Introduction

In addition to buying cryptocurrency directly, investors can gain exposure to the crypto space by buying stock in crypto mining companies. Many crypto mining companies are publicly traded, and shares can be bought and sold through a standard brokerage account. This article looks at 20 such companies, ranks them by market cap, and analyzes ways in which those companies' market caps could possibly impact stock performance.

What is Market Cap?

Market Cap (or market capitalization) is a metric that refers to the sum total value of a company's shares. If a company has 100 shares valued at $1.00 per share, the market cap of the company is 100 x $1.00 = $100.00.

What Can Market Cap Tell Us About A Company?

The market cap is generally correlated with the size of the business. Large and very successful companies such as Google (GOOG) and Apple (AAPL) have market caps worth 10s of billions, 100s of billions, or even trillions of dollars. Companies with a larger market cap are seen as more stable and less risky than companies with a smaller market cap. Companies with a smaller market cap can represent a "gamble" investment with more volatility, but they can also have the potential for greater growth.

Companies that have a market cap of ten billion or more are considered to be "Large-Cap" companies. Companies with a market cap of two billion or less are considered to be "Small Cap" companies.

20 Crypto Mining Companies Ranked By Market Cap

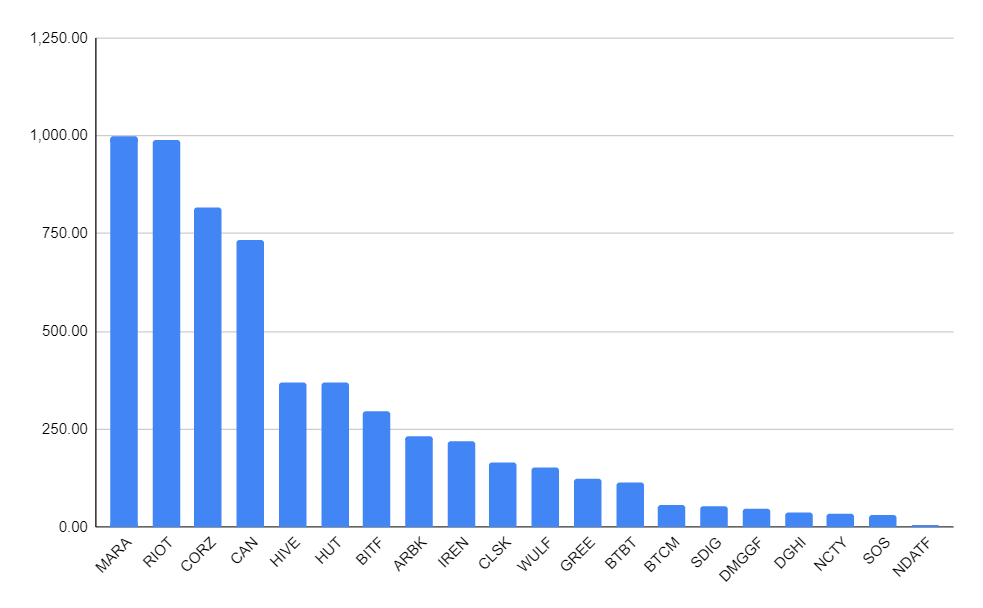

I have ranked 20 crypto mining companies by market cap. Please see the spreadsheet and graph below for details. Data was collected after close of business on Friday, July 29, 2022. I have measured market cap in units of one million dollars, with Marathon Digital Holdings' (MARA) market cap topping one billion dollars.

Analysis and Conclusion

All companies in the above list are considered to be "small cap" companies because they each have a market cap of less than two billion dollars. This means that even the biggest publicly traded crypto mining companies - MARA and RIOT - may have greater volatility than other, larger cap tech stocks. But this theme of great risk, great volatility, and great potential for growth is in step with many other companies and projects in the crypto space.

With that said, MARA, RIOT, CORZ, and CAN have market caps greater than or close to 750 million, and the other companies listed above have market caps far below 500 million. All else being equal, those four largest companies might perform with less volatility than than their smaller competitors. However, it's important to note here that many variables impact a stock's performance, and we're just looking at one metric in this article. We'll review other metrics in future articles.

Interested in trading crypto? Sign up for Gemini using this link, and we’ll both get $10 in Bitcoin when you buy or sell $100 or more within 30 days of opening your account. See terms for details.

I am a crypto enthusiast. I am not a financial advisor, and nothing I say constitutes financial advice. All statements I make are opinions and should not be treated as fact without further research.

Check out my Linktree here.

Posted Using LeoFinance Beta

The rewards earned on this comment will go directly to the people( @dreiberg ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Congratulations @dreiberg! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 50 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!