How BlackRock Conquered the World

It's been a very long time since I watched a Corbett Report documentary.

- They are long videos and a big commitment.

- They are riddled with right-leaning conspiracy theory.

- Heavy themes of deep-state, scamdemic, CBDC, overall world domination, etc.

Not that I necessarily disagree with such sentiment outright, but a lot of nuance is lost when personal bias comes into play combined with the incentive to make the story more interesting and higher stakes. For example, many people seem to think that environmental sustainability is nothing but a left-wing ploy to consolidate more power. It is rarely explicitly stated, but the underlying tone I come across within many libertarian circles goes something like, "This is God's Earth and we could never do anything to undo God's will."

So then as a left-leaning atheist I'm like okay well that's obviously bullshit. Like come on the world is cancer and there is literally a giant plastic island in the middle of the ocean. No contest. In the quest to "own the libs" many of the final conclusions made tend to be just as delusional as the original deception.

Both things can still be true. The left can use unsustainability as a ploy to consolidate more power and the world can ACTUALLY be unsustainable. Pushing autonomous electric vehicles isn't 110% just about being able to track and control everyone. Again, a lot of the half-truth nuance is lost when personal bias comes into play.

https://www.corbettreport.com/blackrock/

All this being said I was extremely compelled to watch this particular documentary simply because Blackrock was in the title and is clearly the centerpiece. I'll be honest I wouldn't care so much about Blackrock if they didn't file an application for a Bitcoin spot EFT recently, but they did, and now I feel it's a bit irresponsible to not learn a bit more about this Goliath.

I know everyone tries to run around and act like "Blackrock controls everything". I mean... they don't, but do they have a bit more power than they should? Sure. Then again has anyone considered that this could be exactly the kind of environment crypto requires to justify its own existence? Probably.

Again, it's extremely reductive to just say that Blackrock owns and controls everything. They are a hedge fund and a money management agency. A lot of the assets 'under their control' don't even technically belong to them. But I guess we'll have plenty of time to get into that.

But it was the Global Financial Crisis of 2007—2008 that catapulted BlackRock to its current position of financial dominance. Just ask Heike Buchter, the German correspondent who literally wrote the book on BlackRock. "Prior to the financial crisis I was not even familiar with the name. But in the years after the Lehman [Brothers] collapse [in 2008], BlackRock appeared everywhere. Everywhere!" Buchter told German news outlet DW in 2015.

BlackRock was perceived to be the only firm that could sort through the dizzying math behind the complicated debt swaps and exotic financial instruments underlying the tottering financial system and many Wall Street kingpins had Fink on speed dial as panic began to grip the markets.

And why wouldn't they trust Fink to pick through the mess of the subprime mortgage meltdown? After all, he was the one who helped launch the whole toxic subprime mortgage industry in the first place.

Ohrly!

A running theme throughout this documentary seems to be that Blackrock has been allowed to play the part of multiple roles that potentially results in a gross conflict of interest. It's clear that such action should be illegal through some kind of anti-trust law but apparently is totally allowed.

So, depending how you look at it, Fink was either the perfect guy to have in charge of sorting out the mess that his CMO monstrosity had created or the first fink who should have gone to jail for it. Guess which way the US government chose to see it?

The Federal Reserve, too, put its faith in BlackRock, turning to the company for assistance in administering the 2008 bailouts. Ultimately, BlackRock ended up playing a role in the $30 billion financing of the sale of Bear Stearns to J.P. Morgan, the $180 billion bailout of AIG, and the $45 billion rescue of Citigroup.

throughout the last decade, he [Fink] has spent his time building up BlackRock's political influence until it has become (as even Bloomberg admits) the de facto "fourth branch of government."

When BlackRock executives managed to get their hands on a confidential Federal Reserve PowerPoint presentation threatening to subject BlackRock to the same regulatory regime as the big banks, the Wall Street behemoth spent millions successfully lobbying the government to drop the proposal.

But lobbying the government is a roundabout way to get what you want. As any good financial guru will tell you, it's far more cost-efficient to make sure that no troublesome regulations are imposed in the first place. Perhaps that's why Fink has been collecting powerful politicians for years now, scooping them up as consultants, advisors and board members so that he can ensure BlackRock has a key agent at the heart of any important political event.

Well that sounds sinister!

But again this is just business as usual in the political world. None of this is novel strategy or out of the ordinary. Lobbyists have been around for quite some time. Politicians can be bought. It is known, but still this particular information is quite good to know even though such things should be expected.

And the rest, as they say, is history.

