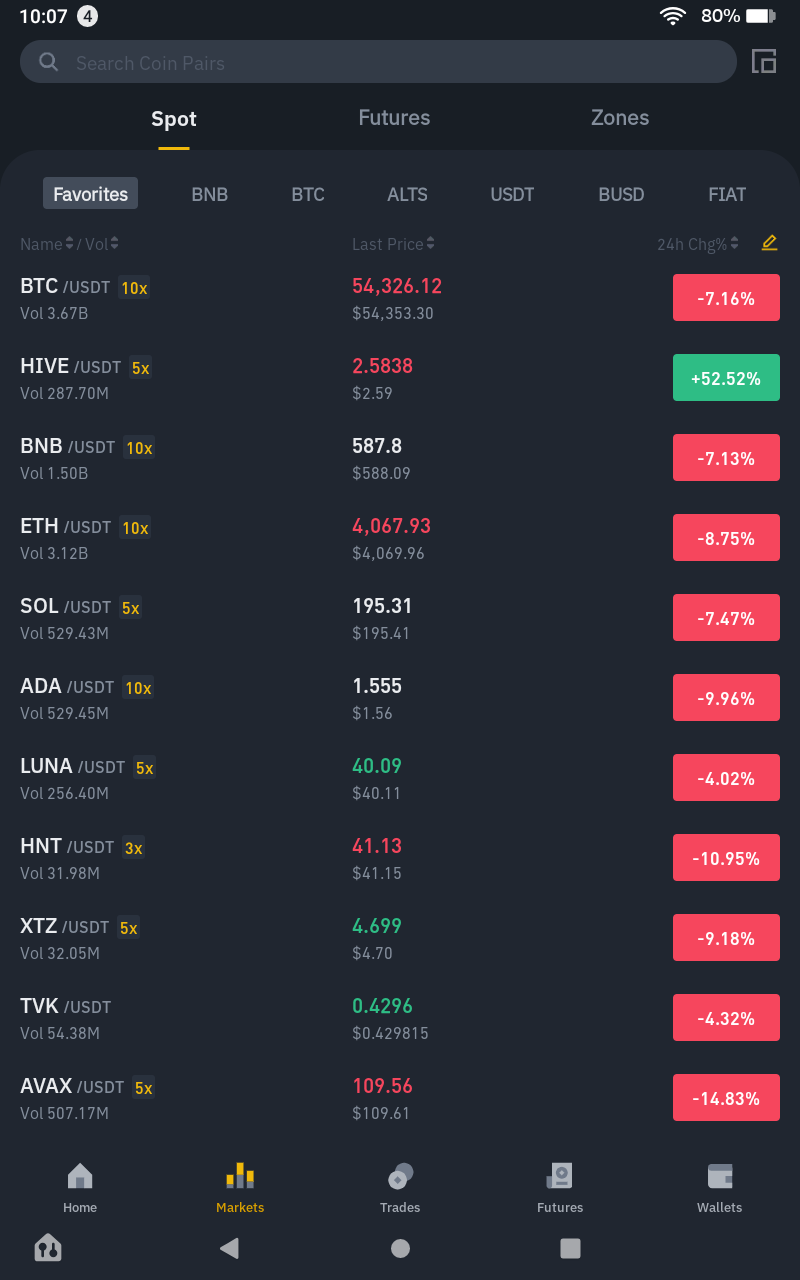

BTC / HIVE Inverse Correlation

If you look at the BTC 4 hour chart, and super impose it over the HIVE / BTC chart, you would get a red candle for every green candle, and a green candle for every red candle. Meaning when BTC jumps, HIVE goes down almost immediately, and viceversa. Obviously, that means almost all trading is algorithmic, but we already knew that.

What's important here is that we get a relevant amount of BTC traded against HIVE, which makes this correlation obvious. Please note this doesn't necessarily mean there's an actual transfer of wealth, that BTC can be recirculated in wash trades. But nevertheless, it's a significant amount of BTC that is used to trade against HIVE. Which is kinda new.

Wen Top, Ser?

Whenever we see our hero doing jumps like this - which happens, if we were to be honest, just a few weeks per year - we always wonder how high can he fly. Or, in technical terms, where's the top.

Well, here things start to be a bit more complicated.

Because of that inverse correlation, we need to know if there will be another BTC ATH. The majority of opinions I follow is still favoriting this, telling that a blow off top is still on the cards. But there is a non-ignorable part that say capital is spreading too thin this time, and it simply cannot flow back fast enough into BTC to determine another ATH. In other words, there are too many crypto projects with enough affinity to keep their capital locked in, and that capital won't flow out to BTC anymore, thus not forming a new blow off top.

If that's the case, then that's it. What we get now, and in the following days / weeks, it will be the highest jump. It will go downhill from there.

