If you can't explain the yield, you are the yield.

In a recent podcast Michael Saylor made a bold claim that he could essentially loan his Bitcoin to a bank for 5% "risk-free" yield. Of course a statement like this is going to trigger just about everyone and their mother when it comes to crypto. Didn't we already learn our lessons on this front with DEFI 2020? It seems as though the corporate maximalists may have not gotten the memo.

It's not.................

Haha, best nearly silent retort ever.

Original clip:

A "non-performing asset"???

Saylor goes so far as to compare 0% yield on Bitcoin to 0% yield on a bond, which is obviously absurd because Bitcoin goes up in terms of USD exponentially over time while a bond is intrinsically pegged to USD. He was clearly spiraling here and just doubling down on the incorrect position.

But you're gonna have incomes... you cover your expenses from your income and you keep stacking sats, and you grow up your stack forever.

This quote from saifedean is also quite bad.

The entire underlying argument here stems from the false concept that nobody should ever spend their Bitcoin, ever, which is obviously a complete farce. The supply of BTC is already hardcapped and there will never be enough to go around. We know the idea is completely bogus because it is totally unsustainable. If everyone followed this advice there would be no liquidity and the entire system would crumble.

Of course there are more nuanced takes like this that show how there's a big difference between overcollateralized lending and 20:1 fractional reserve lending. It is possible to structure debt in a safe way, and banks used to do it this way, but they've just gotten more and more greedy over the years via using more leverage.

Are you saying it should be illegal to rent out a house you own?

Saylor is really spiraling as he continues to flounder and make another false-equivalence. Renting a house is not comparable to renting Bitcoin. The utility of a house is that people can live in it. It's a critical foundation of being a person living in the physical world. Now, what is the utility of renting out BTC? Pause here and think about it for a second.

The only reason to borrow BTC is to short BTC.

Saylor is somewhat operating under the implied assumption here that you could loan your Bitcoin to JP Morgan and get 5% yield and they wouldn't dump the Bitcoin on the market. This is ridiculous, as the only thing they can do with the Bitcoin is short it or loan it to someone else at a higher-than-5% rate so that person can short it (middleman banking).

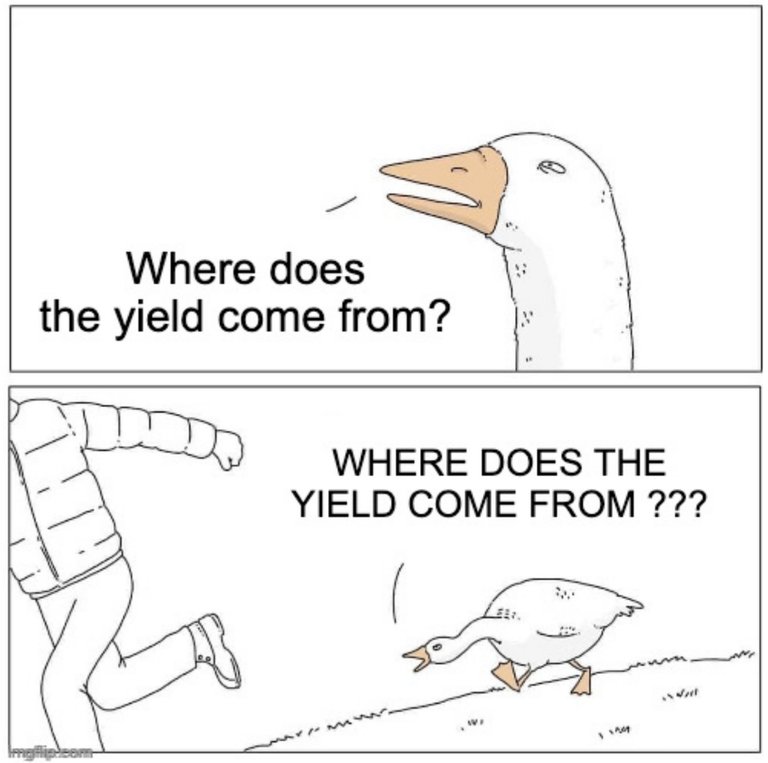

Saifedean is quite correct here in pointing out that this is unsustainable. If everyone is getting 5% yield on their Bitcoin and they use that yield to buy more Bitcoin... where does the magic extra Bitcoin come from? Something would have to break and loans would be in default. Of course it's never that simple in finance and someone else will always be willing to take the other side of the trade to prevent this from happening... but to call it "risk free" in an environment like we are in is just appalling.

The Saylor split personality.

Michael Saylor has two modes of operation. On one side we have an unhinged maximalist degenerate that understands full well the concept of not-your-keys-not-your-crypto (NYKNYC). On the other side we have the corporate businessman and CEO version of Saylor. It was CEO Saylor doing this interview. He knows exactly what he's doing. This is a guy that plays Devil's Advocate and is constantly challenging the norm and learning from his mistakes. Honestly he's the most humble billionaire I've ever seen so I tend to give him a little grace when shit like this hits the fan.

