When I see revolutions in places like Sri Lanka and Kazakhstan I am simultaneously alarmed and relieved. All those conspiracy theorists out there that think there's some all-powerful deepstate that simply controls every aspect of our lives? Yeah, that's such a gross oversimplification. That's not real. Entire governments can fall just by the price of gas doubling. We're getting front row seats to the beginning of one of the most brutal economic depressions the world has ever seen. No single entity is causing it, and no single entity can stop it from happening or mitigate the damages. That's just how complex economic systems work (or don't work, depending on context).

You will own nothing, you will be happy!

Ominous words from one of the most powerful people in the world. I mean think about it. What has to happen to get from here to there? If such a statement were to come true the next decade is going to be littered with one disaster after another, and the authoritarians will move in to seize power in order to navigate such a state of emergency.

When I sneak a peak at my own finances I realize that I can easily outlast 99% of the population in America. Not very difficult considering over half of all Americans are living paycheck to paycheck and also often drowning in debt. When the majority of the population can't even afford any kind of emergency expense whatsoever, how on Earth are they going to afford higher and higher prices on essential products? Long story short: they can't.

Which leads to deflation.

Inflation is not a problem. The solution to higher prices is higher prices (and wages). The real threat is a hyper-deflationary death-spiral that leaves 50% of the population jobless and an absurd level of homelessness and a lower class with near-zero financial support. Will technology save us from suffering the same fate as the Great Depression?

Where does that leave crypto?

So unclear! On one hand everyone just assumes that crypto, as the world's most risk-on asset, will continue to take a beating should we enter and epic economic recession. However, I'm not so sure. I think assumptions like that make an 'ass' out of 'u' and 'me'. Bitcoin is already comically oversold and worldwide adoption is still increasing exponentially with no signs of stopping.

This is a matter of perspective.

I do not view crypto as a risk-on asset used to get rich. I view it as the only possible solution to the systemic failure known as modern society. I view it as the only way to scale up governance structures and the only way to stop absolutely corrupted entities from consolidating all the power in the world.

Given this radically opposite perspective on what crypto is, is it really wise to just assume it's going to get snuffed out during the first signs of the exact systemic failure it was meant to correct? How does that make sense? It can only make sense on short timelines involving flash-crashes and selling the bottom. Meanwhile communities like Hive and Bitcoin have been through this all before. Another bear market is just another folded layer of steel as we forge this Katana of Crypto.

Supermoon July 13th.

Only three days till the next full moon (apparently the moon will be closer to Earth than any other time in 2022). This market still trades on these 2-week cycles. I somewhat expect to be bouncing off $20k and then testing $25k by the end of the month. Not that I'm going to bet on this outcome, just that it's fun to speculate.

Bulls have been needing time to rebalance their positions and find their footing. Bears have been selling at a loss even as the Bank for International Settlements (BIS) has begun allowing deep pockets to hold 1% BTC reserves. Much of the events happening right now are quite coincidental.

We are seeing one centralized custodian after another fall like dominoes from greed and overleverage, while characters like CZ are picking up the pieces and bailing out projects that have merit (for control of the underlying protocol, of course). This is something I predicted would happen a while ago. There are very few leaders in crypto that hedged their positions properly and played it safe during the good times.

Crypto moves 10x faster than legacy systems.

By the time a recession actually starts, crypto may have already had another bull run. Developers are cranking out open-source solutions faster than institutions can even regulate them. The scams and nothing-products are dying out during this liquidity drought. Is that really something to complain about?

Again, Hive is a network that should have died a dozen times over by now. The simple fact that we haven't speaks to the grizzled determination of this community. By all accounts, even if a recession slaps everyone in the face... it won't even be as bad as the crypto winter we experienced from 2018 to 2020. The days of 10 cent Hive are over... and if not count me in as a buyer just like the last time.

Conclusion

Can we outlast our peers to the brink of recession and outright revolution? I think so. Hive specifically provides permissionless jobs that anyone can participate in. Does it need a lot of work? Sure, but the worst things get the more incentive we have to put everything we have into the future of the economy.

Posted Using LeoFinance Beta

I just looked a bit deeper into the connection and found that 2020 was basically flat. Not sure how "reliable" it will remain. Seems to have had its peak in 2021.

https://peakd.com/hive-167922/@tobetada/crypto-analysis-or-btc-moon-connection-overestimated

I agree 99% with you on this one. The only thing I disagree with is that the prices we are currently paying for fuel are due to "an entity" who stubbornly poked the bear(Russia). I guess at what I'm pointing at...

