Oh no everyone!

@edicted has gone crazy!

Poor @edicted's brain is melting because he thinks that increasing inflation raises token price and decreasing inflation lowers it. It's a shame really. We lost a good one.

No, seriously though.

Bitcoin has everyone's brain scrambled into thinking that deflationary economics are a good idea. They are not. We've known they are not for over 100 years. Bitcoin comes along and makes x2 gains every year and all of a sudden everyone thinks it's a good idea. Again, it is not.

Bitcoin rewards the early adopters and creates massive supply shocks every four years that fuck over new users and hamstring its own growth. However, the legacy economy is so fucked, and solving the Byzantine General's problem was such a miracle, that people now wrongfully believe that deflationary economics are a good idea. The best actually. It's a sick joke.

The goal is stability.

All currencies have three main goals:

- Medium of exchange.

- Store of value.

- Unit of account.

Before crypto, it was impossible to have all three of these things. You could choose two but the third would be left out. For example, gold isn't a great medium of exchange because it's heavy and not very divisible. It's also not a good unit of account because it stores value and the price is quite variable depending on when users are hording/dumping it.

Fiat currency is a great unit of account. It's so good most people in the world can measure the price of goods and services in USD even if it's not their native currency. Of course store of value gets sacrificed here. The value of USD will never go up over time. With the advent of the Internet and online banking (and cash), it became a superior medium of exchange compared to silver/copper coins (which is more divisible than gold).

Dat Crypto Doe!

With crypto we can have it all. We can get all three. It's already a superior medium of exchange because it is more divisible than any fiat currency and it is connected to every other crypto via exchange pairs. The borderless permissionless nature of crypto makes it superior for moving money around worldwide.

It's also an obvious store of value, the real big problem is unit-of-account. How do we keep the price stable enough to actually price goods and services when it's a store of value and the prices keep spiking x2 every year on average? The answer seemed impossible until 2021 rolled around.

Yield farms.

The answer has presented itself in spectacular fashion. There is no doubt in my mind that a yield farming asset will surpass Bitcoin in market cap: probably within the next ten years. Only by having high inflation allocated to the community fairly will a crypto be able to attain all three coveted attributes.

With yield farming, we see that it's not about the token price going up. In fact we would only want the token price to go up 10% or less every year so that we can measure the prices of goods an services with the token. The goal is to have the highest SUSTAINABLE yield so that even though token price isn't going up, holders are still getting rich and pumping that value back into the system.

Magitek

The token I am working on will try to accomplish all the things I've been talking about over the last three years. We need to take all the good stuff crypto has created, looking at all the trends, and create a superior prototype asset.

- NFT

- High Yield Farms

- Automated Market Makers

- Algorithmic stable coin

- CDP loan futures market

- DPOS voting structures

- Gaming

That's right, boys and girls.

I am working on a project that incorporates all of this, and I'm adding my own secret sauce of proof-of-burn, which is going to destroy a massive amount of Hive/HBD in addition to other coins once the associated oracle nodes can be trusted.

INFLATION

Okay, so, you're farming a yield and the yield is dropping and the token price is falling to dangerously low levels, what do you do? Ask 99% of the people in the cryptosphere: you need to reduce inflation to lower the supply to increase price. Yeah, that's exactly the opposite thing that needs to happen.

Reducing inflation lowers yield. Lower yield causes even more selling. The price won't pop back up until there's a supply shock, and a supply shock is exactly what we don't want. Supply shocks are bad, not good. We want a healthy supply and enough tokens for everyone.

Every economist knows that a struggling economy needs liquid cash injections to stimulate the market. It's just like drinking a cup of coffee or smoking some meth: the inflation injection is a temporary quick fix if the market is lower than it should be.

How does this work?

Well if the community decides what the inflation print rate is, and the community has a good idea of the true valuation of their own token, the mechanics are simple. When inflation gets increased yields also get increased. Yield farmers will get extremely greedy knowing that inflation is high now, meaning lots of coins are going to get minted. They want those coins, especially with the knowledge that inflation will be lowered later: that is when they will sell (when yields drop and they're farming less).

So yes, it becomes obvious that if you want a higher token price we ironically have to INCREASE THE SUPPLY. It's totally contrary to what everyone seems to believe, which is why someone like me can swoop in with this prototype and show the world how it's done. This is a test to see if we've been doing it wrong this whole time, which I believe is absolutely the case.

