Introduction

In addition to buying cryptocurrency directly, investors can gain exposure to the crypto space by buying stock in crypto mining companies. Many crypto mining companies are publicly traded, and shares can be bought and sold through a standard brokerage account. In my last article, I reviewed 20 publicly traded crypto mining companies and ranked them by market cap. This article looks at seven of those companies, ranks them by PE ratio, and explains how those companies' PE ratios could possibly impact stock performance. The other 13 companies did not have readily available PE ratios to analyze.

What is a PE Ratio?

The PE ratio, or price-to-earnings ratio, of a company is calculated by dividing its market value per share by its earnings per share. In other words, it compares the price of a stock to the amount of money that the company is earning. The earnings per share is used to help determine the value of a company, so the PE ratio can help determine if a company is over- or under-valued. Companies with higher PE ratios are typically seen as overvalued, while companies with lower PE ratios are typically seen as undervalued.

PE ratios can vary widely depending on a number of factors, and a stock with a higher PE ratio is not necessarily a bad buy. With that said, the S&P 500 Index currently has a PE ratio of around 20, and this may be a good benchmark to use when analyzing stocks. Using the S&P 500 Index as a benchmark, we could consider a stock with a PE ratio of 10 to be "cheap." Conversely, we could consider a stock with a PE ratio of 50 to be "expensive."

Seven Crypto Mining Companies Ranked By PE Ratio

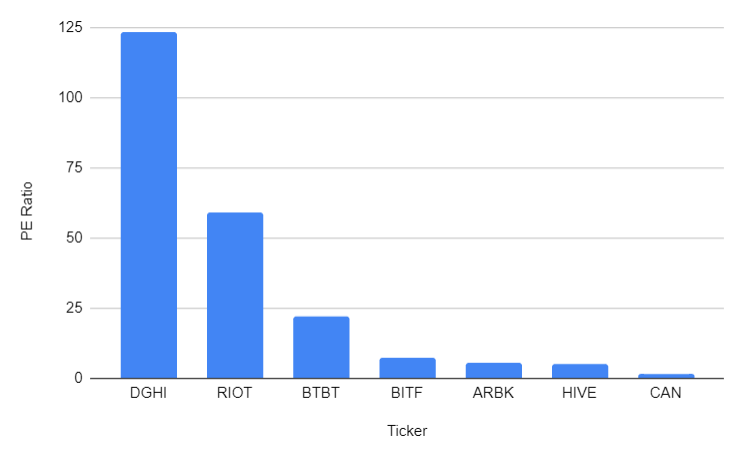

I have ranked seven crypto mining companies by PE ratio. Please see the spreadsheet and graph below for details. Data was collected on Saturday, 08/06/2022.

Analysis and Conclusion

The companies we reviewed have PE ratios that vary widely. At face value, DGHI and RIOT appear to be at least somewhat overbought. BTBT seems fairly priced, and the other stocks appear to be oversold. This suggests that BITF, ARBK, HIVE, and CAN are better "value buys" than the other stocks. These cheaper stocks may be more attractive to investors unless there is some other factor that increases the perceived value of the more expensive stocks.

Interested in trading crypto? Sign up for Gemini using this link, and we’ll both get $10 in Bitcoin when you buy or sell $100 or more within 30 days of opening your account. See terms for details.

I am a crypto enthusiast. I am not a financial advisor, and nothing I say constitutes financial advice. All statements I make are opinions and should not be treated as fact without further research.

Check out my Linktree here.

Posted Using LeoFinance Beta

The rewards earned on this comment will go directly to the people( @dreiberg ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Congratulations @dreiberg! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 200 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!