In regards to the recession, I believe it is already here. I don't see the spending of this year in my area as anything similar to what we had in 2020 and 2021.

Posted Using LeoFinance Beta

It's true... these things are much easier to measure in retrospect.

For example if $18k was the bottom that means we are in a bull market right now.

$18 000 might have been the lowest low, but the way I see it we will "be bottoming" for a while.

Posted using LeoFinance Mobile

The problem is... the solution is... how fast is the crypto economy?

The more pieces of the supply chain that accept and pay in cryptos, the less of a hit the fiat collapse will cause.

The usual giant problem has been, when a currency collapses, the sellers want to sell, and the buyers want to buy, but there is no means of payment for a while. Cryptos may make this transition seem like just a bump in the road.

As any supplier can get set up with a wallet in 30 minutes (to watch ThemTube videos).

But will they? Will they hold out?

Will the big corporations try to block transactions?

Will this mean actually talking to a farmer in Africa to get rubber in America?

Now i can just send him cryptos.

Soon, we will have smart contracts that allow the guy in Africa to know payment has been put up, and that all that needs to happen is shipment and delivery to get it.

This will be an interesting time

On housing, i see nothing but deflation.

I expect in areas that houses will be free to those who will move in.

Nobody there to stop you, the owners passed away, the county office deserted.

This only speaks to the DOLLAR value of crypto and how it could be used to purchase things.

What of the governance?

And what will fill that blackhole of governance?

Crypto. DPOS. Whatever other systems are invented by then.

The truly interesting thing is when DPOS governance bleeds into actual real world decisions.

Something that we always forget about.

It may take ages for a zombie company to die out in normal world but in cryptosphere, it only takes 2 days to go to zero like LUNA.

If Hive is $0.40+ when Bitcoin is around 20K, just imagine when the bull-run starts!

Bear reveals the valuable projects for sure ✌🏼

Posted Using LeoFinance Beta

The Dollar is nearly on par with the Euro today and the crypto markets are still very eager to hodl "stablecoins". The word stablecoin is really something by itself, makes very little sense to me. Wide parts of DEFI are arrested by the USD right now. Meanwhile, it's fancy to hate on BTC maxis nowadays again, but they have a point. The FED is tightening and the world starts burning. Didn't we go out there and started a movement to decouple wealth and FIAT by the means of using crypto? I expect tremendously rising instability with more fiscal tightening down the road this year. There will be more blood in the streets, real human blood.

I'm prepared for increasingly aggressive crypto acceleration between 2023-2025, but right now, the same DApps are in the Top50 for far too long. I'll take a deep breath and #hodl. Woozaahhh. We didn't know that the bear was persistent at the end of last year, maybe we're blind to the winter right now. Somebody should have listed to John Snow.

HAHAHAH

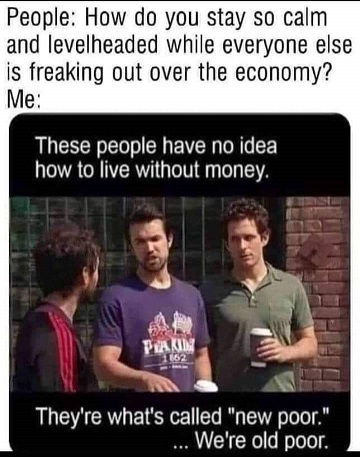

fucken love that meme. It's Always Sunny In Philadelphia, one way of looking at the world through clear glasses.

deflation is really a fear, falling prices lead to lower consumer spending, which is a major component of economic growth.

Companies respond to falling prices by slowing down their production, which leads to layoffs and salary reductions. This further lowers demand and prices.

This all depends on how bad it gets IRL. Are you planning for the black swan that brings chaos to your front door? Do you own productive land and know what to do with it?

Damn liked this one;

Posted Using LeoFinance Beta

Absolutely.

CeFi failed, DeFi like uniswap, PanCakeSwap and SushiSwap sale on. Uniswap passed Coinbase recently.

DeFi programs thrive on inflation, which everyone thinks is bad. I don’t agree. Hive survives and thrives on inflation. Cubfinance had to many farms sucking life out of it, PolyCub fixed that but I don’t know about deflationary Tokenomics. I guess we will see. I still think inflation is the killer app.

You said that, but I borrowed it…

Posted Using LeoFinance Beta