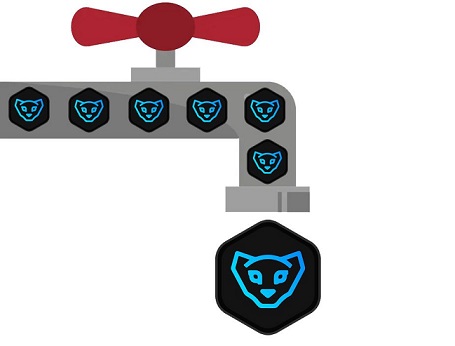

Imagine if Cub just decided to double its inflation right now. What would happen? First of all we have to ask how that inflation is allocated, because after all there are 12 different farms that receive yield.

The most obvious place to apply inflation if we want to increase the price of CUB is the DEN. Right now we have x15 multiplier on the CUB den. What would happen if we raised that to x60 and then doubled total inflation?

I'll tell you what would happen: the price of CUB would moon. Especially if you tell the community this is a temporary measure, lots and lots of CUB is going to move from the LP pools (getting bought) into the DEN. The price can only go up from where it is now.

Do I think CUB should do this? Not really, that's a huge overreaction to the 'problem'. I think we need sliding-scale governance votes that move these numbers around slowly over time rather than all at once.

In addition, increasing the DEN yield is a holy-shit last-resort measure. First, if we want to stimulate price, the LP pools should be incentivized to see if users will buy from the pool and compound farm it. This increases liquidity and creates a more stable environment, while increasing den yield reduces liquidity and cannibalizes the token in order to achieve short-term gains.

However, that strategy will only work if money is coming in from the outside. If users are just dumping their daily farm back into the LPs to compound farm the price will continue to go down, and the only way to increase the price is to cannibalize the LPs by increasing DEN yield.

Analysis

If we raise inflation while the token price is undervalued this will automatically bump up the price. If we lower inflation while the token price is overvalued it will lower the price. This is extremely counterintuitive but it is 100% true. The trick is knowing what the true valuation of the token is in the first place.

I believe the obvious place to start is the x2 doubling curve. The goal is to create a stable asset price with extremely high yield. Meaning: inflation should start a +100% per year in order to try to maintain a stable price. Once the optimal price is discovered the community then raises inflation when it dips and lowers inflation when it spikes.

Again, if price goes up when inflation is decreased that means a supply shock has occurred and the price target is incorrect. The real value of the token is higher, and the network must engage in price discovery once again to try and find it. Conversely, if the price dips when yield is increased that means the network has overvalued their token price and a lower target must be discovered.

The crux of this ENTIRE economic scheme is that ALL users control inflation. This is not true about most networks. On Bitcoin and Ethereum, the only users that control inflation are the miners. This is a very small subset of total users so manipulating inflation in these ways will not work. However, the scheme is perfect for yield farms and probably pretty good for "proof-of-brain" economics (maybe even better because inflation is allocated intelligently instead of statically to each user).

Hive?

It's important to note that on Hive all users do control inflation (meaning this strategy will work for Hive). Hive is the original defi network, and we have a lot of work to do if we are going to catch up to the rest of these guys. We need to fix HBD with CDP smart contracts and convert the internal market (Hive/HBD) into an AMM yield farm. It's painfully obvious.

Considering Hive only has 8% inflation and everyone is trying to say we need even less, I find that absolutely ridiculous. Like I said, I think we need about 100% inflation per year in order to maintain a stable price. If we increased Hive inflation to 100% from 8% the price would fucking moon hard and we'd be forced to guess what the true valuation of the token was. No easy feat. That's why these numbers need to move slowly via DPOS governance voting so the community can constantly speculate and refactor.

At that point we also have to think about rewarding witnesses less and the dev fund less. The more inflation that gets funneled to centralized accounts the worse this strategy will be. That being said, 80% user control of inflation on Hive is still pretty damn good. In fact it's even higher than 100% because liquid tokens have no control over inflation, of which there are many (for now). There would be very few liquid tokens if we started increasing inflation and yield. Everyone would want more control over that increased inflation.

Conclusion

Inflation is the killer dapp, and I'm the only one who knows the truth. Why's that? Because I'm such a smart and special little snowflake. You don't have to believe me: I'm working 10 hours a day on a project that will prove it once and for all.

Again, I'm the only one saying these things.

Literally no one else seems to realize these facts.