. . . or, more accurately, is the present. Because when we peel back the layers of propaganda from the past three years, we find that the remarkable events of the scamdemic have absolutely nothing whatsoever to do with a virus. We are instead witnessing a changeover in the monetary and economic system that was conceived, proposed and then implemented by (you guessed it!) BlackRock.

Transition to scamdemic and central banking

This is where the story gets truly interesting. Not really so much because covid was a smokescreen for a power-grab, but more because very rarely do journalists ever report on the two types of money that exist within the banking sector.

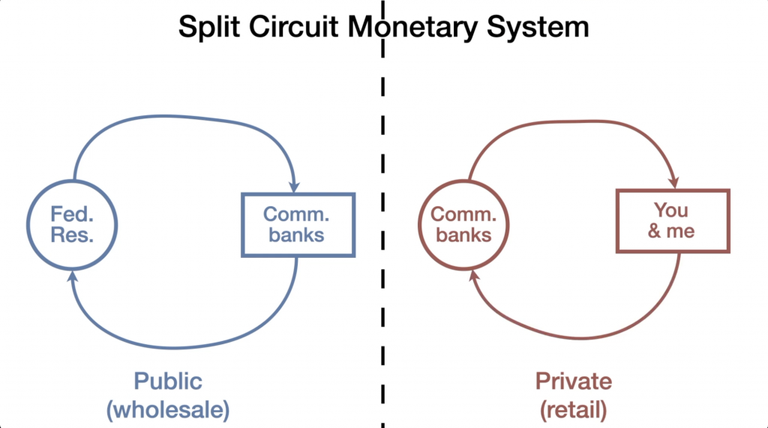

In order to get a handle on what this actually means, I highly suggest you check out John Titus' indispensable videos on the subject, notably "Mommy, Where Does Money Come From?" and "Wherefore Art Thou Reserves?" and "Larry and Carstens' Excellent Pandemic," where he explains the split circuit monetary system.

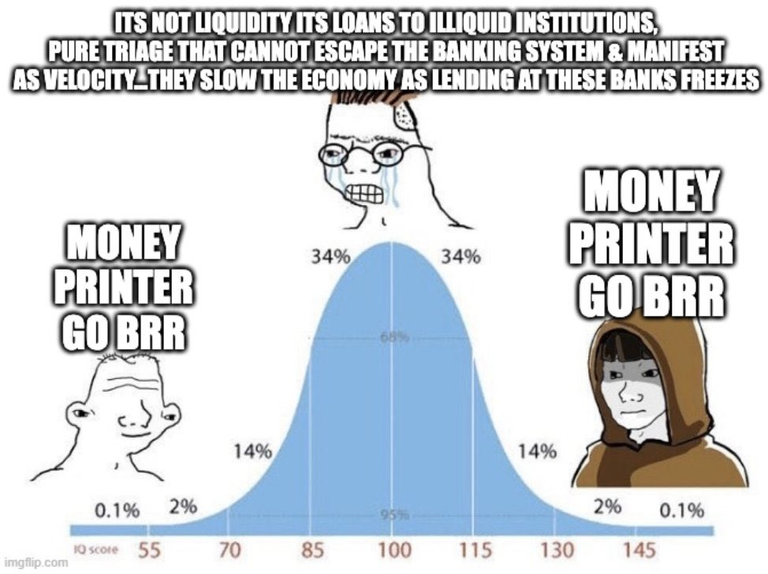

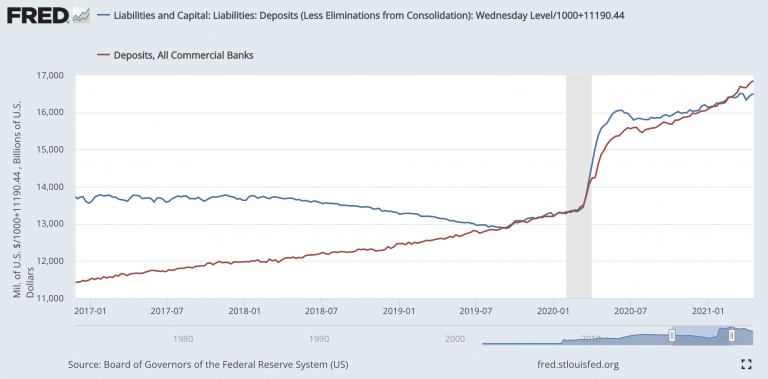

But the point of the two-circuit system is that, historically speaking, the Federal Reserve was never able to "print money" in the sense that people usually understand that term. It is able to create reserve money, which banks can keep on deposit with the Fed to meet their capital requirements. The more reserves they have parked at the Fed, the more bank money they are allowed to conjure into existence and lend out into the real economy. The gap between Fed-created reserve money and bank-created bank money acts as a type of circuit breaker, and this is why the flood of reserve money that the Fed created in the wake of the global financial crisis of 2008 did not result in a spike in commercial bank deposits.