But if another BTC ATH will still occur by the end of the year (some say 100k is possible) then this may happen: HIVE will correct down (potentially down to $0.80 - $1.00) while being sold for the BTC that soars, and then, after this correction, once BTC cools down, that capital will flow back again to HIVE and we may see a second big jump, potentially up to $8.

In this case, we may look at January / February as being the top. After that, tax season will hit and there will be a downtrend across the entire market.

But, as we already know, nothing is set in stone. Anything can happen.

And that's obviously not financial advice, it's just a nice story abut our hero, HIVE, so do your own research and never invest more than you can lose.

Posted Using LeoFinance Beta

my gut is telling there is a long time until the bull run ends and that means a lot of new potential ATHs

I think 🤔 all of this activity of HIVE may be some kind of Chinese 🇨🇳 or Asia effect. Even could be Metaverse effect. I still haven't seen nothing posted about Axie which potentially could drive new gamers looking for training or instructions.

And on the meme coin game, there is 1 million fanatics. Could they be involved in buying HIVE after seen it as a top gainer on most exchanges?

I was caught off 📴 guard as I couldn't buy at 0.80 or even at 1.08 Now is too risky to buy at 2.5 unless you are saving money for next year.

Exciting times. 5 USDT region for Hive is on the making. We will get there soon than most expect. Hope those gains allow for better and faster hive interphases at web publishing

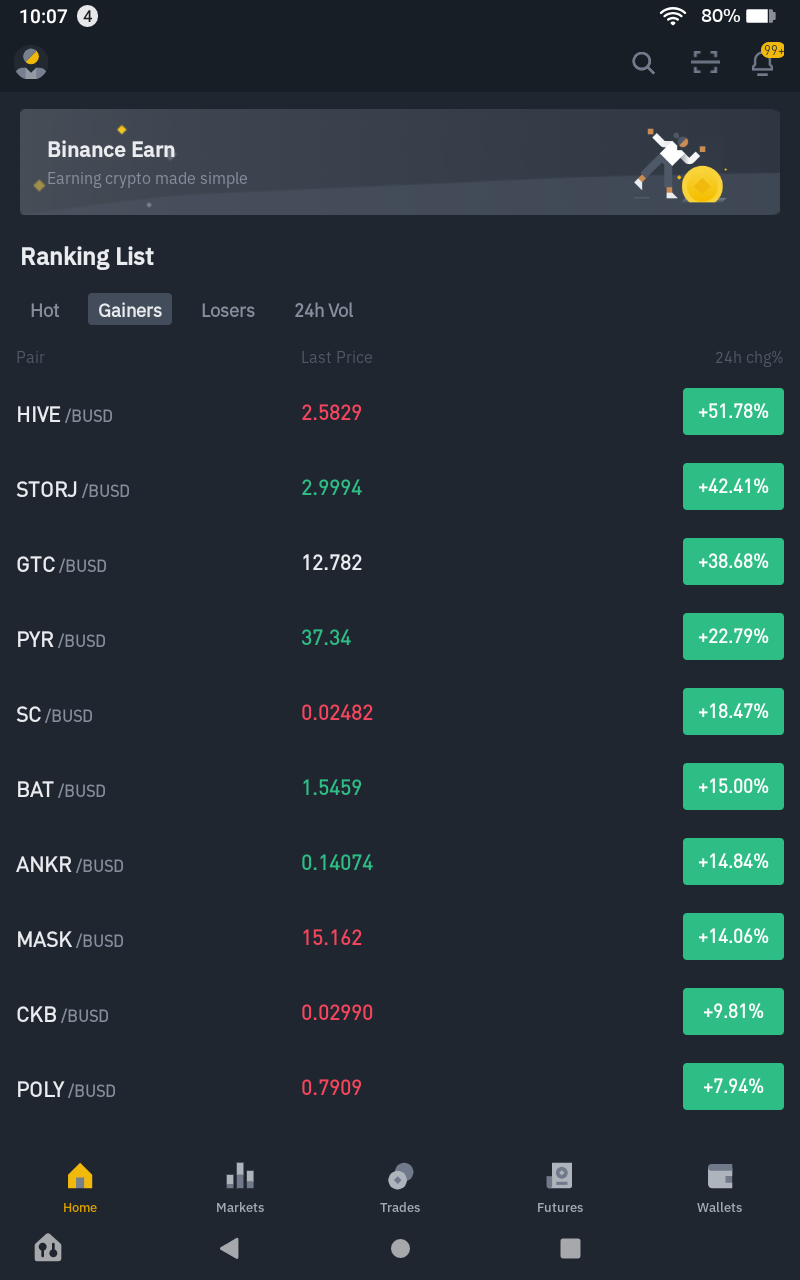

A Green Light 🚦 in a Red Universe 🌌

The Cat 🙀 climbed the tree 🎄

Top gainer on Binance