They are blinded by Bitcoin's inferior deflationary economics.

So what are the chances that I'm right and everyone else is wrong?

Take it with a grain of salt, obviously.

Posted Using LeoFinance Beta

You arent the only one who sees these things. The entire topic of inflation is completely misunderstood, especially by those who are involved in crypto. So it is no surprise that people approach it within individual currencies in the same light.

All inflation is bad according to them. The reality is as long as growth outpaces the inflation, you will have an expanding system. Inflation is an incentive that can fuel more users, higher rewards, and greater prosperity. This is the opposite of what everyone is discussing. Instead, they treat it like a stock, wanting the price to increase relative to fiat.

Posted Using LeoFinance Beta

Yep at least half of the crypto people I talk to speak about hard-caps like that is the only way to do business.

Pretty mindblowing stuff.

Gonna be weird when everyone gets proved wrong.

I don't think their brains will be able to handle it.

Let me explain, why people believe hardcap is a way to go. People are driven by emotions and emotion which created crypto was fear against massive inflation caused by governments, remember bitcoin genesis block.

I think you are right "Inflation is the Killer Dapp" and I love this sentence.

Just remember we are the people who are escaping from government controlling and increasing inflation and this fear and new shelter is what connected us.

Imagine we, the people who run away from oppresive savings order, will create similar order we escaped from.

We as humans, are just silly beings in the end :)

The only thing that matters is liquidity.

As long as there are buyers at the current price it doesn't matter what the inflation is.

Yeah, edicted really has gone crazy, and I think I like it! I’m here for this!

I’m trying to wrap my head around people not dumping if there’s a lot of inflation,...sorry but it’s what Bitcoin has made us to believe, but o do get your point and will love to explore it.

I love this post and the overall analysis you laid out. I will also like to have your opinion on the current Leo tokenomics

If you have a 1000% yield apr and tons of tokens are getting minted in the short term...

and you are armed with the knowledge that yield will go down in the future, what do you do?

You get greedy and stack as many coins as you can so you can dump when tokens aren't being minted anymore.

We already saw this happen every time CUB reduced inflation.

The party was over and the crack addicts panic sold...

This happened 2 times in a big way.

True that! Well, if Cubdefi won’t take this....then we will see how Magitek will spin it off

Posted Using LeoFinance Beta

I can definitely see how a bigger APR actually brings more funds to the platform and stay farming..

And there's definitely no sense in burning at this stage, better redistribute it to increase the farming rewards ?

Posted Using LeoFinance Beta

At some point it stagnates out does it not? Bitcoin will eventually just stagnate.

So curious instead of a deflating token on hive is there one that instead increases the inflation by 3% each year? (well I guess Hive pretty much does this with is 3% APR) But I'm curious if any tribes have yet done this and if so how they are fairing. I agree the deflation only rewards early adaptors. A inflated one still rewards early adopters but it can give new ones coming in a better chance and seeing more tokens flow in stead of a slow crawl.

If we just leave the inflation around say 10% that is still exponential growth, because inflation creates more inflation. This creates compound yields over time.

For example, if inflation is 100% per year it doubles but then it doubles again the next year, this will x4 the total supply instead of x3 (2x2 instead of 1+1+1).

Personally I think a 20% to 30% inflation rate will become the standard on the LOW END for some of these yield farms, with the high end being like x10 200%-300%.

Do you ever ask yourself what happens to bitcoin after the last one is mined.

I wonder all the time. Who runs the chain? Why if mining no longer produces tokens.

When the mining rewards are gone, the miners will still be receiving transaction fees. Whoever mines a block gets the transaction fees from the transactions in the block.

Posted Using LeoFinance Beta

and by that time, the fees alone (in theory) should be more than enough incentive to keep the machines running.

Posted Using LeoFinance Beta

i believe you man maybe the inflation would be the solution or maybe not.

i do not have idea about it, only i am here to learn a lot and of course will tons of money slowly slowly.

by the way good luck with your proyect, i hope you get your goals, right now the money are grow imagine the inflation grown around 5% in my country.

Scarcity without demand is pointless.

Stagnation is also a business killer and a project killer.

If you want more users make it rain on them. If they feel successful they will want more. The idea that users didn't buy is provably wrong. It's just that Fuzzy and Dan and several other large accounts were powering down fast than they bought.

Great article with excellent points.

Inflation doesn't hurt staked stakeholders.