Ah see!

This is something that @taskmaster4450 discusses often, and rarely do we see the concept pop up anywhere else. However, I think that @taskmaster4450 should definitely watch this documentary or do some research on "Going Direct" because the entire point of this Blackrock proposal is apparently to circumvent the spit currency system and simply print money out of thin air; the thing that everyone accuses them of doing anyway.

According to the FED's own data the money on deposit at the FED and new retail money being created is now seemingly traveling in lockstep and very much correlated. When did this happen? Less than a month after a paper Blackrock published (co-wrote by 3 former central bankers) detailing exactly how they were going to break the split monetary system and print money out of thin air. And we shall call this abomination: "Going Direct". lol. Glorious.

"Dealing with the next downturn: From unconventional monetary policy to unprecedented policy coordination."

With this context in mind it's a lot easier to see why so many people are worried about CBDC and the ability to print money out of thin air. This is literally the stated goal of not only Blackrock but also all the central banks that agree with Blackrock. This should come as no surprise to anyone considering everyone wants more power, and what's more powerful than direct control of currency?

How?

This was to be a process where special purpose facilities—which they called "standing emergency fiscal facilities" (SEFFs)—would be created to inject bank money directly into the commercial accounts of various public or private sector entities. These SEFFs would be overseen by the central bankers themselves, thus crossing the streams of the two monetary circuits in a way that had never been done before.

Cool beans.

So let's recap... Not only was the CDC running mock-trials for pandemics in 2019 right before the pandemic hit, but also Blackrock, at the same damn time, was publishing papers about how to print money out of thin air to prevent the next economic downturn? What a fascinating coincidence stacked up on top of another fascinating coincidence! Fun stuff.

Any additional measures to stimulate economic growth will have to go beyond the interest rate channel and “go direct” – when a central bank crediting private or public sector accounts directly with money. One way or another, this will mean subsidising spending – and such a measure would be fiscal rather than monetary by design. This can be done directly through fiscal policy or by expanding the monetary policy toolkit with an instrument that will be fiscal in nature, such as credit easing by way of buying equities. This implies that an effective stimulus would require coordination between monetary and fiscal policy – be it implicitly or explicitly.

"Credit easing by way of buying equities"?

That sounds a lot of generic QE.

But you know what it sounds even more like?

The backstop that the FED created for the banks right after shutting down the top three crypto banks. Almost as if to say: "Yes we want to shut these three banks down but let's make sure there's no collateral damage." So on and so forth: Operation Chokepoint 2.0.

You see? And this is why once we start digging deep enough one just has to assume that literally everything is a conspiracy. There are simply too many "coincidences" stacked on top of each other; at least one has to be rooted in blatant corruption and malice for personal gain. It makes a lot more sense if most of them were premeditated in a lot of situations. Of course some are always "happy accidents". After all: "Let no good crisis go to waste."

Conclusion

BlackRock had truly conquered the world. It was now dictating central bank interventions and then acting in every conceivable role and in direct violation of conflict-of-interest rules, acting as consultant and advisor, as manager, as buyer, as seller and as investor with both the Fed and the very banks, corporations, pension funds and other entities it was bailing out.

Half way through the video there is a transition away from the banking and corruption element into machine learning and their proprietary risk-assessment software called Aladdin (Asset Liability And Debt and Derivative Investment Network) which apparently hundreds of institutions use including Microsoft, Apple, Alphabet (Google parent company), and Vanguard. I look forward to the next video which will be all about Vanguard, which again I know very little about other than people say the word from time to time.

I highly recommend watching the video and perhaps even checking out some of the links within the transcript. There's a lot more information packed within the original content than I could possibly go over in a reasonable amount of time. The main focus for me was this idea of "going direct" and completely fracturing the separation of bank money reserves and retail fiat currency.

It's quite clear that Blackrock may have created a situation in which a complete systemic collapse of the global economy is much more likely than before. Who knows, maybe that's all part of the plan. That's certainly what needs to happen for CBDCs to become a thing, I can tell you that much.

After doing this research it's pretty clear that Blackrock getting involved with Bitcoin and crypto is even worse than previously imagined. If the stated goal of Blackrock is to print money out of thin air... well then we should obviously fully expect them to try and print Bitcoin out of thin air as well by comingling assets and acting as "trusted" custodian of other users' coins. It all seems pretty bleak, but perhaps such a happenstance could completely backfire on them and send them hurdling toward bankruptcy. One can hope.

