99% of everyone seems to think inflation is bad. No one wants their currency devalued by printing more. Why not? Every economist knows that inflation can be used to create growth. The inflation that we print can easily be used to generate more overall value than the liquidity it dilutes when injected into these markets.

Higher inflation means higher market cap. In fact, if the inflation does what we want it to and actually generates more value than it takes away, not only does higher inflation equate to higher market cap, but it also makes the token price higher than it was before. It's a win on every level.

The problem with fiat is that it's controlled by a very small group that engages in crony-capitalism rather than actually helping the bottom of the pyramid. In order to maintain power one must not please the little guy, they must give favors to their keys to power (the ones right below them on the pyramid). So on and so forth it goes down the chain: Trickle-Down Capitalism.

The problem with comparing crypto inflation to fiat inflation is that you can't. They are completely different. It's like comparing apples to a grain of rice. Crypto inflation is smart-inflation and can be allocated anywhere the network sees fit. Not only that, this value is not owed back to a central authority at interest. It's new money owned by the entity that minted it. Again, it is impossible to compare this to central banking.

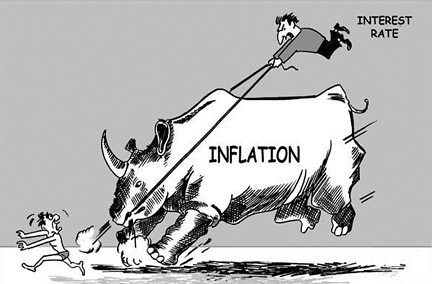

On top of this fact, the ways fiat institutions can distribute fiat inflation is extremely limited. What can they do? They're only tools in the chest are loaning money to commercial banks and manipulating interest rates. More recently they've been doing quantitative easing and security buybacks. Compared to crypto their ability to distribute inflation is a sad joke, and they are at the end of their rope. How many years have interest rates been forced to 0%? They are at the end of the line: it's time for crypto to take over within the next ten years.

Why is Bitcoin valuable?

Because it takes zero risk. Zero inflation means zero risk. Bitcoin governance does not have to worry about corruption when it comes to distributing inflation: because there is none. Why would I make the claim that Bitcoin has ZERO inflation? Because when we consider that millions of BTC are already lost forever and/or will never be spent again, it's clear to see that the market cap based on a supply of 19M BTC is already more the maximum supply. We will never get to 21M. Only more will be lost over time.

Less Risk == Less Reward

It becomes obvious that because Bitcoin has zero inflation, it has no opportunity to allocate value into areas that would greatly benefit the network. It is 100% guaranteed that networks that figure out how to best allocate inflation will skyrocket past Bitcoin in market cap, and all the Bitcoin maximalists will cry their tears of greed as they slowly become more irrelevant.

Bitcoin maxis will be the next Peter Schiff.

You know how stupid and annoying Peter Schiff is? That's exactly what Bitcoin maximalists are going to be like when Bitcoin gets flipped. They'll spew their rationale for why Bitcoin should be number one just like Schiff claims that gold is superior to Bitcoin. It won't be a good look: I assure you.

The trend in DeFi has already made this reality quite obvious. When the network has control of a lot of inflation, even if that inflation is just distributed randomly to stake-holders, that's far better than no inflation at all. Inflation creates growth.

This isn't to say that every network with inflation is going to do well. Quite the contrary, perhaps even more than 75% of these tokens will become completely irrelevant, which is why Bitcoin will remain the safest option for at least a decade. However, sooner or later we are going to figure out a template for inflation that is essentially superior to Bitcoin in every way.

Crypto can scale higher than any corporation. Some of these crypto networks are going to have over a million developers working on them full time. Could you imagine that? A corporation with a MILLION developers? Imagine how fast things would get done, especially when all the code is open source and available to all. This is the direction we are headed in.

What do we need inflation for?

We need inflation to pay devs. We need inflation to teach people the skills they need to be successful in these networks. You heard me right: the future of education is getting paid to learn, not drowning oneself in debt in order to get a worthless college degree. Bitcoin will most certainly not be able to keep up with any platform that figures this stuff out.

Again, that's not to say that I don't like Bitcoin. In 2022 when everything is crashing into the mountain I'll go full Bitcoin maximalist. Bitcoin will do what it always does: maintain its value better than every other crypto. Zero inflation will be a big part of that happenstance. Bitcoin is the anchor.

Conclusion

Inflation is the killer dapp of crypto, and no one seems to realize it. In fact, 99% of the world seems to think exactly the opposite: that deflationary economics are the way to go. Funny considering we already know that's 100% false. When gold was money society ran into all kinds of problems. Removing fiat currency from the gold-standard wasn't a bad idea, in fact it was a really good idea. The problem is that those in charge of printing new money allowed their greed to get the best of them: happens every time.

Now we are in a situation where greed cannot factor in because no one is in charge. These networks distribute inflation based on consensus, not the greed of the elite. Again, to compare fiat inflation to crypto inflation is an extremely foolish mistake that I see pretty much every single person making. Don't do it. Nuff said.

Posted Using LeoFinance Beta

You do math well, can you tell me at what point the largest accounts will cement their hold on the coin because the remaining inflation isn't enough to unseat them?

I seem to recall a tipping point in year 8 being discussed in year 1, but it was a long time ago that I saw the conversation and I'm sure the math has changed.

Were this allowed to occur, does it diminish the functionality of the coin?

What worries me most is the hive on the exchanges coming back and monkey wrenching us just when we have a good thing going.

Anyone who wants to buy millions of Hive can buy millions of Hive pretty much at any time.

Billionaires scoff at these low market caps.