NEVER SELLING

It is this hoarder HODLing ideology of an extremely scarce asset that injected insanity into this discussion. The real answer is to just be willing to provide liquidity to the market and sell a bit when the price is right. Both sides of this conversation disagree with this sentiment, which is how a discussion such as this can go so off the rails even though both people speaking are fairly intelligent.

By refusing to provide liquidity to a market that thrives on liquidity is a complete disservice to Bitcoin. These are the people responsible for making Bitcoin so volatile and unpredictable in the first place. It's all rooted in shear greed. Is +100% on your investment every year really not enough? REALLY?

MOAR MOAR MOAR!

It may be disappointing but it is certainly not surprising; rather this is just more of the same and to be expected. Greed rules everything around us. Let's risk it all for another measly 5%. Yeah, this is a great idea. Perhaps this is the type of thing that will kick off the next bear market, so keep a sharp lookout going forward.

In what circumstance is this a good idea?

We can think of lending BTC to the banks as a way of selling by proxy without actually selling. So imagine in 2025 BTC was trading at something like $500k near the end of that year. You know you should sell but you've decided "never selling". It is at this point you could lend some to JP Morgan knowing that they are going to short it or collateralize it or refinance it or whatever they're going to do with their toolkit. JP Morgan will probably make a bunch of money on this trade because the price is right and bear market is probably coming. Everyone wins.

There's then the small chance that BTC pulls another 10x and JP Morgan gets busted. But then they just get bailed out by the US taxpayer. Saylor won't get back the Bitcoin but he will get back the $500k + 5% price point just like all the other bankruptcy proceedings like GOX and FTX. So even in the worst case scenario the proxy selling became actualized into real selling at $500k, which is still a 9x from here and not a bad trade at all in the grand scheme of things.

Conclusion

Saylor has convinced himself that he should never sell his Bitcoin under any circumstances. Ironically this type of dedication leads to terrible theory-crafting like trying to lend out the asset for a paltry yield. Lending out the critical asset that solves the big problem to the very banks that caused the problem is not the answer. I feel like this should be obvious but apparently it's not. Proxy selling is not the answer. Just sell a little when it goes 10x. You're a big boy you can handle it.

Saylor is a smart guy that does a deep amount of introspection. He hasn't yet had a mega bull market face-melting experience, so his viewpoints and emotional status are more limited and tempered. I have faith that he'll figure out how ridiculous some of the comments he just made really are. If not I'll be there waiting to take the other side of his bad trades.

This is something we are going to have to LEARN. There can be no usury with a fixed money supply.

You cannot lend to JP, and get 5% of bitcoin back. It runs into the hard limit of hard money.

There is one big caveat. We still have the dollar. And its amount of units is still going ballistic. So, if we talk about 5% in dollars, you can do that all day, any day.

I would love someone to do a calculation.

There is a point where you have enough bitcoin. Enough for the rest of your life.

And if, say, bitcoin went up 100% per year,

you could sell half your bitcoin this year, and next year, the half left is worth the same amount,

and you just keep selling half for the rest of your life.

And the never sell thing really has to do with our financial system melting down. Sell bitcoin (going up) for dollars (going down) is fairly stupid in the long term. (in the short term it can be lucrative or just allow you to live). Providing liquidity is nice, but you are betting the financial system will be there next week.

Great comment!

So true; it hits hard.

I've been saying this since like 2019.

Obviously you'd have to adjust for inflation but still.

Once you get to a certain point you're golden and the network effect just carries you.

adjust for inflation and work out the four year cycle, and come up with a max % spending rate.

Too many variables for me to just do in my head. So i hope someone else will do it.

However, i expect soon that bitcoin will have a lot more adoption, and thus have a more stable moving (transaction amount) rate

Infinite money machine go brrrr.

If only it worked that way.

What's funny is that Bitcoin basically is the infinite money glitch but this bitch wants an extra 5% on top.

lol you can't get more greedy than that

people who think like this deserve to lose everything

and they do every single cycle

Great post!

Very based :)

Saylor getting rekt in a FTX like scam would be the mother of all bubbles for Bitcoin.

Never selling is also such an idiocy to which I refuse to subscribe. What’s the point of amassing wealth if you never enjoy it.

At least a small percentage of it.

Exactly but I think the point being made is that "small percentage" is supposed to be this 5% yield? In reality anyone should just be willing to sell 5% or even 10% at any time... especially on huge pamps.

The great thing about fixed supply assets is that you can only sell it once. Although it goes up forever in fiat terms, you need to sell some to get some benefits from it. It will be a new paradigm.

Holding Bitcoin has its value, but I think it’s good to avoid overcomplicating things with pretty serious lending strategies like this. Well if a person is smart to pull this off I'll call em the GOAT 🤣

Na you dont understand.

Make a defi platform,

Let saylor stake the coins there,

Reward him with Yield coin,

Why 5% and not 374734634829%?

LMAO

Yield comes from? =?

profit