Right before clicking 'publish' an app that installed itself without permission on my phone (that I can't delete) is telling me the FED decision happens in one hour. lol... nice. It's FOMC day apparently.

I also felt very strong urges to report on Corbett's BlackRock article. It's always instructive to follow Corbett, as he carefully researches his topics and eliminates bias many other reporters are subject to. I am glad you did, so I don't have to.

BlackRock has a controlling stake in ~90% of the stock corporations in the world. Just as you have control of things you own, so BlackRock has control of the things it owns. It's not a conspiracy theory, doesn't take any speculation, or depend on bias, to grasp how BlackRock can coordinate seemingly disparate policies of different assets in different industries to achieve covert goals, such as implementing an NWO that subjects the entire world to one global government. Honestly, so many politicians have stated their purpose is to create or contribute to the NWO, it's not really a covert goal.

However, despite the wide differences in our outlook and considerations, I am pleased we do agree on the importance of understanding the basics about BlackRock, and found Corbett's report a useful source of information about it.

Thanks!

Actually the real goal is to make the content accessible to a wider audience.

It's pretty easy to get turned off by the NWO deep state angle.

At the same time people are people and everyone has a little bit of power, no matter how small.

So to say that all power is consolidated to this or that agent is always going to be an exaggeration.

I may have downplayed Blackrock's level of power here but also maybe not.

I'm actually not sure.

By the way, Blackrock owns 7,71% of PFE stocks (src). Quite a chunk (22 bio $), but not sure it is enough to have full control. Who knows?

And who is Blackrock?

A board of directors?

Random rich people that keep their assets on deposit there?

When Blackrock goes to vote with their stock how does that process work?

I never hear the answer to any of these questions.

Only that Blackrock controls everything.

How simple and easy.

Good questions indeed. Maybe indeed the board of directors, a gremium of elite people who are hand selected and who´s jobs are never offered publically?

Ah well the public jobs are for sale anyway so :D

You can glean a lot of information on Black Rock not just from reading financial market news but their actual website and most definitely Larry Fink's annual letter he sends out every year. I would say if you just even went over the last three years of his yearly letter to investors you'll find that quite interesting. I did an op quite a while back that highlighted stuff from his yearly letter and stuff from Black Rock website. Once you go over that stuff you'll get a better understand of why they say Black Rock rules the world, he likes to dictate a lot.

I found an op that has a direct quote of how they deal with corporations that don't submit to their demands. There is a bunch of links within the op that if are still out there you'll learn a lot from how Black Rock operates.

https://hive.blog/deepdives/@sunlit7/ishare-too-a-series-of-trumps-deceptions-1

In my opinion, Black Rock is the buying arm of the Fed.

The Fed isn't supposed to own anything, but the end game is to crash everything and buy it all up. Leaving the mother WEFers owning everything. And you will be forever renting.

The telling things is Black Rock has the bid for rebuilding U-crane (Khazaria).

Like, really? Why them... except they are the Khazarian Mafia, and so, of course they will rebuild their homeland just they way they want it.

What we have is truly insider trading. Doing things that no one else can do or are allowed to do. I wouldn't be surprised, if at some time, we find that Black Rock owns ALL of the stock.

This is the meaning behind the name, Black Rock

I've been seeing a lot of references to the Khazarian Mafia recently over the last month.

Never even heard of them before and now like 4 times in the last 4 weeks.

odd

The real bad guys are getting a name.

The originator of this name is a guy called Cliff High.

He describes a group that lived in Khazaria, now U-Crane.

These people were known as the name stealers.

Because a person walking through to or from China, they would invite them in

wine them, dine them, learn all about them, and kill them. Then continue on their trade journey assuming their name.

Russia and Persia got upset by these guys and so ganged up to wipe them out.

Instead of wiping them out, they forced them to take a religion... because they thought these people do these bad things because they do not have a religion

They became the Ashkanazi Jews

And they have continued their name stealing ways.

Becoming King of England. Starting central banks

You also might say they are the cone-heads.

The Khazarian Mafia.

Ive written out blackrock etf before. This only grants more and more power to an already powerful and influential institution. For me blackrock is the epitome of corporate america. And if my conspiracy is to be believed. It is the us govt that truly controls blackrock.

This is quite a post. I understand what you mean when you say to many coincidences to believe they are just that and not conspiracies. This is what keeps conspioracy theories alive, the grains or sometimes pounds of truth they contain.

Modern higher finance is seeming all about creating money out of thin air to deposit in your own corporate coffers and pay yourself a astronomical salary for creating corportae profits. But all on paper.

Produce nothing, but earn unlimited monies, and break the system.