I'm personally not too worried about any funny business.

A lot of the users building on Hive are acquiring more.

We all have incentive for Hive to be a high-value network.

I'm not too worried about the ones that bought it from the market.

Just more in favor of leveling out the influence than some others.

It sounds like you want to jack inflation up to 11 in order for the old money to have less power.

I agree.

I just don't want anybody with 1000X+ the influence of anybody else, that didn't buy it off the market.

How we do that is open to debate.

I'm guessing that all these liquidity pools and defi options will satisfy those that need maximum roi without them reaping the inflation pool that is supposed to be onboarding new folks.

I will be sooo glad when defi flips blogging for why folks come here.

The currency aspects of Hive could dwarf what can be gained from sucking up the pool from the weakest accounts.

Not that some will care, maximum roi means reaping the pool, too.

I'd like to see that minimized and newbs getting the maximum attention.

Hm yep looking forward to that as well.

2nd layer is great for this. Old whales have 0 power unless airdropped it

I admit I am guilty of this. Though I am getting better at changing my opinion since LEO has a high inflation rate but at the same time, it has enough use cases and burn that I think it has a future.

As for Bitcoin Maxis, I don't know if it will come true but it is true that less risk means less rewards. At least they can rest easy knowing that the price is able to go up even if it doesn't go up the most.

Posted Using LeoFinance Beta

No stable coins and no gold peg coins? Will you sell all your HIVE and LEO and CUB or will you keep some? Maximalist sounds like 100% BTC and absolutely nothing else.

In regards to inflation, what do you think about yield farms like CubFinance (1 CUB per block), PancakeSwap (20 CAKE per block) and PantherSwap (new clone that pulled nearly 300 million USD TVL in one day with 75 PANTHER per block)? Is higher inflation also key here?

75 PANTHER per block isn't more inflation than 1 CUB per block.

These are arbitrary numbers.

The starting value doesn't matter.

What matters is how much inflation is going up and down compared to where you started.

Cub starting at 3 per block and going to 2 then 1 was probably a mistake.

I see. Panther started at 100 when it was still on Pancakeswap without its own AMM and two weeks later (yesterday) started the AMM and reduced the inflation to 75. There is no mention in their docs of going lower than that any time soon.

There’s a difference between inflation when liquidity is 100% and every user owns it than inflation where you still need to get it into people’s hands

Then there’s also inflation generated from productivity but that also requires there to be deflation when things aren’t productive like debts not being salvaged so capital allocators make better decisions

To me I see there being enough inflation in fiat and in other Cryptos and we need something that goes the other way like Bitcoin

Of course, that's why there are so many regulations and obstacles to the economic development of bitcoin and other cryptocurrencies, since the elites can't have the control to benefit from them, they simply don't care if there are people willing to accept crypto in their lives.

But in 2025 things will be very different, we will see that the cryptoeconomy will dominate 45% of the world market and will gradually replace the traditional economy that is very moribund and obsolete.

Posted Using LeoFinance Beta

Your completely right, DeFi has changed everything in so many ways that I thought it could but actually wouldn't, so was happily suprised when all of what you've said TOOK OFF. We're on the precipice of something big, and inflation going to the real holder of the asset is one of 1000x things that make crypto the future!

Gotta love that Schiff tweeted that he was wrong about Bitcoin on April Fools Day. That’s some Level 10 snarkiness.

One of the drawbacks of being an agnostic is that I can’t be absolutely sure that Schiff has a place reserved for him in hell.

Posted Using LeoFinance Beta

He's already trapped inside his own personal hell.

No problems here.

Bitcoin hasn't even been flipped and they already look stupid

Posted Using LeoFinance Beta

lol yeah just wait

they'll outdo themselves 1000%

Posted Using LeoFinance Beta

Lol I'm willing to take the other side of that bet, and stupidly stack Sats! When the inflationary models of alt coins start to break down against Bitcoin like other assets do, we'll see!

It's not about stacking sats. Its more about maxis sounding like Peter Schiff when they talk down on alts

I’m not defending maxi’s they’re just the most vocal of Bitcoiners but they’ll eventually have to spend their BTC and if they don’t it just means others liquid Bitcoin is worth more which they will spend and the liquidity will spread! I don’t buy the argument really, does alt coins help with distribution sure, no distribution model is perfect or “fair” but for me proof of work and hard cap is still the one I trust the most

Having an open mindset

is the key element to tackle

the ever evolving crypto market.

Stay awake and make the best move

till the end.

BTC is having a leading time now.

Thing could change where million devs

can revolutionize the marketcap through

inflation.

Posted Using LeoFinance Beta

Not so sure about this is the case on Hive.

Posted Using LeoFinance Beta

Congratulations @edicted! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 29000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Support the HiveBuzz project. Vote for our proposal!

Interesting stuff for me to think on. Having lived through the Ford/Carter stagflation in the USA, the word inflation fills me with anxiety--interesting to consider that inflation NOT caused by corrupt governments might actually be a good thing. I will run these thoughts in the background while I go about my work today. Thanks! !BEER

View or trade

BEER.Hey @edicted, here is a little bit of

BEERfrom @fiberfrau for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Living in Brazil, I guess I know a lot about this.

exactly... the Real is never going to go UP in value. Only down over time.

When more people can not afford the gold they will create new golds.

Posted Using LeoFinance Beta

nice post where I can find an interesting reasoning. Now I see inflation in a different way than I did before.

Posted Using LeoFinance Beta

Cubfinance inflationary versus Polycub deflationary

Now that Khal has instituted the changes you recommended on both Cub and Polycub, do you expect Cub to rise in price?