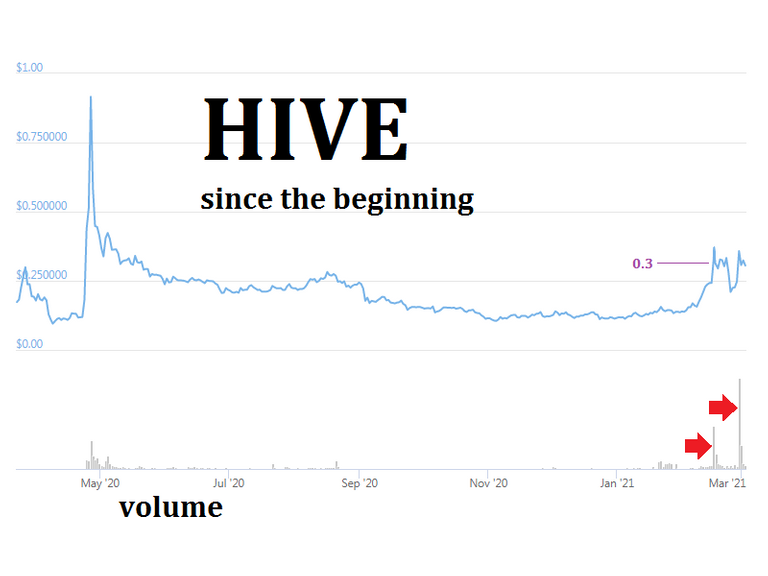

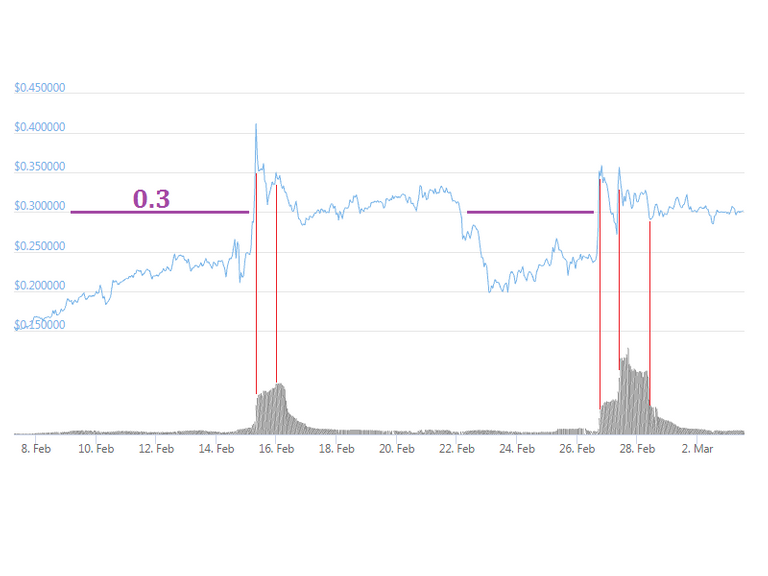

After almost a year of pulling back to 10 cents, the price of HIVE finally rose in early 2021, but has been met by an unprecedented volume of sudden selling, hammering the price down each time it breaks through 0.3 USD.

I recently reported that HIVE's chart has become bullish and weird, noting the price action was quite unusual.

Since then, I've been paying more attention to the fundamentals, and indeed there are many things happening on the blockchain right now, including several projects that are having local impacts on token prices. For example, LeoFinance has announced more expansions in the realm of DeFi, which popped up its price in recent days, and is impacting demand for HIVE.

But what was more interesting was looking at the volume (amount and timing of trading action).

2 weeks ago, trading volume spiked to DOUBLE its previous all-time-high.

A few days ago, it spiked again, this time to QUADRUPLE that previous ath.

I checked, and this is a HIVE thing - STEEM and the other cryptos aren't experiencing this sudden jump in volume. So I zoomed in for more detail. Is this volume responsible for the recent price increases?

Turns out, the volume coincides perfectly with sudden DROPS in price. Price increases were on relatively low volume, and were then followed by jumps in volume and a drop in price. When the price has cooled back below 0.3 USD, the selling stops, allowing the price to resume its bullish grind.

It happened not once, but several times. This is clearly selling volume. If the data are right, somebody or something is dumping unprecedented amounts of HIVE into the market each time the chart breaches 30 cents.

I'm going to leave the "why?" for someone else to write about. What is clear is that volume has hit a level never before seen, that the price chart is looking bullish and weird, and massive selling is blocking HIVE's advance.

Temporarily, at least.

DRutter

Posted Using LeoFinance Beta

That's pretty interesting, and perhaps telling. I don't know why it's doing this, but the chart is bullish, so when things break through this level... it could be GAME ON!

Very interesting thanks for the research.

Much of this has to be wash trading. February 27th is particularly suspect. Volume was 4x market cap. And market cap includes Hive locked up as HP, so volume was really more like 6x liquid Hive.

Just nuts.

Posted Using LeoFinance Beta

I would think the LeoFinance airdrops have a lot to do with it. I know I've been bringing my STeem over and buying Hive, but then I've been selling some of it to buy Leo. I'm sure I'm not alone as the airdrops are dependent upon having staked LEO. The good news is that usually when you have steady prices with lots of volume you're building a base of support. So, next time the price starts climbing, instead of the 10 cent level being the "support" line, it will be closer to 30 cents. And if it can go to 60-70 cents and trade there for a while, that will build another level into the charts. Progress.

Posted Using LeoFinance Beta

The price is fluctuating around 0.3

We hope it continues rising like Steem, above 0.4

Posted Using LeoFinance Beta

I think that some of the selling might be due to profit taking or conversion to fiat, but I could be wrong.