That looks like a very interesting project.

If there's any way a regular joe with no relevant coding or finance skills could help it, let me know!

Posted Using LeoFinance Beta

The amount of tokens in existence does not equal supply. In the context of price discovery supply refers only to items that are placed on sale on the market. I think that you stumbled upon a little dirty secret that governments and those that control the means of production (to use a term borrowed from Karl Marx) already know...inflation is not bad...for everyone. Otherwise, why would they do it?

The thing to take into consideration is that the money supply has to follow the growth of the real economy. Both hyperinflation and hyper-deflation are bad, they are the opposite sides of the same coin.

Inflation is good for those that owe money on a fixed interest rate on a long-term loan...I wonder why governments use debt to finance themselves and why big corporations can get loans at discounted rates? 😃.

Well firstly you're not crazy, and I can't wait to see what your app has in store once it gets launched.

I don't think majority of bitcoin traders are awfully concerned about the status quo though. Many are quite okay seeing it double rapidly albeit once every four years

To be fair Bitcoin is doubling every year, bouncing off the curve.

Bitcoin Doubling Curve

The curve is scary accurate.

All that happens every four years is a supply shock that wrecks newcomers.

The mega-bubble goes x10+ above the curve, but then it just crashes back down to the curve a year later.

Well I think you are right. The Fed has been doing QE and lowering the yields. This does nothing to solve the liquidity crisis but the dollar itself hasn't really mooned by doing so.

Posted Using LeoFinance Beta

The simple act of even mentioning the FED raises huge red flags for me.

All of these concepts I'm talking about to do not apply to currencies with centralized inflation.

Even Bitcoin has centralized inflation because inflation is only applied to miners.

The ability for yield farms to distribute massive amounts of new-money non-debt inflation directly to the community is a completely different animal.

I believe you. You seem to be pretty knowledgeable in these matters. Your project will prove your point hopefully. We shall see.

Posted Using LeoFinance Beta

You keep writing them, I'll keep reading them.

You're absolutely right it's counter-intuitive; but I'm open to the idea.

Wait. Ive read about your Magitek coin before in another blog. But it was basically a foreign language. I think I tossed some silly little comment about how I dig the name cause Final Fantasy is cool. After talking to you a bit and reading some of your blogs, I'm starting to learn quite a lot.

Oof. Yes, that is kinda counterintuitive. But I see you go on to propose a community driven adjustable inflationary schema. I'd be worried about the time frame of 1 year but I understand why, due to the way LPs are setup in a way. If it was all driven by smart contracts and community driven, yeah, I could see it. But man, we've seen communities bicker about the most benign things before.

!LUV

Your post was promoted by @taskmaster4450le

Hi @edicted, you were just shared some LUV thanks to @amphlux. Holding at least 10 LUV in your wallet enables you to give up to 3 LUV per day, for free. See the LUV in your wallet at https://hive-engine.com or learn about LUV at https://peakd.com/@luvshares https://ipfs.io/ipfs/QmUptF5k64xBvsQ9B6MjZo1dc2JwvXTWjWJAnyMCtWZxqM

You made some really good thoughts, especially on the economic need of inflation and that deflationary tokens might not be the key for the future. i mean most of traditional economists agree with you on that point...

Posted Using LeoFinance Beta

Our sub-conscience gets it

that is why folks will invest in altcoins

and diversify.

Inflation controls by a community

will never achieve its goal unless

there is a pattern in place.

Few always sees only few ideas.

When you add the whole community concept

everything changes.

Posted Using LeoFinance Beta

I can definitely see how a bigger APR actually brings more funds to the platform and stay farming..

And there's definitely no sense in burning at this stage, better redistribute it to increase the farming rewards ?

Posted Using LeoFinance Beta

I specifically stated in the OP that POW coins, whose inflation only goes to miners, does not apply to this theory.

I've said it before, I'll say it again:

it does not matter how much inflation there is if that inflation is fair.

With DeFi yield farming it can't get any more fair.

Applying this theory to Hive is a completely different subject (mostly due to downvotes).

If I have 1000 tokens and each one is worth $2: I have $2000.

If inflation increases 100% I now have 2000 tokens worth $2000: nothing has changed except the token price.

It does not matter how much inflation there is: it matters how many buyers there are.

It's the liquidity that matters.

By maintaining a stable price defi tokens will get more liquidity: especially with AMM.